Spare The Rod, Spoil The Gambler

NVDA is a thorn in my side. Time to throw in the towel? C'mon now...

The game taught me the game. And it didn’t spare me the rod while teaching. - Jesse Livermore

That quote is from the 1923 classic Reminiscences of a Stock Operator. I regret that I’ve only read that book once because I remember really enjoying it. It’s the quote that has stuck with me since that reading several years ago. It’s easy for me to empathize with that feeling at the moment. 2024 marks the tenth year since I started self-directing my stock investments. And even though I feel I’ve managed those investment successfully, the market still continues to teach every day.

For every CleanSpark CLSK 0.00%↑ or Applied Digital APLD 0.00%↑ multi-bag realized killer that I’ve had in my day, I also have my degen moments where I continue to average down a losing trade. The most obvious example of that at the moment may be my short Nvidia NVDA 0.00%↑ proxy through the AXS NVDA Bear ETF NVDS 0.00%↑. I put that trade on last year and was fortunate to escape it essentially flat in October right before NVDIA’s big run from $400 to $500 in a matter of a few weeks. Now NVDA is well over $600 and I’m mad I didn’t go long deeply disgusted with this market exuberance.

Naturally, I’ve decided to touch the stove again and I started taking another whack at this hog within the last couple weeks.

Spoiler alert: I’m losing.

NVDA is up 26% year to date. It’s January 30th.

Why the move? Because AI is apparently even more exciting today than it was on December 31st. So exciting, that AI has propelled Microsoft MSFT 0.00%↑over a $3 trillion market capitalization. That company is now worth more than Apple AAPL 0.00%↑. It may be fair to call this sour grapes simply because Mag7 is outperforming most of the stuff that I like, but I’m just not seeing it on these valuations and I don’t think any of this is going to end well.

However, let’s just focus on Nvidia since that’s the company that I have a vested interest in seeing decline. I’m not even going to get to valuations because the market clearly doesn’t care about the 34 price to sales ratio or the 50 forward P/E. If you don’t read QTR’s Fringe Finance, he often shares notes from other investors like Harris Kupperman of Praetorian Capital. This is from today’s post and it’s an absolute banger of an explanation for why watching Mag7 Mag6 (sorry Tesla TSLA 0.00%↑) keep ripping higher every day is so painful for some:

It seems like only retail boomers owned them, as no self-respecting hedge fund will ask for 2 and 20, only to buy Apple. As a result, many funds dramatically trailed their index, even worse, they trailed the MAG7 that their boomer clients are clustered in. Trust me, it feels mighty embarrassing to trail your clients, and still pretend you’re the expert in the room.

Phenomenal.

What generally happens next is FOMO buying by the exact people who are supposed to know better. Yes, the fund managers who can no longer bear watching NVDA go up without being in on the trade start chasing. It usually blows up after that. We saw this during the dot com bubble and we saw it during the COVID “stay at home” stock bubble when names like Zoom ZM 0.00%↑ went utterly parabolic.

