Zcash Is Ripping: What Gives?

The largely left-for-dead privacy coin has had a significant resurgence in recent weeks. ZEC is now outperforming BTC, ETH, SOL, and XMR year to date. Let's see if we can find out why.

Late last week, we had a really good set of comments in the Heretic Speculator chat thread. Remember, every Monday morning I share a new thread with full heretics (paid subs) where I dive into charts and share my real time thinking on the markets throughout the week:

On Friday, we had an observation in last week’s thread that I felt deserved exploration:

on a day where no other coins that I’m following are moving notably to the upside in any meaningful way whatsoever, ZEC is up over 13% and on heavy volume as well. - G Dub 19

Turns out, ZEC has indeed been doing very well in recent weeks and the performance has been so strong, that Zcash is now outperforming four of the top five non-fiat cryptocurrencies in the market year-to-date:

And this isn’t just an example of ‘alt-coin season’ lifting all boats. ZEC is also outperforming privacy-focused blockchain assets like Dash and Monero as well:

The majority of this positive action has come in the last five weeks. With the caveat that I’ve been bullish ZEC for quite some time and fondly remember a triple figure coin price, $40 ZEC is not something ZEC holders have seen in nearly 16 months…

So is this rally just a big bull trap pump? Or is there really a reason to be excited about this run in the price of the coin? We’ll explore several possibilities including ECC developments and on-chain metrics.

Price Action And Zcash News

There are three very telling things on this chart that I think warrant coin price bullishness purely from a TA standpoint:

The 50 week MA has been broken, back-tested, and left in the dust

The coin is now even above the 100 week MA for the first time since May 2022

We can observe several bullish RSI divergences on the weekly chart

The last time we had such a clear bullish RSI divergence on the weekly (March 2020), from this price level no less, ZEC rallied from $18 to $370 in 14 months. To be clear, I’m not saying that we’ll see that happen again. I’m merely pointing out that we’ve seen this coin move very high, very fast in the past and we have similar technical conditions that we did back then.

In scanning X for any news that could be driving these price moves, I came across an article citing Tyler Winklevoss posting support for Zcash. It’s nice, but this is not anything new:

Winklevoss has long-supported Zcash and had the coin listed and withdrawal-enabled on Gemini before other centralized exchanges did. Some of the recent news out of the Electric Coin Company does appear to be neutral to positive, in my view:

Former VP of Strategic Alliances at ECC Paul Brigner just joined Coinbase COIN 0.00%↑ and the Bootstrap Board. I see this as a loss for ECC, personally. But a Zcasher at Coinbase should be a good thing.

Proof-of-Stake migration appears to be on hold with plans for a hybrid proof-of-work and proof-of-stake model to be developed.

The generally controversial “dev fund” that has seen ECC receive 7% of new coin issuance over the last four years is set to expire in November. A new temporary agreement has been established that will see those funds instead going to a grant-based “lockbox.”

On the dev fund change, I think this is very positive. It’s only good for one year, but it was voted on by ZEC holders and I don’t think anyone can reasonably complain about ECC getting a subsidy at this point.

Trading Data

One of the things that G Dub 19 brought up in the chat thread last week was order book action on Coinbase. I decided to dive into the market volume data for ZEC and I was shocked to see that a very tiny, obscure exchange has been moving over a third of the entire Zcash market over the last 24 hours:

I’ve never heard of “YoBit” and don’t know anything about it beyond it being a Panama-based exchange that doesn’t practice KYC. According to Crunchbase, it was apparently founded by someone named Pavel Krymov who was arrested in Moscow 6 years ago for alleged fraud schemes - many of which appear to be crypto-related. In any case, someone is still keeping the lights on over at YoBit and the exchange is facilitating quite a bit of ZEC trading at the moment. ‘

Chart below shows full ZEC market liquidation data:

No matter which exchange speculators have been using, the one thing that has been common of late is shorts are getting wrecked. During this five week run-up, shorts have generally been getting liquidated to a far larger degree than longs. This has not been the case for much of 2024. And the volume spike itself is noteworthy. There appears to be a sustained move higher in volume over the last several weeks that has coincided with this price move:

Interestingly enough, the $36.7 million in ZEC open interest as of August 12th, 2024 is the largest level of OI for Zcash since… August 10th, 2022. Odd to say the least and I’m not quite sure what to make of it.

