The Powell Pivot Has Arrived

The Fed is done hiking. Market euphoria. An "Avalanche" of bliss awaits!

This is going to be a bit of a blended article this evening. It’s also going to be chart-heavy and somewhat brief from a text standpoint. If something doesn’t make sense or if you have a question, jump into the comments and we’ll try to get to the bottom of it. Obviously the big news today is FOMC. Absolute market euphoria has commenced.

TLDR: Rates are staying unchanged and the central bank is now projecting 75 bps of cuts next year. It was about as dovish as Powell has sounded in a long time. For all intents and purposes, it appears as though the Federal Reserve is officially pivoting. Market response? Pure jubilation.

We’re currently working on seven consecutive weeks of gains in the S&P - I could be wrong, but I went back through my chart and I don’t think this has happened since 2013. Measuring from the low on October 27th, the S&P is up 14.8%. Again… this has been in just 7 weeks and we still have two more sessions this week. This has been an absolute face-ripper.

In response to the Fed’s apparant pivot, equities and bonds are justifiably getting all the coverage on Bloomberg right now, but I’m watching the response in the specific markets that have demanded most of my focus lately: namely, crypto and metals.

Gold was up 2% today and now comfortably back over $2,000

Bitcoin is up 4% and has retaken $43k after briefly going below $41k earlier this week.

Listen, I’m sure I’ll do a deeper commentary of what just happened today when I’ve digested it. But for now, the bulls appear to be in total control of everything and the dollar appears to have a date with 102.

Turning to crypto, while Bitcoin continues its march higher, the altcoins are more mixed. One that is still seeing some serious momentum to the upside is Avalanche ($AVAX-USD).

Here’s what’s interesting though, unlike some of the rallies we’ve seen in crypto elsewhere, what we’re seeing in AVAX may actually have some basis in reality if the on-chain data in the broad crypto ecosystem is to be considered. Here’s what I’m seeing and how I’m generally interpreting it:

First off, there is no question that average transaction fees are moving higher again on the top two blockchain networks by market cap, Bitcoin and Ethereum. There’s a larger story here that I’ll likely write about soon but we have to remember what happened the last time Ethereum’s base layer fees spiked in this way. We saw secondary layers and competing L1 smart contract ecosystems emerge. The competing L1s that had some element of success have generally been optimized for low transaction costs at the user end. Avalanche is one such L1.

