Bitcoin Drama: Satoshi Theory, Chain Metrics, and Cycle Data

Speculation about the true identity of Satoshi Nakamoto is trending with the release of "Money Electric: The Bitcoin Mystery." Is the conclusion plausible? Plus, charts and other coin stuff.

"WikiLeaks has kicked the hornet’s nest, and the swarm is headed towards us." - Satoshi Nakamoto

The price of everyone’s favorite cryptocorn certainly hasn’t been going much of anywhere these days, but that doesn’t mean there is a lack of things to talk about. In case you aren’t aware, a documentary by Cullen Hoback called Money Electric: The Bitcoin Mystery dropped on HBO WBD 0.00%↑ last night and it has made some waves in the orangecoin space IBIT 0.00%↑.

In the documentary, Hoback uses loose circumstantial evidence to make the claim that a well-known Bitcoin advocate is actually the true identity of Satoshi Nakamoto. The film is on MAX, so if you want to watch it and don’t want the ending to be spoiled, STOP READING THIS POST. There will be spoilers from here on out.

Last November, I wrote about a handful of Satoshi identity theories and came up empty on a leading candidate:

I’ve gone back and forth on this several times and I can’t even confidently say Satoshi is one person. If we find out years from now that Szabo, Finney, and Back all played roles simultaneously I’d completely believe it.

Before we really get into my thoughts on Money Electric, I recommend watching the full film if you have access to MAX. While Bitcoin maxis some people are very upset with the conclusion drawn by the producers of the film, I think it’s an entertaining watch and it details what Bitcoin is supposed to be somewhat well. Now having said that, I don’t think this documentary convincingly supports its final claim that Peter Todd is the true identity of Satoshi at all based on the evidence provided.

If anything, the most compelling argument that Peter Todd is somehow connected to Satoshi is probably Todd’s reaction to being confronted with the claim that he is Satoshi. In the snipped below, Todd is wearing the black hat and Adam Back, another possible Satoshi, is wearing the orange hat:

I have two main takeaways from this:

First, the body language from both of them is kind of bizarre. But Adam Back seems particularly uneasy to me. It almost seemed like he was surprised Peter Todd was the one being called Satoshi and not him. Back is certainly no stranger to being called Satoshi and it often felt like the film was setting up to make the claim that Satoshi is Adam Back. Which is not at all a controversial take. Barely Sociable fingered Adam Back for Satoshi in a well-researched YouTube GOOG 0.00%↑ piece a few years ago.

Second, I think the reference to John Dillon is important here. Hobuck seems to be using it in an attempt to prove that Peter Todd has a history of using pseudonyms by making the claim that Todd is actually both Satoshi and Dillon.

If you’re having trouble keeping up, Dillon is a character who entered the Bitcoin arena around the time the block size war began. Dillon, a self-described intelligence agency operative, apparently emailed Todd a bounty to implement replace-by-fee in Bitcoin code. Doing so was seen by some as a way to hinder Bitcoin’s transaction scalability on the base layer. This was covered at length in Hijaking Bitcoin by Roger Ver - who was also featured in the documentary and arrested shortly after releasing his book earlier this year.

It’s hard for me to get there that Todd could be both Satoshi and Dillon. The reason for that is Dillon’s role in this appears to be highly antagonistic to the original vision of peer-to-peer payments without an intermediary. But what is admittedly interesting about this is Dillon’s motive seems to be somewhat aligned with Blockstream incentives… Adam Back is the co-founder of Blockstream. Could Dillon actually be Adam Back?

After intentionally thinking way too much about this, I feel as though the only way Peter Todd could be both Satoshi and Dillon is if Satoshi has actually been more than one person all along. For kicks and giggles (don’t at me maxis), let’s pretend ‘Satoshi’ is actually a group effort. If Satoshi is in reality four people working closely together with a blood oath to take the secret to the grave, could those four people conceivably be Adam Back, Peter Todd, Hal Finney, and Len Sassaman?

Sassaman passed away in 2011 and was the Polymarket favorite to be Satoshi before the documentary aired. Finney died in 2014 and was the first person to receive a transaction on the ledger. Since Sassaman and Finney are both gone, that leaves just Back and Todd to take Bitcoin whatever direction they want after big block dissidents forked or left the industry outright. Like I said, kicks and giggles. I don’t think we’ll ever know for sure.

