Bitcoin, Bit Digital, and a Little Bit of Humble Pie?

BTC is making a fool out of me. Is it time to re-adjust expectations? Laying out my Bitcoin-exposure plan for HSEP.

Let’s start with the obvious; like just about every other risk asset, Bitcoin ($BTC-USD) absolutely ripped yesterday in response to the “slowing” inflation figure for April.

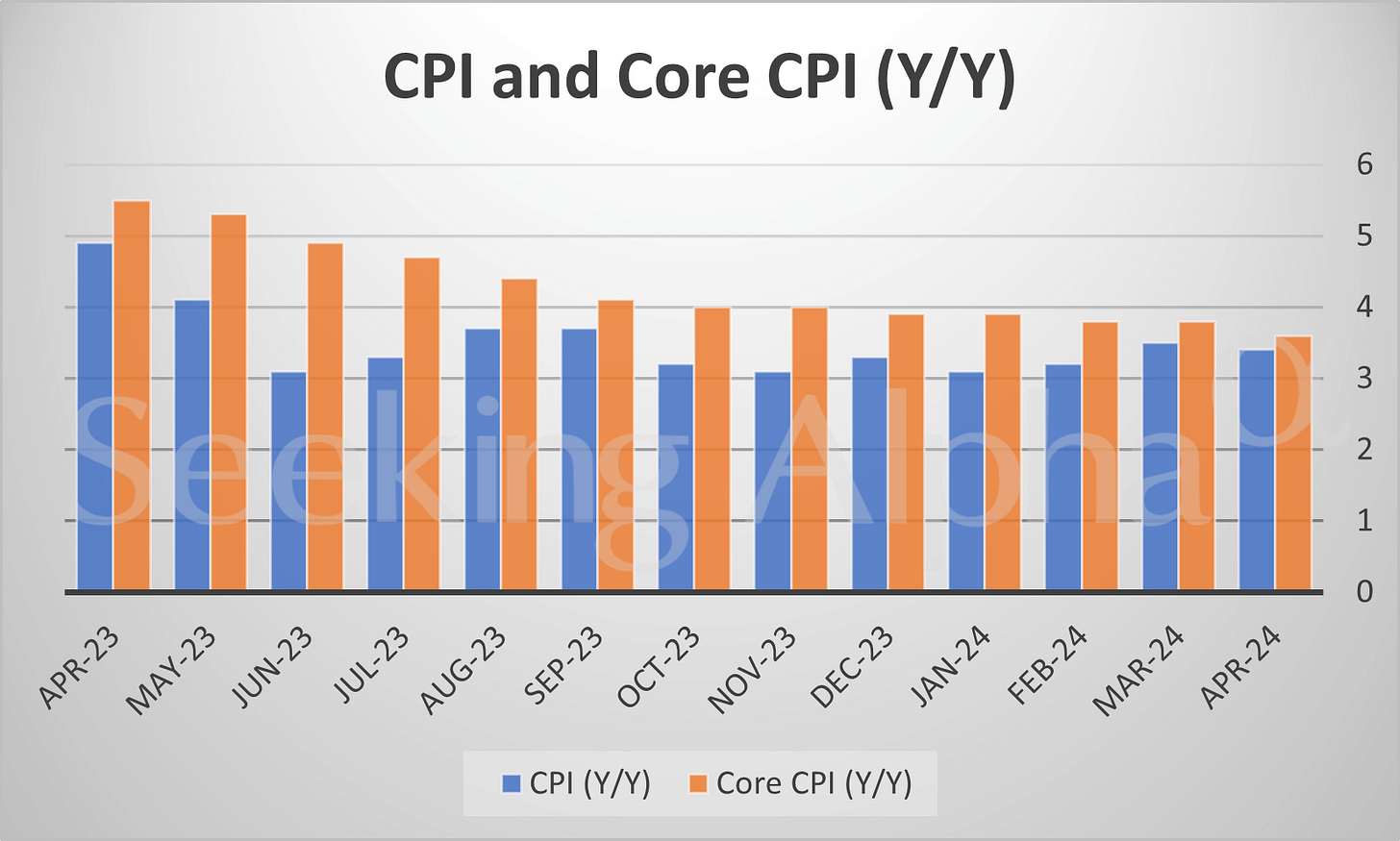

Sure, the rate of increase in inflation looks like it’s going down if you strip out food and energy. But on planet earth, the prices of things that people need to live are still going up. Simply observe the index itself rather than the YoY figures:

