The State of Crypto 2023: The Way I See It

Where is BTC going to end the year? How much should investors put into this industry? I answer those questions and more for Seeking Alpha's State of Crypto Roundtable.

With the backdrop of the SEC pRoTeCTiNg iNVeSToRs by taking a sledgehammer to the industry, Seeking Alpha is working on some roundtable pieces to discuss the state of crypto in 2023. As one of the crypto analysts who frequently provides coverage on that website, SA reached out to me for commentary on 9 questions. In this members-only post, I’m going to share the questions I was asked and provide my answers with graphic support.

Overall, how would you assess investor sentiment toward cryptos?

I think investor sentiment is split into two categories. The retail investors who have stuck around since FTX seem less concerned than the institutional investors. The latter of which have been exiting the market judging by the 8 consecutive weeks of crypto fund outflows as of mid-June. For retail, market sentiment indicators that I follow suggest the fear isn't as extreme as price may be suggesting.

Which (if any) of the crypto miners do you see as the best investment?

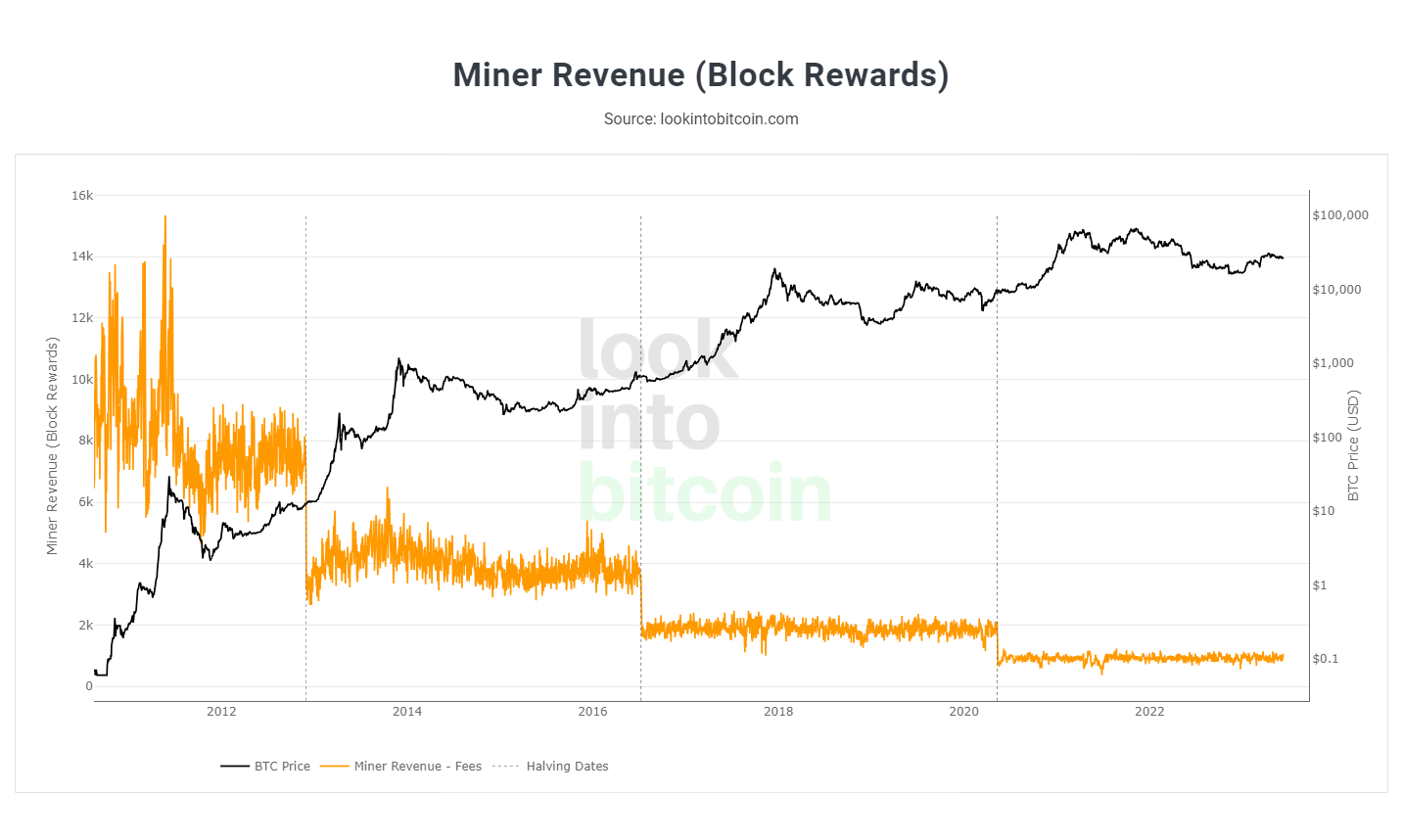

My biggest personal allocation at this time is to Riot Platforms RIOT 0.00%↑ but I do have a position in other miners as well. I think Riot has the right mix of large BTC stack, low debt load, and the high EH/s capacity. But to be clear, I'm not really sold any of these companies are great long term investments unless transaction fees permanently become a meaningful portion of the block reward.

What do you foresee as the biggest event for the rest of 2023 that will affect investors – SEC regulation of cryptos, a ruling in the Ripple litigation, prosecution of Binance or FTX for allegedly violating U.S. securities regulations, a decision on GBTC’s conversion into an ETF, a Fed pivot, etc.?

For Bitcoin, the biggest catalyst is a potential dovish Fed pivot in my opinion. BTC is well positioned as the "inflation-hedge" crypto given its supply cap and stock to flow ratio. As for ETH and many of the alts, I think investors need to keep an eye on the SEC, CFTC, and any crypto-related bills that may pop up in Congress. The early June performances of Solana, Polygon, and Cardano have made it quite clear that the market doesn't want these things labeled unregistered securities by the SEC.

What percentage of an investor’s portfolio should be in cryptos? If investors had no exposure to cryptos and wanted to invest $10,000 in them today, what coins or crypto-related securities should they consider?

With the caveat that I'm not an investment advisor, my feel is that allocation to crypto should probably come down to how close an individual investor is to retirement. The closer to retirement, the less I'd personally speculate in crypto or blockchain tech. I'm 36 and I have about 10% of my liquid investable capital in crypto. That 10% breaks out to roughly 40% BTC, 20% ETH, and then the rest is spread out over a couple dozen alt coins that I believe have high upside potential and ecosystem importance. Those include cryptocurrencies like MATIC, RUNE, ZEC, GRT and LINK.

