The No Inflation Myth

We are told there is no inflation. Of course, all you need to disprove that idea is a calculator and some common sense. Red pill time.

There’s no inflation.

It’s a line we’ve been fed from economic thinkers and government bureaucrats for some time. Before we get into the why, let’s first just establish that no inflation is a claim that can be easily debunked. No inflation is a myth. If you haven’t listened to QTR’s latest podcast, I’d encourage you to do so. He gives a fun profanity-filled anecdote about how serious consumer price inflation can be hidden in something like a tube of toothpaste. It’s a little strategy called shrinkflation and it’s a creative way for businesses to gradually charge you more for the products you buy over time without a noticeable uptick in nominal expense. The catch is, you’re getting much less product for the same dollar you spend.

Don’t just take Chris’ word for it. You can see these kinds of things with your own two eyes. In the UK, the Office for National Statistics (ONS) found 206 examples of shrinkflation from 2015 to 2017 alone.

This isn’t just a British phenomenon. Do a little digging and you can probably find examples in your own home. Would you like to know how much the price of a battery has gone up in just 4 years?

In April 2016, Costco was selling consumers packs of 72 AA batteries for $18.99. By unit, that is just over 26 cents per battery. Today, Costco sells 48 packs of AA batteries for the low price of just $16.99. By unit, that price is now over 35 cents per battery. Representing a compound annual growth rate (CAGR) of 7.6%.

That 7.6% consumer inflation rate is well above the 1.5% aggregate inflation estimates from the BLS. And this is just one example of shrinkflation that is a bit more hidden. There are several examples of inflation that are far more overt if you simply look for the price history of some very common items. Let’s stick with Costco because it is fundamentally a company that promises cost savings for consumers through bulk-buying. Here are some items that are either close comps or exact SKUs that you would find in the Faybomb house. Each of these examples are of the same item. Size and item number are identical.

The Honey Nut Cheerios that were $7.95 in July 2017 are $9.49 in July 2020. The Kirkland Signature Colombian Coffee that was $8.99 in 2016 is $10.99 in 2020. The Perrier Sparkling Mineral Water that was $16.79 in July 2017 is $19.49 in July 2020.

These real inflation figures are far more in line with the consumer inflation estimates one would see on a “fringe” website like Shadow Government Statistics.

How could this be? How could government figures be getting it so wrong on official inflation numbers? For starters, we can’t just focus on headline numbers. We have to break the data down and see where the inflation really is. These writers from the St Louis Fed correctly hypothesize that improvements in technology help keep inflation numbers down. The problem is, this is just one part of what consumers buy. It’s great that we can buy 60 inch connected TVs for a few hundred bucks. Since that’s not an everyday purchase, the low inflation benefit is felt less. This AEI visualization of the BLS data says it all.

The big takeaway from this chart for me is that childcare, healthcare, and education are all massively outpacing wages. Furthermore, wages are barely beating food and shelter. While cars and electronics become cheaper as technology improves, the things that we pay for on a regular basis are much more expensive.

So why are we being served the “no inflation” propaganda? The scary but unfortunate explanation could just be that it is intentional. Why would government entities want us to be so certain that inflation is under control somewhere in the 1.5% to 2% range if it really isn’t? There are 3 main reasons that I can think of.

Inflation hedges take wealth out of the system.

