We Await The Wizard

Rates are dropping, stonks are rising. Cryptos and metals, living together. Mass Hysteria! Don't blow this, Jerome!

Alright guys, I figured it was worth doing a full post on all of the action these last two days. I’ve been sharing a lot of this stuff in the thread for this week, but I recognize it’s unlikely that all of you are lurking in there.

🚨Run-on Sentence Alert 🚨

Keep in mind, I’m getting this post out before Credit Master Wizard Jerome has soothed any doubt about cuts this year in conjunction with what will likely be a 2-3% face ripping equity move higher into the close today as the market once again rallies on rate cuts that haven’t yet happened.

But I have a fairly busy afternoon on the docket today and I want to get these thoughts out there now.

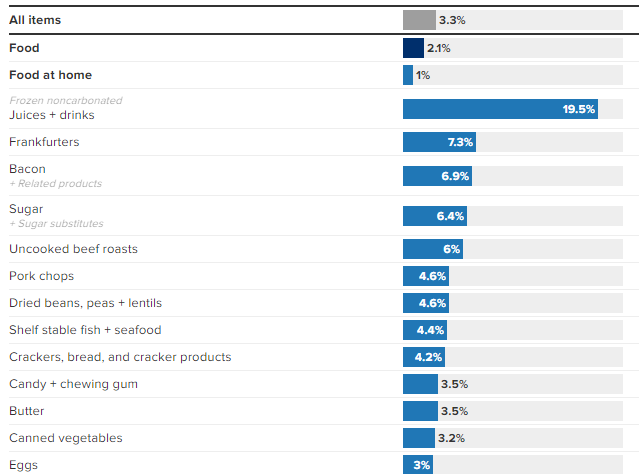

Looking beyond the hilariousness of every major protein far surpassing the level of 1% YoY food at home price growth, the CPI as calculated by the brainiacs at the BLS has come in an absolutely frigid 3.3% in May versus an expectation of 3.4%. Victory laps will likely ensue despite the fact that May CPI is still well ahead of Fed’s self-imposed mandate of just 2% annual purchasing power theft.