This is not “going down.” In fact, if one considers April 2021 (4.1% year over year) to be the unofficial starting point of this high inflation era, than April 2024 is the beginning of our fourth year of high inflation. Anyone have a guess as to which month was the lowest YoY rate of change in CPI over the last 3 years? No peeking!

It was June 2023 at 3.05%. That means April 2024 was the tenth consecutive month where the YoY CPI print was above the low of the last three years. The question then is why did almost everything rally yesterday? Gold, Bitcoin, bonds, stocks, all of it… you had to try to lose money yesterday and even then you may not have been able to. Why?

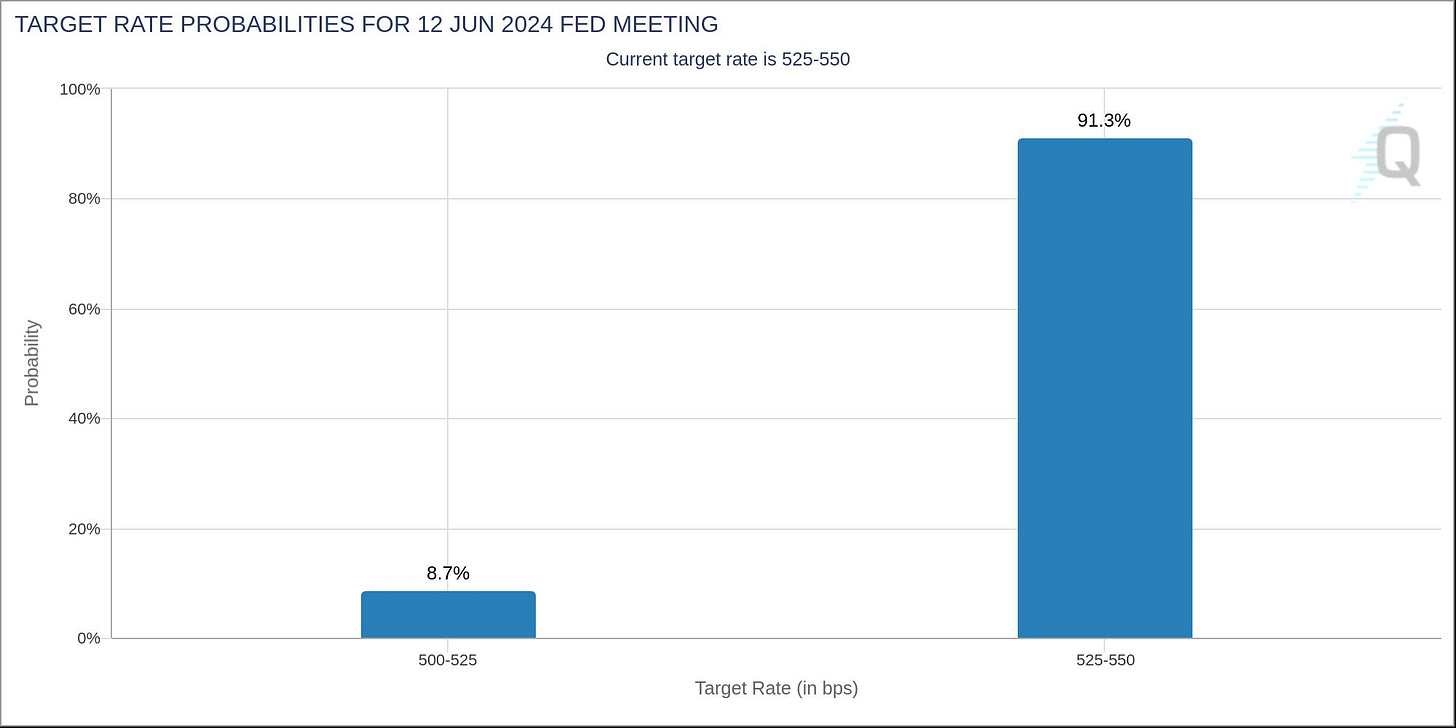

I highly doubt it’s because of the notion that inflation is cooling or going down. I don’t think the Fed (or investors) actually care about inflation - more so the optics that the Fed has everything “under control.”

