Stadiums and Sponsorships: What is the Real Sports/Crypto Synergy Bet?

While Crypto.com unabashedly buys naming rights to the whole sports universe, this digital asset company is quietly landing partnerships with big players.

One of the biggest news pieces out of the crypto landscape this week was the announcement that Crypto.com had bought the naming rights to LA's Staples Center. For any non-sports enthusiasts out there, that's a pretty big deal. The Staples Center is where the Los Angeles Lakers and several other LA-based sports franchises play their home games. While the LA venue sponsorship is remarkable for the magnitude of the investment from Crypto.com, it's just the latest move from a company that has been going bananas in the marketing department for a while. Back in July, Crypto.com snagged a deal with UFC. That was about a month after landing a big Formula 1 sponsorship.

In response to all of this news, Crypto.com's native token (CRO) has been on a tear. The coin is now up about 4x since the UFC and Formula 1 sponsorship announcements this summer.

As of writing, CRO now claims the #16 spot on the crypto market cap list - that's a big deal. What does CRO even do? Holders of that asset get special deals in the Crypto.com platform. That's the easiest way to explain it. For instance, if you hold CRO in your account, you may get a higher interest yield on stablecoins or other cryptocurrencies than you would if you weren't holding CRO. This is a common strategy for these yield supply custodians. Celsius and Nexo do the same thing with their tokens CEL and NEXO. Though Celsius and Nexo, to my knowledge, aren't sponsoring sporting leagues and venues.

I can't help but notice this seems a bit like the tech bubble all over again. It is well documented how many dot com era stadium naming rights deals went to absolute hell when the bubble burst. Even my beloved Patriots are the brunt of this joke with CMGI Field. From The Street:

Never heard of CMGI Stadium, you say? No worries. Neither has anyone else. The tech and venture capital company was set to paste its logo all over the Patriots' new home field for 15 years when it agreed to a $114 million naming rights deal in 2000. That agreement didn't even make it to the stadium's first kickoff. The tech bubble burst and CMGI was reduced to a penny stock before fading into obscurity

via The Street

Yikes. Crypto.com isn't the only digital asset company buying up venue naming rights. Popular crypto exchange FTX famously grabbed the Miami Heat home venue. Shifting back to Crypto.com though, Steve Kalifowitz is the company's CMO and he was just on The Pomp Podcast talking about the company's marketing strategy. On two occasions he compared his sporting league sponsorships to buying an advertisement in the Super Bowl. Buying a Super Bowl spot was famously done by Pets.com during the tech bubble. I'm not saying this is all doomed to fail. Don't get me wrong. It's a little scary, but early crypto buyers want broader adoption. We're supposed to expect this kind of "mainstreamization" of crypto. That said, I'm not buying CRO. I don't have a crypto.com account. This kind of stuff makes me nervous.

