FOMC how can I explain it? I’ll take it, frame by frame it

If you’re a hip-hop fan and ready to feel old, here’s a great start to your Wednesday: Naughty by Nature’s “O.P.P” is 31 years old. I really miss the 90’s! 80’s kids grew up in a fun time, but man, the 90’s - I loved it.

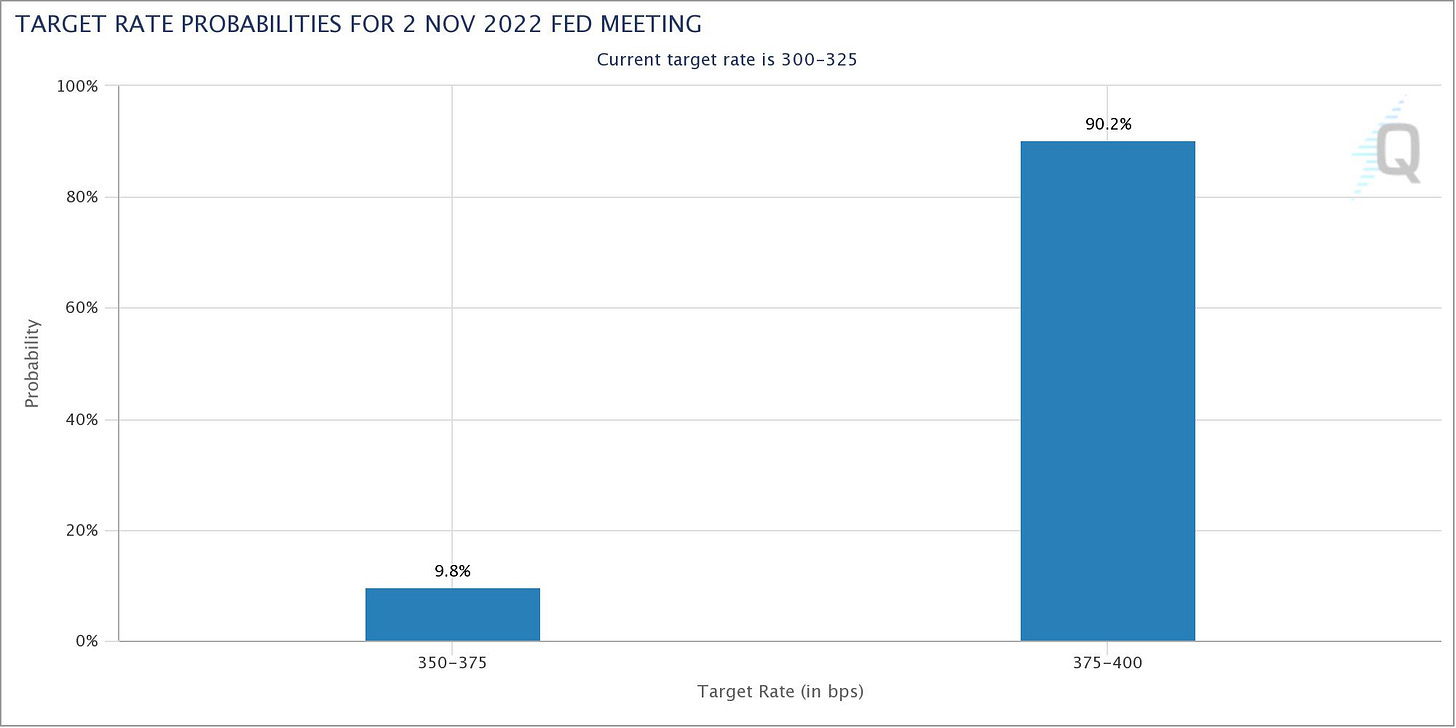

Alright no more fun. Let’s get down to business. Credit Master Jerome is speaking today and everyone is wondering, will he wear the red tie, the blue tie, or something a little more sinister; a light purple tie? Okay, I’ll get serious now. The market has essentially priced in a rate increase of 75 bps for later today:

With less than a 10% chance for 50, it’s safe to say we know where rates are going because the bond market has been telling us rates need to be at 4%.

