Spotify Stock: A Quick Assessment

Spotify the product is benefiting me as a user too much. In this post; the company financials, Joe Rogan, and what I think Spotify the company should do soon.

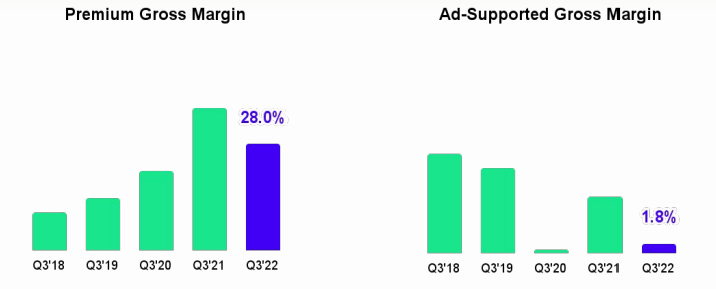

I was going though some old emails this morning and it occurred to me that Spotify SPOT 0.00%↑ emailed me A LOT in December - 8 times. Spotify is one of the few products that I interact with probably every single day. Strangely, I’m not a premium user of the platform because the ads haven’t bothered me enough yet - and this gets us to the emails. As an ad-supported user, the company emails me with the carrot of a free premium subscription trial on a regular basis. This is to be understood since the gross margin on my usage is statistically putrid:

Sooner or later I’m sure I’ll bite the bullet and do premium but the promo email purge got me thinking about Spotify the business. 8 times in December seemed like a lot…

After about 5 minutes of research, turns out that was about the same amount of promo carrots as December 2021 as well - 7 emails. All part of the company’s user conversion plan it seems. I’ve owned Spotify stock previously but when the broad market had problems last year, I had to make some tough calls and Spotify didn’t make it in the portfolio. It’s been a bit since I got under the hood so I decided to take a look at the financials again.

Key Figures

As is often the case in growth stonks, the top line revenue figures and sexy numbers like user growth look good. Total revenue was up 21% year over year in Q3 and total MAUs were up 20% to 456 million monthly active users (so much for the Joe Rogan drama exodus - more on him in a moment):

But those numbers can sometimes hide the real health of a business. As we can see in the table above, it’s actually the lower-margin ad-supported MAUS (like me) that are growing more than the people who are willing to actually pay for the product. This is a problem when ad-supported users make up less than 13% of your total revenue even as cost of revenue climbs more.

For the nine month period ended 9/30, cost of revenue was up 24.2% for premium users while cost of revenue for free users was up 38% year over year. Like revenue, cost of revenue for ad-supported users is still a fraction of overall cost of revenue. But there is no question in my mind that Spotify’s financials are indicating the ad-based model is more of marketing expense currently than a real driver of profit.

Here’s where it gets interesting; according to the company’s shareholder deck, the ad-supported growth is largely due to podcasting rather than music:

Our music business grew high single digits Y/Y and was led by high single digit growth in impressions sold. Podcast revenue grew in the strong double-digit range Y/Y across both our Original and Exclusive podcasts and the Spotify Audience Network. Podcast growth was led by the Spotify Audience Network, where sold impressions grew strong double-digits and CPMs increased double-digits.

I think this is interesting because it speaks to how I use the platform and the way that I use it probably isn’t sustainable for Spotify long term. I’d call Spotify’s earnings trend generally poor; there are a few exceptions, but quarterly earnings have been perpetually negative and it got worse in Q3:

With $163 million in negative net earnings from Q3-22, Spotify just had it’s worst quarter from an earnings perspective since Q2-20. The company certainly seems to be playing the long game and spending a lot on podcasting and machine learning. While Spotify the product is phenomenal (IMHO), Spotify the business can’t survive on just great product UE alone when so many music streaming competitors exist from companies like Amazon AMZN 0.00%↑, Apple AAPL 0.00%↑, and Google GOOG 0.00%↑ - from the Spotify deck:

2022 continues to be an investment year for Spotify, as we build out the resources and infrastructure necessary to drive our multi-modal, multi-vertical strategy forward. We continue to re-evaluate our spending with an eye towards increasing return efficiency and enhancing productivity across the organization.

This gets me back to how I currently use Spotify and I think it ties into why the company doesn’t make as much money as it probably should…

The Joe Rogan Podcast

I wouldn’t call myself a dedicated or loyal Joe Rogan podcast viewer, but I’d say I probably watch it once a week on my connected TV. What up, Roku ROKU 0.00%↑? If you want to give yourself nightmares watch this recent one with Ghosthunters Sam and Colby.

Rogan and Spotify quite famously agreed to a multi-million dollar exclusivity deal a couple years back and there was a lot of drama about whether or not Spotify would stick by Rogan when the n-word montage emerged - something that I covered back in February of last year. Judging by the growth in Spotify MAUs and the fact that Rogan is still chugging along, it would appear the biggest losers from the attempt to cancel Rogan might have actually been Neil Young and Joni Mitchell:

Neil Young did end up getting his music pulled from the platform - though his featured material and some live performances are still there. But his revenue from Spotify streams has certainly taken a hit judging by his massive fall from 6.1 million monthly listeners in December 2021 to 2.8 million in February 2022. Same story for Joni Mitchell:

I respect them for going through with what they said they would do even though they were pretty obviously on the wrong side of the argument. But anyway, back to Joe Rogan…

Rogan’s deal with Spotify was back in 2020 and the show has actually produced a declining number of podcasts each year since 2019. When I think about how I personally watch Rogan’s show, it’s pretty obvious to me that Spotify probably needs to rethink it a bit. For instance, I can go into the Spotify app on my Roku and watch an entire Rogan podcast without seeing a single advertisement and then leave the app and go about my evening. Even if the show is three hours long - I’m never actually providing the company any revenue through my usage. That’s all cost for Spotify and you have to wonder how much longer it can do that.

Of course, not every podcast on Spotify is getting a $200 million dollar exclusivity deal. But the company’s user growth is in the product’s least profitable user tier. If I were in charge of Spotify, I’d start paywalling some of the exclusive content before the gross margin from ad-supported users goes negative. As a user, I can tolerate ads to a degree. I won’t be able to tolerate losing access to exclusive content that I enjoy while maintaining access to non-exclusive content that I enjoy - that’s the biggest catalyst that leads to my conversion from free to paid. I’d imagine there are many users who feel the same.

From a stock performance perspective, SPOT shares traded down considerably from a high of $387 in early 2021 to under $100 now. At one point, SPOT was trading hands in the $70’s. Even after this massive decline, the stock is already getting overbought after a brief relief rally. Spotify releases earnings for the end of 2022 at the end of this month. It’s definitely a stock I’m watching. But not one that I’m longing or considering longing for either myself or the Heretic Speculator Equity Portfolio at the moment. If we truly are entering a time when earnings matter, Spotify is going to struggle as an investment.

Disclaimer: I’m not an investment advisor. I share what I personally do and why I do it. I’ve been managing my own investments since 2014. I have good years and bad years. Fortunately more good than bad so far. I’m unfortunately long ROKU.