The Future of Finance Must Be Permissionless

There are various companies, networks, and protocols trying to figure out how to get this right. Clear winner? Hardly. But I think we have a pretty good start.

As Thomas Sowell says, there are no solutions, only tradeoffs. Want an example? Physical gold is wonderful. It’s nobody’s liability, doesn’t tarnish, truly permissionless, and is a nearly perfect monetary instrument. I say “nearly” because there is one major flaw; it can’t scale in physical form because it’s expensive to move far distances. That means trading it globally either requires shipping it, likely with a third party carrier — or — trust in a third party custodian to settle the transaction on some centralized ledger with metal held in a vault somewhere that never actually moves.

I firmly believe physical gold is the best thing we have for true permissionless money and that’s the key reason it has held its value for (checks notes) thousands of years. But using it for cross border payments requires trust in a digital system that is controlled and managed by centralized actors. I’m just not sure digital payments need to function that way. The question is how do we get a decentralized network of market participants who manage a distributed ledger for the benefit of everyone? Before we get to that, maybe a better question would be why should we even want that?

Centralized, Permissioned Systems Lead To Financial Weaponization

We need permissionless systems because of the ability to weaponize finance when it is digital and centralized - as it already is today. And I can say with quite a bit of confidence financial weaponization is already a far bigger problem than most people likely realize. Go down the list of instances of blatant financial weaponization we’ve witnessed in just the last 3 years:

America blocking Russia from the global financial system

Canada’s clown-prince ordering the banks to freeze the assets of trucker rally supporters - not even just the participants, the supporters

PayPal PYPL 0.00%↑ de-platforming a literal charity for going against the wishes of the pharma mafia

I picked these three examples, in part, because they were the first to pop into my mind. But also because they’re individual examples with differing dynamics. We have examples of nation-state vs nation-state, nation-state vs its citizens, and corporation vs its customers. But no matter which flavor of weaponization we’ve observed, the underlying motivation from the perpetrator seems to usually be the same; it’s to intentionally harm political adversaries.

Today we’re going to look at two crypto networks that aren’t named Bitcoin, Ethereum, or Zcash (which remain my top 3 crypto holdings, by the way). One network we’ll explore today aims to integrate crypto with the existing payments infrastructure. The other is focused on eliminating the need for centralized exchanges entirely. What they both have in common is that they’re chain-agnostic and built for a future where potentially any blockchain can succeed. Yet I think one is poorly constructed and the other looks much better.

In my opinion, crypto rails are actually pretty good at peer to peer payments already. Whether you swap sats on Bitcoin’s Lightning Network, use the base layer of something like Dash, or prefer stablecoins on a smart contract chain like Polygon or Avalanche, the ability to use permissionless networks already exists. What hasn’t yet been solved is the complexity of the user interface and the reliance on centralized third parties for swaps and interoperability.

Flexa Network: New Currencies With Old Infrastructure

One of the on-chain protocols trying to solve crypto payments is Flexa Network (AMP-USD), formerly known as "Flexacoin." This is an interesting coin but going long AMP at this point would be very contrarian. I do not have a position in AMP, nor do I plan to take one in the future. But I do think assessing how the network is constructed and what has unfolded with Amp from the sidelines can provide really good insight into how we might view other crypto projects and payment protocols going forward.

AMP is the collateral token of the Flexa Network. Flexa is a payment processing network that allows consumers to buy everyday goods and services with a number of different cryptocurrencies that vary from stablecoins to native chain cryptocurrencies. If a merchant is Flexa-enabled, the consumer can literally buy anything in the store with crypto rather than fiat. This is a very important protocol because its one of the few blockchain native tools that I have found that actually allows cryptocurrencies to be used for payment at well-known retail stores.

Flexa has an interesting structure because the network is essentially just a big pool of AMP tokens that have been deposited (or staked) for settling transactions. Because cryptocurrency network block times vary between blockchains, AMP allows the transactions to settle immediately even when the user pays with a slower blockchain like Bitcoin or Litecoin. AMP is essentially held in escrow so the merchant and consumer can go on their merry way immediately after the transaction:

token’s utility in the Flexa network is to temporarily secure cryptocurrency transactions while they are awaiting confirmation on the blockchain. To put it another way, Flexacoin represents the assurance that any given Flexa network transaction will settle

The AMP collateral is offered by liquidity providers who designate which staking pool they'd like to fund. Depending on which pool they choose, the staking reward is different. Currently, there is a little over $49 million in Flexa capacity, or TVL. That spending capacity is pooled for Bitcoin, Litecoin, Zcash, Cardano, Dogecoin, Polygon, and Solana, among others. At the merchant level, Flexa is integrated with Clover, Woo Commerce, Aurus, and numerous other payment processors as well. There is an interesting security component to using Flexa that I think is probably underappreciated;

In the graphic above, Flexa is showing how many layers there are to a typical credit card transaction. It's no wonder credit card processing fees are so high given this level of middlemen in one single transaction but I think this also illustrates the potential data security cost associated with having so many touchpoints interacting with sensitive information. By comparison, wallet apps that integrate with the Flexa network don't require this many layers.

