The Fed Can't Hike

Initial jobless claims surprised to the upside this morning and it appears to be reversing. Stable prices or full employment? Oh the dilemma...

We got a very interesting initial jobless claims print this morning before the market opened. While it’s nothing too alarming, at 248k, it was nearly 30k more than what some economists were expecting. Here’s what that trend looks like going back roughly the last year.

I took out the COVID spike because with that in there, it would be impossible to read the trend. The average over the last 4 weeks has been 243k initial claims. For context, the average weekly initial claims for the entire year leading up to the COVID spike was 216k. So even though claims were impressively low for most of December 2021, it kind of looks like the trend has bottomed and is reversing.

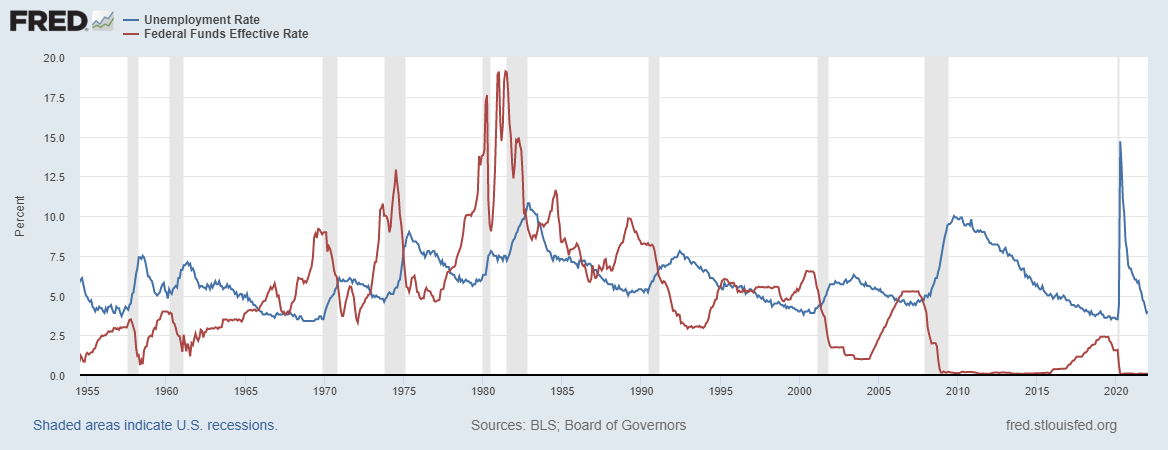

Are we sure there will be an interest rate hike in March? I know I’m beating a dead horse at this point with this question, but I can’t comprehend the notion that the Federal Reserve could possibly be this unaware of the data and of history. If initial claims continue higher, we’re probably going to see a move up in the unemployment rate for February. Let’s look at the relationship between the unemployment rate and the Federal Funds Effective Rate over the last few decades.

It’s a perfect inverse. Generally speaking, when the unemployment rate rises, interest rates are sharply cut. We saw this after the dot com bubble, after the financial crisis, after the COVID shock, and pretty much throughout every cycle hike of the last six decades. Speaking of cycles, the unemployment rate is now at the same level that it generally bottoms and reverses.

The Fed has two mandates; stable prices and full employment. The only logical explanation for the Fed not raising rates at this time is because it believes doing so will hinder the job market. Because the Fed has completely whiffed on stable prices over the last year. Consider this:

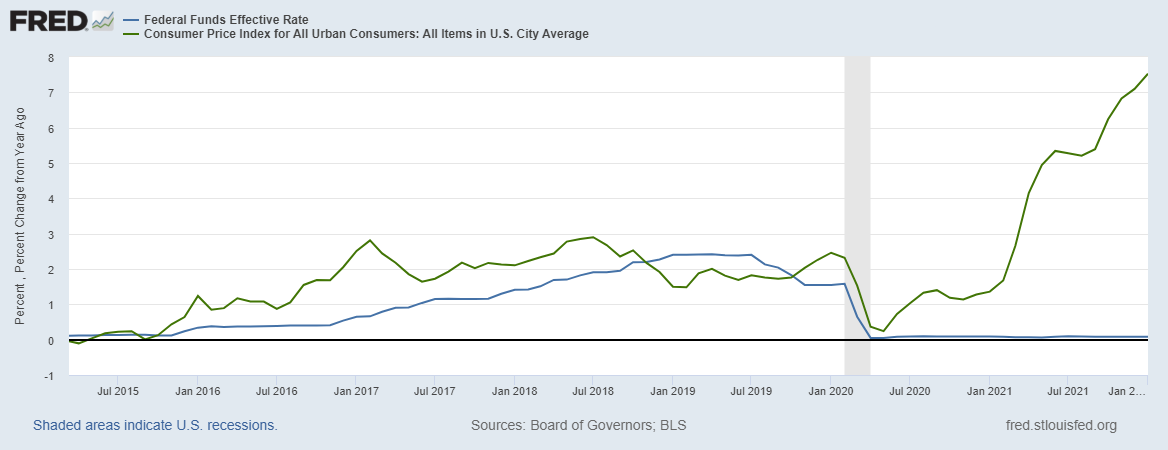

This is the Federal Funds Effective rate in blue with the year over year change in the CPI in green. Here, we see an effective rate that generally moves with Consumer Price Inflation; either a little ahead or a little behind. But something broke after the financial crisis. With CPI prints normalizing in 2010 through 2012, the Fed still kept rates at zero. It wasn’t until CPI bottomed in 2015 and started moving back up again that the Fed got serious about allowing the cost of credit to move back up. And now the elephant in the room.

An honest and truly independent central bank would have been raising rates in April of last year when it was quite clear the figures were getting hot. But they didn’t. Convincing themselves that inflation would be transitory even though anybody with basic critical thinking skills could have told them the level of monetary debasement during COVID coupled with supply chain shocks and goods shortages would lead to even higher price inflation in the months ahead.

So this is where we are now. The Fed is, generously, 8 months behind the curve. And now jobless claims are moving back up. The Fed can’t meaningfully hike to battle inflation. It’s pretty obvious. Occam’s razor. If they could, they would have already. Even if they raise a half a point at the March meeting to save face, I believe it will cause so much damage in the macro economy that they’ll quickly reverse course when they see the job market data and the decline in STONKS. So that’s how I’m positioned. I flat out don’t believe them. I don’t think there will be a hike in March even though the market has already priced one in.

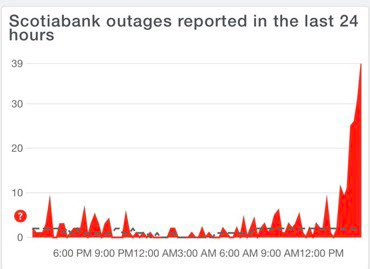

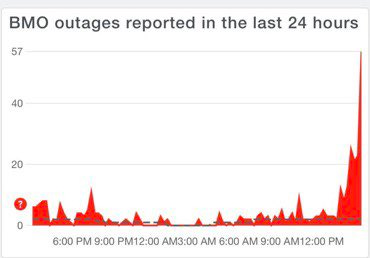

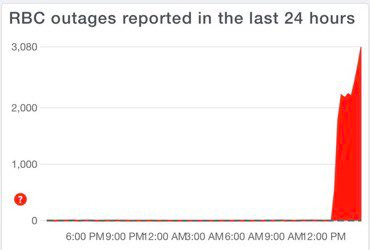

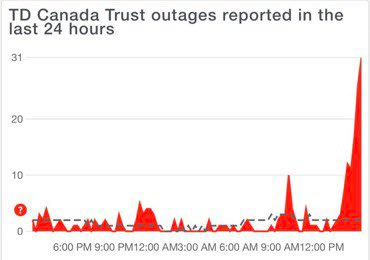

How can they wiggle their way out of a hike next month? Who knows… but I have a funny feeling they may try to blame financial instability in Canada. You know… the country that just announced the financial oppression of its citizens and appears to be at the beginning of an epic bank run?

Yeah, that Canada.

Disclosure: I’m not an investment advisor. I merely share what I do and why I do it. You shouldn’t take anything I say as investment advice and always do your own research when making investment decisions. Cryptocurrencies, tokens, STONKs, and digital trinkets could all go to zero. I have no job and I live in my wife’s basement. I’m the last person on the face of the earth who you should listen to for financial advice or life advice. I’m not featured on trustworthy financial news sources like CNBC or Bloomberg and I don’t wear a necktie when I make my trades.

"I have a funny feeling they may try to blame financial instability on Canada"- Yes!

Looking at the CPI / Fed Rate chart, it has always seemed to me the best times were when we had an honest rate of around 4% - 6%. This creates a path to decent fixed earnings and makes people think before borrowing, yet won't choke off credit markets. Present debt loads couldn't stand this level of cost so I think the Fed is boxed in pretty tight. Reality always wins and many today have never experienced this so it will be interesting. Not fun, but interesting. Pray, plan, prepare and RESIST.