The Pay TV Model is Eroding

Carriage fees, the proliferation of apps, and why the best wager in the future of video media might not be a streaming platform company.

Does it feel like everyone has their own streaming subscription service these days? That’s because they all do. The adoption of streaming as the primary video consumption vehicle is likely to create a very large ripple effect in mainstream media, sports, and technology. The implications of this macro trend shift are large. In this report, I’m going to take some time explaining the structure of the Pay-TV business.

It’s very important that we understand “the why” behind what is driving consumption trends so we can make the proper bets on the future of media. The video consumption market landscape is completely different than it was even just five years ago. There will be a day of reckoning for a lot of the media companies that are currently offering subscription services if those services fail to replace former revenue streams. I do believe that streaming is the present and future of video media. Before we get into why the Pay-TV structure is breaking down and pick our horse to ride through that shift, first we’ll go over some industry terms that you’ll read throughout this report.

Industry Terms and Acronyms

MVPD – Multichannel Video Programming Distributor – these are businesses that package feeds from various content owners and sell those packages as bundles to consumers. MVPD is a quick way to say cable, satellite, or internet protocol television (IPTV) operator. Examples of MVPDs are Dish Network, DirecTV, and Charter/Spectrum.

vMVPD – Virtual Multichannel Video Programming Distributor – these are the businesses that fundamentally do the same thing as the traditional MVPDs, but they utilize the internet rather than satellite or cable. They’re different from IPTV because vMVPD platforms don’t require a STB and IPTV typically does. Examples of vMVPD providers are Sling TV, YouTube TV, and Hulu Live TV.

STB - Set Top Box – these are the in-home receiver units that cable, satellite, and IPTV services use as the tuner and DVR for their service feeds. It’s what the consumer points that remote at.

Major Broadcast Networks – the broadcast networks are the national media brands who produce video content that is distributed across the country. Examples of Broadcast networks are ABC, CBS, NBC, and FOX.

Local Station Groups – the local station groups are large media companies that specialize in managing local television stations. These companies work affiliate agreements with the major broadcast networks to get the rights to popular sports and prime programming. Examples of local station groups are Sinclair, Nexstar, and Gray Television.

O&O – Owned and Operated – these are local affiliate stations that are owned by the broadcast networks as opposed to owned by the local station groups. An example of an owned and operated TV station is FOX32 Chicago.

Retransmission or Carriage Fees – These are the payments that MVPD/vMVPD operators make to the Local Station Groups and the O&O stations for the rights to distribute their channels as part of the MVPD and vMVPD bundles.

Broadcast and The Rise of Cable

For most of TV’s history, the legacy broadcast networks had a very strong share of consumer video consumption. The broadcast networks utilized O&O stations and local station group affiliation deals to get national reach. For decades, TV consumers generally had access to 3 or 4 TV channels and they used an antenna to pick up the over the air video streams for free. Then cable came along. In addition to all of the broadcast networks, there were new cable only networks like CNN, ESPN, and the Discovery channel. All of these channels were combined in one massive Pay-TV bundle. And every channel in the bundle received a carriage fee from the MVPD.

Suddenly, instead of 3 or 4 channels, viewers had dozens or even hundreds of channels to choose from as long as they were willing to pay the cable provider the subscription fee to get the whole bundle. For consumers this was initially good. In addition to a plethora of new viewing choices, even the local broadcast network affiliate channels were included. Everything was in one place and viewers didn’t have to fuss with antenna signals to get their programming crisp and clear.

However, the emergence of cable and satellite providers added another layer to the distribution model. With added layers come added costs. Cable and satellite operators charged subscribers a monthly fee for the TV bundle that the consumer was buying. From that monthly fee, cable providers paid channel owners carriage fees for the rights to distribute the content through their service. When these carriage agreements are reached, the cost of the programming is always passed down to the customers. It’s critical to grasp this concept because it’s one of the biggest reasons why the business model is breaking down.

Around 2012 or so, things began to change. Frustrated with the ever increasing monthly costs and scores of un-watched channels, consumers began canceling their pay TV subscriptions. This became affectionately known as “cutting the cord.” With pay TV households in America declining and the rapid rise of Netflix, a new era in media began taking shape.

