Elite Narratives & Elite Numbers

The CPI is a horrible measure of inflation. Unless you need to use it to prove inflation is actually low. Wait, what?

This populist age can be brought to an end at the snap of a finger. All that needs to be done, is for elites to start listening to, respecting, and God forbid, working for ordinary people. - Winston Marshall

Last month I was in a multi-day - let’s call it “discussion” - with Scott Winship on Twitter. Winship is the Senior Fellow & Director for the Center on Opportunity and Social Mobility at the American Enterprise Institute (AEI). On the surface, this is an organization that is dedicated to many of the same ends that I happen to agree with.

From AEI’s about page:

AEI scholars are committed to making the intellectual, moral, and practical case for expanding freedom, increasing individual opportunity, and strengthening the free enterprise system in America and around the world.

Judging purely by this, the AEI is not an organization that I would consider myself ideologically opposed to by any stretch of the imagination. The background of our discussion then is important. Our interaction came in the comments of a larger point being made by Nick Gillespie of Reason Magazine. Gillespie was critiquing the recently viral Scott Galloway video describing the economic and social angst currently experienced by millennials. Nick Gillespie’s argument, which heavily cites the work of Scott Winship and Jeremy Horpedahl, is that most millennials are actually better off than their parents were at the same age and that inflation-adjusted wealth metrics favor millennials.

You can watch many of the same arguments he made in his thread in this 2021 Reason video (which he also shared):

A Twitter user by the name of Joseph Tranfo responded to the Twitter thread with the following:

Nick, I'm a fan of you and Reason, but you notably omitted @profgalloway's references to addiction, anxiety, depression, obesity, and non-elective celibacy (those are what I recall without reviewing the clip). Those are almost certainly more important than the economic piece.

To which I added:

This and the economic piece is likely wrong anyway because one of the primary data inputs in this study (CPI adjustment) has changed in methodology during the time period being studied.

This elicited a response from Winship that, after several tweets back and forth, resulted in him sharing a 9 year old Forbes article - and I swear I’m not making this up - demonstrating why CPI is a shitty, unreliable metric:

There are any number of technical issues that make price measurement imprecise, and the issues are bigger the longer the period between income comparisons. We must accept that we cannot know the “true” increase in the cost of living. But many commentators, in my experience, jump from this uncontroversial fact to a sort of nihilism that denies entirely the usefulness of attempting to assess income trends.

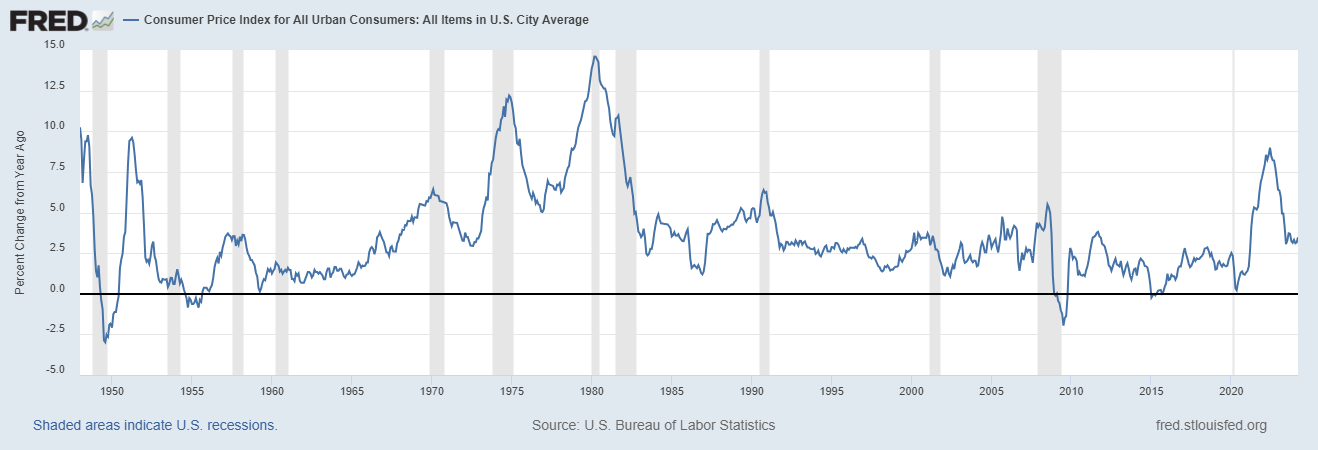

If you’re having a hard time keeping up, my initial tweet insinuated that CPI is unreliable. And after several days seemingly arguing, Winship shared his article about how CPI is unreliable. So essentially, we were arguing because we were arguing? Not so much actually. Winship contends that CPI overstates inflation. And to Winship and Nick’s credit, citing articles and videos in late April 2024 that predate the worst consumer price inflation since the 1970’s to justify this position was an ambitious approach:

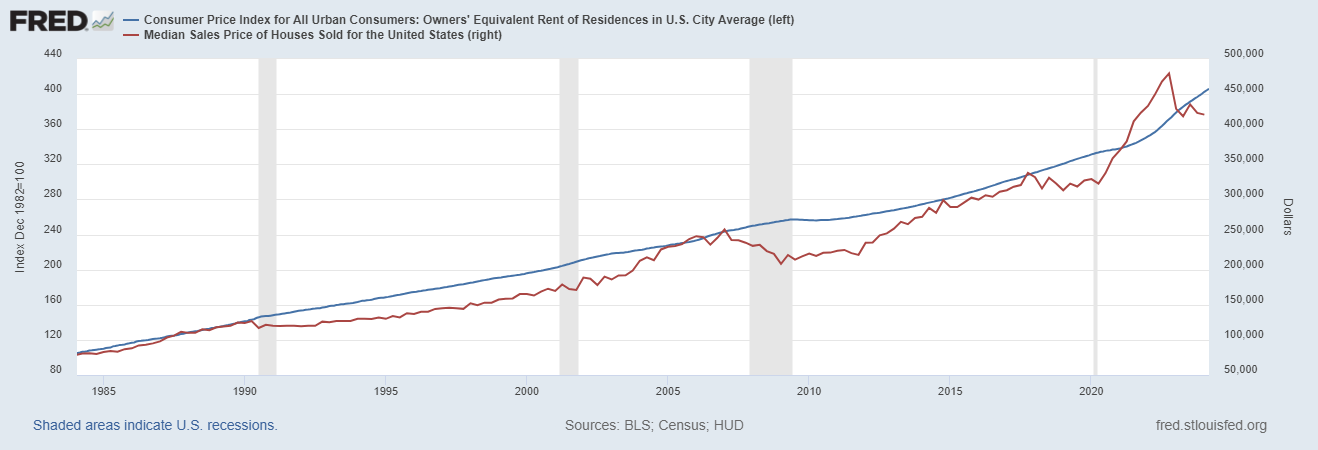

To be sure, there are likely instances where CPI overstates inflation. Consider the current lag in the owners’ equivalent rent- which the BLS uses as a major shelter cost input in the CPI - versus the median sales price of homes in the US:

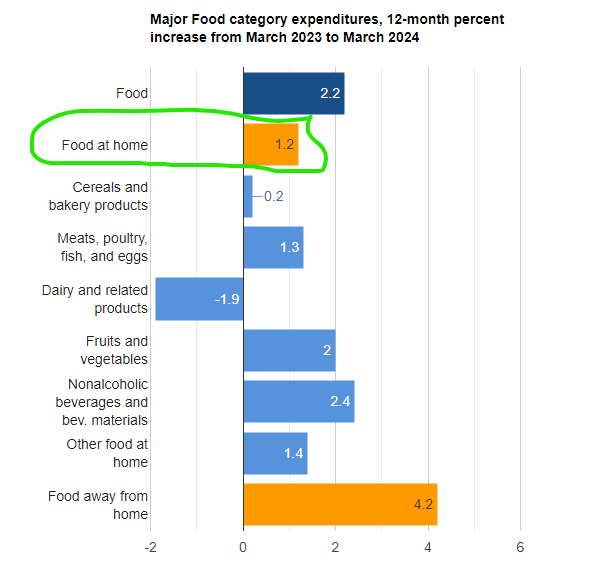

After likely understating inflation for much of 2021 through 2023, it’s now possibly fair to say owners’ equivalent rent is lagging home prices and potentially overstating the CPI currently. This is not an insignificant point since the rent portion of shelter accounts for 26.7% of the entire index. One of the other top inputs in the broader number is food. Which is additionally broken out to food at home, food away from home, and several other sub-categories like beverages, meats, and dairy.

Food at home is 8.1% of the index. In March, the CPI estimate for this category was a 1.2% increase:

According to the BLS, the Q1-24 quarterly average was 1.1% - well below the broader CPI. Let me be clear about this: there is just absolutely no way in hell the measure of food at home is accurate as the BLS calculates it. I’ve done my own calculations and compared total spend by store and by quarter. Here’s the bottom line: between Aldi, Meijer, and Costco COST 0.00%↑ our aggregate spending on groceries was up 21.4% in Q1-24 over Q1-23.

When getting more granular than that, the data gets really messy but from a “food at home” standpoint, we’re spending 21% more than we did this time last year. And this is not a small percentage of our total spending. We live a very simple life. Even though the CPI has food at home at just 8.1% of the index, our groceries make up 20.3% of our monthly budget. So even though Janet Yellen or Jerome Powell may not feel the increase in food at home, we sure as hell do. Admittedly, some of this YoY increase may be attributable to changes in personal consumption habits, but I know without a shadow of a doubt that higher prices are indeed the larger driver. My daughter is growing, but she ain’t growing that much.

Now I’m not going to sit here and say that everyone’s personal level of “food at home” inflation is 21% in 2024 or that groceries are 20% of everyone’s monthly budget. But I do suspect that food at home costs rose far higher than 1.2% for most people last quarter. Perhaps this is why Winston Marshall's recent argument at an Oxford Union debate on populism against Nancy “Nvidia NVDA 0.00%↑ Calls” Pelosi’s rambling incoherence has struck a chord with so many people online.

Should we be surprised or sad that we can also see financial nihilism is alive and well through the intraday happenings in GameStop GME 0.00%↑ stonk:

We can choose to handwave away the legitimate concerns of the populace as extremism, or we can take steps at addressing some of the root causes of most of the economic issues facing working class Americans. Namely, a debt-based system built with fake money and a controlled/managed cost of capital.

Scott Galloway has valid points. And to a degree Gillespie and Winship do as well. But for me the person with the finger on the pulse is still Travis Kling. So when Blockworks’ opinion writers call you names for the audacity of considering a vote against the financial status quo, keep the receipts and remember why distributed, “code is law” blockchain technology was created in the first place. I would argue eliminating the power of the central bankers, who drive (and want!) inflation would be a great way to…

expanding freedom, increasing individual opportunity, and strengthening the free enterprise system in America and around the world

Disclaimer: I’m not an investment advisor. I have a calculator and an ax to grind.