The Search For Utility In The Era of Grift

A brief point on crypto-politics in America. And an off the radar altcoin that may have a run brewing.

Many in the crypto market were suspecting the beginning of a sizable rally to commence this month. Seasonal history seemed favorable. Fund manager Q4 re-balancing figured to bring new capital into the recently approved spot ETFs. And with one month remaining before the election, there’s been political pressure on US candidates to carve out clear, less-adversarial policy positions for the industry.

BOOOLISH… right?

On the latter, the desperation from supposed ‘grassroots’ pro-crypto organizations to get Democrats to look more accepting of the industry has manifested in a bullshit generous make-believe supportive grade for the incumbent administration. This was obviously viewed as ridiculous to anyone who has been paying even a small amount of attention to industry news over the last 3 years and that didn’t go unchecked by the community. Sanity has since been restored, but for how long?

The VP debate is in the rear-view mirror. It didn’t help the blue team if the deepest betting market is to be believed…

The red team moved from 48% probability to a draw following the ‘Vance Glance.’ Your move, StandWithCrypto…

Trump realized, certainly before the Democrats, that there are 80 million crypto holders in America and a lot of them are single-issue voters. And it’s a very passionate community. So being anti-crypto is a little bit like being anti-dog. It’s just not smart politics. I think the Democrats are getting there, but Trump got there first. The speech he gave at the crypto conference in Nashville, Tennessee was kind of a crypto-business owner’s dream. My role these days is to get the Democrats to have a rational and smart policy. Which I think they will, but we know if the Republicans win it’s really going to be opening the floodgates for crypto. - Mike Novogratz, CEO Galaxy Digital Holdings ($BRPHF)

There’s a lot in that commentary from Mike Novagratz that requires dissecting. First, and not to go all “maxi” here, Trump’s Nashville speech was at a Bitcoin conference not a ‘crypto’ conference. To many that may seem like nit picking, but it isn’t. I’m not saying Bitcoin is somehow different from ‘crypto’ as maxis generally do. What I am saying is Bitcoin 2024 was about Bitcoin, not about the broader cryptocurrency industry. It would be like saying the Anime Expo is a media convention. Sure, Anime has a place in the media industry but network TV news is not Anime.

So, how does Novo get that distinction wrong?

This is purely a guess on my part, but I’ll go with it anyway; Novogratz, a Democratic voter, badly needs Democrats to flip on crypto or his New York-based business is likely going to suffer. Bitcoin will be fine whether the Harris campaign embraces cryptocurrencies or not because it’s global and decentralized well enough. Frankly, Bitcoin’s ‘number-go-up’ game could potentially even do better under Harris than under Trump because competitive digital assets will get chopped at the knees and the orange coin will likely account for the impending brrrr of the money printer.

But crypto-businesses in the United States can’t live on just selling people Bitcoin for a few bps, they need the broader ecosystem to be welcomed in the United States for the financial infrastructure innovation that it will enable. The desire to be able to make investments, take risks, and see planted seeds grow into beautiful, sustainable yield-generating organisms will simply be satisfied offshore for good if we don’t get bi-partisan advocacy for the innovation that I’ve described numerous times.

And right now, there’s simply no question that the real power brokers on the blue team have been trying to thwart the domestic growth of the industry. There are literally dozens of examples to choose from but perhaps one of the best is what is currently happening to Caitlin Long and Custodia Bank. I won’t dive into that here but you can read this piece by Marty Bent for yourself. Here’s a little appetizer:

This affidavit is a bombshell because it confirms speculation that Silvergate was solvent in early 2023 and wasn't shut down because of bad risk management on behalf of the bank's management team, but instead was forced to shutter its doors because the Biden Administration, with strong influence from Senator Elizabeth Warren, forced Silvergate's hand because they didn't like that they were banking digital asset companies.

Interestingly, Barney Frank - the Ranking Member of the House Financial Services Committee before Maxine Waters and the back half of the Dodd-Frank Act - made a similar accusation about the handling of Signature Bank as well last year. But that’s all in the past. There are votes on the line now and if the lack of mainstream discussion about COVID lock-down policy is a reflection of how these cycles go, campaigns are about promises of tomorrow rather than accounting for the mistakes of yesterday. So that leaves us with rhetoric. How is that going for single-issue crypto voters hungry for policy clarity?

The week that was for the Presidential Candidates in NYC: (Harris) attended a star studded fundraiser in Manhattan and gave vague policy proposals about digital assets. (Trump) bought burgers with bitcoin at a dive bar and engaged directly with bitcoiners at a small business. - Marty Bent, via x

There is a not so subtle insinuation here that despite “joy” and manufactured optics, one candidate is seen as continuing to carry water for the establishment while the other is for the people. We could certainly debate what is perceived pandering against a lack of even the bare minimum regarding policy clarity. But it isn’t necessary. We have three years of actions that tell the tale.

Actions speak louder than love songs.

That’s enough political pontificating for one day. Now, for the cryptocorn data that many of you are here for…

But crypto-businesses in the United States can’t live on just selling people Bitcoin for a few bps, they need the broader ecosystem to be welcomed in the United States for the financial infrastructure innovation that it will enable.

When I say innovation, what do I mean? Sure, Bitcoin is an incredible innovation that shows the power of artificial caps on supply. But that’s not really the innovation that I’m talking about. Bitcoin was originally designed to be money. I don’t know if we’ll ever be able to refer to it as money at scale, but it’s certainly an immensely valuable idea. Whether it lives on as money, collateral, a collectible, or a digital artifact from a changing of the monetary standards of today remains to be seen.

