The Ethereum Conundrum

Gary Gensler's SEC appears poised to classify the native token of the network as an unregistered security. Yet, ETH is arguably the best long term investment bet in the crypto market. What to do?

Ya Boi: If the spread between junk and t-bills is closing, does that mean junk is improving or are t-bills becoming junk?

Grandma: T-bills are becoming junk.

Ya Boi: So then where do you go?

6 yr-old child: The zoo!

Dogecoin it is.

Among a sea of investors who possess near certainty that the wind is at their backs, I’m becoming increasingly suspicious that the market is going to disappoint a lot of people. My recent posts have shared a theme; valuation. In the equity market, these fundamentals are usually pretty straightforward. Not so in crypto. But I can safely say that what has previously been mere pondering via email love notes over these last few weeks has started to morph into what I’d call conviction.

One of the things that I’ve been forced to internalize from following the crypto market over the last several years is the idea that it may be more similar to the stock market than either camp would probably like to admit. “Value investing” doesn’t seem to work in either market today. It’s currently more about passive fund flow into top assets and major narratives than anything else.

To be clear, this may reverse at some point. Value may get its day in the sun. As investors, we have to know when something is moving because of sound fundamentals and when it’s ripping because of narrative and/or technical analyst chart-think. To this point, crypto is mostly driven by the latter. And if you require any proof of that just go to the comments of my Grayscale Litecoin Trust $LTCN article from yesterday. In it, I make the case that paying $438 for a coin that costs $107 is going to end badly. But the chart followers insinuate technical analysis matters more than valuation.

The TA says different,but to each his own. - Flightmedic1

Frankly, I’m annoyed by this. Not because I don’t think TA matters - I obviously do. But more so because it’s difficult for me to argue that “Flightmedic1” is wrong. As it turns out, valuation is entirely subjective and while I can say it’s dumb to pay $47 for LTCN when the NAV of the shares is about $9, someone else probably thinks its dumb that the NAV of LTCN shares is even $9 at all and not $0.

Upon reflection, it’s difficult to argue any of these moves in price have much merit beyond the fact that someone is simply willing to fill the ask. With this as a basic framework, we can start to ponder whether scrolls from the past should be our roadmap today or if they should be tossed to the side. Allow me to briefly make the case for the latter. As this fledgling market matures, even though they have rarely mattered in the recent past, I suspect silly concepts like positive earnings will ultimately matter… yes, even in crypto.

iT’S diFfErent THiS tImE

Joke? Not really. Things are already very different this time precisely because of Bitcoin’s spot ETF approvals. The new all time high in BTC came before the halving this time rather than after. This is the first time this has happened in a halving cycle and it means this time already is different. I don’t think there can be any doubt at this point that the spot ETFs have pulled forward post-halving demand for BTC.

Now the question is, how much of that demand has been pulled forward? I have no idea and I’m not going to pretend that I do. But there are additional nuggets that may imply we’re dealing with a very different market than we were during the last halving cycle. I’ll bring it back to the Grayscale funds again because it’s wild to me that this is still happening:

Not pictured above are Grayscale’s Ethereum and Ethereum Classic funds - each of which are actually still trading at discounts rather than 200-700% premiums. I view this as perplexing since even Grayscale’s Ethereum fund once traded at a 950% premium during the last bull run:

So why is the fund not participating in the mania now?

Canary In The Coal Mine?

One possible reason Ethereum is still 32% off its 2021 high and trading at a discount through Grayscale could be the recent development that the SEC wants to label the asset an unregistered security. There is reportedly quite a bit of pressure being put on The Ethereum Foundation and other unnamed companies.

Speculation alert 🚨: I think it’s probably safe to assume one of the unnamed companies is Coinbase COIN since they’re operating a top 3 Ethereum layer 2 by TVL.

Priced in BTC, ETH is battling a breakdown of what has reliably served as support for close to three years. The sentiment around the prospect for a spot ETH ETF in the United States later this Spring certainly isn’t helping things either. Via the previously linked Coindesk article:

The SEC is evaluating multiple applications for an Ether ETF, but analysts following the process are becoming less optimistic that any such applications will be approved by the federal regulator, citing a lack of engagement between applicants and SEC officials.

We’re supposed to find out about the first batch of spot ETH ETFs in the US in the next few weeks as final deadlines for Ark 21 Shares and Van Eck applications are near the end of May. Something that has caught my eye in the leadup to those deadlines is the outflow from Ethereum-based investment products globally:

CoinShares analyst James Butterfill added this near the bottom of his latest fund flows blog:

Ethereum saw a 4th week of outflows of US$19m, being a common trait post network upgrades, reflecting investor apprehension of their success.

