Solana: Payments, Fees, & Network Incentives

What does it take to get my friends to adopt public blockchain tech? They probably can't know they're using it.

Something magical happened this spring. The New York Knicks, Indiana Pacers, Cleveland Cavaliers, and Boston Celtics all made the Eastern Conference semi-finals. I know, riveting!

Actually this was fun for a few of my friends and I because all four teams were represented by a group of five of us who used to hang out at Applebee’s after work back in the day. Two Celtics fans, a Knicks fan, a Cavs fan, and a Pacers fan. Naturally, we had to make a friendly wager on our teams. My only concern at the time? How the heck are these guys - who live all over the country - going to pay me and the other Celtics fan when Boston inevitably advances to the NBA Finals?

I don’t have Venmo or PayPal PYPL 0.00%↑ - so that rules out two popular options. Cash App SQ 0.00%↑ or Zelle? Meh. If I can normalize public blockchain rails, I’d love to do it. Yet, in an informal survey of the group, even something like stablecoins over the Solana ($SOL-USD) blockchain seems to be a hill too hard to climb at this juncture. A pity considering Solana has one of the better stablecoin market cap growth stories since the beginning of 2023:

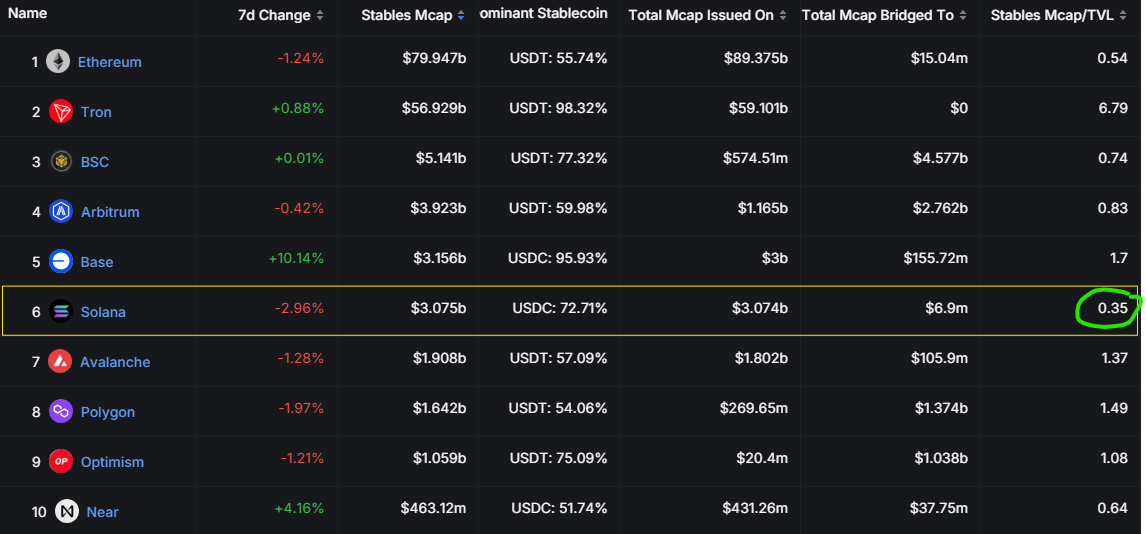

At slightly under $3.1 billion in stablecoin liquidity, Solana ranks 6th among public blockchain networks for fiat units on-chain. There are certainly larger pools of USD-denominated capital in crypto. But Solana does happen to have a large USDC footprint. With $2.3 billion in USDC, or roughly 75% of the chain’s total stable supply, Solana is the third largest network for USDC footprint. Meaning, if one wants to avoid something like Tether on Tron ($TRX-USD) and pay minimal transaction fees, USDC on either Coinbase’s COIN 0.00%↑ Ethereum L2 “Base” or Solana might be the best way to spend dollars cheaply on-chain.

And though clearly fragmented just as the traditional walled garden payment applications like Venmo or Cash App are, stacked DAUs in the smart contract blockchain landscape have been ripping for months:

Of course, there’s that little UE problem that I’ve mentioned before. Even with notable improvements in crypto payment user experience from entities like Helio, there is still a long way to go before this stuff is truly usable for most people. Solana recently featured a case study for Solana Pay through Shopify SHOP 0.00%↑ - and while touting a reduction in fees and an increase in transaction volume for Helio, paying for products through Shopify with the Solana Pay plugin still requires wallet competency at the user end:

To be clear, I happen to think this is awesome and I hope more ecommerce stores integrate Solana Pay - I’d use it if it meant a reduction in the cost of the goods or services purchased. But that admittedly might require dynamic pricing online similar to how bullion dealers pass Visa’s V 0.00%↑ payment processing fees on to the buyers:

In my view, this is what it’s going to take to get normal people my degenerate gambler friends to be willing to learn how to use a crypto wallet. It’s likely going to take dynamic pricing and upcharges for credit card usage. Does that mean this crypto stuff can never work? On the contrary. Frankly, it may simply be an indication of just how early we truly are in the transition from modern day payment processing to how “digital money” will ultimately be transferred globally in the future.