Streaming Changed the Game

This all brings us to now. Netflix has helped create a market expectation of on-demand viewing without cords or cables. To be clear, the Netflix business model is certainly not without its own issues. Sustainable or not, Netflix has proven a concept. And that concept is streaming, on-demand video. This market expectation is now disrupting the media landscape to an incredible degree. And every company that has exposure to the old model has to make significant changes before they run out of time.

When the consumer figured out they could just stream content over the internet whenever they wanted, many more cost-sensitive video viewers started reassessing how much they actually needed cable or satellite services. This led to the beginning of cord cutting. eMarketer is projecting there will be more non-pay TV households than pay TV households by 2024.

Because Netflix helped prove out the streaming consumption method, content owners have figured out that there are layers to the current distribution model that may not be necessary. Sports fans, for instance, have actually been big beneficiaries of this overly complex distribution system because their viewing has largely been subsidized by non-sports viewers who paid for the whole bundle. This is what that distribution has looked like for Sports fans historically. I shared this graphic previously in a FuboTV article for Seeking Alpha:

You can see above that leagues like the NFL have typically entered into production and broadcast rights with major networks like CBS and FOX. FOX and CBS then sell this content to local station groups like Sinclair through the affiliation agreements that I mentioned above. The station groups then sell the content to the MVPD and vMVPD service operators. The viewers subscribe to these services to get all of their TV viewing needs taken care of. It probably goes without saying, but this model is now going through a shakeup because of streaming and cord cutting. In that same Seeking Alpha article, I hypothesized that for Sports leagues, the model will probably end up looking more like this:

While I clearly see two links in the distribution chain ultimately getting cut out, the MVPD/vMVPD link is absolutely the first to go. Now here’s the little secret. In the example, the graphic focused on Sports leagues. But all content owners can be put in a very similar model. Every cable news channel. Every lifestyle network. Even every broadcast station at this point. If you own video content, you probably have exposure to this model. The MVPD/vMVPDs have direct exposure because it is their services that are getting canceled by the consumer. The local station groups and the O&Os have exposure because their carriage fees go away when MVPD operators lose their subscriber base. And the major broadcast networks have exposure because local station groups can’t possibly continue to pay what they pay for affiliation agreements as retransmission fees are now between 45-50% of most of their annual revenue.

Just about every content owner is now building out a streaming platform. The success of Disney+ is probably just the beginning of new streaming entrants. Some of these content owners absolutely must do this because they are so big, they actually have exposure to the MVPD/vMVPD model in multiple ways. Exposure to that model threatens to erode revenue significantly if they don’t plan for a streaming solution. Comcast immediately comes to mind. Other content owners also deal with affiliate station groups who subsidize programming fees for them. These content owners also have a vested interest in growing a direct to consumer model because the consumer is largely rejecting the affiliate stations who they have typically utilized as both a direct source of revenue and for distribution. Paramount, Fox, and Disney immediately come to mind.

Connecting The Dots

Whether they realized it or not, pay TV consumers in the US were paying for all of the local content they could have easily watched for free with an antenna. This stable subscription money eventually grew to a revenue stream that rivaled the advertising buckets of the local TV station groups. Given the potential for advertising revenue declines due to a recession in the next 12 to 24 months and declining pay-TV carriage revenue from cord-cutting, the local station groups like Sinclair, Nexstar, and Gray are almost un-investable in my eyes.

Before the internet, a reversion to free over the air viewing may have been possible as pay TV bundles became too expensive. But just as the internet disrupted physical printed newspapers and analog radio stations, bandwidth has again improved and it’s finally video’s turn to face the reckoning. Now though, the entire content consumption preference has shifted from appointment television viewed in real time to streaming video on demand. TV executives have taken this very critical consumption change for granted, in my opinion. Local station groups that operate small local TV stations are still scheduling their TV news programs exactly the same why they were 10 years ago even though the consumption trend has completely changed. I wouldn’t touch the locals station groups.

Since the local station groups are doomed, that means affiliate agreement payments from local station groups that are paid to the major broadcast networks are going to take a massive hit as well. Like the local groups, the major networks also have exposure to declining carriage fee revenue through their O&O stations. And this doesn’t even attempt to calculate how the major network reach will be impacted by declining Pay-TV subs and what that likely means for the major network advertising rates. It’s a mess. Then there is the MVPDs and vMVPDs. Most of these companies are in a bad position as they’ve made an entire business out of selling content owned by other companies that now have a motivation to plan for a future without them. Those companies look pretty terrible as well.