For me, it’s the market simply rallying again on the same rate cuts that haven’t happened yet. Regardless, I have to admit that I missed a really nice chance to buy BTC at $60k a few days before it ripped up to $66k.

However one chooses to view these Bitcoin trend lines whether by blue downtrend or orange downtrend, Wednesday’s candle was a clear breakout. Headfake? We don’t know yet. I think it’s reasonable to expect a back-test of the 50 day MA at $63.5, but that certainly doesn’t mean we’ll get it. In any case, this is the chart that I think matters more…

Bitcoin has closed below it’s 8 week MA for 5 consecutive weeks. Today it’s once again flirting with a close above that level. This is the level that I think is important and will shift my view from cautious to big time bullish. But again, daily closes above the 8 week MA don’t matter as much as the weekly close does. When we get that, I think we’re off to the races. If that means I miss a short term opportunity, so be it. But to be clear, I am of the opinion that we will get this 8 week MA breakout this year. I’m just not convinced yet that it’s going to happen this week.

To be clear again; I still have plenty of BTC exposure on at this point in time. I own it directly on chain. I have exposure through the ETF wrapper and to a more volatile degree through selective exposure to miners. What I don’t have currently though is exposure in HSEP and I want to change that. Last week I mentioned that I’d be sharing some thoughts on the Osprey Bitcoin Trust $OBTC this week and today is the day!

OBTC Strategy

OBTC is managed by Osprey Funds. Like Grayscale’s Bitcoin Trust ETF GBTC 0.00%↑ before being converted to an ETF, OBTC was and remains a closed end fund. So shareholders don’t actually have any real mechanism for redeeming the BTC represented by the shares. Because OBTC is essentially BTC in a locked box without shareholder access to the key, it trades at a discount to the BTC held in the fund. Yesterday that discount was over 8%.

For much of the last twelve months, this fund’s discount to NAV traded in line with GBTC pre-ETF conversion. Obviously GBTC converted and has been dealing with unrelenting redemptions for the last four months. For whatever reason, Osprey opted to not convert and the NAV never closed. The company had a failed attempt at a tender offer at NAV earlier this year - the massive collapse in the discount ratio during the month of February was due to Osprey cancelling the tender offer. Importantly, the tender offer cancellation was a regulatory problem with the SEC rather than due to a lack of shareholder demand. I won’t get into the weeds on all that, it doesn’t change how this is going to end, in my view.

In March, Osprey disclosed that the fund is courting suitors for the business. If it can’t find a suitor, the fund will be liquidated at the end of August and shareholders will be paid out proceeds from that liquidation. My feeling is that the fund will not be bought out by a suitor and will instead by liquidated. I take that view because Osprey’s 0.49% management fee is well above the current market rate for most of the ETFs. Since the fund’s AUM is just $166 million, I’m not sure it’s worth it to an existing asset manager to bail out Osprey and buy the fund for less than a million in annual fee revenue.

So this is a really straightforward wager as I see it. The fund trades at an 8% discount to NAV. Buying $1,000 worth of BTC via OBTC costs $920 and at the end of August the fund will sell that $1,000 and distribute it to shareholders. The risk in firing off all the capital that would go into this trade at once would be the price risk in Bitcoin. Thus, I think it makes more sense to manage cost basis in very small increments between now and the end of August:

Of course, the closer the share price gets to the NAV, the less return to be expected at liquidation. But in my view, 8% is a good enough discount to take advantage of the arbitrage and OBTC is already a holding in my Roth IRA. Even if my base case happens and BTC pulls back to $63.5k to test the 50 day MA, at 8% off, OBTC is about $19 per share. This is how I have my HSEP orders currently set up:

I have a little over $900 in settled cash sitting in this account. If I can get close to $500 of that put into OBTC before August at variable rates before liquidation, it gives me both exposure to any upside in Bitcoin and a small premium at payout time assuming my average remains below NAV.

