Post-Ethereum Merge: The Fight For Bitcoin Begins

The Merge came and went. A highly impressive technological feat? Absolutely. A dangerous precedent for other Proof-of-Work coins? I'm afraid so.

Bitcoin is entering the fight of its life. In a little over a month, it will be 14 years since the release of Satoshi Nakamoto’s white paper. Since then, Bitcoin has gone through a handful of booms and busts. It has seen the second largest economic power on the planet ban its mining; a move that was followed by a handful of additional nations doing the same. Despite Bitcoin largely taking each shot without batting an eye, there is one thing it has yet to encounter; a federal funds rate above 3%. That could change next week.

This matters because the prevailing market sentiment is that BTC will perform like all other risk assets if the central bank continues to tighten monetarily through balance sheet asset roll off and rate hikes. At least for now, that sentiment appears to be true and I agree with it. But for Bitcoin to perform as a peer to peer payment network like it was originally intended, network adoption must continue regardless of price. If anything, lower fiat-denominated prices should make exposure less risky to those who haven’t bought it yet.

Bitcoin and The Merge

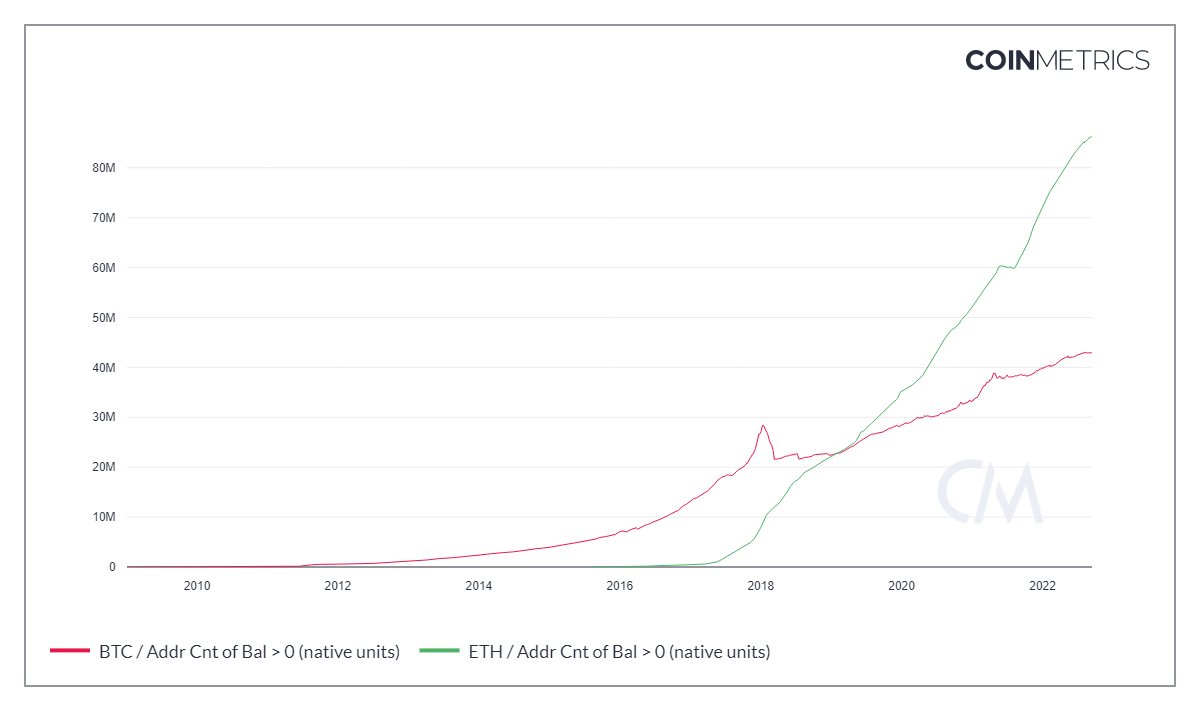

How Bitcoin reacts to continued monetary tightening is just one part of the fight ahead. There is no denying the rise of Ethereum. There are now over 86 million non-zero balance ETH addresses:

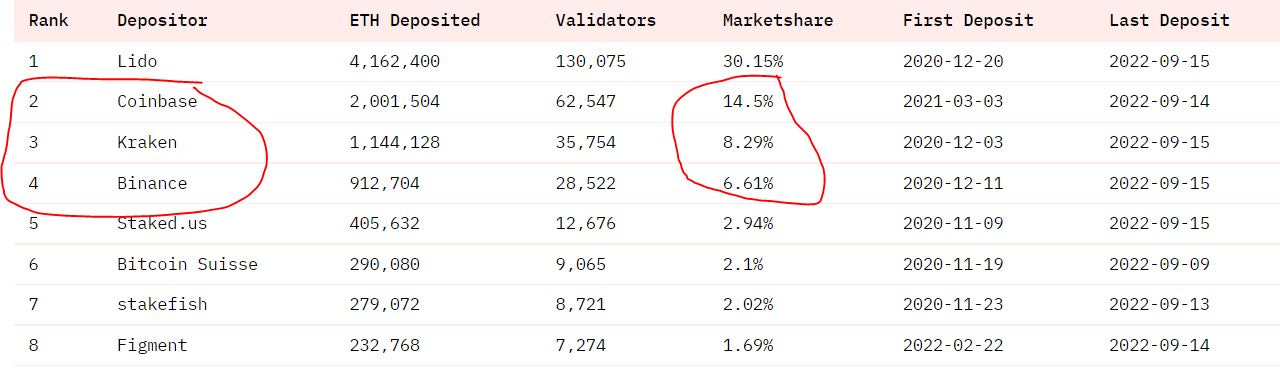

That rise has been exponential and judging from the 2:1 edge ETH now has over BTC in non-zero balances on-chain, Ethereum has helped onboard millions to the idea that self-custody of assets is paramount to financial freedom. In that way, I believe Ethereum has actually been helpful to Bitcoin - though some might disagree. I’m sure this won’t come as breaking news to those who follow crypto, but Ethereum developers just shifted from proof-of-work to proof-of-stake. This means Ethereum “mining” is over. Instead, whoever wants to pile the most wealth into ETH will make the rules. Those rule makers are now largely centralized based on who secured Beacon Chain leading up to the shift to PoS:

The regulatory capture risk of Ethereum is now pretty clear. Proof of stake means whoever has the most money can control the network. And nobody has more money than an entity that can keyboard it into existence. As a side effect of the “The Merge,” Ethereum’s transition to PoS has two big effects on Bitcoin:

It has returned Bitcoin’s proof-of-work dominance from 63% to over 94%

It will prove transitioning from proof-of-work to proof-of-stake is possible

Number two opens up potential problems for Bitcoin. Like it or not, and to be clear I don’t, there will be more pressure on Bitcoin developers to move to proof-of-stake as well. Proof-of-work is far more energy intense than Proof-of-stake. We debate the validity of the argument until the cows come home, it doesn’t change that the argument can be made that PoW is terrible for the environment.

The problem is for those who value decentralization and censorship resistance, changing Bitcoin from proof-of-work to proof-of-stake is almost certainly a non-starter. Regardless, the pressure will undoubtedly remain. We’re already seeing the idea of a domestic Bitcoin mining ban being floated by the current administration under the guise of environmental protection.

Financial Weaponization

Despite the ominous tone on mining, it is this current administration that has probably made the best case yet for a decentralized monetary system. With respect to Honk Honk Trudeau and his weaponization of the Canadian banking industry; it is Joey Ice Cream, wielding the sword that is the SWIFT system against Russia, who has shown so perfectly that fiat currencies aren’t actually open to everyone. Even when those currencies are the supposed global reserve currency.

“No one man should have all this power.”

Kanye West

The current geopolitical setup is one that calls for a deliberate move toward monetary decentralization. If not at the state level than certainly at the individual level. There is no doubt some in the established order understand what is happening. Congressman Brad Sherman has proven it in a public setting:

An awful lot of our international power comes from the fact that the dollar is the standard unit of international finance and transactions. Clearing through the New York Fed is critical for major oil and other transactions. It is the announced purpose of the supporters of cryptocurrency to take that power away from us, to put us in a position where the most significant sanctions we have against Iran, for example, would become irrelevant.