That said, we may not actually be that far off from the dynamic pricing described above. I’d wager the lower the gross margin for the business, the greater the likelihood payment processing fees will be transparently disclosed as add-on expenses. I know I’m already seeing these kinds of charges itemized at restaurants. When the market accepts it, they all start doing it.

Incentive → Outcome

Show me the incentive and I’ll show you the outcome. - Charlie Munger, Berkshire Hathaway Vice Chairman

Perhaps there was at least a small amount of fear driving the late great Charlie Munger’s personal disdain for Bitcoin ($BTC-USD) in the years leading up to his passing. I’ve noted in a previous post that Munger simultaneously held the view that Bitcoin is worthless while also saying it could undermine the Federal Reserve system in the same interview. Look, I get.

This is why Munger and Buffett actually hate(d) Bitcoin so much... Here’s Berkshire Hathaway’s top 5 holdings:

The men running a holding company that disclosed Bank of America BAC 0.00%↑ and American Express AXP 0.00%↑ as 2 of its top 3 positions hate a decentralized ledger network? Get outta town! A bank that borrows at zero and lends at five coupled with one of the world’s largest payment processing companies that profits from revolving credit? Not liking Bitcoin, you say?! One thing was created to be used without intermediaries. The other two would be those very intermediaries.

I really don’t mean to pick on Munger or Buffett. I’m merely establishing that Munger was correct; incentives drive outcomes - and also opinions. Since intermediaries add cost to a transaction, the question is who will charge the lowest rate for securely moving dollars over the internet? The next question is who can do it cheaply and still have an incentive to do it at all? The first question is easy to answer, the second less so.

The average cost to transact on Solana is a small fraction of a penny. Despite this, the network itself has experienced a dramatic surge in total fees since the start of the year. This growth in fees, which can generally be viewed as “revenue” for network validators, has allowed the circulating price to fee ratio of SOL to fall from over 800x in November down to just 82x in April. Now here’s where it gets interesting as “valuation” and “incentives” collide:

May will be the third consecutive month with average DAUs on Solana near or above 900k. But because fees are so cheap to these end users, the network validators are actually paid with new coins from staking rather than from the fees from transactions. This theoretically works so long there is still a strong organic bid on SOL to pay gas from those 900k DAUs. But it does mean we might need to consider alternative valuation methods.

Circulating P/F ratio can be a useful mechanism for valuing SOL but it can’t be the only thing we consider since the fees aren’t what is ultimately driving all of the yield from transaction validation. I’ve referenced NVT ratio in the past. In the chart below, I’ve drawn a red custom metric line that divides the market capitalization of Solana by the settlement volume on chain. This gives us a metric that is similar to NVT ratio:

Given how much volatility there is in daily settlement figures, this ratio oscillates up and down quite a bit. The longer term trend though is down. On Monday, the ratio was 32. At times in April the ratio was in the teens. We can also look at market cap to TVL ratios - or total value locked. At 15.9, Solana actually has one of the higher MC/TVL ratios of the top 10 ten blockchain networks in DeFi. I actually don’t care for this metric for Solana all that much either because I see stablecoin transfers as the killer application for this network right now. Fortunately, we can also look at the Stablecoin market cap/TVL ratio to get a better sense for how large a network’s stable footprint is in the grand scheme of total DeFi activity:

Solana’s Stables MC/TVL ratio is 0.35. My interpretation is that it shows reliance on other forms of DeFi rather than stablecoin liquidity. To disrupt US dollar-denominated payments more broadly, I’d want to see a number more like the 6.8 ratio that can be observed on Tron. So if we take all of these attempts at valuing Solana together, it’s difficult to make the case that SOL is cheap. However, it is rather exciting as a fast, cheap, usable network for both businesses and peer to peer transfers.

Closing Thoughts

At its best, the utility of cryptography doesn’t require end user awareness to work. Cryptocurrency networks still require awareness and a certain level of technological competency. Getting into the weeds regarding code, PoS vs PoW, inflation rates, or valuation multiples won’t be what drives long term adoption of distributed ledger technology. What will drive the outcome of adoption is the incentive of cheaper fees. Merchants and customers have to want it to make it happen. And there is certainly an increasing incentive for them to want it.

I’m of the view that merchant adoption of this technology will probably have to come before my friends and I are settling up basketball bets with Solana. Convenience over self-custody is hard to overcome. And signing transactions and paying gas are not things I’d imagine most people can wrap their minds around. Time will tell. But an app or two that disguise the blockchain networks working underneath the hood would be a nice addition to this ecosystem.

Disclaimer: I’m not an investment advisor. I’m long SOL.

interesting piece Mike. What do you think of something like Lightspark, run by David Marcus. His idea is to do what you are suggesting here, but the end user still stays with the same front end. (paypal or whoever) and the back end is Lighting but the end user doesn't see it. I think he also wants to make a front end for the average end user. But I haven't tried his product nor Strike either. Have you ? any experience on those 2 apps?.