Pricing By Payment Method

Apple's mafia-style iOS rules, subscription models online, and the blockchain asset that can disrupt it all.

“Show me the incentive and I’ll show you the outcome”

My wife and I went out to dinner at one of our favorite local spots a couple weeks ago. It had admittedly been too long since we’d had an actual “date night” together with no kid, dog, grand parents, etc. Anyway, when the bill came, we were shown two different amounts due. One figure if we paid in cash and a different (higher) amount due for using a credit card. Cash was obviously the lower amount because credit card usage costs the merchant a payment processing fee.

I shared a similar story in May 2023 when I was charged an additional $1 on a $20 honey purchase (5%) at my local farmer’s market:

This is the second season I’ve been buying honey from this particular merchant but it’s the first time I’ve been charged a fee for using a credit card. - Ya boi, May 2023

Last summer, this was a unique situation. This summer it is not. The date night dinner featured totally transparent pricing by payment method. And I did the math; even with 2% cash back rewards on my card, it still made better financial sense to pay with cash.

This happened again yesterday.

Not at dinner or at a farmer’s market. No, this time at an ice cream stand for a $6 transaction with my daughter. Pay with a card? Over $6. Cash? A little under $6. This time, I had the cash on me so we saved what was roughly a quarter. Smaller, physical businesses can obviously provide an incentive for cash usage by passing on processing fees to consumers.

I’m completely okay with this. If credit cards were our only payment option, I’d perhaps feel different. But specifically because we do have cheaper options available, I’m totally fine with merchants passing on expensive payment methods to consumers who wish to choose convenience over a more direct form of payment. Metal dealers have been doing it for as long as I can remember and likely longer than that.

For many bigger, higher volume merchants - the credit card processing fees might make more sense because cash slows a transaction down. But for smaller, low volume merchants, cash has advantages. Which is why I think this move to ‘pricing by payment method’ is going to continue. Actually, I know this is going to continue… why?

In The Rotten Apple

In recent days, the “creator community” has taken note of something that is currently ongoing with Patreon. If you’re unfamiliar with the company, Patreon can be viewed as one of the pioneers in content creator subscriptions. Before Google GOOG 0.00%↑ enabled it’s in-platform tipping feature for Youtubers, many streamers looked to platforms like Patreon for supplemental income in addition to the pittance that YouTube pays them from ad revenue.

Essentially, if you have a large enough audience and a decent amount of “big fans,” you can do well with Patreon. But there’s now trouble in paradise. Apple AAPL 0.00%↑ has decided Patreon owes tribute on any in-app purchases via iOS devices. From Patreon earlier this week:

Apple is requiring that Patreon switch to their iOS in-app purchase system starting this November, or risk being removed from the App Store.

Justifiably, people who use Patreon for income are very upset about this because Apple will begin taking 30% of any in-app purchase that is made through the Patreon app on an iOS device. This goes for subscriptions and any transactions through a creator’s Patreon shop. This won’t apply to existing Patreon subscribers, only new subscribers who support Patreon users through the Patreon app on iOS devices.

But like any good crime boss, Apple’s in-app purchase rule comes with the threat of broken legs if the app-owner doesn’t comply. So essentially, Patreon is left with the choice of not having a presence in Apple’s app store, or paying the Don his tribute. Since Patreon is running a business, they want to be in the app-store. Still…

30% is A LOT.

Assume for a moment that you run a Patreon page and have big fans who are willing to pay $10 per month to support you. Depending on which plan you have, Patreon is taking somewhere between 8-12% (let’s just say 10%) off the top. Then there’s also payment processing fees of 5% in addition to Patreon’s cut. I admittedly don’t know if Apple’s 30% fee means the 5% processing fee won’t be required on the back-end. But let’s just pretend it does (it may not).

At 30% to Apple and 10% to Patreon, the content creator is getting $6 of that $10 subscription fee and this is before Uncle Sam gets his cut. It’s before any other expenses for the Patreon creator are factored in, of which there could be several if it’s a polished program/production/publication. The point is, 30% is a big hit and for some creators it could realistically be the difference in being profitable or not.

And remember, Apple isn’t really doing anything for this 30% cut. I covered this concept in late 2022 when Apple quite preposterously took the position that blockchain-based purchases of NFTs through Coinbase’s COIN 0.00%↑ wallet application were subject to Apple’s 30% in-app purchase system.

