Zooko, ZEC, and The Future of Zcash

With Zcash's founder stepping down as CEO of the network's primary developer, the future of the network is anything but certain. Still, I ride with the shields.

They’re going to Zcash tech. They’re just not going to the Zcash chain. - Joel Valenzuela, Digital Cash Network

The quote above is a really insightful nugget from Joel Valenzuela’s recent Digital Cash Network podcast episode with Ian Sagstetter about Zcash’s legacy. It wraps up a 12 episode mini-series in which Valenzuela explored Zcash, its history, use, and development. The full episode is definitely worth a listen:

Valenzuela’s point is essentially that the developers of Zcash ($ZEC-USD) have created marvelous open source technology that has been utilized by numerous other blockchain networks in the broader crypto ecosystem. And yet, despite the amazing advancements that have been developed by these advocates for Zcash ‘the idea,’ growth of Zcash ‘the network’ has been a massive disappointment.

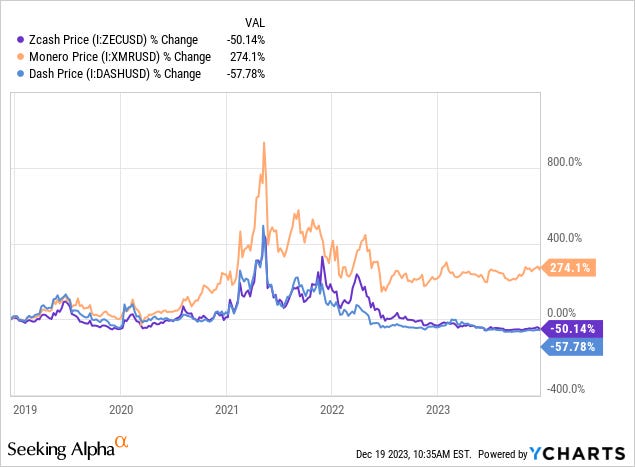

In the podcast, Valenzuela and Sagstetter (formerly of ECC) make the case that Zcash’s legacy may ultimately transcend the actual Zcash network. While wonderful if true, it doesn’t necessarily help the ZEC holders (of which I am one) who continue to watch an egregiously hated unloved cryptocoin underperform pretty much everything else in the market. ZEC’s primary competitor in the privacy coin segment is Monero ($XMR-USD). There can be no doubt at this point that XMR has been the better long term bet for crypto speculators.

A few of you followed me to Heretic Speculator from the BlockChain Reaction days. You guys likely recall ZEC was one of my top holdings in the BCR crypto portfolio. Despite the weakness, ZEC is a coin that I’ve actually continued to buy in the time since that research service ended. Furthermore, I’ve written quite openly about Zcash right here on Heretic Speculator even before BCR launched.

Given that, I feel as though I have an obligation to share my thoughts on the departure of Zcash founder Zooko Wilcox as CEO from Electric Coin Company (ECC) which was announced yesterday.

The Road Ahead

If there was any single person who could be called the “face” of Zcash, it’s Zooko Wilcox. Zooko is to Zcash what Satoshi Nakamoto is to Bitcoin.

The big difference is that Zooko is completely doxxed and nobody knows definitively who Satoshi is. That has arguably been to the detriment of both Zooko and Zcash. On his own departure yesterday, Zooko said the following:

For me personally, Zcash took over not only my life but also my identity. It was hard for others to see Zcash as something separate from me. Sometimes it was hard for me to do that myself. It has been an incredible experience, and I’ll always be grateful that I had the opportunity to live out one of my science fiction dreams in reality. However, in the long run, I don’t think this conflation of Zcash with me personally is healthy for me, and I don’t think it’s healthy for Zcash. Zcash’s role in human history is, and will be, much bigger than any individual.

In addition to founding Zcash and being one of the 6 members involved in the initial launch ceremony, Zooko was the CEO of Zcash’s primary developer, Electric Coin Company (ECC), up until yesterday. From the ECC blogpost:

Now, it’s time to start a new chapter. Josh Swihart, formerly SVP of Growth at ECC, will return to ECC and take over the reins from Zooko as CEO. He will be responsible for all strategic and tactical decisions. Zooko will remain in his role as a director on the board of the Bootstrap Project, the parent company of ECC.

Thus, a new era is born for both ECC and by extension Zcash. To his credit, Swihart is already off to the races. From a Twitter post earlier today:

Licensing Orchard (and originally Halo 2) under BOSL was done with great intent and led to the grant used to fund Brave's integration of shielded Zcash into their browser wallet. However, there are projects that would like to integrate Zcash that simply will not because they don't want to deal with non-standard licenses or take the time to try to understand them. Today, we are removing that friction. It's time to set Zcash free.

In my view, this is an interesting Day 1 move and is a clear attempt at addressing the first of three priorities for growth emphasized by Swihart yesterday:

Removing friction

Increasing utility through user-focused products

Securing ECC financial sustainability

On that last part, Zcash has been criticized by many in the crypto community largely since the network’s inception. Among other things, the reward structure for new coin issuance has come under quite a bit of scrutiny as miners received 80% of new supply emissions and ECC received a portion of the remainder.