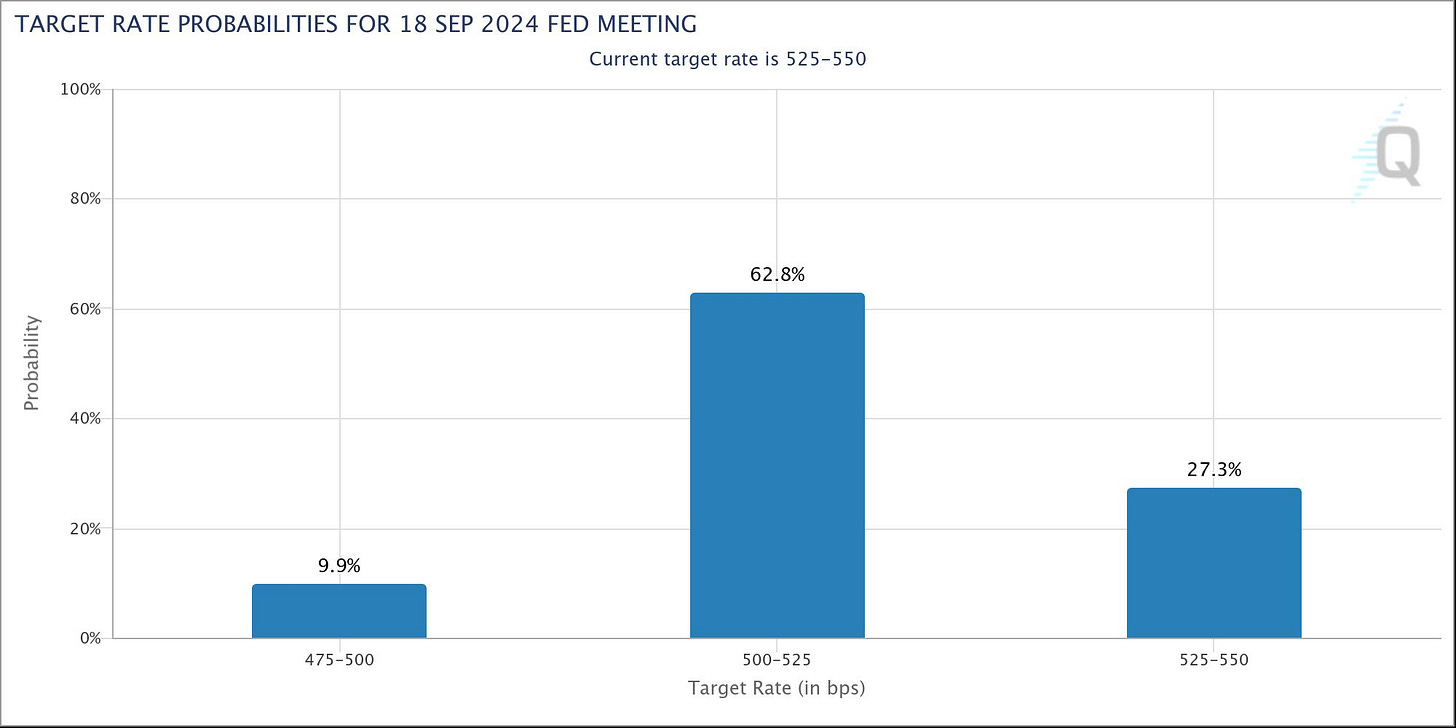

As I said last week, I don’t hate the players, I’m just very bothered by the game. Alas, it turns out I’ve been positioned somewhat well in that game (at least so far) with CME rate probabilities showing a 73% chance of lower rates by September:

How does one express the declining rates trade? That’s up to each individual but last week I highlighted the iShares 1-3 Year Treasury ETF SHY 0.00%↑ for full heretics and that is looking good from where I sit:

The decent inverse proxy of this chart would be the US 2-year which has absolutely nerfed more than 3% today and is (currently) below the 200 day moving average:

Of course, if one takes the view that yields are coming down across the board, the iShares 20+ Year ETF TLT 0.00%↑ may not be a bad trade either, but I view this one as more of a short term position:

I’m not convinced of a breakout here until the 200 MA is taken out on a daily close and we’re simply not there yet. It never hurts to lock in a little on a move like the one we’re seeing today. As far as the big movers go, there are quite a bit of charts to observe:

TeraWulf WULF 0.00%↑ is leading the pack higher in the Bitcoin mining industry - see what I did there? I don’t personally hold this one at this time but the traders have obviously taken notice of this name. That or it’s seen as a buyout candidate as miner consolidation takes shape this year and speculators are pushing the price up.

If you haven’t been following along in the chat, I abandoned my Osprey Bitcoin Trust $OBTC strategy for HSEP and am now putting that capital into Riot Platforms RIOT 0.00%↑ - my stink bid order below $9 didn’t fill yesterday but my average is now slightly above $10 and we’re looking good if the sector rallies together. RIOT has quite a bit of catching up to do given what I expect will be a nice summer of power credits. You can read more about that thesis here ← Seeking Alpha freebie link…

As for Bitcoin, who the hell knows? It’s up, it’s down. It’s up, it’s down. We can’t shake this range at the moment but it does seem as though bias is to the upside at this point. I remain of the view that dips are buys. Short of a breakout that makes a new high, I probably wouldn’t chase rips too aggressively.

As expected, metals are looking fine. Silver has rallied off the 50 day and off trend quite nicely. I have not procured my next batch of physical but that’s my fault for waiting.

I’m entirely unsure of what to make of First Majestic AG 0.00%↑ at the moment. I see a metal market rallying and a miner market rallying along with it. Yet, AG has fallen more than 5% from it’s devilish intraday high of $6.66 and is one of the view stocks in my portfolio that is actually red today. Even Molson Coors TAP 0.00%↑ is ahead of it’s Tuesday close and that stock has gone down virtually in a straight line for the last 10 weeks.

Point is, I’m losing confidence in AG and that probably means I need to take the position off. Which brings me to my final thought for the day and an important subscriber note; I will be on vacation for the entirety of next week and I’m planning to participate in a much needed unplugging. That means you won’t see a Monday morning thread next week and any content that I send to your inboxes will be pre-produced. I do plan to get one post out but it isn’t finished yet. Stay tuned.

I’ll be active in the chat tomorrow. But Friday I need to sleep for my trip as I’ll be driving 17 hours through the evening. If you don’t hear from me between now and then…

Disclaimer: I’m not an investment advisor. I’m long TAP, TLT, SHY, BTC, RIOT, and AG, among a couple dozen other stonks, ETFs, and shitcoins.

And as painful as it is to see all the red, at least so far $BTC’s beating has been pretty mild relative to just about every shitcoin in existence, the AVERAGE one of which is down ~15-20% right now as far as I’m seeing (not including $ETH). Also it’s been feeling to me for days upon days now that Bitcoin has needed a good puking. Out with the wet paper hands —> let the big boys add some more to their piles now, thank you very much!

P.s I’m not one of the “big boys” but I do like to pretend I am from time to time….Bam!! Smash buy 0.1 BTC!! 💥 🤛💪 who’s your daddy??!!

Here’s to hoping that this crypto action tonight proves to be one final good puking for $BTC, setting the stage for our next move upwards to break new ATH’s….🙏🤞🙏