To make my thoughts on this perfectly clear; if you accept the idea that Apple should get a 30% cut of every transaction that happens on an iPhone, than you would have to also accept the notion that Whirlpool WHR 0.00%↑ or General Electric GE 0.00%↑ have a claim on every pizza that is baked in the ovens they manufacture. It’s completely ridiculous and I honestly can’t believe Apple is still getting away with it.

Yet, perhaps there is a shelf-life on it… further down in the Patreon post from earlier this week, we get the ‘pricing by payment method’ capability feature to combat Apple:

Based on creator feedback, we've built an optional tool that can automatically increase your prices — only in the iOS app — to offset the cost of Apple's fee. This way, you’ll continue to earn at least the same amount per membership as you do on all other platforms.

Good on Patreon. I think it’s the right call. And I hope the creators who are using Patreon for income do indeed opt to pass that 30% Apple ransom on to new subs. Convenience has a price. Just as it does at the ice cream stand these days. Changing behavior requires an incentive. And nothing screams change behavior quite like the prospect of having to pay more - for the same food, service, subscriptions, or whatever - based on what method of payment you’re using.

Substack, the platform that I use to distribute this very publication/newsletter, has insinuated that the clock is ticking here as well…

It certainly appears as though the same iOS ransom is coming to Substack soon:

The emergence of the creator economy presents an interesting challenge and opportunity for Apple, and some delicate questions for Patreon and Substack. We want creators and subscribers to benefit from the power of Apple’s in-app purchases. In fact, at Substack we have been working with Apple to bring in-app purchases into our app, because we believe that anything that reduces the friction of a subscription is great for creators. We’re doing everything in our power to make the implementation of in-app purchases as creator-friendly as possible. - Hamish McKenzie, Substack co-Founder

Bold is my emphasis. Reading between the lines; the 30% Apple ransom is probably coming to Heretic Speculator soon as well.

Now, it’s very important to remember that no such ransom exists when subscribing to a Patreon/Substack publication through either the android app or via the good old-fashion website version of these publications.

And if we assume that Apple’s in-app purchase fees are coming to Substack in the near future (reasonable assumption in my view), then only new subscriptions figure to be impacted. Existing subscribers shouldn’t have to pay such fees. As I see it, Substack has two options when the Tim Cook gets his bat out:

Allow creators to push the cost through to subscribers, and create a transparent ‘price by payment method’ model in the same way Patreon appears to be doing, or

Allow creators to individually opt out of iOS app subscriptions altogether and turn-off in-app purchases through Apple’s walled garden

Frankly, I hope they go with number two. Because if they don’t, we’re going to have a bit of a problem. Heretic Speculator is $100 per year. That’s slightly over 27 cents per day. And Apple might feel justified in taking 8 of those cents soon?

I appreciate the concept of a network effect, but I still don’t think I can get there. If you’ve been on the fence and you want to join the full heretics through an iOS app, maybe do it now before Tim Cook shakes us upside down for a couple nickels. Here’s a little sweetener to show you I’m serious:

Call it the ‘Get Ahead of The Apple Mafia Tribute’ discount. I’d rather give you 15% off today than charge you 30% more because of Apple tomorrow.

Circle vs Apple

I’d be less salty about all of this if there weren’t so many other ways to avoid Apple’s iOS fees. The most straightforward way to achieve this, of course, is to just not buy stuff through iOS in-app purchases and instead go through a desktop website. But there are other, slightly more cumbersome ways to do these transactions as well. I know I’ve already made this point before… in fact, I’ve been talking about how public blockchains can help mitigate transaction costs for quite some time…

But I believe ‘pricing by payment method’ is what pushes forward public blockchain usage by choice. Here’s a recent example from May:

Getting into the weeds regarding code, PoS vs PoW, inflation rates, or valuation multiples won’t be what drives long term adoption of distributed ledger technology. What will drive the outcome of adoption is the incentive of cheaper fees. Merchants and customers have to want it to make it happen. And there is certainly an increasing incentive for them to want it.