So how do we turn this into an actionable insight? How do we put investment money to work right now? It should be pretty obvious if you’ve followed my work over the last 12 months that I’m very bullish streaming. I’m very bullish content and content owners. The issue that I see with many of the content owners is they have significant exposure to the old distribution system. Disney, for instance, is a great name. It has great intellectual property and a theme park business on top of a growing streaming footprint.

The problem with Disney is the unwind of the MVPD model really hurts the company’s stable subscription revenue. Disney has to delicately navigate that and it isn’t going to be easy since Disney-owned ESPN gets $10 a month from every single Pay-TV household in the country even though only a small fraction of those people actually watch the network. Disney has quite a bit to lose from the changing consumption model. As do sports fans who have had their viewing subsidized by the rest of the country so ESPN could buy billion dollar sports licensing rights packages..

Truth be told, many of the content owners who have benefited from the now dying MVPD model are going to see their revenue decline even if they can successfully transition to a direct to consumer streaming model. The reason is because many of these brands have been paid by consumers who don’t watch. That is ultimately the point. But I have an idea for this environment. And it’s a bit unconventional for me. But, again, if you’ve been following how I’ve approached certain streaming names, it might not come as a huge surprise how I’m playing this. And no, I’m not going to just tell you to buy Roku. Buckle up, this is one might not be what you’re thinking.

The Big Idea

I’m not picking a content owner

I have almost no interest in trying to pick a traditional content winner at this point. A big reason why I like Roku (ROKU) as a long term investment play is because it is largely platform agnostic. If you want to bet on streaming platforms you can do so through Netflix (NFLX), fuboTV (FUBO), or Chicken Soup for the Soul Entertainment (CSSE). If you want to bet on traditional TV names that are desperately trying to transition to streaming entities, you can look at any of the major broadcast network owners like Comcast (CMCSA), Disney (DIS), Paramount Global (PARA), or Fox Corporation (FOX). Good luck.

There may come a time when betting on those kinds of names will be de-risked better than now. Until then, I don’t want to own content owners unless they are streaming pure plays (CSSE). Content is at the mercy of what is trendy, platform subscriber churn, and brand loyalty. I don’t know that there is any one subscription service that is essential. What probably is essential to do any of this streaming from the comfort of your home is an internet connection. I want to own the new distribution method. We don’t need to pick between a bunch of bad train companies if we can just buy good rails.

The ISP Idea

The internet service provider names are challenging as well because most of them are suffering the exact same kind of self-cannibalization that the MVPD carriage fee reliant content owners are suffering. Specifically, the cable/video subscription bundle breaking down hurts a lot of these ISP providers as well because they all sell cable as part of the internet bundle.

If you think back to my You Have the Power series, in the first installment of that series I highlighted how more than 60% of CNN’s revenue comes from MVPD subscribers rather than from advertisers. This puts CNN as a network in a highly disadvantageous situation as MVPD subscribers look for more cost savings. This is especially true in times of high inflation. What we want to find is an ISP company that is not as reliant on video services for more than 50% of its revenue.

I’m picking Liberty Broadband Corporation

Liberty is a bizarre company. For starters, it’s been involved in spin-offs and purchases and all sorts of corporate transactions. It’s a nightmare trying to get through all of the details in the company’s filings. There four different share classes currently on the open market. These are Liberty's tickers and how they are different:

LBRDA – Series A common, 1 vote per share, no yield

LBRDB – Series B common, 10 votes per share, no yield

LBRDK – Series C common, non-voting, no yield

LBRDP – Series A redeemable preferred shares, 6.5% yield, mandatory redemption: March 9, 2039

I’ll tell you up front that in addition to the Series A common stock, I’m buying a larger weighting of the preferred shares. I’m not as concerned about the voting rights advantage in the B shares because the B shares trade OTC. Hence, much less liquidity in that symbol. But for the benefit of this research report, my real recommendation is the preferred shares.

