SVG Contagion Update

We're seeing signs of problems at Circle and through payroll processors who held assets at SVP.

You may see me hitting your inboxes a couple more times about Silicon Valley Bank SIVB 0.00%↑ and the contagion from its collapse over the next few days. Here’s a brief update to show this is far from contained and about more than just VCs in Cali. Contagion has already hit the east coast with Boston-based depositors lining up outside Boston Private Bank yesterday. You can see in Larry’s tweet below, Boston Private is owned by SVB:

This is bad enough. But the real chaos is still going to be from the companies who have accounts with SVP - and some of them are payroll processors:

Effective immediately & going forward, Rippling payroll runs will process through JPMC. However, pay runs in flight for today out of SVB have not been paid.

Here’s what a video editing startup said late last night:

30 days ago our small team was celebrating closing a $5M fundraise that would enable us to make a bet on our future. Today we are unable to access those funds due to the SVB shutdown.

Here’s what a kid’s retailer called Camp said yesterday:

Unfortunately, we had most of our company’s cash assets at a bank which just collapsed. I’m sure you’ve heard the news. We are hopeful that this will be resolved soon, but in the meantime we are turning to you, our most valuable customers, to help us

Camp is offering 40% (optional) discounts on merch to raise capital. And this is just the normie business side. There is a rather large crisis now happening in crypto as a result of SVB collapse. Circle.

USDC Stablecoin Loses Peg

Circle is the issuer of USDC. This is supposed to be a stablecoin that has full parity 1:1 with the US dollar. Mechanically the way USDC works is fairly simple. Crypto participants who want dollar liquidity on crypto rails deposit their USD with Circle. Circle keeps those dollars in cash and in treasuries (for a profit spread) and then mints the crypto coin USDC on public blockchain ledgers for the depositor. USDC is a derivative off the dollar, but throughout its history it has generally held peg very closely.

Right now USDC is going for $0.91 as panic sellers have officially priced in the loss of Circle’s entire $3 billion assets held at SVP. Circle has $40 billion in assets (counting the SVP funds). At $40 billion, $3 billion makes up 7.5% of Circle’s funds - this would mean Circle can theoretically access $0.925 for every unit USDC - thus, the $0.91 re-rating. The issue though is as withdrawals are processed, that $3 billion hole becomes a larger percent of Circle’s assets.

If depositors start trying to exit USDC by asking Circle for their dollars back, USDC’s peg will continue moving lower. For instance, let's say holders go full panic and Circle processes $10 billion in withdrawals over the weekend. That would give Circle an asset balance of $30 billion but it would still be holding that $3 billion dollars in SVP that it can’t access. At that point, USDC units only have 90% backing and USDC will almost certainly move under 90 cents as a result.

Because we still don’t know what other dominoes remain. SVP isn’t the only bank Circle used and it’s entirely possible that those banks have problems as well. I would imagine Circle will pause withdrawals. If it doesn’t, they’re opening themselves up to a highly destructive run while SVP gets sorted out.

I have to say it… meanwhile, it’s tick tock next block with Bitcoin and most other cryptocurrencies. No pauses. No transaction halts. Make no mistake, USDC is losing peg because of problems in TradFi, not DeFi. Let that sink in.

Rate Hikes are Likely Done

The bond market and the gold market are both screaming the same thing. The Fed is done. Any possibility of a soft landing is toast, in my opinion. The Fed has officially started breaking things and it’s now showing in bank collapses.