Chain Data

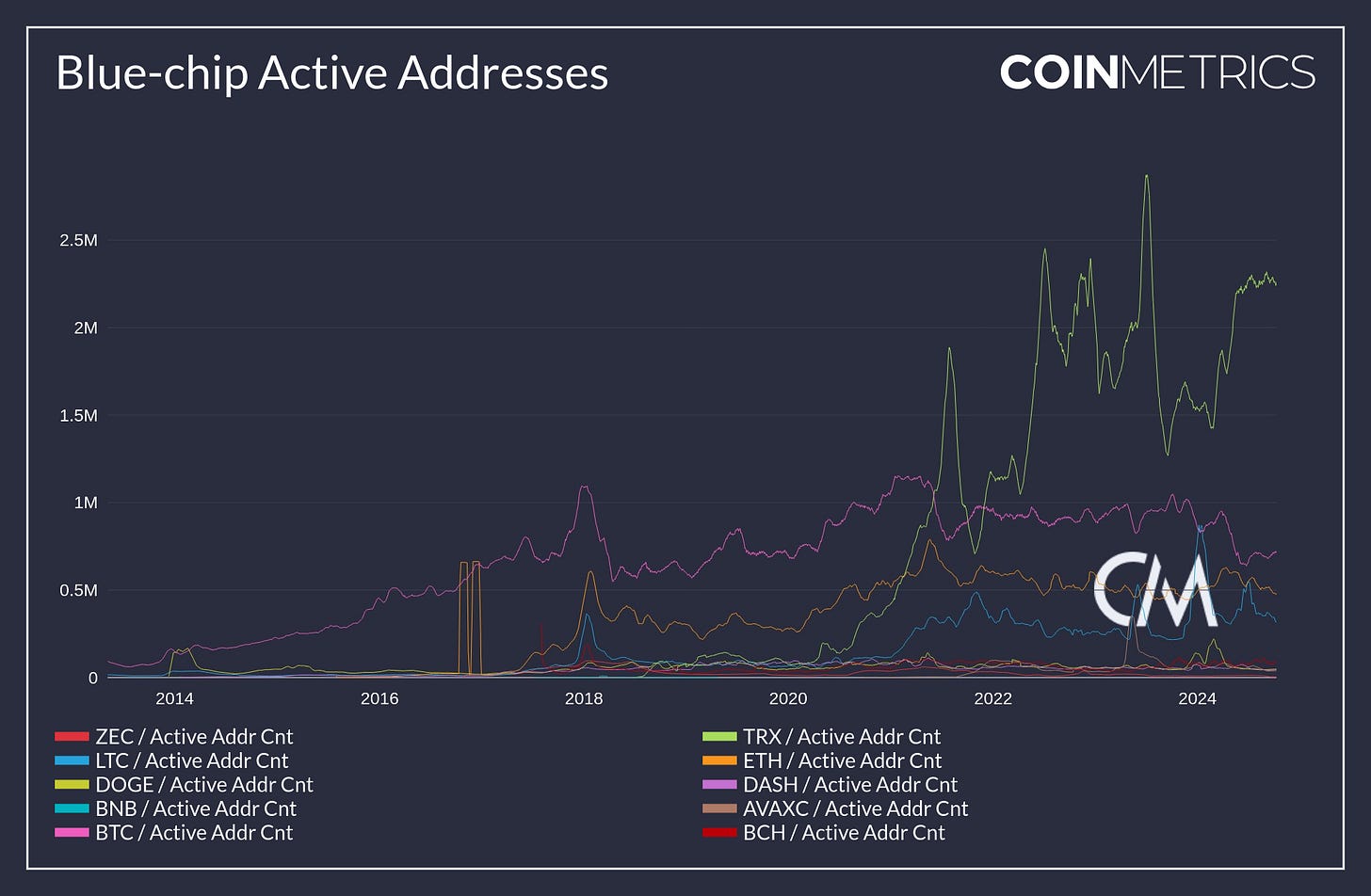

For the duration of this section, we’re going to be looking at 30 day rolling averages from CoinMetrics. First, a metric that every leading crypto-analyst suddenly started hating after the trend began going in the wrong direction… active addresses:

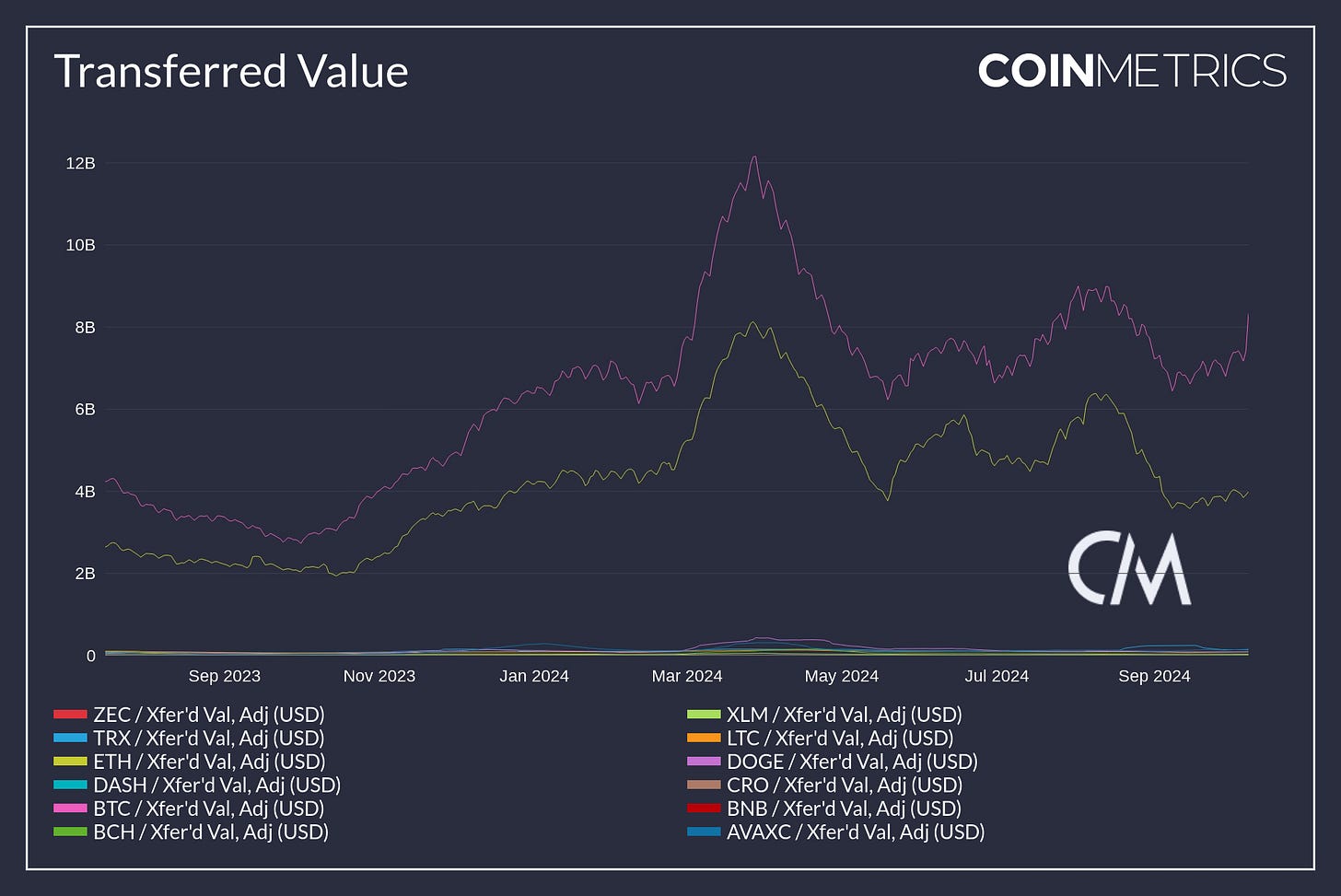

Bitcoin is still well off highs here at about 740k. Nothing really comes close to Tron at this point which has been averaging over 2 million DAAs since May. Though I have to admit, this sample doesn’t include blockchains like Solana, Sui (all the rage right now), or Polygon (huge beneficiary of Polymarket betting). Of course, users are less important than value. And Bitcoin is still the undisputed champ in adjusted transferred value after taking out wash trading:

Bitcoin’s $8.3 billion in average daily transferred value over the last month is more than double the next chain (Ethereum). Nothing else really comes remotely close to either of these chains. When thinking about transferred value, the next logical place to go is the good old NVT ratio - or the USD market cap to the value transacted on the networks.

