The Sports Super App Will Break Things

Imagine being able to watch live NFL, NBA, MLB, NHL, and NASCAR all in one neat little package of a streaming app! Well dream no longer, it's in the works. But it will have negative ripple effects.

Earlier this week, the Wall Street Journal reported that Disney DIS 0.00%↑, Warner Bros Discovery WBD 0.00%↑, and Fox FOX 0.00%↑ are planning to launch a joint venture streaming app that would be focused solely on sports. Disney owns ESPN and ABC, Warner Bros owns TNT/TBS, and Fox obviously owns both Fox and Fox Sports. With the exception of Paramount Global PARA 0.00%↑ which owns CBS, the three companies working on this JV essentially own the broadcast distribution rights to every national telecast from the major US sports leagues.

If this streaming platform does indeed come to fruition, it will potentially create enormous ripple effects that will impact the entire communications industry. Consider for a moment how different the average TV viewer consumption habits are today compared to the average TV viewer a decade ago:

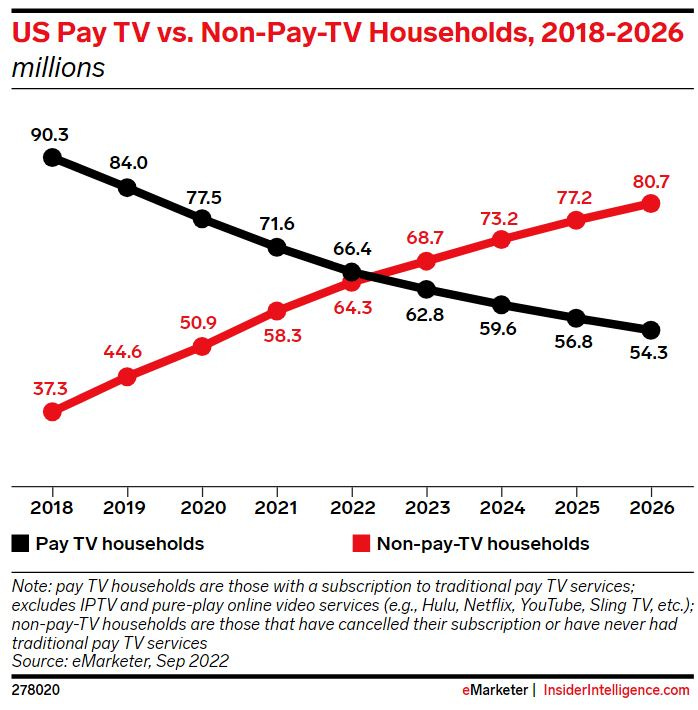

Ten years ago, it was rare to not have cable or satellite. Today, there are more households that don’t subscribe to these services than households that do. This eMarketer pay-tv trend forecast was made in 2022. According to the most recent data, cord-cutting actually appears to be happening faster. Screenmedia has pay-TV households at less than 61 million in the US as of Q2-23. Regardless of which data source you use, both agree on one thing; 2023 was the year non-pay TV households outnumbered pay-TV households.

It has been widely viewed by many industry analysts that live sports has been essentially the only piece of content left that has been holding up the cable/sat bundle model. You take away live sports out of those bundles and the rest of it starts to unravel quickly. Now here’s the crazy part; realistically, there are maybe 20-25 million households in the US that have truly been benefiting from this pay-TV model.

Pay-TV has been in secular decline for several reasons:

Price increases year after year

Too many unwatched channels

Streaming as an alternative

Contract obligations

There has clearly been a “cost saving” undertone to all of this and nominal monthly costs obviously can’t go up in perpetuity. When one really audits how they use their pay-TV service, they generally find that they only watch 5 or 6 channels with any kind of regularity and most of them are probably available free over the air with a $20 antenna.

Getting Into The Numbers

At the peak of pay-TV subscriptions, the overwhelming majority of subscribers were essentially subsidizing programming costs for the sports fans whether they watched ESPN or not. That channel has historically been the most expensive offering in the bundle at about $10 per month. And there are plenty of other channels dedicated to sports that also demand a pretty penny. Back in 2016 sports programming accounted for 40% of the total bundle cost according to Kagan. At that time, there were still 100 million US households subscribing to pay TV.

If we assume that sports programming cost percentage is still the same 40% today (it’s probably higher) and use the monthly cost of vMVPD services like YouTube TV ($73) and Hulu Live TV ($77) to build our 2024 programming cost proxy, live sports programming today probably costs the user about $30 per month. Just for kicks, another way to calculate this would be to use subscriber and cost data from a company like Charter Communications CHTR 0.00%↑ which owns Spectrum.

In the table above I’m dividing Charter’s $10.6 billion in programming expense by the 13.5 million pay-TV subscribers to get both annual and monthly programming costs to the distributor - in this case Spectrum. I think its fair to assume these figures are fairly close across the board. What we find is even if Spectrum provided customers with video programming at cost (doubtful), sports accounts for over $26 per month. Of course, there’s still that little issue of profit margin and the cost of that programming to the consumer is likely higher.