Where do you see the price of Bitcoin at the end of 2023?

I don't usually like giving price forecasts but I assume by the end of the year we'll have already seen the Fed stop hiking rates. Provided there isn't some sort of black swan event that specifically impacts Bitcoin (very possible), I don't see why BTC shouldn't be trading closer to $35k. The question is do we get one final washout down to $20-21k from our current $26k level before that happens. I suspect it may.

What is your top crypto pick for 2023?

My top crypto pick for 2023 was MATIC back in December of 2022. Given the recent news that the SEC believes that coin is an unregistered security, the YTD performance has not been what I'd hoped at the start of the year. While I personally view MATIC as more of a digital commodity since it's a gas token on the Proof of Stake chain, I view recent weakness as a buying opportunity. MATIC may not finish the year where it started, but I imagine it will close out the year well ahead of these recent lows.

For 2023, are there any crypto/blockchain-related ETFs worth considering in terms of portfolio allocation?

I'm not a huge fan of crypto ETFs for several reasons. There really aren't many that can even be considered and the ones that I've looked at have significant exposure to companies that I don't think are going to survive long term. I think investors are better off doing the work and picking the individual stocks themselves or with their advisors.

How significant is the Bitcoin Halving event next year, and how will it affect Bitcoin’s price?

History shows the halving is followed by a new all time high within 12 to 18 months. I see no reason why that won't be the same this time around provided there isn't a global coordinated effort by governments to destroy the mining sector. So long as there is demand for a decentralized payment network that can't be controlled or manipulated by central actors, the coin will have value and the miners will have a home somewhere.

How will the Treasury’s outsized bond sales to replenish its coffers (Treasury General Account) impact crypto prices?

That could certainly be seen as a potential headwind for crypto but I'd wager the impact will be less on Bitcoin than it is for traditional equities. Bitcoin is global. And there is clearly a motivation outside of the US to de-dollarized. There will be a bid for BTC somewhere. The reality is Bitcoin was designed to be a new system of peer to peer payment outside of the old rails, and with clearly defined rules about inflation rates and supply. That's appealing to a lot of people and even sovereign nations as we've seen from El Salvador.

Disclaimer: I’m not an investment advisor.