Kiss, Marry, Kill: Bitcoin's 'Sell The News' Volcano

Bitcoin is down over 15% from yesterday's intraday high. Don't panic! This was very necessary and even foreshadowed by ya boi. It's also an opportunity to position for the next run.

Bitcoin briefly hit $49k yesterday. Today it went under $42k for a brief period. More than a 15% selloff in less than 48 hours:

Bitcoin is now battling to stay above its 50 day moving average. How quickly things change!

Are we having fun yet?

I love these markets.

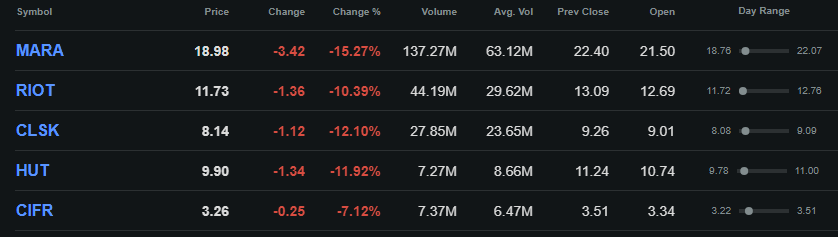

Look guys, there is no doubt in my mind that this massive pullback is a good thing. We needed this badly. The mining stocks sort of foreshadowed the carnage yesterday when they immediately sold off the ETF launches. Those companies have continued lower today and on serious volume. I mean just look at these declines today:

The bigger firms have been hit the hardest in many instances. One public miner, Bitdeer BTDR 0.00%↑ (not pictured above), is down a staggering 57% since December 27th. But as I noted in the Heretic Speculator chat while 2023 was winding down to a close, the end of year monster rallies in the mining stocks were silly and generally beyond logic:

The anecdotal evidence that I shared with full heretics was clear, we were obviously in a FOMO environment. Here’s an example of how crazy it got; this was my opening paragraph from my “Risks” section in my Marathon Digital MARA 0.00%↑ article for Seeking Alpha on December 19th:

MARA is up over 400% since the beginning of the year. In my view, investors should be cognizant of possible profit taking here in the short term as we approach the end of the year. Beyond that, Bitcoin itself has generally been overbought in recent weeks and may be due for a sizeable pullback under $40k per coin. In that event, MARA shares will likely decline as well.

At the time, MARA shares were $20. Eight calendar days and just five market sessions later, MARA traded above $31. In no world did that rally, that quickly make sense. Now for full disclosure, I labeled MARA a buy in my article and continue to own shares. In fact, I bought some more today. Now that we’ve had our blow off tops for this shorter term wave, weakness in the coming days/weeks can likely be expected. That means now is time to start thinking about which names to be dollar cost averaging to and which names to kick to the curb for the post-halving rally later this year.

Lets Play a Game

Back in the early Barstool Sports days, one of my favorite running content pieces was a cruder version of the game “Kiss, Marry, Kill.” I think you probably get the idea of how to play. Basically, you are given 3 options and must assign each one with “Kiss,” “Marry,” or “Kill.” The catch is, you have to use each tag only once and you can do this with pretty much anything. So today, we’re going to apply Kiss, Marry, Kill to a couple of different crypto-themed ideas.

Ready?

Here we go…

Please bear in mind. These are ONLY my opinions. None of this is investment advice or an inducement for you to purchase securities. Everything I mention today has significant risk associated with ownership.

Bitcoin Trust/ETF

Kiss: MicroStrategy

MicroStrategy MSTR 0.00%↑ is actually my top equity pick for 2024. This is sort of a cop out to be honest but MSTR has essentially served as a levered Bitcoin ETF since Michael Saylor turned the company’s balance sheet into a de facto Bitcoin ETF during the last cycle. Many smarter men than me predicted his downfall because of it. He’s still doing just fine.