What I’m referring to more is the notion that any currency can be settled digitally and across borders in a matter of a few seconds through a distributed ledger system. Rather than write the same piece that I’ve written about stablecoins a few different times already, I’d like to instead bring the focus to which networks are utilizing such instruments. Because it is the network where the investment capital will thrive rather than in the currency itself.

Stablecoins are a logical step forward for at least three reasons;

Transaction cost minimization

They’re actually a good thing for fiat survival because most are backed by the very same T-bills that back dollar deposits at banks

They allow for trading out of the more conceptual, extrinsic value cryptocurrencies during times of flash crashes and economic shocks

To be clear, stables are far from perfect. They’re more corruptible than chain-native currencies like Bitcoin, Litecoin, or Zcash but they can serve an important on-boarding purpose. I maintain that they’ll be the “killer app” of crypto rails because they represent units of account that people understand.

IntoTheBlock has interesting data here. Stablecoin volume in August hit nearly $1.5 trillion - a record. And even though volume came off a bit in September, the long term trend here remains up. Furthermore, of the coins shown, DAI has had the largest share of stablecoin volume 8 of the last 9 months. If you’re bullish the MakerDAO ($MKR-USD) system, you can’t be much happier with this. It’s super bullish.

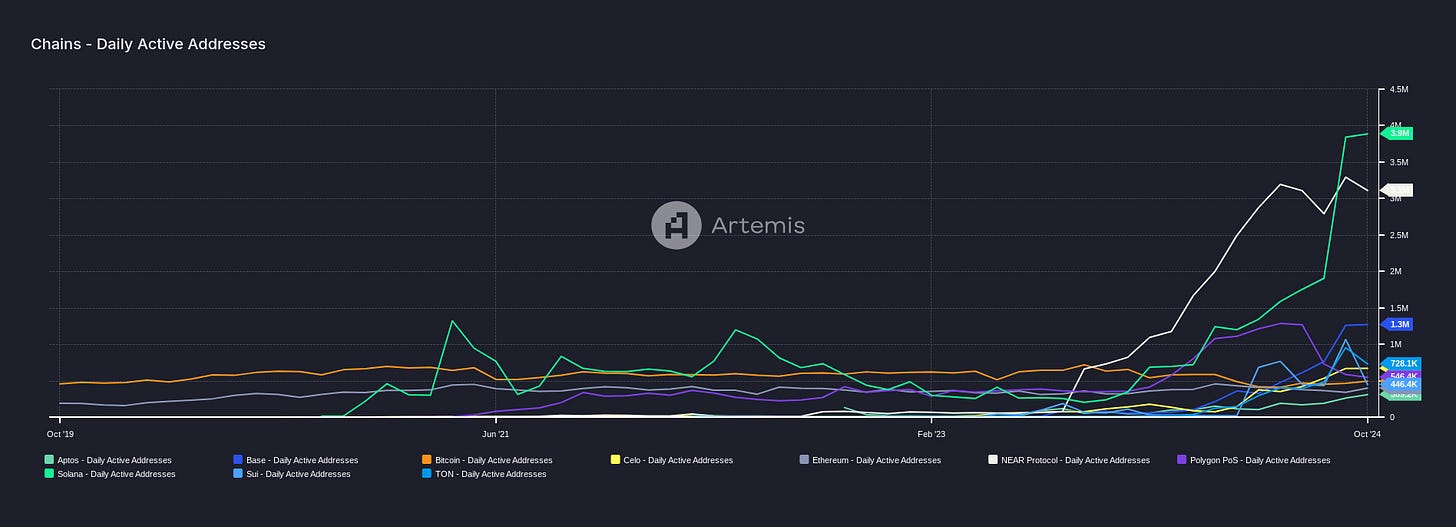

And yet, MKR has been absolutely unable to get off the mat these last few months. As far as I can tell, the IntoBlock chart preceding the MKR chart above doesn’t include non-EVM chains like Solana. So it isn’t quite the full picture though it’s a very good one nonetheless. What I also find interesting is the data from Artemis that breaks out activity by currency. See if you can find anything that stands out in the table below…

Currently, the 2nd most used stablecoin by DAAs is cUSD. This is a currency that lives on the Celo Blockchain. Celo is really not a chain where you’re going to find NFTs, meme coins, or other forms of crypto-grift. It’s primarily designed for stablecoin usage on mobile devices outside the US.

In the chart above, I’m showing full month average DAAs for Aptos, Base, Bitcoin, Celo, Ethereum, NEAR, Polygon, Solana, Sui, and TON. At 670k so far in October, Celo is in the top 5 of these 10 chains for daily active addresses. This is despite just $123 million in TVL, which is dead last of the chains sampled here. So what can we derive from this?

Simply put; usage.

Celo has a stablecoin market cap of $298.8 million against $180.4 million in 24 hour stablecoin transfer volume. Essentially 60% of the stable cap on that chain is active all things being equal. TON’s is 38%. Ethereum’s is 34%. To be sure, other chains (Base, Solana) have much stronger velocity metrics than Celo, TON, and Ethereum. But those chains generally have far more going on (NFTs, Yield farming, meme coins).

Takeaways? Draw your own conclusions. But given this data, I think it’s interesting seeing Celo as one of the few coins that is actually up over the last week.

Disclosure: I own some CELO. And MKR. And BTC. A bunch of other digital trinkets.

Hmmm I hadn’t heard of celo