LBRDP share price at call: $27.07

Market cap at call: $23.1 billion

Anticipated hold: 10 years

My plan

The reason why I want the preferred shares over the common is because of the yield. Like I said earlier, this is an unconventional idea for me. I don’t think these big internet service providers like Charter are at significant risk of going out of business. They are basically operating essential utilities at this point in the eyes of many and the entire streaming media model isn’t going anywhere if people can’t access the content with an internet connection. Like I said, on this idea, let’s own the rails instead of trying to pick a train company. At this point I do intend to average into a position over the course of the next few years. There likely won’t be a tremendous amount of capital appreciation in the preferred shares unless Charter stock goes ballistic. Though we’re probably punting on significant capital appreciation with this trade idea, what we are getting in return is a 6.5% annual payout at a time when most stocks pay no dividend at all, a recession is probably right around the corner, and a balanced approach to preferred shares through a preferred stock ETF like PFFD comes about 100 basis points below Liberty’s current yield.

Liberty Details

This is a very interesting company and I can’t recall investing in a name quite like this one before. While Liberty owns GCI Holdings; which is a company that did $970 million in revenue last year. If you’re keeping up with the numbers, you’re probably asking why I’m recommending a company that is valued at 25 times sales given a $23 billion market cap. Great question!

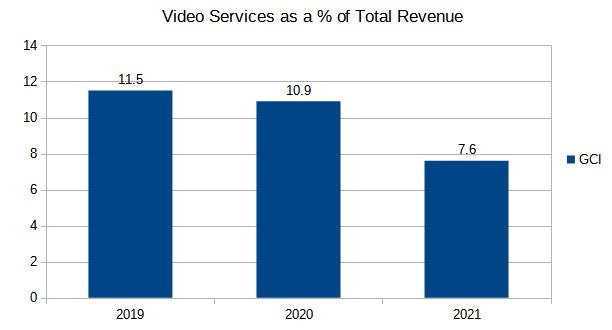

Liberty Broadband owns 25% of Charter Communications (CHTR). Charter’s market cap as of writing is $113 billion. As an owner of 25% of that company, buying Liberty shares is like buying Charter Communications at a massive discount. And that’s without even assigning any value at all to the GCI Holdings part of the business. GCI has a favorable setup concerning the MVPD risk. Less than 8% of GCI’s revenue last year came from B2B or B2C video services:

As you can see that percentage is down quite a bit from where it was just two years ago. And even in 2019, that figure was actually really strong compared to other ISP providers. Here’s how the full revenue breakout looks for GCI Holdings:

The biggest growth areas have been in data and wireless. This is good.

And then there’s Charter

Obviously with a 25% equity stake in Charter Communications makes that holding a far more significant driver of Liberty’s market capitalization. The GCI Holdings business is solid. But Charter is where most of the exposure lies with Liberty. Glancing at some of Charter’s numbers tells an interesting story and I think the company is actually fairly well positioned to navigate the changing Pay-TV landscape despite being a MVPD provider. This is the customer breakout from Charter’s annual filing:

94% of Charter’s customer base is buying internet services. Despite the 2% year over year decline in video customers, the company had a 2% increase in revenue per residential customer. The broadband business is the better margin business. Video customers are declining while internet customers increased on a year over year basis. This is what investors want to see. And one final point on the customer breakout; during a recession, businesses go under. Less than 7% of Charter’s customer relationships are businesses. As far as recession concerns go, Charter might be fairly well insulated since it’s core customer is a consumer who buys internet services.

Share buybacks

Likely recognizing the value proposition in its own common shares, Liberty bought a significant amount of its own common shares last quarter.

Liberty shares are undervalued based on the company’s equity stake in Charter Communications alone. The GCI part of the business has already transitioned to a broadband business. And Charter is well positioned to do the same. I’m not surprised the company has been buying back shares as aggressively as it has over the last few months.

Risks

Potential headwinds include but aren’t limited to:

unknown competitors entering the broadband space

the potential for revenue share declines to competitors

some customers could potentially cut internet services entirely in favor of unlimited mobile data plans for phone and tablet devices – though I imagine this would be a rare outcome and only manifest in homes without a television or desktop computer

Charter has a larger debt to equity to ratio than peers

This is a high conviction investment for me personally but you should always do your own research and never take my word for it.

Disclaimer: I am not an investment adviser. I hold no licenses or registrations. I am not a financial professional. None of this is a recommendation or a solicitation for you to buy shares of any of the equities mentioned in this report. Invest at your own discretion while bearing in mind your personal risk tolerance. I am long LBRDP shares and plan to hold those shares for the foreseeable future.