The Tokenomic Problem

I could get into the key metrics pertaining to coin price, coin supply, allocation, and vesting schedule but none of it is really necessary. While all of that stuff is admittedly bad, the fundamental issue with the Flexa Network construction is that AMP is the only collateral token. So if there isn’t organic demand for AMP and the price goes down, the spending capacity on the network goes down with AMP. And that’s precisely what has happened:

At its peak, the spending capacity on the Flexa Network was over $2.5 billion. Yes, billion. Now it’s under $50 million. Meanwhile, the actual number of AMP tokens that are staked for liquidity providing are still near the all time high. The loss in capacity is entirely due to the collapse of the price of the AMP token itself.

If that wasn’t bad enough, it might actually get worse… Flexa Network is “decentralized” in that it has individual liquidity providers posting AMP as collateral. But that’s about where the decentralization begins and ends, in my view. Case in point, the Ampera Foundation drama…

The Ampera Foundation

Tyler Spalding was previously the CEO of the Flexa Network. But earlier this year he announced his departure from Flexa and shared the launch of the "Ampera Foundation." Ampera is to be an independent entity from Flexa but one that would be governed by AMP token holders. Ampera's goal is to create a chain-agnostic DeFi protocol:

With the growth of DeFi, it has become clear that a more extensible, integrated protocol will provide the most utility and requisite security. As the first initiative of the AF, a new collateral protocol will be launched within the coming weeks.

In the Medium post detailing some of the rationale, Ampera essentially made the argument that DeFi didn't really exist when Flexa was initially launched and it has now completely dwarfed Flexa's adoption. There was an AMA session on Twitter Spaces following this announcement and the reaction from the AMP community was... not good. Here are some of their sticking points:

Ampera's planned DeFi protocol will allow for various assets to be held in collateral - thus, mitigating the need for AMP as a utility token

To combat that issue, Spalding said AMP would instead be the governance token of Ampera's DeFi offering

An AMP token donation that was given by Flexa to the Ampera Foundation for community building initiatives

In response to the AMA, I saw a lot of community members throwing around the phrase "rug pull." As far as I can tell, there is still no roadmap or update to the Ampera Foundation's DeFi product on Medium after several months.

There is some thinking within the AMP community that Ampera was launched to create a distance between AMP, Flexa, and Spalding. AMP was alleged to be an unregistered security long before the SEC went on its industry-wide rampage following the collapse of FTX. The unregistered security designation by the SEC is one that could be problematic for those involved with developing anything that utilizes AMP.

I'm not going to speculate on whether that is right, wrong, or even possible. What I will say is, as a protocol, Flexa does seem to actually work well for the users themselves. In the past, I've seen guys sharing videos on Twitter of using ZEC to buy items at Dunkin Donuts and Chipotle CMG 0.00%↑. I think the issue for Flexa is that AMP is hurting Flexa's utility rather than helping it.

Even though AMP holders may not want to hear it, Flexa's problem is that the collateral is AMP rather than the coins in the spending pools. But the reason why AMP is what is used for the pools is because of the settlement problem with using the native assets. You can't buy a coffee with Litecoin because it takes too long for the transaction to process on chain. This is a very difficult problem to solve and why despite the issue with the collateral itself, I still think Flexa is interesting as an idea.

While not focusing on payment processing, there is a completely different crypto protocol that is constructed the way I think Flexa probably should have been.

The Chaos of Multi-Chain

One of the major pain points in crypto aside from user interface is chain interoperability. There are some networks, like Cosmos, that have interoperability in mind from genesis. But generally the most popular decentralized exchanges, or DEXes, are optimized for one blockchain ecosystem. A DEX that I personally like a lot is Uniswap. But even that protocol has limitations. If somebody wants to swap from Ethereum to Bitcoin, they need an intermediary. There are a couple of solutions to this problem; minting "wrapped" Bitcoin derivatives and centralized exchanges.

