My focus lately has been more on the specific names that I like and follow. As such, it’s been a few weeks since I’ve offered up some technical thoughts on the broader financial markets. Today, we’re going to have a look at stocks, Silver, Bitcoin, and oil. First, stonks:

Recall what I said in my Monday thread this week:

SPX looks like it has a date with 5200. I still think stocks are way overvalued have no real business going up but... at this point in the Empire, it's all one trade.

Well, 5,200 achievement unlocked. Now what?

The red line at the top of this chart is a trend line that goes all the way back to Summer of 2022 and presumably further than that. More recently it has served as top resistance in the broader trend before stonks went totally batty in the first quarter and took out the line entirely before falling back down in April. Zooming in:

Today, in what is our 7th SPX increase in the last 8 sessions, we have once again met this red trendline while the RSI has met with the descending trendline that dates back to mid-December. I could admittedly go either way on this. I think stocks should go down while acknowledging that they probably won’t. One reason I’m thinking that stocks may actually hold up here is the potential action in yields:

Remember Monday when I wrote about Molson Coors TAP 0.00%↑? That stock is actually up 2.5% this week but the dividend yield of roughly 3% is still well behind the rate on the US 10 year. And honestly, the ten year looks like it might be headed back up after spending most of the week at its 50 day MA. If yields were going down, I’d assume it would be from capital allocators buying bonds. That would theoretically come at the expense of stocks. So far, we’re just not seeing the breakdown in yields that I think would warrant rebalancing.

Something that has broken down is Oil. WTI Crude fell out of range last week and his subsequently failed a retest of the both 100 and 200 day MAs. Less than two months after Oil’s “Golden Cross” in March, the 50 day is already headed back down.

Silver is probably one of my favorite charts at the moment. Solid uptrend. Just took out and back-tested both trendline resistance and the 50 day MA in recent weeks. I think anything under $28 is a steal at this point as I wouldn’t be even remotely surprised to see a breakout above $30 in the coming months.

Best way to play Silver? Obviously, I’m a proponent of both physical metal and investment instruments like the Sprott Physical Silver Trust PSLV 0.00%↑. But for crypto-degen-like gains, what do you buy when metal is up and oil is down?

Miners.

Silver is close to breaking out over multi-year resistance and miners have barely noticed - until recently.

Right now, First Majestic Silver AG 0.00%↑ is my only active position in HSEP. I’ve made two buys this week. Current average is $7.17. I wouldn’t rule out another buy here if we get another test of $7. But I’m not going to go much higher than 50% allocation. The rest of the capital is for my next BTC proxy wager.

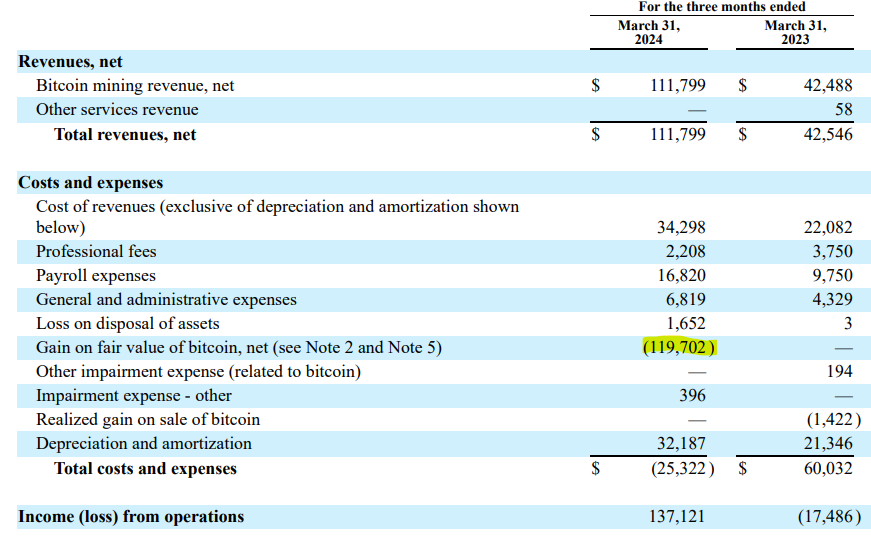

After CleanSpark’s CLSK 0.00%↑ recent earnings report, I think this company has one of the better fundamental setups post-halving. Even when stripping out the (admittedly preposterous) unrealized gain on fair value of BTC from quarterly operations, CleanSpark actually had positive net income for quarter ended March.

They also raised a ton of capital and now have over $680 million in combined liquidity between cash and BTC for buying weak miners post-halving. And that brings us to BTC. The best thing for CleanSpark right now would be a temporary decline in BTC to force capitulation from some of the company’s acquisition targets. Then they can fire off some of that dry powder and scale EH/s through the rest of the year. BTC appears to want this as well:

I still think we’re going back below $55k short term and the weekly candle may reinforce that opinion:

We have yet another failure to retake the 8 week MA with a coin price that is actually now almost as close to the 20 week MA as it is to the 8.

Here’s what I want to see playout:

BTC drops to $52k to test the 200 day MA, which holds as support (I’m buying this BTC drop big time btw)

BTC regains $56k on weekly close following $52k test, (I’m buying more BTC at this point)

CLSK falls with BTC price correction

On a pullback of this nature, my plan is to also buy both CLSK and OBTC for the Heretic Speculator Equity Portfolio. More on OBTC next week!

Hope you guys have a great weekend!

Disclaimer: I’m not an investment advisor. I’m long AG, CLSK, and OBTC in my Roth IRA.