“Tier 2” PoW Payment-Chain Trends

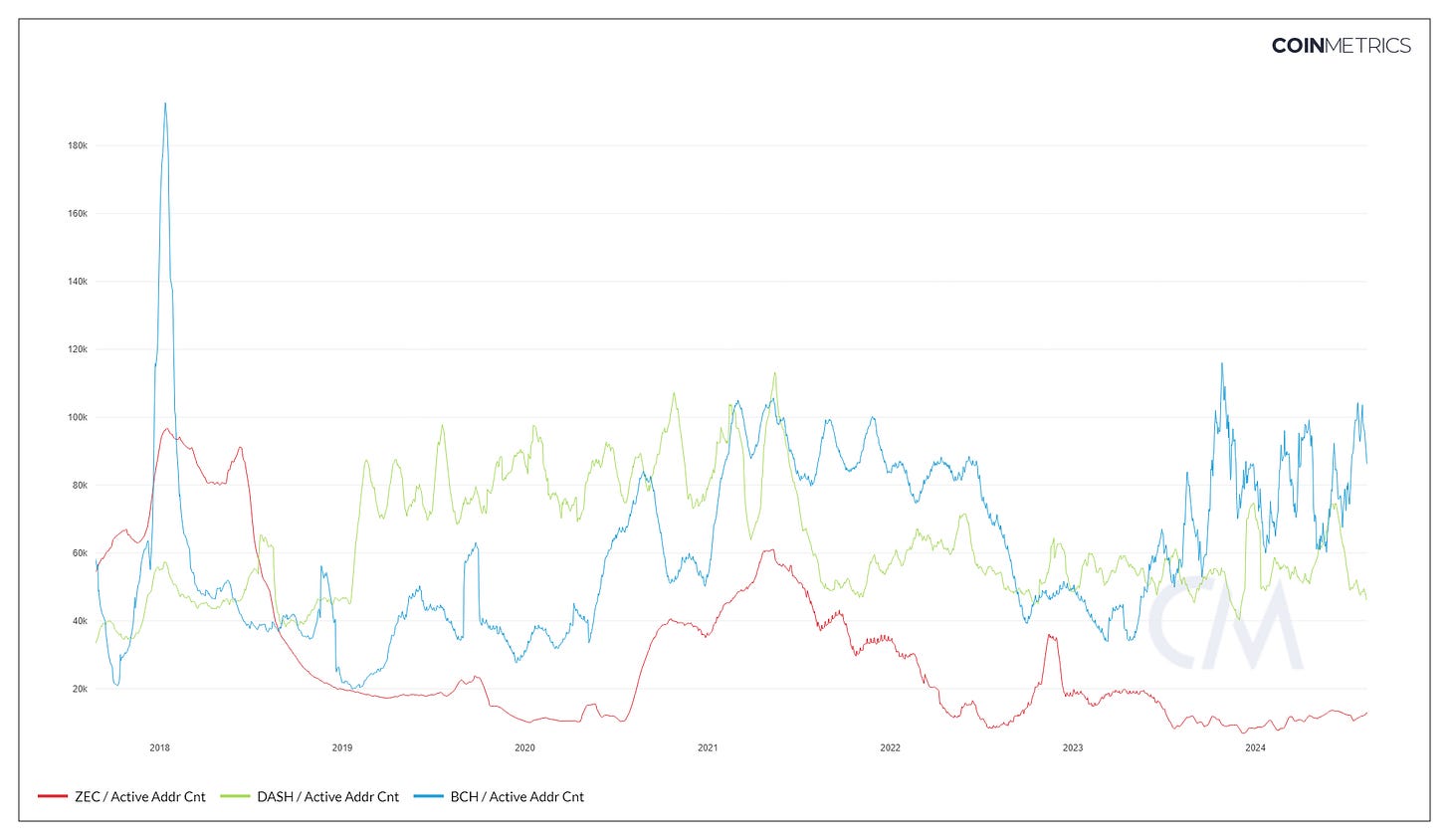

I’m actually stripping Litecoin out from this analysis because I view it as more of a “Tier 1” payment-chain coin than a “Tier 2” payment-chain coin. LTC has unquestioned utility. It’s cheap on an NVT ratio basis relative to Bitcoin. I think it deserves a place in portfolios. The “tier 2” PoW coins are more akin to scratch off tickets at this juncture. For comparative purposes, I’m using Bitcoin Cash and Dash:

Active addresses, while moving up slowly year to date, are not all that impressive in my personal opinion. Zcash is averaging just 13k daily active addresses over the last month. Bitcoin Cash is at 86k and Dash is just under 47k. In this area, ZEC is not competitive.

The same is true for daily transactions. Here we see only Bitcoin Cash really doing anything meaningful with about 73k daily transactions. Dash is doing 12k. Zcash is slightly above 3k.

Valuation-wise, ZEC has the lowest NVT ratio at 60 and it isn’t even close. BCH commands a 3x premium to ZEC and DASH trades at more than double the NVT ratio of ZEC. This isn’t the only metric where ZEC is theoretically “cheap.”

While not the cheapest coin of the three, ZEC’s market capitalization to realized capitalization (MVRV, or the average price at which the coins last moved) is just 0.51. Meaning, the average ZEC holder is underwater by about 50%. I can speak to the validity of this personally, unfortunately. DASH has an MVRV of just 0.25 (yuck) and BCH comes in at 1.27. In case you’re curious, Bitcoin’s MVRV is just above 2 - indicating the average coin is now worth double what it was one it last moved.

Closing Thoughts

I would love nothing more than to hit “send” on this email and tell you all why ZEC is going to keep going higher. From a TA standpoint, I actually think we could see that happen after a much needed pullback. But my gut reaction to this after looking at all of these charts is this price move is probably more of a short squeeze than anything else. There is no fundamental growth in adoption of the network itself that justifies this bump. Active addresses and transactions aren’t going much of anywhere.

