A Noteworthy Laggard Among Positive YTD Crypto Investment Flows

There's not much love for a certain "blue chip" crypto this year. Let's explore some possible reasons.

Late last night I submitted an article to Seeking Alpha covering the ProShares Bitcoin Strategy ETF BITO 0.00%↑. This is a fund that utilizes futures contracts rather than exposure to spot. Basically, BITO has no direct Bitcoin ($BTC-USD) holdings and serves more as a straight forward bet on the coin’s price. One of the charts that I shared in that piece is unrelated to the fund itself but I think it paints a very interesting picture that shows how this cycle is different from the last one so far:

Forgive the awful labeling. Each stacked column is a quarter’s worth of customer volume for Coinbase COIN 0.00%↑. The one on the far right is Q1-24 and includes Bitcoin’s latest all time high price set in March. The tallest one is Q4-21 when BTC’s previous cycle peak took place. Notice anything?

Here’s a hint from the article:

Institutional volume was off 31% from the level during Bitcoin's previous cycle peak. In the same quarter, retail volume did less than a third of what it did in the fourth quarter of 2021. The signal here is that, at least in the US market, the bid is mainly coming through products like ETFs. Which means BTC could behave a bit more like a more traditional investment asset than it likely has in past cycles.

Bold above is my emphasis for the sake of this follow up piece. I see two possible scenarios here and I’ve detailed the first one before:

Retail is buying through the ETFs

Retail isn’t buying at all

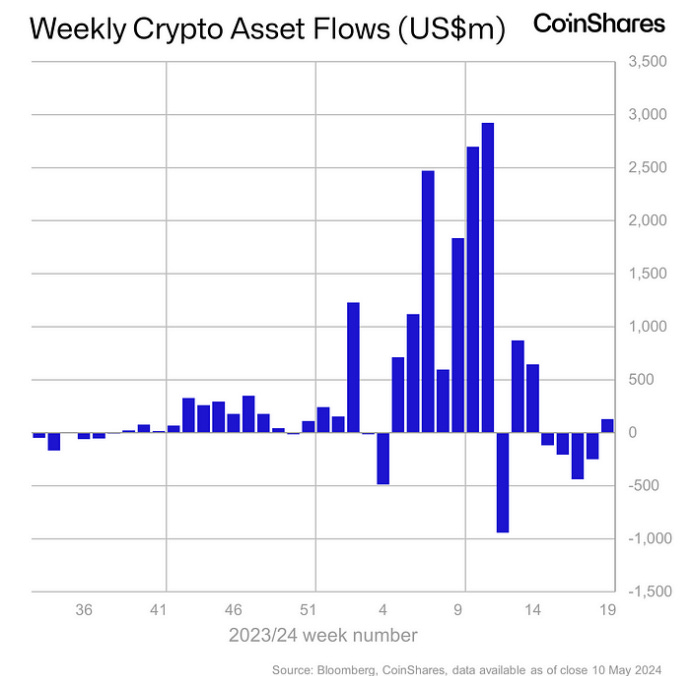

There are certainly signs that ETF buying is coming from professional money mangers. Take for instance the State of Wisconsin Investment Board which just piled $163 million into the iShares Bitcoin ETF IBIT 0.00%↑ and the Grayscale Bitcoin Trust ETF GBTC 0.00%↑ in the last quarter. More recently, we’ve seen investment demand for crypto cool off with four consecutive weeks of outflow during April:

That outflow streak came to an end last week with $130 million in positive net flow but it isn’t indiscriminate buying. Breaking it down by asset and I see a very interesting development:

Fund managers are selling Ethereum ($ETH-USD) rather than buying. The question is why. It’s obviously not because of a broad disinterest in altcoins. Litecoin ($LTC-USD) investment is up year to date. Polkadot ($DOT-USD) investment is up year to date. Each of which have experienced better net flow than current market darling Solana ($SOL-USD) which has a dramatically higher AUM starting point.

So why is ETH negative?

What’s Wrong With Ethereum?

Unlike Bitcoin which made a new all time high in March, Ethereum never actually made a new ATH earlier this year after rallying up over $4,000 per coin. Additionally, the asset has sold of roughly 30% from the March peak which is where it still currently sits. For context, Bitcoin only pulled back about 22% from its March high and is just 12% away from it as I type this. This is admittedly just a guess, but I suspect the primary driver of could actually be a consequence of Dencun.

Fees on Ethereum had been trending higher through the second half of 2023 and into Q1-24. They are now in the toilet. Ethereum fees by month:

March: $606m

April: $221m

May (as of 5/14): $40m

We are halfway through May and we are not even sniffing the April pace - which was down 64% from March. The problem here is Ethereum ecosystem activity has simply migrated from the primary chain to the scaling chains. April was a fantastic month for daily transactions for EVM blockchains:

This activity just isn’t happening on Ethereum’s main layer and the fees paid by L2 operators to Ethereum validators were just intentionally cut by Dencun in March. Even though I was bullish Ethereum (and Dencun) back in March/April, there is no question in my mind that Ethereum’s profitability is now suffering because of L2s (like Base) eating fees:

When I wroth “The Ethereum Conundrum” at the beginning of April, Ethereum was far and away the most profitable blockchain. April and May are now showing negative earnings months.

The residual effect of Ethereum’s shift from profitable to unprofitable is the coin itself has now turned into an inflationary token once again. I think we have to take a deep breath here and remember that this is only two months of data. It’s easy to point to fund managers pulling capital from Ethereum-based investment products and theorize its in response to a combative SEC and broader US regulatory environment.

However, I think it could be more accurate to say ETH is struggling because the economics of the chain just dramatically changed. To be fair, Solana is an inflationary coin as well that pays validators via new token issuance. This may not be a problem if it’s an understood factor going into any coin exposure. But if you bought ETH expecting it to be a deflationary asset, perhaps the disappearing profitability of the chain post-Dencun has soured some viewpoints?

No doubt, it’s something to keep an eye on going forward.

Disclaimer: I’m not an investment advisor. I’m long BTC, ETH, LTC, and SOL.