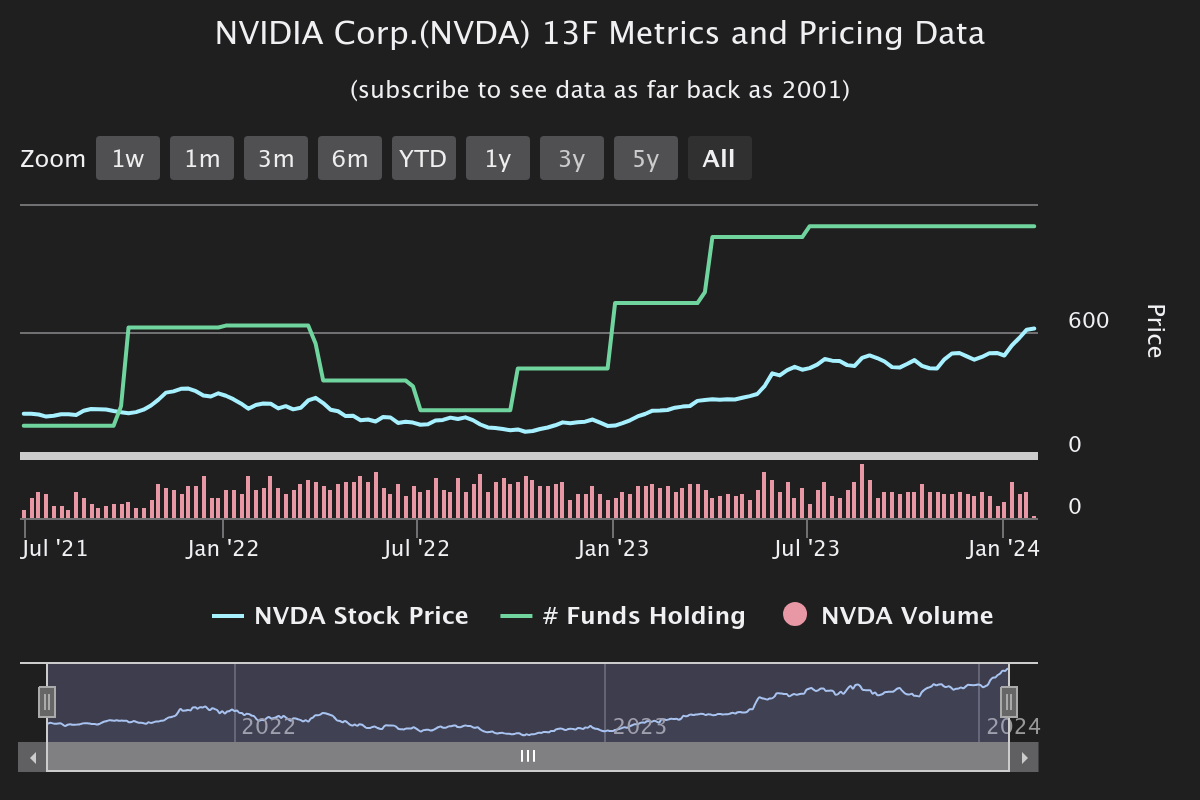

What we don’t know is what phase of the FOMO we are in and what it will take to prick the whole thing. Consider a very simple metric like the number of fund managers holding NVDA:

In September 2022, there were 2,620 funds holding the stock. We can see the stairstep up in holders for three consecutive quarters from there. Today, we’re at 3,503 funds (+34%) with disclosed positions in NVDA. What’s interesting though is the number hasn’t moved since July. If we go all the way back to 2021 when NVDA was last rallying on its crypto GPU mining narrative, funds increased holdings from 2,545 to 3,026 (19%) in a matter of just a few months.

That rapid growth in holders was actually a top signal. NVDA hit $346 per share in November 2021 at the peak of the crypto bull run and proceeded to collapse nearly 70% over the next year. Now, there are a couple considerations that should be noted before we go projecting the same thing to happen again. “The Merge” of the Ethereum ($ETH-USD) Beacon chain in September 2022 marked the end of the blockchain’s proof-of-work consensus mechanism. This meant NVIDIA’s GPUs were no longer needed for ETH mining.

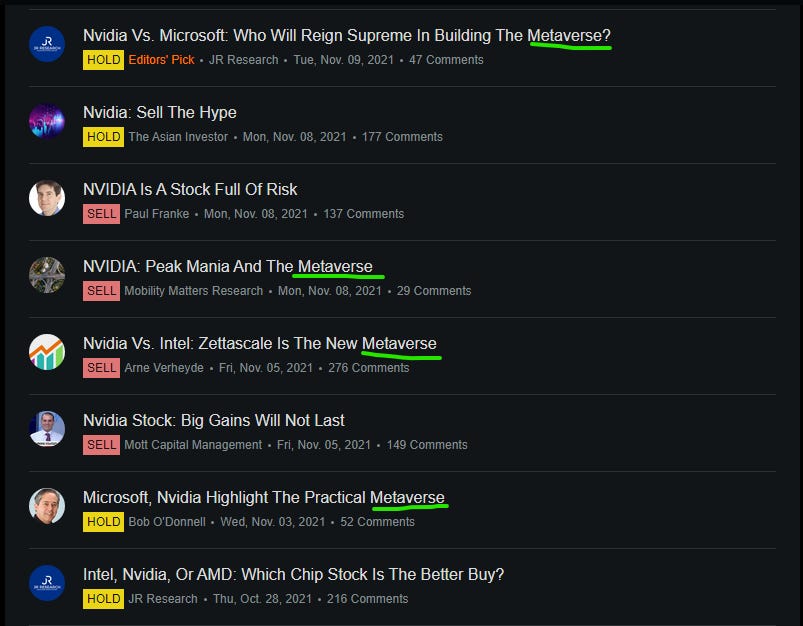

If we compare the tops of Zoom, NVIDIA, and Ethereum from the 2020/2021 bull run in risk assets, we can see NVDA rallied far after the “stay at home” trade peaked. In fact, ETH and NVDA topped within a couple days of each other in November 2021. Just for kicks, I went back to November 2021 to see what the Seeking Alpha contributor headlines for NVDA looked like at that time:

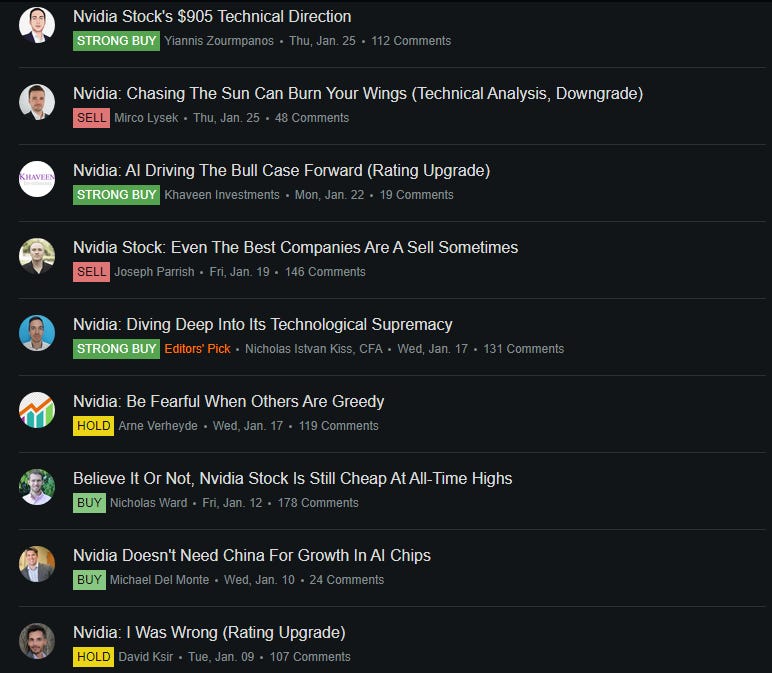

Impressively, SA analysts were pretty much on it with most of them posting bearish calls. But what struck me as the most surprising nugget from this was that it was the “metaverse” that was the perceived hype driver of NVDA shares back then. Here’s how it looks today:

Here we see a much different vibe. We have bears throwing in the towel and upgrading. We have $905 price targets. Not $900, $905. Warren Buffett quotes. And just a couple brave souls who are still willing to call the stock a sell. As an SA contributor myself, I can say that I’ve never personally covered NVDA for that platform. But I do know how the game works over on Seeking Alpha and a stock like NVDA today is going to bring in all sorts of attention both from readers and from analysts. This is good for article earnings. It may not always incentivize strong work. Point is, this signal may actually be a bit more noisy than it was two years ago.

What I also want to know is what the same people who called NVDA a sell in November 2021 are saying about it now. Specifically, Paul Franke, Michael Kramer (Mott Capital Management), Arne Verheyde, and Mobility Matters Research. Here’s where they fall:

Paul Franke: “Strong Sell” at $423 in August 2023

Michael Kramer: Calling for a pullback at $285 in May 2023

Arne Verheyde: “Hold,” this month and pictured above

Mobility Matters Research: “Hold,” last covered at $160 in December 2022

Interestingly, only Arne Verheyde has what I’d call recent coverage. But I wouldn’t say any of them have a dramatically bullish view. Obviously, this is just anecdotal and there may be no real value to be derived from it, but getting a pulse from the market is usually a good way to get a sense for how close we may be to peaks.

If we take the fund manager allocation figures from above as an indicator, I don’t know where the incremental buyer is coming from here. You could argue that as a proxy short, I’m actually the incremental buyer, but NVDA’s short position is virtually non-existent at slightly over 1% - point is, this is not a short squeeze driving this. It’s all hype and FOMO.

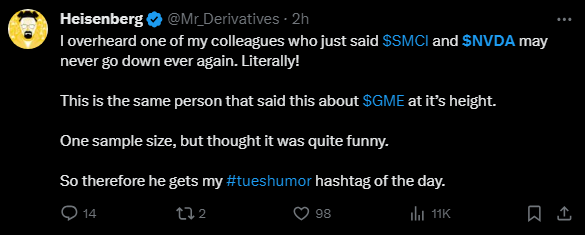

There’s stuff like this tweet above. Which while hilarious needs to be taken with a huge grain of salt. But I do think when you find several hints like this, it can be valuable. When I worked for an employer during the 2021 crypto bull run, I knew things were getting out of hand when I had coworkers talking about Dogecoin ($DOGE-USD). I miss out on that sort of thing now as I’m self-employed but I can get a pulse check on my friend who happens to be an NVDA long. He and I debated the stock in October. At that time he told me he would never sell it.

As fate would have it, I saw him again over the weekend. It was the first time seeing each other since our last group get together in October. Naturally, NVDA came up. He wasn’t gloating, he’s actually a really nice person and I appreciate that about him. But there is zero doubt in my mind that he’s flat out not considering bearish perspectives. He listens, he acknowledges good points. He still refuses to take profit. Why? Because it’s going up.

Insiders dumping? Doesn’t matter. Valuation multiples? Don’t matter. The potential commoditization of GPUs and margin tightening through upcoming competition? Not concerning. The idea that some of the crypto miner-turned data center companies who buy NVIDIA’s chips missing on their own HPC/AI product offering guidance? Not a big enough part of the market. As long as none of this phases the stock, it’s not going to phase the stock’s “investors” either. Bearish perspectives don’t matter, until they matter.