Elsewhere in the world of Bitcoin and Bitcoin speculations…

Bit Digital Earnings

I’ve been covering miner earnings over on Seeking Alpha for much of the last two weeks. One of the companies that I haven’t covered this month is no doubt a familiar one for the heretics. Bit Digital BTBT 0.00%↑ just reported earnings yesterday and became the latest mining company to report positive quarterly net income in Q1-24. Like just about every other miner, the overwhelming majority of the company’s positive net income came from simply re-rating the crypto on the balance sheet following adoption of FASB fair accounting changes.

Take out the accounting change and Bit Digital did $1.3 million in quarterly net income from actual operations. Notably, BTBT is one of the few mining companies that is actually generating meaningful revenue from its HPC business - $8.1 million of the company’s $30.3 million in quarterly revenue came from its AI data center business, or 26.7%.

Judging from CEO Sam Tabar’s comments on the conference call this morning, it seems pretty clear that the company views HPC as the future of the company. While still guiding for 6 EH/s in the future, they’re taking a very pragmatic approach to scaling and they view the “grow at any cost” strategy that can be observed by many other companies in the space to be dubious.

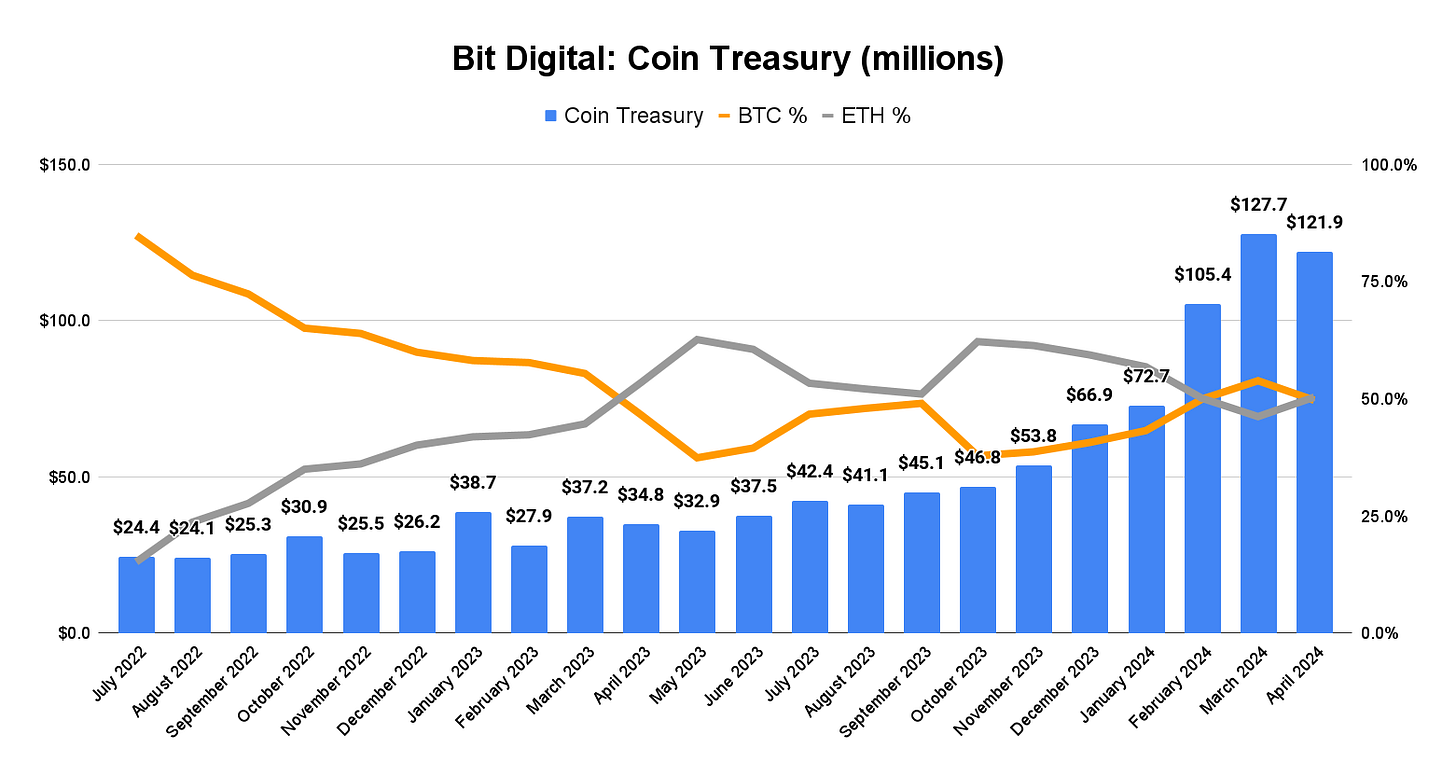

Something I couldn’t help but notice was just how little mention of Ethereum ($ETH-USD) staking there was on this call and probably for good reason. Staking ETH only generated $326k in the quarter and Bit Digital has a considerable amount of capital tied up in ETH.

At the end of April, 50% of the company’s crypto on the balance sheet was allocated to ETH with a large percentage of that ETH being actively staked. This is entirely speculation on my part; but I can’t help but wonder if Bit Digital may exit this strategy all together in the future.

As I pointed out yesterday, the economics of Ethereum have taken a dramatic step back following the Dencun upgrade in March and Bit Digital wants to scale its HPC business because the margins are so much better than they are in BTC mining.

“There are no halvings in AI.” - Sam Tabar, loosely quoted from this morning’s call

In order to scale HPC services, the company is considering raising debt to finance the buildout. According to Tabar, financing terms for AI compute are far better than for BTC mining - which I absolutely believe to be true given how problematic the long term incentive model is for Bitcoin mining. To me, there’s $60 million in ETH that is generating very little return from staking. Perhaps that capital could be liquidated and redeployed to HPC? We’ll see.