Other ideas

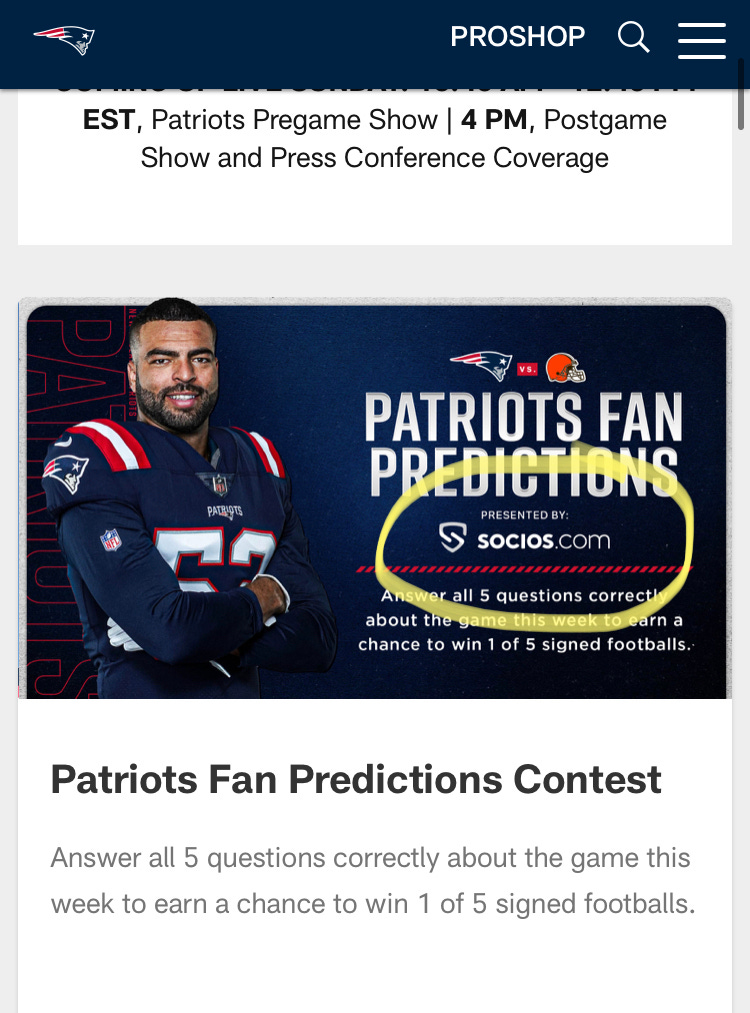

I'm a believer in crypto. I'm also a believer in targeting smart marketing decisions as an investor signal. Last week I saw something that made me say, "oh damn" out loud. Sorry, I'm bringing it back to the Patriots. I was scrolling through the team's website looking for information on gameday and there it was. Next to Kyle Van Noy's folded arms:

Patriots Fan Predictions presented by Socios.com. You don't say! Some of you may be thinking, "cool, what the hell is Socios.com?" I'm going to tell you. Socios.com is a fan engagement and community coin builder. The idea is that each sports franchise can launch their own "fan token." The fan token can be structured any way the team wants, but generally it will act like a rewards membership. Here's how Socios describes it:

Fan Tokens give you the power to influence decisions of your favourite teams, unlock VIP rewards and access to exclusive promotions, games, chat & a superfan recognition.

from Socios.com

Honestly, it's a slam dunk for a fanbase like the Green Bay Packers. Anyway, what makes this idea so interesting is the fan tokens are built on top of the Chiliz blockchain. That means that the Chiliz token (CHZ) is needed to do certain things with the fan tokens. If you want to buy them, sell them, you need CHZ. So even if you don't care about sports or sports fan tokens but you like the idea and want to make a bet that it works, you can just buy the Chiliz token and sit on it.

CHZ is well off both its all time high and its all time low. It appears to be finding a solid base in the $0.25-0.50 range.

What's the actual market for something like this?

It’s tough to say. I believe community building is going to be a big theme for all sorts of companies going forward. Especially as more people and businesses discover Web 3. It's the natural progression from the previous commoditized relationship between company and consumer to a more Twitter-like "following" that engages with a brand. Sports teams are uniquely positioned to benefit from this kind of fan interaction quicker. To this point, Socios has been more of an international play. There are dozens of soccer teams that have built fan tokens overseas.

The Patriots are the first and currently only NFL team to partner with Socios. This is in large part because Socios hasn't attempted to expand into the US market just yet. That appears to be changing right now. Check out how many NBA teams the company has partnered with:

That's 24 of the 30 NBA teams. That's not nothing. While these are currently marketing deals more than anything else, it's a start. And it means that if there is a true synergy between crypto users and sports fans, Chiliz is probably going to perform very well. And hopefully they won't think they need to sponsor a sports stadium to spread the word.

Disclaimer: Not investment advice. I'm not a financial advisor. Please do your own research. I am long CHZ, CEL, and NEXO.