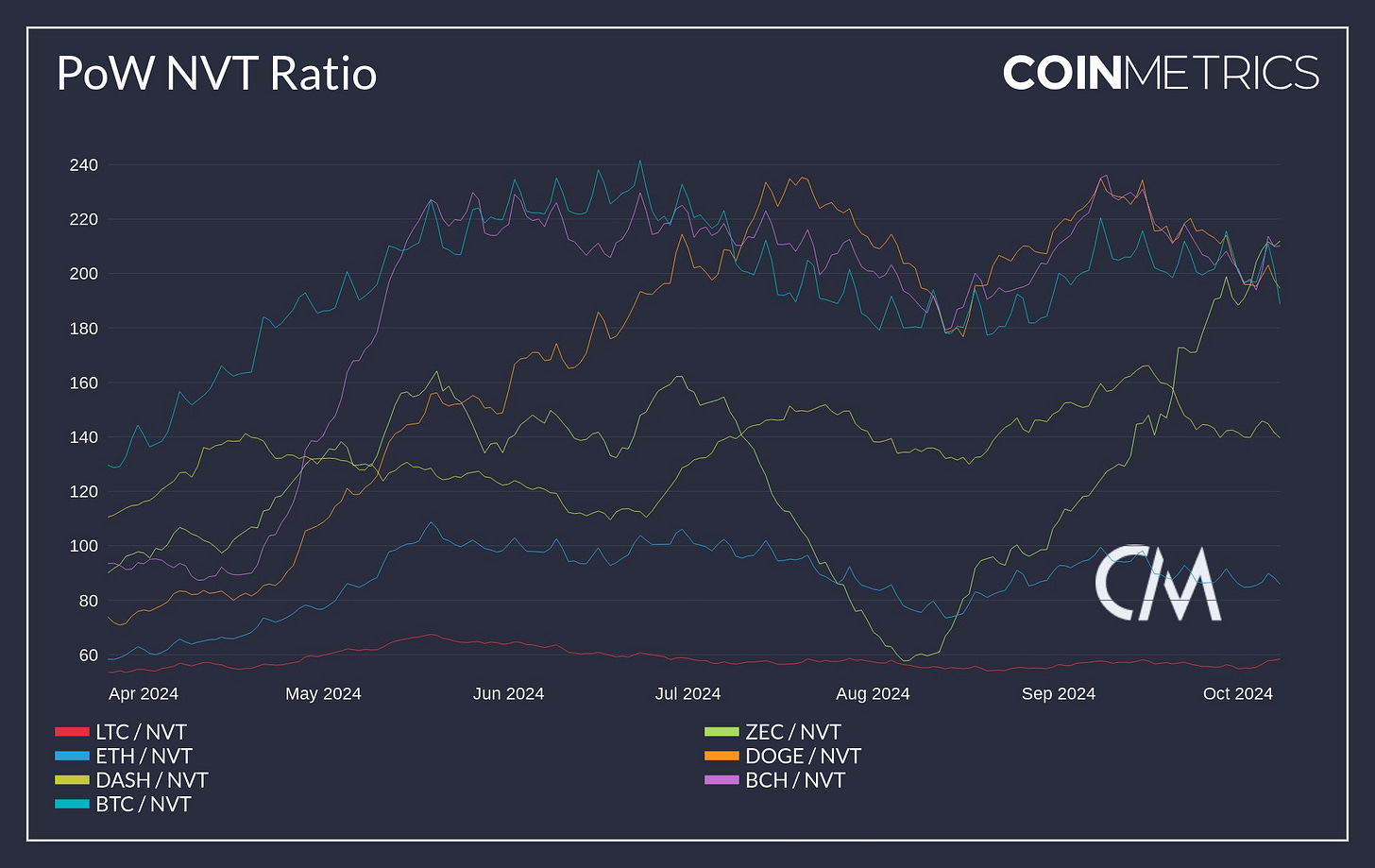

Something crazy happened here over the last two months. Check this out:

That light green line that goes virtually straight up startingi n mid-August is Zcash. ZEC’s NVT ratio in early August was 58. Today, it’s 212! Meaning, Zcash went from being the second cheapest proof-of-work coin that I follow to the most expensive in just two months. Mind-boggling. Per usual, I wouldn’t call Bitcoin cheap at 188. But it’s currently cheaper from an NVT ratio standpoint than ZEC, DOGE, and BCH. LTC remains in a class all by itself at 58.