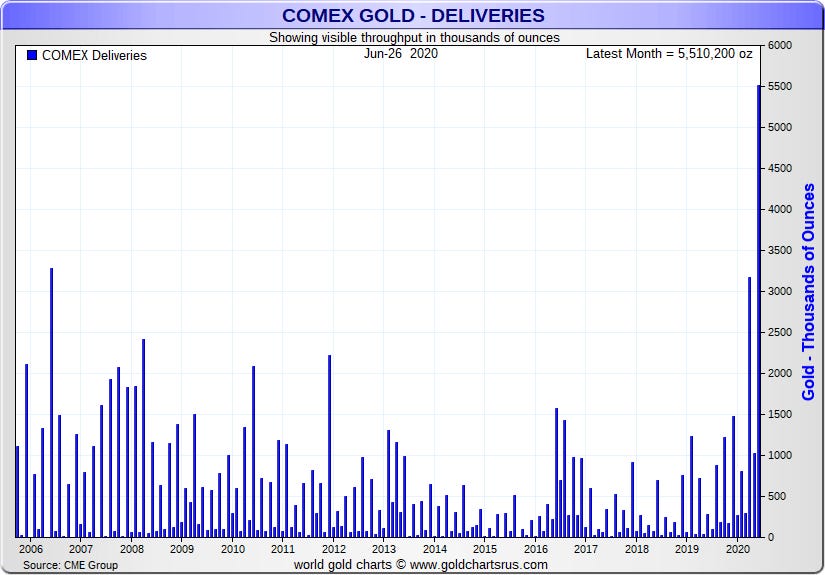

Have you seen gold and silver lately? They’re on friggin’ fire. Why is that? There are a variety of factors playing into the rally, but the biggest one in my opinion is monetary policy. Buying physical gold and silver to store in your home safe or a third party vault takes your wealth out of the banking system. Wealth out of the system is much harder to tax. And as we can see from the recent action in the metal market, a big part of this surge in gold is from buyers who want physical delivery.

The parasites reliant on taxes to exist must get their feed. So, if we convince people there isn’t any inflation, there’s no need to hedge against inflation and that wealth stays taxable. It would appear from this COMEX data people are now seriously hedging against inflation with physical metal deliveries. That wealth is now going to be sitting in metal, not paying taxes.

High inflation hurts confidence in USD.

If US citizens were actually paying attention to what is happening to the currency they’re forced to use, they would probably be livid. With high inflation, interest yields on savings accounts and treasury bills have to be higher than the rate of inflation. If not, it would mean the real yield on savings is actually negative. We are experiencing that exact scenario right now.

The blue line above is the 10 year inflation breakeven rate from the St Louis Fed. The red line is the yield on the 10 year note. Bond investors want the red line to be above the blue line. Not only has the 10 year note fallen below the breakeven rate, but the spread has been steadily widening since March. This is all very bad for the US dollar. It means inflation is rising and the traditional safe haven of US treasury bonds isn’t going to protect purchasing power.

Loss of purchasing power is how confidence in the currency can get rattled. All of this, obviously, is a big reason why gold is rallying. If official consumer price inflation was honestly reflected and proved higher than most currently believe it to be, confidence in the currency would have shaken a long time ago. Hence, we must believe inflation isn’t high. Even though it is.

Lower inflation keeps COLA adjustments down.

Some may realize there is a bit of a demographic problem facing the United States right now. Long story short, baby boomers are retiring. As more of them continue to retire, they transition from social security contributors to recipients. By itself, this isn’t an issue. But with the double tap of declining birth rates and lower labor force participation, it’s not too difficult to get to a point where we ask how we can possibly fund the entitlement programs these people have been promised.

Real Vision has explored this topic in great detail and I’d recommend watching both Retirement Crisis installments to really get a handle on the issue.

You may be asking, “what does this have to do with inflation?” Here’s your answer: it is already a question as to how the current workforce is going to be able to pay boomers their Social Security benefits. That payment burden is even more daunting if the cost of living adjustments (COLA) that are factored into Social Security benefits annually actually reflected the inflation that retirees are likely experiencing. Consider, at over $1 trillion in Social Security spending last year, Social Security makes up 23% of the federal government’s annual budget.

How does this number compare to previous years? It is very much in the same ballpark as what we experienced going back to the 1990s. Though if you go further back, you can see that it steadily increased from less than 10% in the 1950’s to more than 22% over the next 40 years.

I’d wager people on Social Security aren’t buying cars, electronics, and furniture. They’re probably buying healthcare products and food — the things that are outperforming aggregate inflation estimates. If the examples from our Costco exercise are any indication, COLA adjustments that are more in line with the items retirees are actually buying should probably be closer to 5 or 6% annually. That kind of compound growth rate would be brutal on a workforce that is already wobbly and trying to pay for their own household needs with understated inflation numbers. As you can see, it’s important for the continuation of the entire system that the COLA adjustment stays low.

Putting it all together

Official inflation has to stay low even if real consumer price inflation isn’t low. No inflation is a myth. You know it. I know it. They know it. But as long as we all think inflation is low, we’ll have confidence in the dollar, we’ll keep currency in the system, and we’ll keep social program obligations as low as possible. This all has consequences, of course. And we can see the symptoms of these consequences throughout the political realm.

At this point in the article, you’re either scared as hell or in denial. I want to stress, none of this analysis is politically motivated. I was very careful not to opine for or against specific policies of the President, congress, or the Federal Reserve. This is not a political issue. It is a systemic currency issue. It doesn’t matter if you’re blue or red. You either want to protect your time and wealth or you don’t. The choice is yours.