Trust me, I get it. It’s the same thing over and over again. But there are a lot of new people here since I last wrote about stablecoins and for those who are already somewhat familiar with these ideas, repetition helps concepts sink in better. This is the future that onboards the first billion:

This is a picture from a coffee shop that accepts USDC payments. There are apparently six coffee shops that are doing this in the United States. That’s how early we are to this.

Again, USDC is a dollar derivative that lives on public blockchains. It has the same collateral backing as the USD sitting in your traditional bank account or through your Venmo PYPL 0.00%↑ app (T-bills). Circle is the issuer of USDC and it has the token minted on over a dozen blockchains including Ethereum, Solana, Polygon, Arbitrum, Optimism, and Base - among numerous others.

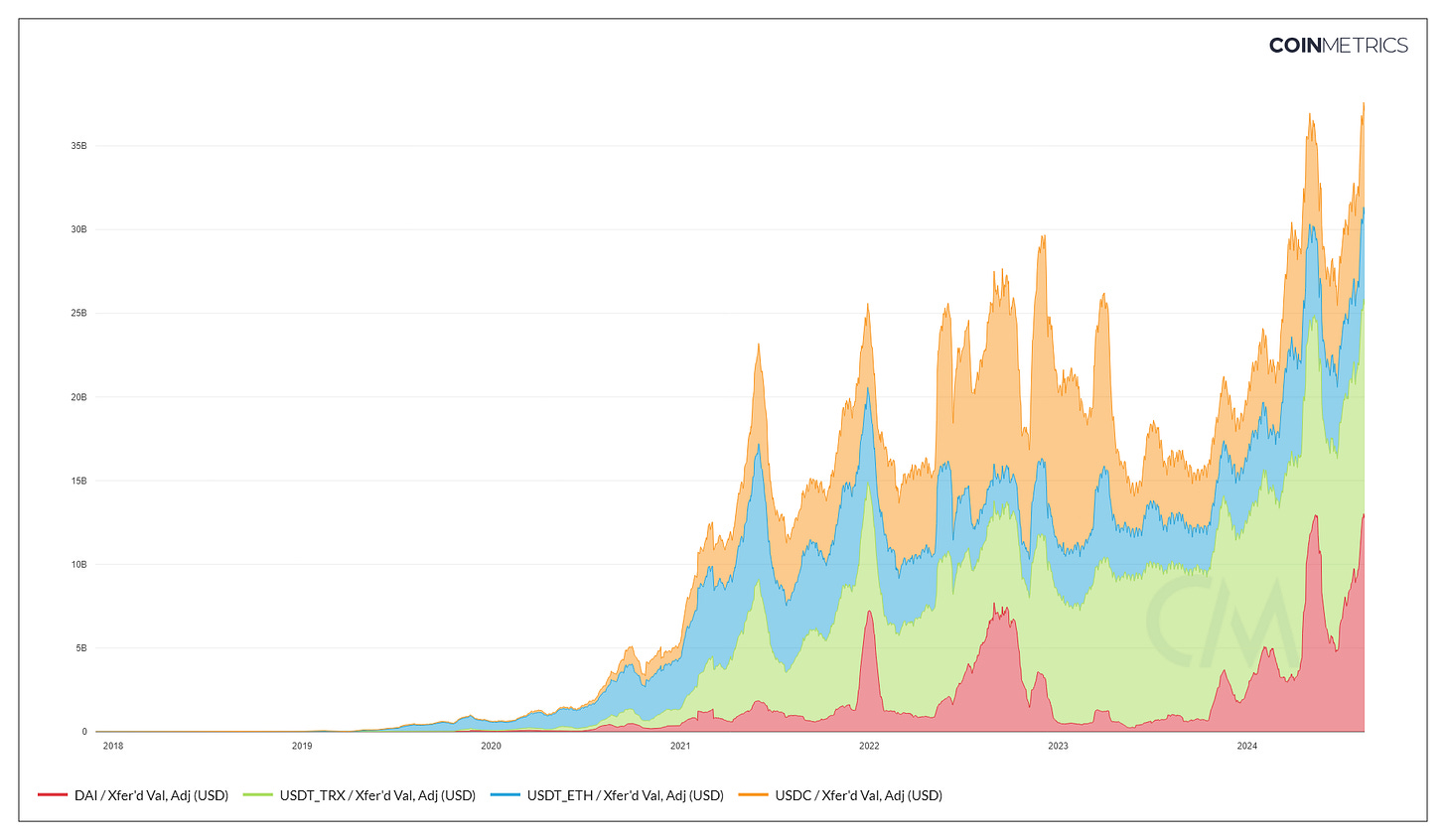

USDC isn’t the only one. There’s also the behemoth in the space, Tether, which accounts for 70% of the entire $168 billion stablecoin market. There’s the “decentralized” stablecoin DAI that is part of the MakerDAO ecosystem. And several others that I didn’t include in the chart above because they’re simply not on the same level of the three just mentioned either from an issuance or a volume standpoint. But the chart above shows the 30 day average transferred value of these three tokens over Ethereum and Tron.

Usage is clearly growing. It would certainly be fair to acknowledge that Tether over the Tron blockchain has been a big driver of that growth. But seeing “USDC accepted here” signs, as early as we may be, is a very appealing signal. Because the thing is, slingin’ phones, computers, goofy goggles, earbuds, music subscriptions, video subscriptions, and taking 30% from any developer who dare use iOS simply isn’t enough world domination; Apple wants to own the payments space as well.

Jeremy Allaire is the CEO of USDC issuer Circle. A few days ago, he seemed highly bullish on wallet applications that utilize public blockchain-based stablecoins being able to integrate with Apple’s NFC chip for contact-less transactions. Shortly later he shared this:

To incorporate this new solution in their iPhone apps, developers will need to enter into a commercial agreement with Apple, request the NFC and SE entitlement, and pay the associated fees. This ensures that only authorized developers who meet certain industry and regulatory requirements, and commit to Apple’s ongoing security and privacy standards, can access the relevant APIs