The latter is obvious, most users already have centralized exchange access because those entities have become the main on-ramp for new crypto users. This on-ramp business model is why Coinbase COIN 0.00%↑ and FTX were buying Super Bowl ads in 2022. The problem with Wrapped Bitcoin, or WBTC-USD, is it requires depositing BTC with a custodian as part of the WBTC minting process. There is a better way.

THORChain and a Brief History

Simply put, THORChain (RUNE-USD) is a layer 1 PoS blockchain that primarily functions as a decentralized automated market maker (or AMM) connecting native chains. It doesn't use custodial wrapping or a minting mechanism. The developers say it is not actually a cross-chain bridge and the user maintains custody of the assets being swapped. Nine Realms is considered the core developer. The president of Nine Realms is Gavin McDermott.

You can sort of view THORChain as a chain-agnostic DEX. And it’s theoretically a very large threat to centralized exchanges like Coinbase COIN 0.00%↑, Binance, or Kucoin. THORChain is built on Cosmos SDK and can link UTXO coins like Litecoin or Dogecoin to EVM smart contract ecosystems like Avalanche or Ethereum. Currently, THORChain enables swapping between 9 ecosystems:

Bitcoin

Ethereum

Binance Beacon Chain

Dogecoin

Bitcoin Cash

Litecoin

Cosmos Hub

Avalanche C-Chain

THORChain

As far as I can tell, there isn't any other base layer decentralized protocol that has this level of cross-chain integrations. At the user level, swaps from one chain to another utilize the RUNE token without the swapper ever knowing. For example, when a user wants to swap from Bitcoin to Ethereum, the interface looks like any standard BTC to ETH swap that you'd see in a centralized exchange. However behind the scenes, the application that utilizes THORChain accomplishes this because of concentrated LP RUNE pairs.

When a user wants to swap Bitcoin to Ethereum, BTC is transferred to RUNE and the RUNE is then transferred to Ethereum. The Ethereum is then deposited into the ETH address of the user. Because THORChain is an interoperability chain that integrates at the application layer, a user of an app like edge wallet can swap BTC for ETH in-app with THORChain without ever knowing they used RUNE.

Tokenomics

THORChain has a very familiar token utility. It's used to pay the transaction fees on the network. And as a proof of stake chain, validators are paid out a portion of the transaction fees as a token yield. The liquidity providers that keep the AMM functioning properly are also paid out a portion of the fees through RUNE rewards. While there is a max supply of RUNE token, there is a bit more dilution coming for token holders with just 66% of the RUNE in circulation:

Total Token Supply: 500 million

Circulating Supply: 333.9 million (67%)

Token Price: $1.00

Market capitalization: $334 million

Fully diluted cap: $500 million

Market Cap Rank: 97

The chart of the coin's price looks abysmal and is now down 95% from an all time high of $21.26 in May 2021. Initially there was supposed to be 1 billion RUNE at launch but the group behind the project ultimately decided to burn half of the supply evenly among the initial allocation schedule. With 15% going to seed investors and 62% of the total supply going to airdrops and rewards, there is a better balance of allocation of RUNE than we've seen in some other crypto projects before. The release schedule of the tokens wont be complete until around 2028:

Despite the remaining inflation, all of the dilution is coming by way of liquidity incentives and rewards; essentially, early investor coin dump risk should be very much in the rear view mirror at this point.

Application Utility

I can say that I've actually used THORChain. And I never had to touch RUNE to do it but RUNE was used in my transaction. This is a huge deal. Because it means RUNE acts as a utility token operating under the hood of any application that integrates with the THORChain network. And there is a considerable reason to integrate. Take for instance, ShapeShift, a wallet application and on-chain portfolio manager that I’m very fond of. ShapeShift has THORChain integration. I can swap Ethereum to Bitcoin in a completely decentralized manner. From the user's perspective, the best part is THORChain actually makes it cheaper to swap from ETH to BTC than from ETH to WBTC.

In ShapeShift, if I swap from ETH to Wrapped Bitcoin, I'm utilizing two ERC-20 tokens in the transaction which results in a higher gas fee. But in the example I shared above, when swapping from ETH to BTC through THORChain, I'm only utilizing one ERC-20 token and get a more favorable gas fee as a result provided the Bitcoin network transaction fee is lower than Ethereum gas. THORChain is essentially destroying a key reason for WBTC to exist. There is $5 billion tied up in the WBTC derivative. When something can cannibalize an entire token model of that size the way THORChain appears to be able to do, I think long term crypto investors have to take notice.

Network Activity

From a network usage standpoint, THORChain is still in its infancy. Since launch there have been just 12 million cumulative swaps on the network and daily swaps is generally volatile. We saw a big spike in swaps following the FTX collapse and then another noticeable uptick when the regional bank problems started in March.