Look, ten years following markets isn’t a long time. But it’s enough to have seen this kind behavior. And I’ve seen this many, many times. It generally doesn’t end well. Everyone seems to be mainly focused on earnings for the company and for competing chip makers like Advanced Micro Devices AMD 0.00%↑ - who happens to be announcing after the bell today. I’d wager that by the time it’s obvious the gains have been had, it’s going to be too late to lock them in.

The NVDS Rationale

One might ask why not simply play the options if I’m so convinced NVDA is at or near a top. The most straightforward answer is I don’t like giving myself deadlines for price targets and that’s generally why I avoid options. I’d rather not be right directionally but still get the timing wrong on a strike price. Directly shorting is also a fast way to end up broke and I have no interest in owing my broker if I end being really wrong.

I’d rather express my thesis through NVDS because it’s essentially a duration-less option and I’m only risking the capital that I put in. Yes, I’m getting waxed on this trade right now as I’m down about 15%. But, this is why I’ve been allocating to the ETF in very small increments over a multi-week period of time.

That way, I mitigate the fund decay effect of the leverage on the way down but still let it work for me when NVDA inevitably corrects. As a 1.25 leveraged ETF that rebalances daily, I actually want NVDA’s reversal to be very similar to it’s climb… daily and relentless. What I don’t want to see is a sudden massive 20% down day in NVDA as it will limit my total return. Here’s how the math works:

NVDS tracks the inverse performance of NVDA and multiplies it by 1.25. If NVDA goes down 2% everyday for a 10 day stretch, longs actually lose less money than they would in a 20% single down day - the direct short seller wants the single down day of 20%. Not so with the leveraged short ETF. Let’s assume the same scenario: NVDA goes down 2% each day for 10 straight days. With NVDS, the rebalancing allows my position to appreciate more compared to a single down day.

Of course, the real world experience is unlikely to mimic the model. NVDA won’t go down 2% every day for two straight weeks. But I still think this thing is way ahead of itself. There are numerous macro headwinds that could have an impact on the broad market in a negative way. NVIDIA is priced for absolute perfection and the bulls refuse to lock in gains.

It’s all emotion driving this. And emotions can be volatile. I mean look at this insanity from the often on-point Ed Yardeni via MarketWatch yesterday in comparing NVDA to Cisco during dot com. He’s actually calling for higher prices:

So instead of a repeat of the inflationary 1970s or a replay of the productivity-led boom of the 1920s, the current decade has the potential to play out like the tech-led stock market party of the 1990s. To quote Prince: “Let’s party like it’s 1999.”

It’s almost as if he’s making the argument that, yes, we are in a bubble. But it just started so keep buying tech no matter the price. Josh Brown just told his audience on CNBC that he’s selling AMD because, and I quote:

I look at things like RSI when I make a decision of if a stock is too hot. AMD hit 78 relative strength index.

Brown, who has a large NVDA position, sold AMD instead because he doesn’t want to own both. This is, frankly, hilarious. Why? Because when this video dropped four days ago, NVDA’s RSI was 84 - it was more overbought than AMD. But he can’t bring himself to sell. Why? These guys don’t want to go out on a limb. Everyone loves NVDA. Nobody wants to be the guy who wrecks the party.

Well, unless you’re a heretic.

Here’s the thing, tech companies aren’t beanie babies. They’re not philosophical artifacts from a cypherpunk vision that simply isn’t manifesting. These are supposed to not be jokes. Owning a company shouldn’t be like buying Pokémon cards. And it feels like that’s where we are right now. God love him, my friend is a huge NVDA bull and I’m just not sure how much he actually knows about the company or its products.

The point is, I’ve heard “I’m never selling this stock” numerous times in the last decade. It’s easy to say that when the number is going up every single day. Conviction dies with lower prices. And I’m just not convinced every NVDA bull in January 2024 is sitting at the table with diamond hands.

So in closing…

I’m still indirectly short NVDA through NVDS. It’s not working. I keep buying NVDS anyway. At some point the tables will turn. Until then, I get the rod and that’s fine. Because identifying who the gambler is in this scenario is entirely up to your own perspective. I would argue bulls and bears both inevitably get the rod if they don’t learn from history. And the spoils from being on the right side of the trade can be given back very quickly if one doesn’t respect TA, sentiment signal, and fundamental indicators.

Disclaimer: I’m not an investment advisor. I’m long NVDS. It’s a very high risk trade. Don’t do what I do.

UPDATE as of 2/7/24: Franke has a fresh sell call for NVDA on Seeking Alpha. Josh Brown is now selling. And the Financial Times wrote a piece that highlights the potential CoreWeave problem. That piece is titled "Sell Nvidia."

https://www.ft.com/content/e1beb7a5-6c91-4d7f-bc90-79689774881d