Longer Term Cycle Data

The all important HODLer balance of BTC has dripped down to 12.8 million of the 19.7 million coins in circulation. This is a decline of about 1 million BTC since the start of the year:

Bitcoin’s HODLer balance hasn’t been this low since Q1-23. I don’t think this is anything to be all that concerned about, to be honest. Typically what we’ve seen historically is HODLer balance peaks somewhere before the real bull run begins. It isn’t until HODLer balance starts going back up that the top has been in. As far as post-halving price performance goes, the 2024 vintage has been a massive dud:

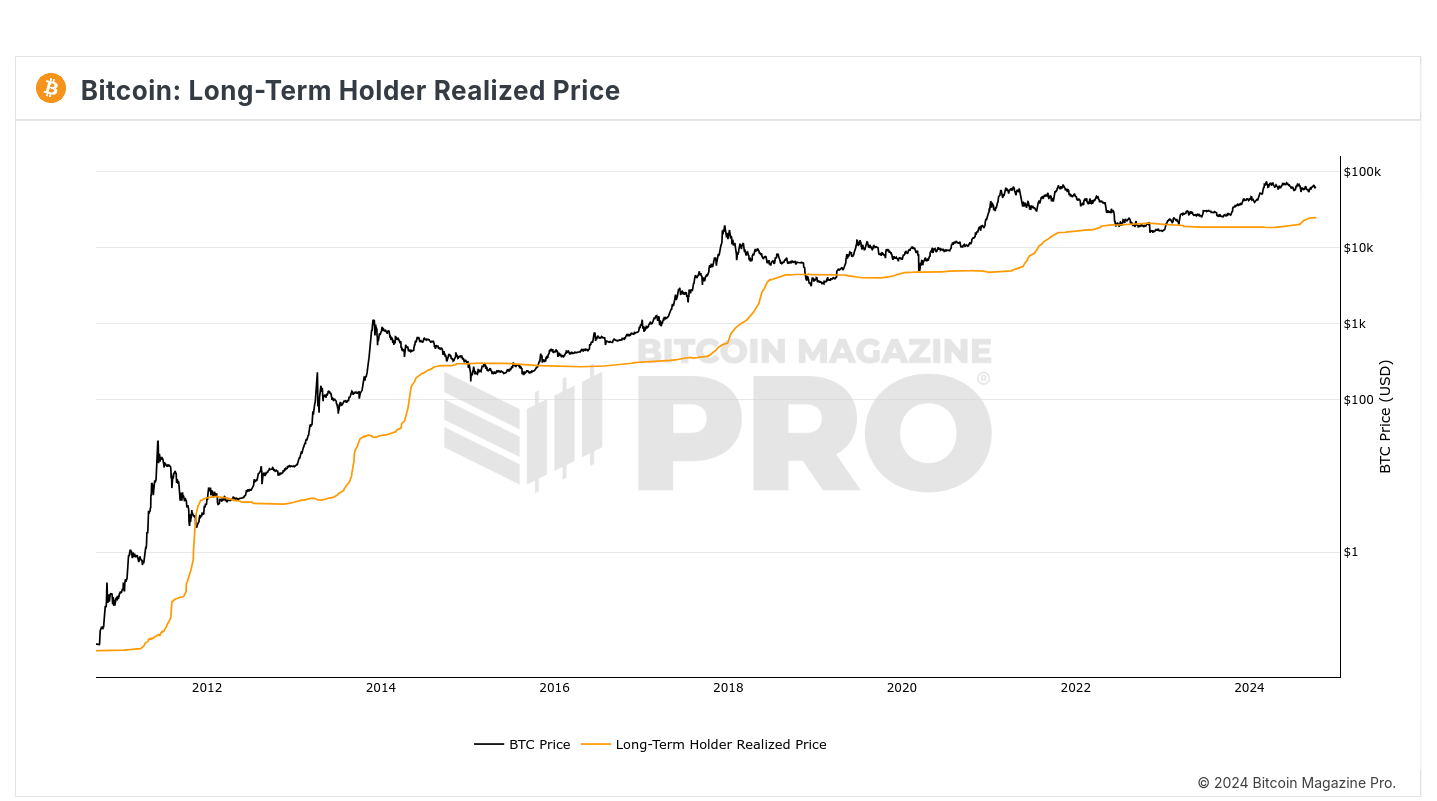

This post-halving epoch is admittedly off to a rough start. We are not currently following historical patterns from the previous three epochs. I suspect the approval of the spot ETFs changed things and pulled forward quite a bit of post-halving demand. But the other problem is we just don’t have the same level of retail mania that we’ve seen in the past. If/when that happens, we generally see market prices explode as much as 10x higher than realized prices.

