This is Fine.

CNBC unleashed the "Markets in Turmoil" graphic. While that's generally a sign of a bottom, let's think a bit deeper than that on the current market meltdown.

I think we have watched the Paw Patrol movie 3 times in the last 48 hours in the Faybomb household. My daughter thinks she's Chase. If you're unfamiliar with this flavor of cinematic excellence, Chase is the German Shepard puppy who serves as the top dog in Nickelodeon's Paw Patrol. He's adorable and my kid loves him. She mainly likes him because his outfit is blue and she's obsessed with the color blue. I'm apparently Rocky. He's the green dog who specializes in recycling. A fine character choice I must say. Today though, I don't really feel like Rocky from the Paw Patrol. I feel like the meme doggy who calmly sits in his kitchen drinking coffee while the world burns around him.

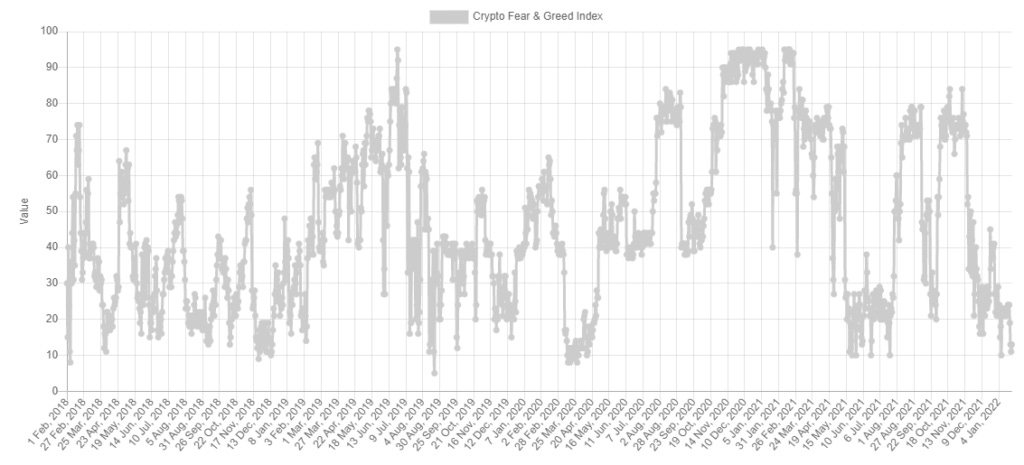

The fear is great in me at the moment. Not just for Bitcoin but for the broad market in general. Last week I bought stocks that were down 75-85% from their all time highs. They're all still going down. Mainly though, the fear is about Bitcoin, which is also taking down every single other digital asset with it. I'm not alone either. Check out this history for the Crypto fear and greed index:

The fear now is about as strong as it was during the March 2020 selloff. Does that mean the crypto market will stabilize down here and catch a bid? Certainly not. But history has shown time and again that investors who buy during these absolute bloodbaths end up doing well shortly after. And it isn't just crypto that is getting curb stomped right now. Check out the S&P 500.

It's basically been a 10% correction straight down. It's even worse in the Nasdaq which is now in striking distance of a bear market:

No support. No bids. It's a total meltdown.

What's causing the carnage? Quantitative tightening (if you can call it that)? A Federal Reserve poised to fight inflation by raising interest rates? Perhaps. These are the things that I'm thinking about right now:

Does the Fed have the political cover to raise interest rates to fight inflation? I would say yes. I think the people pulling Biden's arm and leg strings care more about inflation than STONKS. After all, most Americans don't have much exposure to equities. But Americans are definitely feeling it at the grocery store and at the pump. Inflation is the most regressive tax we have. So when inflation is high, Americans take notice. I think Washington will be okay with sacrificing the stock market temporarily if it means the inflation goes away.

That leads us to the Fed. With the political cover to raise rates, one would think it's all but a certainty that rates will rise and the price action in highly speculative assets like tech and crypto reflects that. This is where I'm significantly less convinced than the professional wall street neckties though. As I wrote for Seeking Alpha two months ago:

With the exception of a three-year period leading up to the financial crisis, the funds rate has been below, often considerably below, the median consumer price index. For another perspective, the prime loan rate has almost always been higher than the year over year change in consumer price inflation. Beyond that, the rate has generally front run that consumer price inflation higher. That has not been the case this time. The time to raise interest rates was months ago. Not not. Not tomorrow. Months ago.

The point is, if the Fed could raise rates, the central bank should have done it months ago. But they haven't. Why? Now Bitcoin is off 50% from highs. The Nasdaq is off 20%. The S&P is off 10%. The Fed has successfully jawboned higher rates so much that the market has begun the rerating of the speculative assets as if the hikes are guaranteed.

What if rate hikes don't come? Or what if we get a quarter point hike in March? Can that meaningfully fight a consumer price inflation that is 7% best case? Of course not.

I'm not saying buy stocks or crypto today. I'm not even saying buy them this week. But if, like me, you believe the Fed can't honestly fight inflation, this whole market pig is going to rerate again. Rate hikes are probably going to be a massive sell the rumor buy the news event. And that's if they even happen at all.

Standard Disclaimer: not investment advice.