The Market is Forward Hoping

Being a bear in a bar full of bulls is a lonely place to be. When that happens, it's important to take a step back, reassess, and either change your mind or simply wait.

I’ve been thinking a lot about The Big Short lately. Perhaps it’s because I have a bearish macro bias thesis. Or perhaps it’s because I have a bearish macro bias thesis that didn’t work all that well when I was hedged earlier this month and now I want to escape to the home theater…

There is a reason why I closed my market short proxy last week. And that’s because as bearish as I may be on broader economic fundamentals and equity valuations, I still have to admit when I’m wrong and just get out of the way of the bulls when they come barreling down the street. I could continue trying to run with them and take the horns, but I’d rather not.

This morning, we received a new CPI print for October. The year over year rate of 3.2% consumer price inflation came in slightly under the consensus estimate of 3.3%. Pure jubilation ensued in an equity market that is quickly becoming overbought after being oversold a mere twelve sessions and four gap opens ago:

Shorts have been squeezed. FOMO is clearly in the air. Dogs and cats are living together…

Of course, the market has interpreted this CPI news bullishly because normalizing inflation means rates might be done going up. Let’s put aside the idea that 3% year over year inflation against enormous baseline levels may not actually be all that inspiring when the Fed has a self-given mandate of 2% inflation. But let’s say Fed rate increases are over for the sake of the argument.

The market seems to think rates being done going up also means rates are that much closer to going down. That has to be the case because rates simply maintaining this “higher for longer” level isn’t going to help sell any more cars or houses. That said, perhaps rates will indeed go down because we don’t think they’re going up any longer. In that case, rates going down is theoretically bullish because it likely means more casino tokens are coming into the slot machine that is the US financial market.

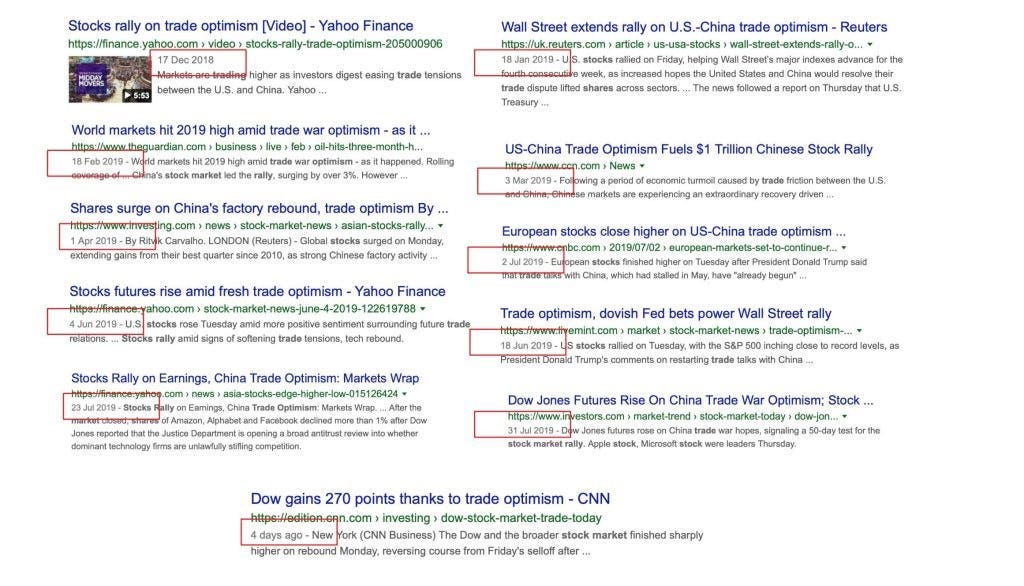

Our most recent memory of a rate hikes ending is from 2019 when the Federal Reserve paused at the beginning of the year and then started lowering rates again in the second half of 2019. Simultaneously, the equity market was absolutely ripping on “Trade Optimism” headlines seemingly every single day:

But there’s an important problem with the S&P chart overlayed with Federal Funds that I depicted above. For some reason, the daily S&P 500 index data in the FRED economic research chart only goes back to 2013. Fortunately, the Nasdaq data goes back further. What happened to this rate/stonks relationship after the Fed started cutting in late 2007?

Total destruction. And this brings us to the most important question; will the most telegraphed recession ever actually manifest in the government data at some point? Because that seems to be the critical missing piece for the bear thesis. Admittedly, that’s anyone’s guess. In the meantime, oil just fell 20% from peak to trough over a 7 week period and small caps continue to act as though trouble is brewing in spite of that juicy 5.5% rip in the Russell 2000 today.

Ultimately, I really don’t know how this is going to go. And when I don’t know, I try to read analysts, traders, and gauge general sentiment from others. All I can say is, sentiment is… boastful.

Just don’t fucking dance. - Ben Rickert/Ben Hockett

I get it. I like to mention my wins as well and it’s an important part of earning a rep and growing a following on any platform. But here’s what I observe right now:

I see a guy who literally has “stay humble” in his bio dunking on a fellow analyst as part of a 20-tweet long chest thump of a Twitter thread

I see a popular trader who used to call a spade a spade now mocking a viewpoint he used to share not too long ago

Oh and I see all of this happening based on a CPI number that is… probably wrong. Or maybe food at home really is only up 2.2% year over year…

Dr. Doom isn’t back yet. But he’s not far away. Bear market rallies are often aggressive to the upside. Or maybe AI will validate all these preposterous Mag7 valuations.

Recommendations

Read

Treasury Auctions Explained For People With Short Attention Spans by

& James LavishA really solid explanation of the carnage in last week’s US treasury auction. Long story short:

Watch

The Pragmatic Duo joined forces for a very interesting market conversation on The Pragmatic Investor podcast recently.

hosted of The Pragmatic Optimist for this one and it’s well worth the time. Personally, I like Amrita’s portfolio construction approach quite a bit.Listen

This was a really interesting change of pace for Tom Luongo’s Gold, Goats ‘n Guns podcast but I enjoyed it nonetheless. Eric Peters is an automotive blogger and he and Tom dove in for an hour and a half on EVs and how government efficiency standards have essentially destroyed the ability to produce a small pickup. It was really interesting and I found myself discovering why our 2021 Rav4 doesn’t actually accelerate when I gun it.

Hope you guys enjoy the selections and thanks for reading.

Disclaimer: I’m not an investment advisor.

Thank you for the shoutout. Also great post with a superb macro overview.

Thank you! Let’s hope high-inflation is over soon , I’m tired of spending over $5.00 for a gallon of gas and over $6.00 for a loaf of good bread. The cost of goods and services in our household have doubled and tripled sometimes the last few years.