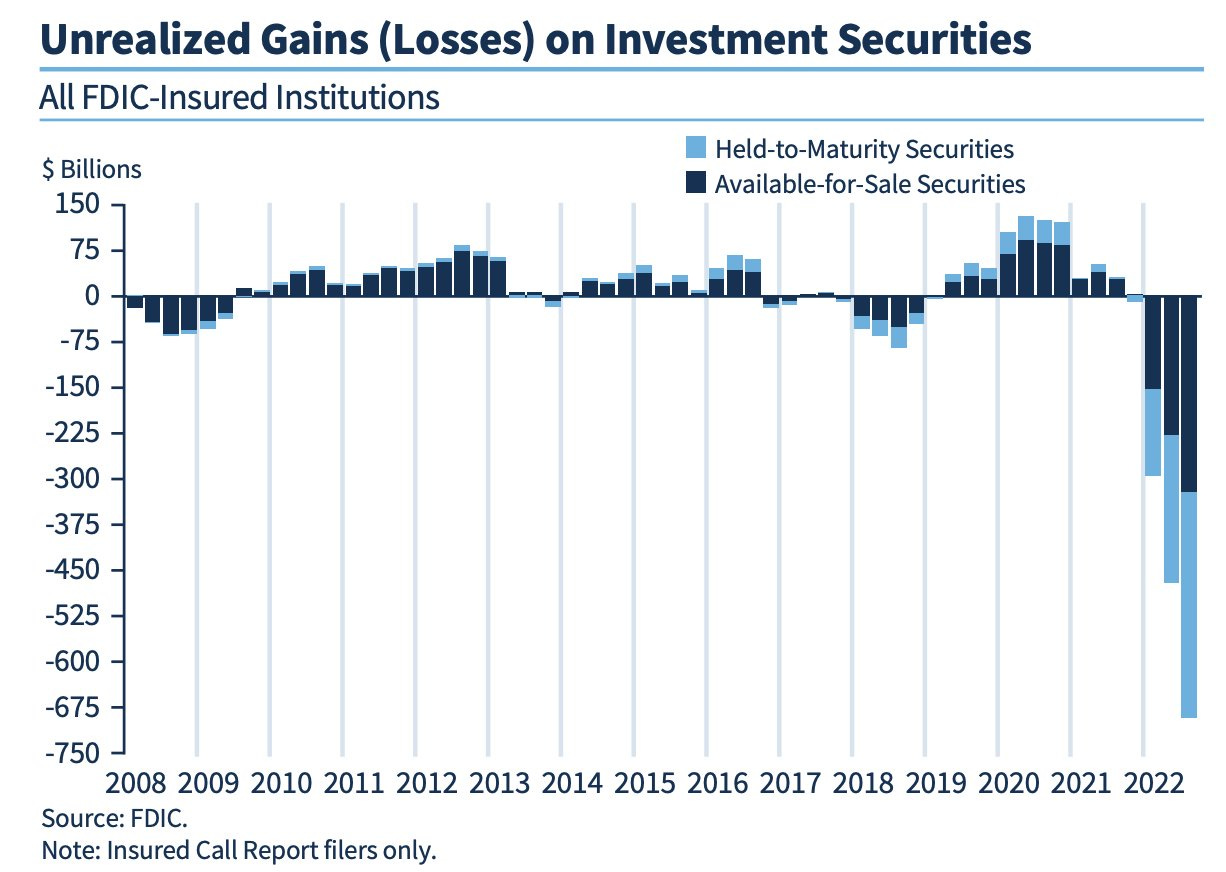

This chart with FDIC data shows the unrealized losses on investments in FDIC-insured products. It’s a blood bath. The biggest issue though might not even be that so many investments are underwater. If there are more dominoes from SVP (and we’re already seeing them), I question just how much FDIC can do:

The reserve ratio is currently 1.26% - this means that the worse this contagion gets, the less likely it will be that FDIC insurance can cover all depositor losses.

I believe we are going to see the word “bailout” thrown around A LOT in the days and weeks ahead. And I want to reiterate that I’m absolutely not trying to cause panic. But I think it has been obvious for a long time that our financial systems are made up of hocus pocus and faith - we’re just now entering the shitstorm. I love native cryptos, obviously. But the safest thing you can have now is cash and metal.

Disclaimer: I’m not an investment advisor. I live in my wife’s basement and I have no job. I share what I personally do and why I do it. I hold Gold, Silver, BTC, ZEC, and numerous other cryptos in self-custody.

Bullets and butter baby!

Can you please explain why JPow will probably not raise rates now?