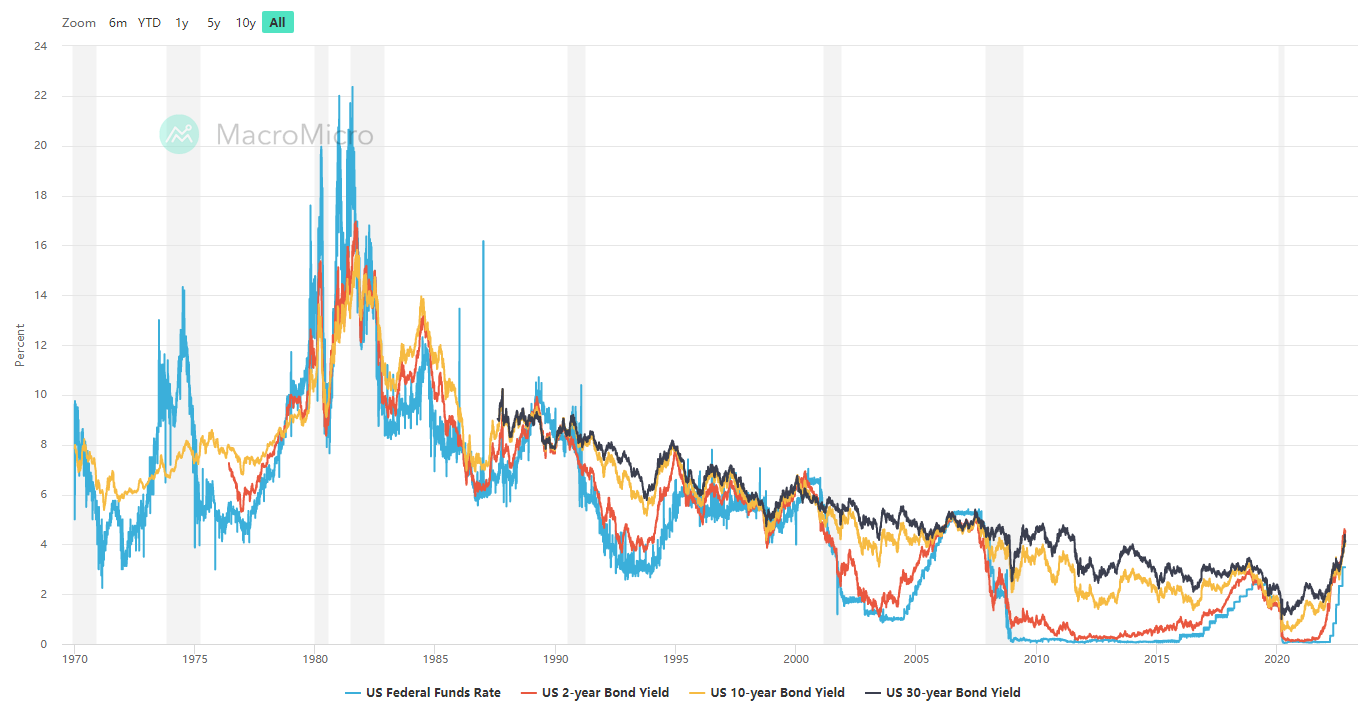

As I’m sure those of you who have been reading this stack for awhile know, I did not think the Fed would get rates this high. But they have, and with rates set to go up by another 75 basis points today, the cost of credit will officially be higher than at any point since pre-GFC. And as I’ve mentioned numerous times, higher credit cost means larger interest payments for the federal government when it refinances it’s debt outstanding.

And roughly a third of the $30+ trillion in debt is shorter duration. This is going to balloon interest payments as a percentage of government spending very quickly. The Fed will pivot. Sure as you’re born, they will lower rates again much sooner than many people think. I still believe that. In the meantime, what does all of this mean for equities?

The Dollar vs Everything

Brent Johnson’s dollar milkshake theory was a fantastic call. Almost everything measured in dollars has struggled all year; metal, equities, crypto, you name it. Commodities have done fairly well, but paper wealth assets haven’t done so great. The dollar strength is a big reason why. Right now, the dollar index (DXY) is right at 50 day moving average support.

I am of the opinion that the dollar is going lower after the dust settles from FOMC. If there isn’t a hawkish surprise of some sort, I think the “pain trade” is going to be to the upside over the next couple weeks. Of course, I could be very wrong. I have been before. I will be again. But I’m going into FOMC with some risk on and some cash ready to buy some things I want.

The S&P's current resistance is the 100 day moving average. It's kissed it two of the last three sessions but has failed to close above. My personal view is as long as there are no hawkish surprises today, the market wants to take equities to the 200 DMA, which is currently 4,100 - that’s where I plan to get much lighter.

That said, I’ve taken risk off in some places. I didn’t like the response to Molson Coors (TAP) earnings yesterday, so I closed that position. I took off the ARCC position as well. I have re-deployed that capital into some of my other positions. Notably, I’ve added to Noodles and Company (NDLS):

I think that name is looking good for a big relief rally continuation that will take it to $6.75 at minimum but we could potentially see a gap-fill at $8.18 if the market really gets some momentum to the upside.

I’d like to reposition my Chicken Soup debt shares into common. I think there is far more upside there since the RedBox mini-squeeze unraveled. Full disclosure, I do not own CSSE currently but I have an order that I’d like to see filled a little under $7.

I’m obviously very bullish Gold and Silver and I have bought quite a bit of Sprott shares. I also added to the AEM and AG trades. You can’t tell from the Google doc, but I’m personally well ahead on First Majestic because I’ve been averaging down. Again, all of this could end up blowing up in my face if Jerome comes out and throws water on everything (entirely possible). But I don’t think that’s going to happen. I think there is growing political pressure on the Fed to slow down:

Even though the left seems to be losing political power, I do think the central bank will find a way to oblige because the biggest losers if the Fed keeps hiking and allowing bonds to mature is the US government. And it doesn’t matter how bad the sea of red is on Tuesday - all of these people are in the business of spending money that we don’t have.

Good luck today.

Disclosure: I’m not an investment advisor. I merely share what I do and why I do it. You shouldn’t take anything I say as investment advice and always do your own research when making investment decisions. Cryptocurrencies, tokens, STONKs, and digital trinkets could all go to zero. I have no job and I live in my wife’s basement. I’m the last person on the face of the earth who you should listen to for financial advice or life advice.