In an otherwise empty mailbox yesterday, I found something magnificent… an offer for a HELOC! This stands for Home Equity Line of Credit - essentially, tapping the value of one’s home to raise cash. The are legitimate reasons to do this and also some really bad reasons. You’d have to go back 6 full months in my Notes feed to find it, but the return of the HELOC is something that I’ve felt is possible for, well, 6 full months:

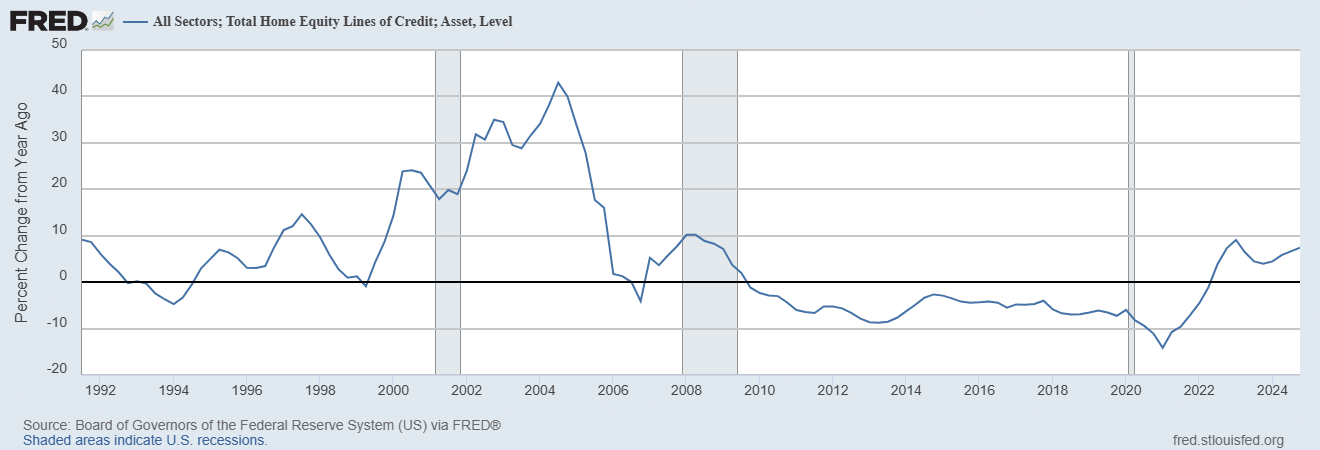

My theory at that time was that homeowners with large credit card burdens would start tapping the equity in their homes soon with real estate equity figures high, credit card delinquencies rising, and interest rates still at multi-year highs. Two quarters later, nominal HELOCs have risen from $384 billion in Q2-24 to $402 billion at the end of the year:

Look, the aggregate numbers are just coming off lows. But there is no question the year over year rate of change in HELOC balances picked up steam through 2024 and is now at levels last seen when the housing market blew up. We won’t see Q1 data until June.

Somebody who actually is worth following is Mike Green…

We obviously remember the housing crisis in 2007. But we forget the rationale for why “Subprime was contained.” By summer 2006, homebuilders were down nearly 50% from highs, and it was “obvious” to many of us that the economy was headed into a recession. Delinquencies were mounting in the household sector, especially in subprime. Danny and Porter began touring real estate, sweating their asses off in the Florida heat and waving hello to crocodiles invested in abandoned swimming pools (a growth biz for 2006) - Mike Green, Oops, We Did It Again…

How do those homebuilders look now? Well, here’s the monthly chart of the SPDR S&P Homebuilders ETF XHB 0.00%↑:

XHB launched in January 2006 and proceeded to fall 82% over the next 33 months virtually in a straight line. The COVID-era crash recovered in mere months. The 2021 top eventually recovered and shot to new highs. We’re in bear market territory again. Your move, Jerome.