That realized price level is currently $25k. I’m not saying we see BTC take out a quarter million per coin; to the contrary, I actually think this cycle’s top is potentially going to disappoint bulls considerably unless we see the global liquidity spigot go utterly parabolic:

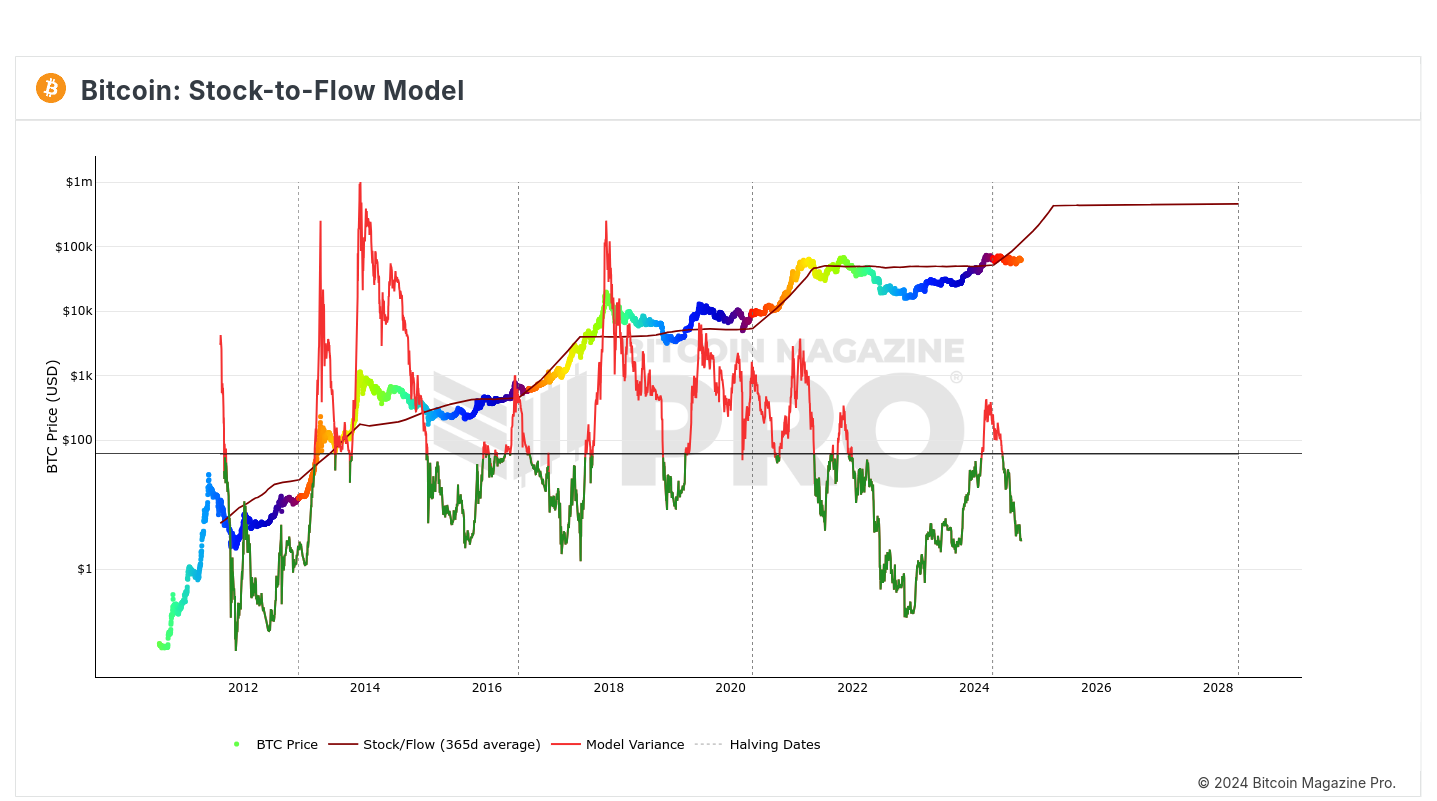

That could indeed happen, but right now we’re already seeing a resurgence in global M2 growth and the price of BTC hasn’t gone anywhere for 6 months. So that’s where we are. For those who care about such mystic crystal balls, the famed Plan B Stock-To-Flow Model is again in deeply negative variance:

The variance is currently at -0.6. Based on the model projection, BTC should be at $113k already. Frankly, if we take out a brief 4 month period between mid-February and mid-June of this year, the S2F model has been in negative variance for two and half years. Perhaps it’s a bad model??

Well, if you’ve made it this far. Congrats! I’ll tell you what I really think about Satoshi Theory. Ready?

Gun to my head…

Satoshi is Adam Back.

There, I said it… enjoy!

Polygon is cheap right now, no? Fwiw, I’m a Sassaman maxi