Management seems very committed to HODLing the Bitcoin on the balance sheet. The value of which is equally large in comparison to ETH. At the end of March, the company had $291 million in total assets and just $26 million in total liabilities. Bit Digital is still guiding for $100 million in annualized HPC revenue.

By my calculations it has a 21 BTC per EH/s figure post-halving at current efficiency numbers, which indicates maybe 50 BTC per month going forward. At a $70k BTC price, that’s $42 million in annualized revenue from mining. So let’s say worst case $142 million in annual revenue at a $279 million market cap. And there’s still no debt to service at this time. I personally still think BTBT is a great (but volatile) speculative buy.

Disclaimer: I’m not an investment advisor. I’m long BTC, ETH, BTBT, and OBTC.

IREN reported recently and beat expectations I believe. That’s my 2nd largest holding in the miner arena and I’m up a decent 10-20% on my overall investments, don’t know the exact number, but some of those gains are in taxable accounts and therefore I’m that much more reluctant to sell my positions in those accounts in particular right now. But I’m persuadable at the same time. I personally find IREN to be a bit of an enigma in that I don’t see much chatter about that one, at least not so much in the venues where I typically will search for market banter. (It’s very possible I’m just not looking in the right places btw). But anyway, the relative lack of hype around IREN is a bit curious to me as it seems to check certain boxes (all renewable energy {I think?}, also other significant revenue sources {AI - and one of the early ones to make this crossover amongst all the publicly traded miners if I’m not mistaken}, multinational/diversified geographical exposure, etc) and these things have led me to feel in the past that maybe it’s just a bit ‘under the radar’ for the time being. However, something can only remain ‘under the radar’ for so long before an undeniably biased observer who seeks to employ intellectual honesty to the best of his ability, must acknowledge that perhaps it’s more a case of ‘the rest of the market just doesn’t care that much about what you’ve found intriguing’.

Any thoughts on IREN by anyone who’s familiar with that one?

Any miners that anyone would recommend not touching with a 10-ft pole? If I have a small position in any of those, I’m ready to pull the rip cord as I haven’t gotten too deep in the weeds with some of my smaller miner positions tbh 😬