Marry: Fidelity Wise Origin Bitcoin Trust

Fidelity Wise Origin Bitcoin Trust FBTC 0.00%↑ is a strong Bitcoin ETF offering in my opinion. It isn’t the lowest fee, but at 0.25% it’s far from the most expensive. Of the 11 currently approved spot ETFs, only Fidelity is handling custody themselves and not relying on Coinbase COIN 0.00%↑ for security of the underlying. The less third party risk the better IMHO.

Kill: Grayscale Bitcoin Trust

Grayscale Bitcoin Trust GBTC 0.00%↑, my how far we’ve come. This ticker is one that I’ve been in and out of many times through the years. It is easily one of my best investments in my young career. But it’s time to say goodbye. GBTC’s fees are just way too high compared to the rest of the market and they are no longer the only game in town. I’ll forever be grateful these maniacs took on the SEC in court (and won) when the entire industry around them was blowing up. Cheers for that, Grayscale. But we’re on to Cincinnati. It’s Jerod Mayo’s team now.

Bitcoin Miner

There probably won’t be too many surprises here.

Kiss: CleanSpark

CleanSpark CLSK 0.00%↑ has the right mix of balance sheet health, production capacity and Bitcoin HODL. It’s the only miner in the top 5 by debt to equity, BTC in treasury, and monthly EH/s. Not even Marathon Digital can say that.

Marry: Marathon Digital

What Marathon Digital lacks in the debt department, it more than makes up for in production and HODL stack. It’s the biggest producer by far and has the largest unencumbered stack by far. I cringe at the thought of “HODLing” any mining equity if I’m being totally honest, but if you believe transaction fees will remain a larger part of the block reward post halving, MARA is the name to hold long term while all of the other miners spend and dilute to try to match MARA’s scale (they all dilute like a drunken congress passing a spending bill FWIW).

Kill: Hut 8

Hut 8 Mining HUT 0.00%↑ has been one of the big let downs over the last two years. At one point this was my favorite miner. But a litany of issues during crypto winter put Hut 8 in a very weak position from a production standpoint and the company had to merge with a highly indebted peer just to keep up with the scaling that we’ve seen from other mid-tier miners. It isn’t a pretty story here. Their HPC segment is anemic. I’m completely out of this one personally even though it will probably ride BTC’s coat tails in 2024.

Altcoin Trust/Equity

Kiss: Grayscale Ethereum Trust

If Ethereum is indeed the next crypto to get a spot ETF in the US, then the Grayscale Ethereum Trust $ETHE at 14% discount seems like a solid arb play. Is the NAV discount going to ever get back to 1.5% like GBTC? Probably not in my view. But this one seems like the logical “next play” for crypto/TradFi hype and I think it’s a good place to be.

Marry: Bit Digital

Of all of the Bitcoin miners, Bit Digital BTBT 0.00%↑ is the only one that has an Ethereum staking strategy. Beyond that, they’re one of at least 7 or 8 miners that are in the process of launching generative AI/HPC services as secondary revenue streams. I like the company’s CEO. He seems to be in crypto for some of the same reasons that I am - which is not something I’d say about all of these guys. As far as I can tell, this is the only public miner that touches BTC, ETH staking, and AI. It’s a very high risk pick, but I think a wager here will do well with responsible size.

Kill: Grayscale Solana Trust

Perhaps a copout because I already wrote about Grayscale Solana Trust $GSOL back in November.

The fund isn’t the largest NAV premium by any means, but it’s by far the biggest premium Grayscale currently has pertaining to its top 5 single asset funds by AUM. I’d stay away from it completely. I swear it isn’t personal against Grayscale.

That’s all for now. Hope you guys enjoyed the game and cheers to what is hopefully a great weekend. Remember, the crypto market never sleeps and big moves sometimes happen when Wall Street analysts are in their bubble bathes.

Disclaimer: I’m not an investment advisor. None of this is investment advice. All shitcoins and shitcos could go to zero. Bitcoin is used for drugs, money laundering, and human trafficking according to the biggest grifters on planet earth.