You Win Some, You Lose Some

The Tiger Woods Scotty Cameron putter on Collectable was my single biggest alternative investment position. I just got an exit...

It’s admittedly been a long time since I’ve talked about alternative investments but I do still try to follow some of what goes on in the space. I won’t say I’ve lost interest since Otis was bought out by Public but I will concede that of the classes that I allocate to, the alts get the least of my attention.

For those of you who are newer to this little stack, when I say alternative investments I mean things like sports memorabilia, vintage wine, and art. In the past, I’ve used fractional apps like Collectable, Masterworks, Vint and Vinovest. Here’s the quick and easy version of my broad approach to these industries:

Scarcity is good.

Manufactured scarcity is not.

As an example, here’s how I apply these rules to sports memorabilia: I don’t generally care for cards, certainly not modern era cards. I like game-used equipment or uniforms much more. This has actually worked out very well for me over the last year as sports memorabilia as a category has fallen much less than cards have:

Trust me, you don’t want to see the “max” view - they both get really ugly. Turns out, the COVID/Stimmy everything bubble artificially ramped the prices of Ken Griffey Jr cards and Michael Jordan sneakers. Don’t cry for me though, that chart above is category index. I’ve still done well with my personal alt portfolio for a couple reasons. Through a combination of timely exits and picking the right assets, I’m still very much ahead on these ideas.

There have been duds, to be sure. But my top holding by allocation? Up 200% since my IPO purchase. Or is it?

The Tiger Woods Scotty Cameron Putter

For those of you who haven’t had the peek behind the curtain, my biggest alt holding has been the Tiger Woods Scotty Cameron putter on Collectable for quite some time. Turns out, I got another exit this weekend:

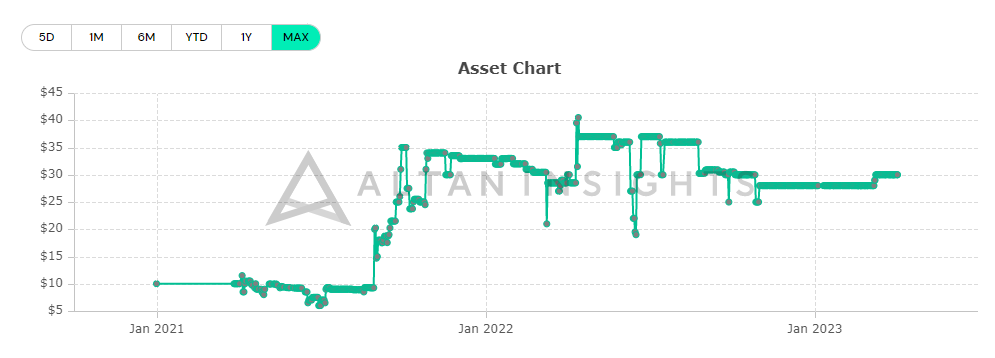

The putter’s IPO price was $10 per share. With 21,586 shares outstanding, it had an implied market cap of $215,860 on December 31st, 2020 when it launched. It last traded for $30 per share in the Collectable app - or a $647,580 implied valuation. Even though this is often a liquidity-challenged market, I’d actually say the putter had seen better trading liquidity than many other fractionalized assets on Collectable:

This isn’t exclusive to Collectable, these alternative investment platforms are notoriously very illiquid. However, the putter had seen more trading volume relative to its market cap than most of the other assets I checked; even the ones that have lower valuations and more trading history.

From where I sit, the higher the Vol/MC ratio, the more realistic the valuation. While the Tiger putter certainly can’t compete with Collectable’s Jordan PSA 10 RC, it’s still well ahead of the $2.4 million Wilt uniform both in aggregate volume and Vol/MC ratio. The point is, small illiquid bids goosing the Tiger putter valuation weren’t a major concern of mine.

Collectable recently allowed shareholders to vote for or against auctioning off this putter in the Golden Age Masters Week Gold Auction. I did not vote, but the rest of the shareholders voted in favor and the auction was from March 27th through August 8th. Final price?

$221,376. And that’s with the preposterous 20% seller fee already tacked on. This club sold for a massive 66% discount to where it was last valued by Collectable shareholders just a couple weeks ago. And that auction price was less than $6,000 ahead of the IPO valuation from late 2020. Fractional assets often trade at premiums to what they would sell for in full, but not that big of a premium.

This is a club that some thought would command a 7-figure haul. Turns out, the old price is the new price again. The asset is still listed with the $647,580 valuation in the Collectable app and Collectable hasn’t tweeted anything in 5 days. Ouch. Certainly not what any of us were hoping for.

The lesson?

Alternative investing is really hard. Like many things, these assets are incredibly difficult to value because so much of what drives that value is narrative or background story. It’s art, not science. And frankly, most of these things are collectables not investments. It’s easy to get caught up in a mania. Especially when rates are zero and money is easy.

I’ve taken some shots in this alt investment space for a little over 2 and a half years. At this point, I’ve had quite a few wins and a handful of losses. This one is basically break even but it still sort of feels like a loss even though it probably shouldn’t. But it’s a good reminder that most of this is just numbers on a screen. And if you can’t hold it or touch it, it’s much less fun to collect.

So what the heck should I do with the exit proceeds? Stonks? T-bills?

Disclaimer: I am not a financial advisor. Assess your own risk tolerance before buying digital trinkets expecting to sell them at a higher price down the line.