Bold again my emphasis. Ah yes… fees. The only reason Apple would be willing to open up to wallet developers who would very much be in competition with Apple Pay is for the fees. I should also mention stablecoins on public blockchains have a very concerning privacy issue, of which, solutions are fledgling - but they do exist. But to be clear, I’m very much of the view that stablecoin payments are the more viable blockchain onboarding vector than any blockchain-native crypto currency (Bitcoin, Ethereum, Solana, etc.) at this point in time. I hold that view because I think the unit of account is a barrier that most can’t get over. While far from perfect, stables over low-cost chains is very much a step in the right direction in my opinion.

Again, incentives:

Merchants must incentivize customers to not want to not use payment processing companies like Square SQ 0.00%↑, Visa V 0.00%↑, or Clover. Or for online-based businesses (like this one) Stripe. Cash in person to save 5% seems pretty realistic to me. But how do we do this online? I think that’s where things like USDC and more decentralized cryptocurrencies come into play.

I don’t know for sure if/when Substack will begin paying Apple’s iOS ransom. But it seems like it’s definitely coming. I have no interest in leaving Subtack at this point in time. I like it here. I’m enjoying not having to worry about things like cpanels, plugins, and widgets. But I’m flat out not going to let Apple take 30% of my business. Get the rate.

To those of you who are already “Full Heretics.” I appreciate you. That “blue chip” post I teased earlier this week is still coming. Just a little bit later than I anticipated.

I hope everyone has a wonderful weekend! Make sure you pay for your ice cream in cash.

I pay particular attention to CC fees and attempt to avoid them as well. I have a local club membership that I used to auto pay with a CC, then a few months ago, they decided to add a 3% fee to all transactions, including paying for your membership. I started writing checks and dropping it off. 1-3% might not seem like much when the transaction is $10-$20 but it all adds up - and when you take 3% on a bill that's around $300-$400, then yeah, it's an eye opener for sure. Also, I rarely pay with my phone and just use my PC and the company website. I have been noticing more and more "little shops" adding CC fees for using them, and yeah, even with getting cash back, it doesn't cover the fee, in fact, it's usually at least 3-4x the cash back I would get. Might have to start carrying around the checkbook again..............

The walled garden of any company is tyranny and convenience is your opt-in because you always have a choice. But as you compensate for a lesser evil of subscription as a service (always a renter never an owner) you go the way they want you to go. No barrier to the derivative dollar but pretty soon tulips. Self-hosting, inconvenience, illiquid assets and the prohibited are the way forward however this is against the herd and more a niche.