Unlike the core issue discussed above with Flexa/AMP, THORChain liquidity providers use both RUNE and the native assets of the chain integration for the swap pairs.

For instance, if I wanted to provide liquidity for the Litecoin pool, I’d have to post both RUNE and LTC as collateral. If someone else decides to swap DOGE for LTC and uses a wallet app or DEX that has integrated with THORChain, that person would sign the swap transaction. In the plumbing of the system, the DOGE would enter a DOGE/RUNE liquidity pair that would send the RUNE to the LTC/RUNE liquidity pair that I posted.

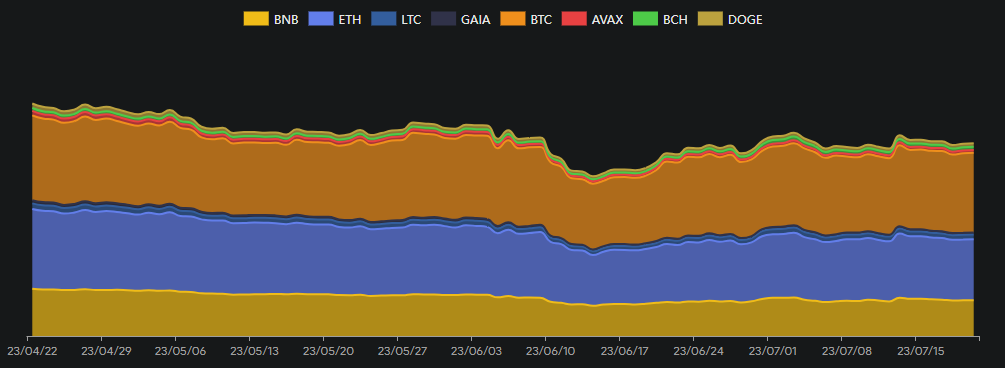

LTC would come out on the other end and this action would require a small transaction fee to process - this fee would incentivize the liquidity providers. Understandably, Bitcoin and Ethereum have the largest pool depth in THORChain with $41.3 million and $31.7 million respectively:

After that, Binance makes up $18.5 million and the rest is spread out among Litecoin, Avalanche, Dogecoin, Bitcoin Cash, and Cosmos. There is a little over $100 million total in liquidity pool as expressed by the TVL figure; and again, the top 3 assets make up the overwhelming majority of the pool depth.

Risks

Beyond the fact that centralized exchanges exist, I think we have to anticipate future competition in the public blockchain space for what THORChain is building. Centralized exchanges clearly have quite a bit to lose by forfeiting share to other centralized peers and DEXes. We’ve already seen DEX share of transactions increase over the last 3 years from less than 1% to 22% in May:

That competition could create a race to the bottom in transaction fees that could make centralized exchanges more appealing to crypto swappers. Furthermore, cross-chain swapping is hard to get right. We've seen countless examples of bridge hacks that have resulted in hundreds of millions of dollars getting siphoned away from liquidity providers. While THORChain is not a bridge, it is not immune from sophisticated heists either.

Summary

Centralized exchanges may have a vested interest in using the regulatory apparatus to eliminate decentralized competitors. We saw Sam Bankman-Fried trying to do this before FTX collapsed. While it might be cheaper to swap small transaction-value ETH to BTC in a Coinbase account than it is to swap directly on the blockchain networks, they're not actually free swaps.

The more the value of the transaction increases, the greater the likelihood the swapper wants to eliminate intermediary fees to the degree that it can by having full custody of the assets. This would theoretically put THORChain in the driver's seat in a cryptocurrency world where centralized exchanges are losing their grip on trades.

If we do crypto right, it has to be decentralized. Furthermore, the industry can’t be a bunch of fragmented networks with no interoperability. If that happens, it isn’t any better than the fiat regime with dozens of different currencies and rent-seeking middlemen. And most importantly, it has to be permissionless. THORChain checks the right boxes.

My general view is the RUNE token was a big beneficiary of the crypto mania during the 2020/2021 bull run. The coin has now sold off by more than 95% yet the network itself has held up totally fine during the bear market. The chain solves a big problem plaguing the industry and the native token has utility in the network. These are the kinds of ideas that I like to allocate to.

Disclaimer: I hold RUNE, LTC, BTC, ETH, ZEC, MATIC, AVAX, and a bunch of other shitcoins that I didn’t mention in this note. I’m also not an investment advisor and buying crypto coins is highly risky. A lot of these things could go to zero and many of them likely will. But we’re trying out this whole digital decentralization thing and it’s the best we have so far.