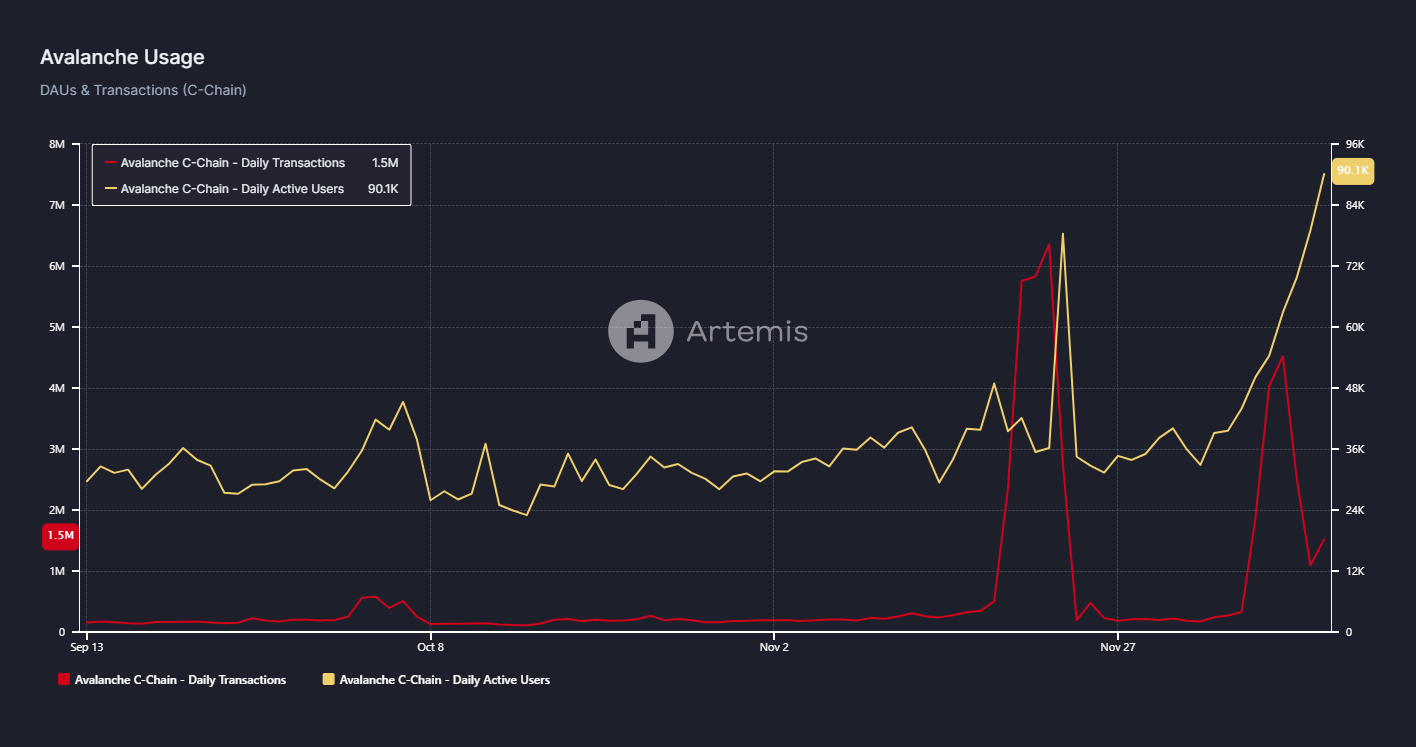

Perhaps it should be unsurprising then that we’ve seen daily transactions and daily active users spiking on Avalanche in recent weeks in tandem with fees on Ethereum rising.

However, even when considering that Avalanche is theoretically a low-fee blockchain, the magnitude of the change in activity in such a short amount of time has driven Avalanche fees much higher in recent weeks. I dove into valuation ratios for Avalanche and I was incredibly surprised by what I saw:

Even with AVAX rallying about 400% in the last two or three months, the fully diluted P/F ratio of the network has actually come down near a 52 week low. This begs the question, where is all of this activity happening?

The main area that I see engagement growth is in token swaps. We can see in the DappRadar table above that 30 day changes in activity have generally come from two apps: Trader Joe and Uniswap. Given the apparent trading demand on-chain, it is perhaps surprising then that the stablecoin market cap on Avalanche has not meaningfully grown even as network TVL has grown due to AVAX price appreciation.

Avalanche’s market cap to TVL ratio is now nearly 17 and that’s a bit rich compared to the sub-10 ratios we see on networks like Ethereum or Polygon. That said, Solana trades at a 34 MC/TVL ratio. So AVAX going higher isn’t totally out of the realm of possibility. Still, I’m getting defensive in this one now and here’s why…

Let’s assume rates are indeed finished rising. If the “T-bill and chill” trade is officially over (I’m not sure it is), crypto native assets may indeed continue their rallies. However, some of these assets, like AVAX, have exploded recently and I do question how much higher this thing can go this year. All of these markets have sort of a “buy the rumor, sell the news” feel to me.

Furthermore, the last time we saw this activity spike on Avalanche happen, it didn’t stick beyond being a short term flash in the pan and AVAX headed lower. My short term plan is swapping out of some of my AVAX and putting it into USDC for ThorFi yield on Avalanche.

Look, I’m not a huge fan of USDC and I don’t like that Circle has the ability to freeze funds. So there is quite a bit of risk in doing this, but I really like the 11% APR on Avalanche-USDC through ThorFi at the moment. If the Fed cuts are indeed coming next year, crypto yields from DeFi look a lot more attractive if the economic models supporting those yields are not ponzi-nomic.

In my view, it’s difficult to find too many better USD-denominated yield opportunities than we’re seeing right now through ThorFi Savers on Avalanche. The way I see it: why not lock in a monster AVAX gain and collect some USDC yield in the process? Anyway, that’s my current approach.

Disclaimer: I’m not an investment advisor. Crypto is incredibly risky and you should never put anything you can’t afford to lose into these speculative instruments.