Two Years of Costco Receipts Tell The Story: Inflation Is Still a Problem

They said it was transitory until they clearly couldn't get away with it anymore. Coffee is 50% more expensive than it was a year ago. Let's dive into a few more examples shall we?

I remember the good old days on Heretic Speculator. It wasn’t all that long ago that “inflation” was a silly conspiracy theory heard mostly from the sound money proponents. As someone who really started to develop his economic thinking from the precious metals community in 2014 or so, it’s been a mix of vindicating and disturbing watching the inflation narrative shift over the last 15 months or so.

A lot of the collective establishment distrust that I think we’re know seeing manifest at a large scale through many different avenues has some root in the currency and in government statistics, in my humble opinion. When I started learning about how CPI figures are gamed, there was really no going back for me. I wrote about it in 2020 in article called The No Inflation Myth. Very few people read it. But the core argument made in that piece holds true to this day.

When the public was forced home and stimmies rained down on the masses, it felt like the “helicopter money” that had been prophesized by Mike Maloney in the Hidden Secrets of Money YouTube series several years prior. I decided to start keeping my own purchase records to the best ability that I could. Costco has always been my desired inflation tracker even though I’ve used other proxies in the past.

One of the things that we’ve done for years is spend as much as we can with a cashback rewards credit card. We always pay it off every month so we’re essentially just capturing the processing fee to lower our prices on our purchases. Using these credit cards also allows us to download 18 months of transaction history as almost everything we do is now tracked and recorded.

I won’t share the exact numbers but I compared our combined grocery expenses from April and May of 2021 to April and May of 2022 to get an approximate personal inflation metric for groceries. So far, we are spending 23.1% more on product from Meijer & Aldi than we did last year in Q2. That is astounding but it doesn’t allow us to really get into the weeds. That’s where my Costco receipts come in.

Drumroll please…

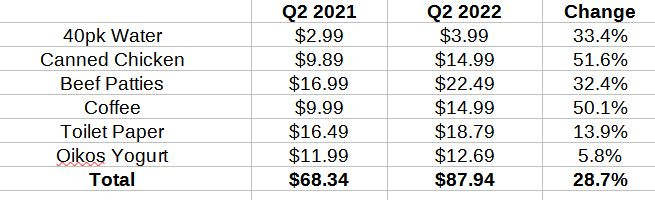

These are not cherry picked purchases. These are the things that had the most instances of common SKU. To me that means we buy them the most regularly and that makes them the closest thing to “essentials.”

This is the price history for Kirkland Signature 3lb coffee tins:

Year over year increase is 50.1%. Four consecutive price increases. Here’s canned chicken:

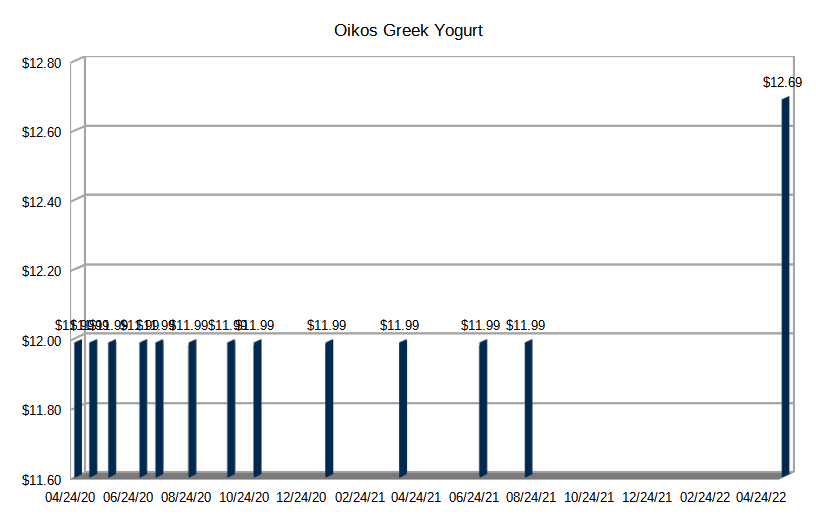

51.6% higher than last year. 2 consecutive price increases. Here’s Greek Yogurt:

That gap in purchases is because we switched up our Yogurt buying for a brief period. It looks more extreme because of the chart axis, but that’s actually just an increase of 5.8%. Here’s bottled water:

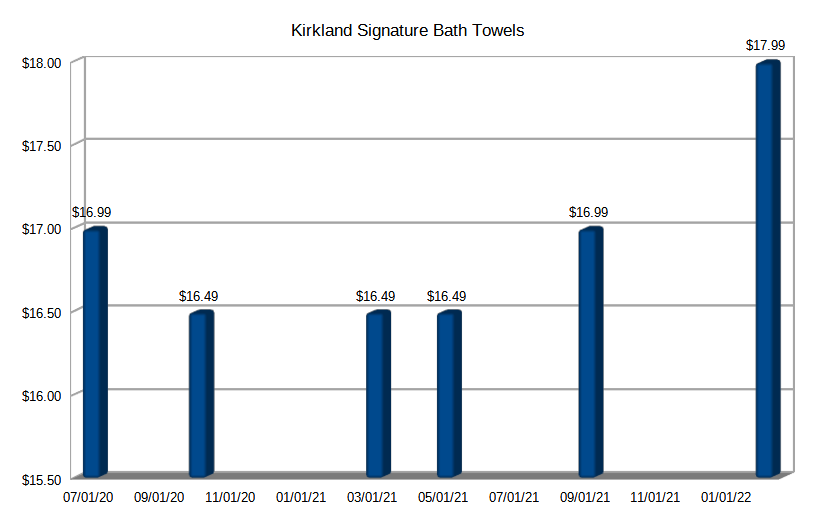

That chart was unreadable with data labels, sorry. $2.99 per 40 pack for just about forever. Now $3.99 - 3 increases in a 7 month period. 33.4% year over year inflation. Here’s toilet paper:

Just 13.9% from 2021 after the Great COVID TP Raid of 2020. And here’s frozen beef patties:

Those are up 32.4%. Disregard the big gaps. It’s generally a summer time purchase for when we have cookouts. Which we plan to have this summer as well. To put a full picture on our personal rate of inflation at Costco for our typical purchases, we get a 28.7% rate of year over year inflation.

That’s pretty close to our 23.1% year over year inflation derived from our Aldi/Meijer purchase history as well. When you’re in the mid to high-20’s, what’s a few percentage points among friends? Now to be clear, this is not the complete picture of our total household expenses. Our mortgage hasn’t increased. Neither has the car payment. But our utilities are higher. The price at the pump is obviously roughly double from where it was a year ago and that’s likely the big reason for all of the other inflation we’re experiencing.

Full circle

The cruel nature of this can’t be overstated. We aren’t making more money than we made in Q2 of 2021. In fact, when you look at the expenses from our credit card purchases in aggregate, through May we spent almost exactly the same amount of money on our lives as we did in Q2-21 through May. The difference is we spent money in 2021 on fun things. We have made cuts to what we have bought, not how much we have spent. We took a trip last year that we didn’t make this year. We supported more local businesses last year than we have this year. We donated more last year.

All of these price increases have real and unseen costs. And all of this was predictable which is precisely why I kept the receipts to being with. The notion that trillions of dollars in currency debasement wouldn’t have consequences is absurd. It is both insulting and infuriating that our leaders, both elected and unelected, choose to lie to us about inflation. They acted like it was “transitory” even though they knew it wasn’t. And Janet Yellen wasn’t elected by the people. Jerome Powell wasn’t elected by the people. These elite leaders are the ones making policy for millions of Americans and we never got a say.

In a few minutes, we’ll be getting a new inflation number. Maybe it will be lower than 8%. Maybe it will be higher. Who knows. Who cares? In the real world, we know what our lying eyes see.

Great article. I do love seeing actual receipts instead of the manufactured expert’s evidence. Sadly the “me or your lyin’ eyes” truism is just a fact of life now. As many other have put it, any statement coming from the sources engineering these non-stop crises or their “fact-checkers” is almost 100% guaranteed to be a lie. So doing or believing the complete opposite is pretty much fail-safe.

We’ve prepped as best as we can, but unless folks are truly wealthy, what’s coming is going to hurt us all.

BLS Data from today's report: food at home +11.9% https://www.youtube.com/watch?v=JgHnTLdSFpY