The most contentiously debated aspect of Zcash’s launch was not necessarily that a mining reward ‘haircut’ was imposed, but that significant allocations were earmarked for the founders and early investors. The concern here being that allocating these funds in such a way, especially to members who might not contribute directly to the project, equates to a free subsidy for a privileged few. A far-cry from the open and level playing field that Bitcoin lauded from day one. - Colin Baird

It’s probably fair to conclude that the struggle over founder allocations has hindered the broader development of the network. This was evidently a turnoff for the kind of crypto user that Zcash would theoretically appeal to. As such, I believe ECC has been a crutch for Zcash development and true decentralization has likely suffered. As I understand it, the current funding structure is set to expire in Q4 2024. At that point, we’ll find out what the future holds for Zcash. Governance over “decentralized” networks is one of the major issues facing the broader ecosystem to this day and I doubt it will be any different here.

Price And Fundamentals

As the Zcash network has struggled to grow, so too as any investment made in ZEC over the last several years. From that standpoint, the performance of ZEC has been undeniably abysmal. It hasn’t just lagged privacy-peer XMR, ZEC is one of the few coins that is actually down year to date:

I’m just as disappointed about this as anyone. This underperformance has, at least in part, been due to a multitude of issues over the last 24 months or so. I’ve detailed a few of them in the past:

From where I sit, the 2022 spam attack was enormously detrimental

Financial privacy is a third rail in today’s regulatory apparatus

ECC layoffs earlier this year were a bad sign

Hashrate centralization continues to be a major problem

In an ecosystem that claims to want decentralization, Zcash is reliant on ECC for development and ViaBTC for hashrate. Each of which are big problems. Ultimately though, the biggest reason why ZEC is dragging is because Zcash as a network isn’t really growing. We’re nearly 3 weeks into the month and pacing just 3,097 transactions per day for December:

December usually lags the annual average. But this is a particularly weak month during what has been a weak year for Zcash already. Growth has obviously been poor. But as 2023 nears a close, ZEC holders can’t dwell on governance or execution issues from the past. The network itself actually works quite well at this point in time. If Zcash was vaporware, I could see cutting the loss and selling ZEC. But it isn’t vaporware, there is real value in ZK tech and what the developers have built. Sure everybody hates it, but that’s generally a reason to buy something that works not sell it.

Accepting Reality

As much as I like Zcash the protocol and have been rooting for its success, I think it would be unproductive to view ZEC as a viable investment at this point in time. ZEC is and can continue to be a wonderful private digital currency. If the Zcash network can actually survive long enough to migrate to a proof-of-stake consensus mechanism, Zcash may have a shot at long term success. But of all the big issues Zcash may be facing, the one that is easiest to solve is simply usage.

We have a ZEC shielded pool that has been flat since April and currently stands at about 1.3 million ZEC, or 8% of the circulating supply. For a network focused on privacy, this is not a large number. Per the Zooko/ECC announcement yesterday:

we’re excited to redouble our focus on the Zcash user, and we feel confident in Josh’s leadership — in finding product-market fit, unlocking new partnerships and collaboration, improving Zcash usability, and increasing adoption.

Product-market fit. That’s really the name of the game isn’t it? This is where I think Zcash is going to have to open itself to the broader crypto ecosystem and see what those fits can be. Can Zcash transition to a network that has more than just ZEC? For instance, could we see decentralized stablecoins like DAI find their way Zcash? Or could we see some form of wrapped Bitcoin on the Zcash network since Bitcoin fees are high and Lightning looks cooked?

Afterall, 19 million of the 50 million non-zero BTC addresses are effectively dead since the fee to transact the funds is larger than the funds on the addresses:

Zcash is far cheaper to move and has privacy features that Bitcoin simply can’t match. Could there be a fit there? We’ll see. Whether it be stablecoins or wrapped assets; in both examples, ZEC can maintain value as the gas token for transaction payments. It’s anyone’s guess at this point, but I think just about anything should be on the table.

Closing Thoughts

I’d argue that the reality of the cryptocurrency market as 2023 comes to a close is one of a market functioning largely inverse from how I and others might think it should be. I’ve lamented this in the past and acknowledge that I’m surely guilty of chasing gains as well; but “number go up” is what drives most of the returns in crypto. Real utility is often overlooked as boring or inadequate.

Of course, there are exceptions to this, but for every THORChain ($RUNE-USD) there are 10 or 20 dog money meme coins. There are surely good reasons for that and I’m not going to pontificate on them other than to say if you’re chasing NVIDIA NVDA 0.00%↑ at a 40 P/E you may also be fine with buying “Bonk” at any price.

For ZEC holders, the market is what matters. And for the market to truly appreciate Zcash the network, higher ZEC prices have to solve the centralization problems. At $28, ZEC isn’t profitable to mine. And the miner relationship with Zcash may be difficult to salvage even if it becomes profitable again. Coupled with 80% miner rewards rather than a full 100%, proof-of-stake is still on the Zcash roadmap. The implementation of PoS consensus would render mining ZEC useless so it’s entirely unsurprising that many who actually do mine ZEC, sell it for Bitcoin shortly after.

For Zcash advocates, network adoption is what matters. And that adoption comes from continued advocacy and also network usage. Hoarding ZODL’ing ZEC isn’t the way to spread it. Using it is.

🛡️

Disclaimer: I’m an internet rando not an investment advisor. Cryptocurrencies are risky and the overwhelming majority of them are going to zero. Absolutely none of them are perfect.