Taking both of these estimates together, I think it’s fair to assume $30-35 per month for the JV super app is a base case expectation for two reasons. First, it’s likely a premium to what the content owners/producers are getting from wholesale buyers (Spectrum), so it’s a net win. Second, it’s still a low enough entry price point that it could entice sports fans who only have pay-TV services specifically for the live sports to cancel those services through companies like Spectrum, Dish DISH 0.00%↑ , YouTube TV, or Hulu Live TV and buy the content directly from the producers.

In my opinion, this will essentially kill the vMVPD movement (Sling, Hulu Live, etc) and likely accelerate the decline of cable/sat services as well. And there is still another rather large problem.

The Biggest Losers?

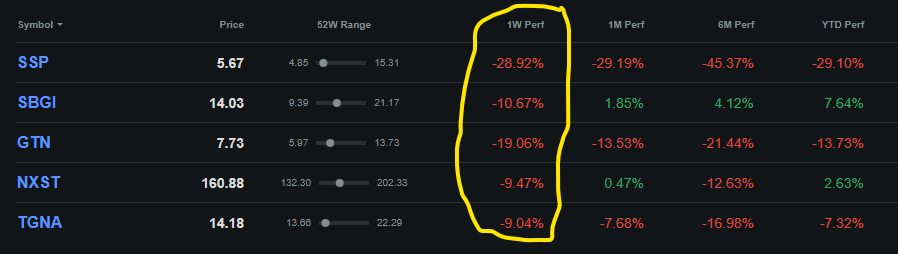

With the exception of fuboTV FUBO 0.00%↑ which I believe is dead in the water if this live sports super app happens, the biggest losers are probably the local broadcasters and the market appears to know it:

Scripps SSP 0.00%↑ down 29% this week, Sinclair SBGI 0.00%↑ down 11%, Gray GTN 0.00%↑ down 19%, Nexstar NXST 0.00%↑ and PoopCorp TGNA 0.00%↑ both down about 9%. And all of this has been in essentially one session (Wednesday). Who says Wall Street analysts aren’t smart?

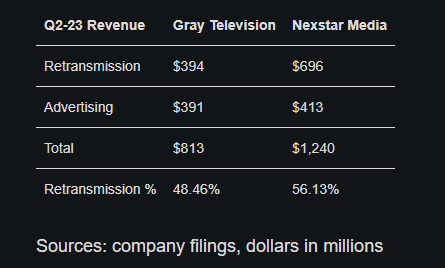

The issue? Retransmission fees:

In the last decade or so the local broadcasters have mainly grown revenue through retransmission fees rather than advertising. These are the fees that the local TV broadcast groups charge the cable/sat distributors for carrying their signals. Through several years of negotiation cycles, these fees have grown from roughly 10% of revenue to 45-55% for most of these companies. The point is, the local broadcasters have become increasingly more reliant on a model that started dying over a decade ago. Classic.

Let’s assume for a moment that the die hard sports fans who religiously watch programming like Monday Night Football and the NBA playoffs are the ones who are going to move to this new sports super app. Monday Night Football just averaged 17.1 million viewers each week. Last year the NBA playoffs did about 4.3 million on average. If we assume that there’s some overlay here between the audiences and just use a blanket round number of 20 million super app subscribers, it has the potential to erode what remains of the pay-TV audience by 30-35% depending on where total subs are in Q1-24.

All things being uniform, that equates to about a 13-18% direct hit to local station group revenues depending on the company. And it also risks slashing the reach of each individual station. This means that ad agencies who make up large portions of ad buys are going to demand concessions on ad rates. It doesn’t happen over night so I won’t say this is catastrophic news for these companies, but it’s not good at all. It is a question of time not destination.

The middleman distributors will get hit here too but most of them have ISP services to fall back on. Local TV station groups don’t have that luxury. Where the doom cycle gets really uncomfortable is when one factors in that two of the companies who are launching this super app also deal with the station groups for affiliation agreements. This takes bargaining power away from the station groups because FOX and ABC clearly don’t really need the locals to get their programming out there anymore. And if some national news and legacy syndication programming is the major selling point to local broadcasters, I’m not sure how big that bid is going to be.

Final Thoughts

When I worked as a media analyst, one of the top executives from our company made a visit to my local station and held a roundtable discussion in the conference room. This discussion included managers and some of the staffers. Something this executive said has stuck with me ever since that day and I’ll never forget it.

He essentially made the case that it was imperative that each local broadcaster start thinking about life after network affiliations. Meaning, if you’re a local station that has an affiliation with ABC, CBS, FOX, or NBC, it was probably prudent to assume and prepare for a future where local stations are entirely reliant on internal content creation for revenue.

About a year later he retired. Shortly after that we were bought out by one of the companies mentioned above. As far as I can tell, none of these groups are ready for life after affiliates. If losing retrans revenue doesn’t light a fire, I’m not sure what will. I don’t know if this sports super app necessarily means investors should buy DIS, FOX, or WBD - but I do have some conviction in my thesis that the local station groups are probably untouchable today even at sub-10 P/E ratios.

Disclaimer: I am not an investment advisor. I worked in the local TV broadcast industry for a little over a decade for various station groups. I don’t currently have positions in any of the stock tickers shared in this article. I occasionally trade WBD, PARA, and DIS.

🤦🏼 love FUBO, interesting post though. How it will play out will be something to watch.