Things You Don't See At The Bottom

Grayscale's crypto funds have been trading at sizeable discounts to NAV over the last two years. However, one fund is now flashing alarm signals.

I’ve admittedly covered the topic far more for Seeking Alpha, but one of the things that I’ve occasionally talked about here on Heretic Speculator is the NAV discount arbitrage in the Grayscale funds. TLDR for those who don’t know what I’m referencing:

Grayscale is the largest digital asset manager in the public equity markets

The company has securitized versions of many of the top cryptos. These closed end fund shares are tradable on the over the counter market

Due to the volatile nature of crypto and the illiquidity of the funds on secondary, the shares have often traded at large premiums or discounts to the real value of the underlying assets (or NAV)

In the last couple years, the NAV discounts that we’ve seen in almost all of Grayscale’s funds have been viewed as some of the big trading arbitrage opportunities in the market.

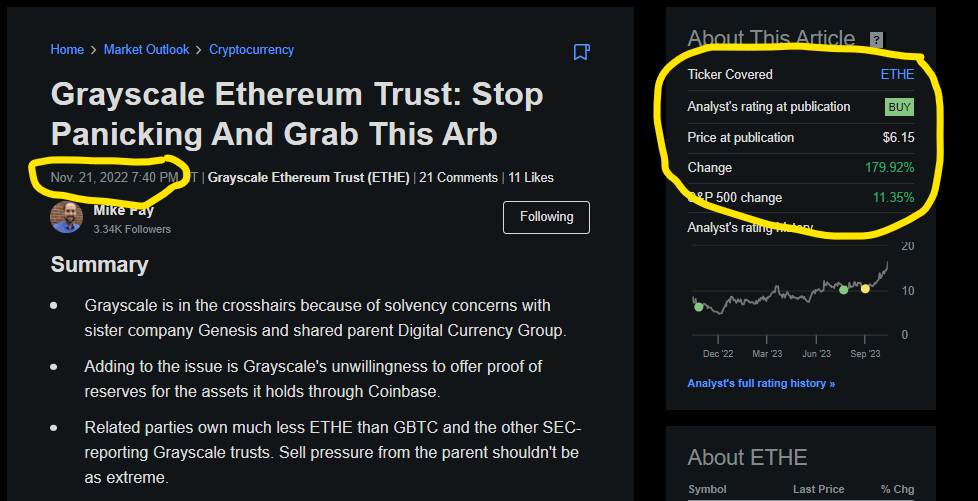

For example, last December, Grayscale’s flagship product the Grayscale Bitcoin Trust $GBTC briefly traded at a 50% discount to the net asset value of the fund - two years earlier it often traded at a 40% premium. It wasn’t just the Bitcoin fund trading at a silly discount in December, Grayscale’s Ethereum fund traded at a mind-boggling 60% discount at one point. I was banging the table late last year that some of these funds were buys specifically due to that discount:

In hindsight, I’m glad I stayed level headed back then and it has worked out very well for me. However, now that it’s becoming increasingly likely that we’ll soon see a spot Bitcoin ETF hit the public markets, the discounts on these funds have begun to close. GBTC closed Friday at $29.92. The NAV of the fund was $33.20 by my rough estimate based on Thursday’s BTC/Share data. That means GBTC’s fund discount is now less than 10%. It’s been a phenomenal trade, but the arb is indeed ending. Again, this is largely due to ETF excitement but also to the general bullishness in the broader crypto market as well.

Things are getting so interesting in crypto currently that the froth that has been missing for the better part of two years has reemerged in many of the Grayscale funds. Consider what we are currently witnessing in Grayscale’s Solana Trust $GSOL:

GSOL, which ended the week at $202 per share, recorded an absolutely blistering 146% weekly gain. You may be wondering, “so what?” After all, Solana $SOL-USD has also been absolutely pumping over the last several weeks:

So it’s only natural that Grayscale’s Solana Trust shares would pump as well, right? Yeah… but… one problem… Grayscale’s Solana Trust has 0.38072705 Solana per share backing the fund - this the only asset in the fund. At a $54 SOL price, each share has a net asset value of $20.56. So at $202 per share, GSOL ended the week at a 882% premium to NAV. Meaning, GSOL could fall by 85% on Monday and still be overpriced if Solana stays where it is. And reminder, I thought Solana was getting ahead of itself at $44 a week and a half ago.

I don’t know how these things happen, frankly. It’s almost as if people have absolutely no idea what they’re doing in these markets. All I can say is when I look at what is happening in GSOL, I do get nervous that we may be nearing exhaustion in the broader crypto market. When people will pay absolutely any price for exposure to an idea, it’s time to take a step back and ponder where we are from a sentiment standpoint.

Of course, this doesn’t mean everything looks bad at the same time. On Monday, I’ll share a public market crypto-adjacent idea that I think still has quite a bit of upside from here. Paid subs only so think about pulling the trigger on that upgrade! Short of that, it’s always helpful when you like, comment and share these public articles. It’s cliché, but it’s a great way support the stack non-monetarily.

Hope you all have a wonderful weekend!

Disclaimer: I’m not an investment advisor.

Very helpful. Thanks.