Even shielded ZEC has pulled back considerably from a spike up to 1.8 million ZEC. None of this means ZEC can’t keep going up anyway. As I’ve been saying for what feels like months, it’s capital flows and sentiment driving these digital assets more than real world adoption. One could certainly argue ZEC has been unfairly hammered over the last two years following the spam attack of 2022. But in my view, if ZEC goes higher from here - and I would enjoy it very much if it does - it’s because it’s changing sentiment in the market rather than real growth in usage. Perhaps improvements in sentiment can help lead to further adoption, but I’m simply not seeing that in the data yet.

FWIW: I’m still long ZEC personally and plan to stick with it for years.

Wonderful Insights! Thanks Mike!

Appreciate the investigative research you shared on it, Mike, thank you. I felt kinda guilty basically asking you if you could maybe do the DD for me, but it seems my assumptions were spot-on that you’d be far more efficient AND proficient with that task than if I had to try and make any sense of what (if anything) was behind the recent noteworthy increases in both the trading volume and the price performance of $ZEC. I remain intrigued by it personally, and so much so in fact that I made the bold and slightly difficult decision about 5 days ago to flip my $ZEC trading strategy completely on its head. I flipped from my previously-active program of selling off small pieces of my $ZEC position into strength via the $ZEC-$BTC pair on Coinbase to actively purchasing more $ZEC (somewhat re-building my former $ZEC position) via the $ZEC-$USDC pair on relative dips these past few days. Done buying and selling it for now…I think? 🤷🏼♂️…didn’t get my full position back, but I’m cool with that. All the $ZEC I had flipped were for small gains anyway, and for all we know, this puppy could easily be right back to trading in the upper-teens $ per coin before the wkend anyway lol..