I think that’s an interesting framing. I’ll take his word for it. The last paragraph from the CoinShares post is the most interesting to me, however. Bold my emphasis:

Altcoins saw inflows totaling US$18.3m last week, with Solana leading, seeing US$6.1m inflows. Other notable flows were from Filecoin, Polkadot and Chainlink, with inflows of US$3.9m, US$2.4m and US$1.9m respectively.

Why would Solana, Filecoin, and Chainlink be leading altcoin fund flows in investment products? Could it be, just perhaps, that private placements are finding their way to Grayscale’s obnoxiously overvalued altcoin funds? Turns out, yes!

You gotta love that 6x spike in shares outstanding in FILG in a matter of just a couple weeks. I know the change in the table above shows the year to date change, but these private placements didn’t start until well into the year:

This premium meltdown in FILG is going to be delicious. Just to make sure you’re picking up what I’m throwing down here; the CoinShares altcoin data requires context. Filecoin, Chainlink, and Solana fund flows are benefiting from the 2,600%, 600%, and 500% NAV rate premiums currently present in Grayscale’s single asset funds.

What is happening is accredited investors are buying those cryptos at the market rate and placing the assets for secondary sales through Grayscale’s closed end funds. They’re essentially creating more shares of these funds at massive discounts to what the secondary market price of the shares currently is. Assuming these secondary prices remain at large premiums through 12 month lockup periods, the private placers can sell the funds on secondary and pocket the spread when share lockups expire. It’s a great trade if it holds up. I’ve been beating this dead horse on Seeking Alpha. The chartists don’t want to listen.

In the meantime, non-accredited investors may have other opportunities.

Ethereum Is Dead, Long Live Ethereum

Despite the lack of excitement and the regulatory ambiguity present in the market for Ethereum, I still like ETH and this network a lot purely from a potential capital return standpoint.

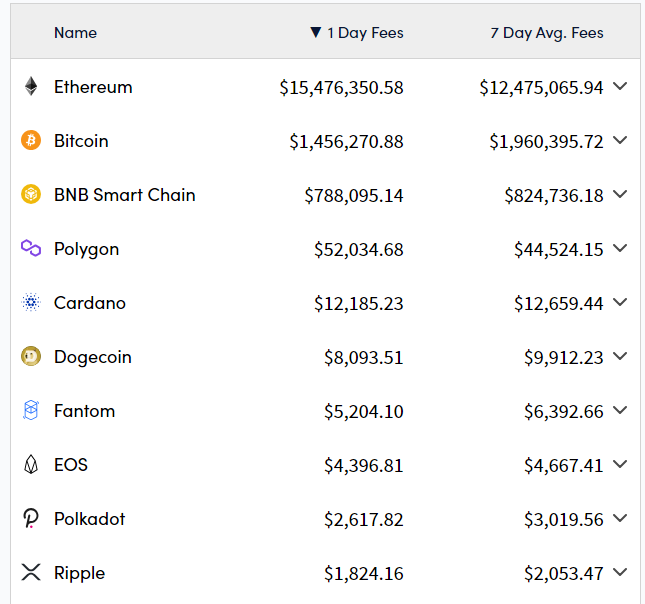

When it gets down to dollars and cents, there is just no real debate against Ethereum being the most successful L1 blockchain in the market from a profitability standpoint. The network is averaging over $12 million in daily fees over the last week - and this is typical not an outlier. No other network even comes close to these fees and most of the L1s are laughably low by comparison.

Of course, many public blockchains are centralized optimized for low fees. When one adjusts for token issuance and generates a figure close to what would be considered “earnings,” Ethereum is again the clear standout.

Ethereum earned over $250 million in March. Of the remaining top 20 chains as shown by Token Terminal, only Tron, Binance, and Stellar weren’t in the red. One can’t help but wonder how sustainable all of this is if operations are essentially funded through token dilution and the only network that has meaningful earnings to speak of operates with a deflationary token and wicked high transaction fees. Here’s Solana’s weekly earnings trend by comparison:

Ugly. Hey, it least the chain never shuts down.

Here’s my final takeaway from this long diatribe of an email/post: between the Grayscale discounts, the regulatory drama, and the investment outflows - the market seems to not like Ethereum right now. Yet, ETH has the largest DeFi footprint in the market and has an L2 ecosystem that, though admittedly very fragmented, is growing usage faster than almost every competing L1 in the market. I suppose you could say I’m buying the fear.

Disclaimer: I’m not an investment advisor. I play the crypto ponies.