Another analyst absolutely worth following is Nick Gerli from Reventure Consulting - his video from yesterday is essentially must watch material in my view:

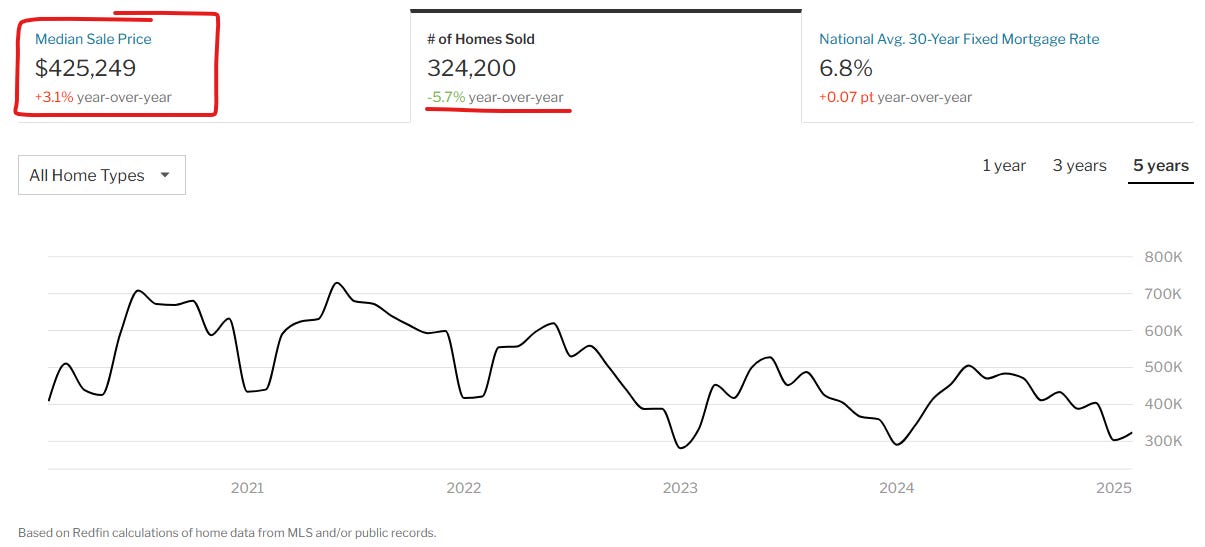

Adding to part of Nick’s presentation here, consider this chart showing February home sale data from Redfin:

So what’s the problem?

As Nick explains, homebuilders are doing literally anything they can to keep prices from falling - even offering zero down on home mortgages for new builds. Homebuilders eat that cost; so they experience gross margin compression whether they sell at a lower price to a buyer who can put money down or at a higher price to a seller who can’t put money down. The zero down route is likely chosen because of optics. So why are actors in the housing market so afraid of prices going down?

Perhaps the answer is different depending on the perspective of each player in the game. But let me take a stab at why I think it would be bad to see national prices follow Austin, Tampa, Salt Lake City, and Nashville to the downside. This is from Peter St Onge:

The numbers come from Moody's Analytics, who finds that the top 10% of Americans accounted for just 36% of consumer spending 30 years ago, but now it's up to 49.7%. And it's getting worse fast: in Biden's last year the top tenth increased spending by 12% while the other 90% of Americans actually spent less.

The takeaway here is the top 10% of Americans based on income are essentially holding the up the entire economy. We cannot have these people see their paper net worth go down, or they will tighten their belts and then the jig is up.

Finally, I mentioned Mike Green earlier in this post. I can’t stress enough that you really might want to read his latest piece. It’s very good and very important. Those of us who have been hinting at the possibility that official data could be fake have seemingly been proven right…

Ooopsie indeed. By the way, Germany wants its Gold back. Surely we have it…

Disclaimer: I’m not an investment advisor. I’m not a geopolitical analyst. I like boring stocks, Bitcoin, and precious metals. I speculate in coins and save in Gold & Silver. Everything could go to zero. Nothing is guaranteed and nobody owes you a damn thing.