Bold my emphasis. Brad Sherman gets it. As does Charlie Munger; who earlier this year said this about Bitcoin:

It’s evil because it undermines the Federal Reserve system and the national currency system. Which we desperately need to maintain its integrity in government control and so on.

Where Charles is mistaken is with his placement of the word “evil.” It is the Federal Reserve system and the national currency system that deserve that designation. They robbed savers, crushed those with lower incomes, forced compliance from sovereign nations, blown massive debt-based bubbles, and financialized the domestic economy while allowing crumbling infrastructure and the hollowing out of manufacturing. But sure, Bitcoin is bad.

The old guard isn’t going out quietly. The problem for the federal government is it’s so bumbling and slow that it can’t even figure out how it wants to go about regulating crypto. The Treasury, the SEC, and the CFTC are all in the mix for “regulation” of an asset class that none of them actually understand from a technical perspective. They can’t ban Bitcoin literally. It’s too late for that. I’ve laid out why in a previous article. They can just make it really inconvenient or criminal to use it. The can ban Bitcoin figuratively.

But the most important part of Bitcoin’s decentralization is proof-of-work consensus. The push to lobby Bitcoiners into proof-of-stake is coming. And if that were to actually happen, it would probably be the end of decentralized digital money adoption. We’d still have gold and silver - provided private ownership doesn’t get banned again. But the best shot Bitcoin proponents have at keeping Bitcoin permission-less is by getting merchants on their side. And there is a totally justifiable reason to try to get small businesses on board.

Merchants Are the Key

Send it. Prove the concept. We have to actually use these currencies to show people how simple it is. The masses already understand peer to peer digital payments thanks to Venmo, Cash App and PayPal. Bitcoin’s advantage is that it isn’t a walled garden. It can be sent from person to person regardless of the application. I can send Bitcoin to your Unstoppable Wallet from ShapeShift, Edge, or Trust Wallet. Your ticket to the stadium that is the blockchain gets you to the same seat no matter which door you enter.

The best way to onboard the masses may ultimately be through the merchants. If you already “get” crypto, be a champion for local businesses. Explain to them how it’s cheaper to sell goods and services with Bitcoin’s Lightning Network than it is to use Visa or Square. Profit margin increases through payment expense reduction is how merchants will adopt Bitcoin. And when the merchants are on board, the masses will follow.

As a consumer, show me a way I can save money on transactions and I’ll show you purchases with Bitcoin. Ironically, it’s the metal dealers who have already figured this out. Go look at the price breakout by payment method on SD Bullion and you’ll see it’s 3% cheaper to buy a Gold Eagle with Bitcoin than it is with a credit card. I get it, Bitcoin can fluctuate more than 3% in a day and often does. But using Bitcoin will increase adoption of Bitcoin. Bitcoin adoption ultimately requires education. This will likely be harder in the west where “stable” currencies are taken for granted. But it’s worth the effort if it puts an end to global financial tyranny.

As fate would have it, the bigger businesses are already fighting against high processing fees. Walmart and Target are both supporting a bi-partisan bill that attempts to get Visa and Mastercard processing fees in the US more inline with other countries. How many companies have endorsed that bill? Is 1,600 a lot? Not to beat a dead horse, but Bitcoin fixes this.

The Time is Now

Call Bitcoin an inflation hedge, a medium of exchange, a risk asset, a cryptocurrency, or a synthetic commodity; whatever you want. I don’t really care what label each individual chooses to put on the wrapper. Whatever it is, Bitcoin’s time is now. The fight is going to get tougher. But it’s a fight worth taking on and I believe proof-of-work advocates should be united on this regardless of which coin they admire the most.

Disclosure: I’m not an investment advisor. I merely share what I do and why I do it. You shouldn’t take anything I say as investment advice and always do your own research when making investment decisions. Cryptocurrencies, tokens, STONKs, and digital trinkets could all go to zero. I have no job and I live in my wife’s basement. I’m the last person on the face of the earth who you should listen to for financial advice or life advice.