The Blank Check Bailout: My God

In a joint announcement from the Federal Reserve, FDIC, and US Treasury last night, only one thing is clear; banks can borrow against asset values that they don't actually have.

As I foreshadowed over the weekend, I have many more thoughts on this banking situation. For those who need to be brought up to speed if you were on vacation or unplugged, here's a very brief TLDR rundown of the last few days:

Silvergate Capital SI 0.00%↑ closed on Wednesday (mostly crypto-clientele)

Silicon Valley Bank SIVB 0.00%↑ (or SVB) was taken over by FDIC on Friday (large startup/VC clientele)

In an incredible joint statement Sunday evening (more on this in a moment), the FDIC, Federal Reserve, and US Treasury have confirmed SVB deposits will be made hole and accessible Monday

In a separate release by those same three entities, the announcement was made that Signature Bank SBNY 0.00%↑ is also being taken over by FDIC

That makes three banks now closed in less than a week. It's impossible not to notice Silvergate, Silicon Valley Bank, and Signature Bank all had ties with crypto firms. All three are now just memories and there aren't a whole lot of options for crypto friendly-banking going forward. Bank of New York Mellon BK 0.00%↑ is still in the mix but fresh capital inflows in this space might be a little stagnant for a while. But then again, maybe not. Who really knows?

Caused By Rate Hikes

The question that most of the 'normies' in finance are now asking is does this mean the rate hike cycle is over? Here's a fun answer: maybe, but maybe not. Before the release from regulators last night I was pretty convinced the Fed hikes would be done as it’s obvious things are now breaking in the financial world. However, there is some astounding language in that announcement that leaves me much less convinced the hiking cycle is over.

In the announcement about SVB depositors last night, the government announced a new program that had some pretty staggering details:

The additional funding will be made available through the creation of a new Bank Term Funding Program (BTFP), offering loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. These assets will be valued at par. The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution's need to quickly sell those securities in times of stress.

Bold my emphasis. Astonishing, to be totally honest. What this is saying is it allows banks to borrow against assets at full value, even if the positions are underwater. This is important because it's precisely why the banks that went down over the last week fell apart. While the President just acted like nobody knows what happened to these banks in his presser, that’s not reality. It’s very obvious what happened to these banks.

In a nutshell; when you deposit your money with a banking institution they lend it out. It’s not just sitting in cash. Sometimes its lent out to other banks or businesses. But the ‘safest’ borrower on the planet is Uncle Sam. And a lot of this cash people like you and I deposit with our bank ends up in US treasuries. Please recall this chart from my contagion update over the weekend:

The treasuries that are held as collateral by these banks have been absolutely decimated over the last year because the interest rates have increased - meaning any bonds that pay a lower yield are worth less than the newly issued bonds that offer better yields if held to maturity. This is a problem if depositors want their money back because it means the banks have to sell the bonds before they mature at a loss. And these losses are massive. The problem for the banks is they’re not passing those yields through to the depositors.

So in addition to people dipping into savings accounts just to get by, the savvy depositors who have the means have been moving cash out of low-yield accounts and into money market funds. Commercial banks have been losing deposits as a result:

This has essentially been a digital bank run due to high interest rates for banks but not for the depositors. But the powers that be can’t admit any of this because inflation is so high. To admit that the banks are breaking down with rates at just 4% would be a problem because it might wake a few up to the idea that this entire fiat monetary/fiscal system scam that the Treasury department and the Federal Reserve have been running has always been a Ponzi scheme.

And that brings us back to the verbiage from the joint presser last night. This new program that was just created yesterday allows for:

loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. These assets will be valued at par.

Allowing banks to borrow from the government against assets that are underwater at par is asinine to me. It would be like if you bought a new car, wrecked it, and then the government still gave you a loan that equaled the full value of the purchase price of the vehicle even when the government knows the car is wrecked. It’s insanity and it only makes any sense if you believe one of these two things:

The Fed now has the cover to keep raising rates in it's ‘fight’ to tame inflation while regulators essentially pretend that the treasury holdings these banks are using as collateral aren't getting crushed as a result of those hikes.

Or, regulators know these treasury prices are going to re-rate and the paper losses won't be as bad over the next year - hence, lending against those currently underwater positions isn't as risky because they won’t be underwater for much longer.

For number two to be right, it would mean US debt prices have to rally and yields would move much lower. So far, that's exactly what the market seems to be expecting:

10 year yields have swiftly reversed and tested trend. Same in the 2 year yields:

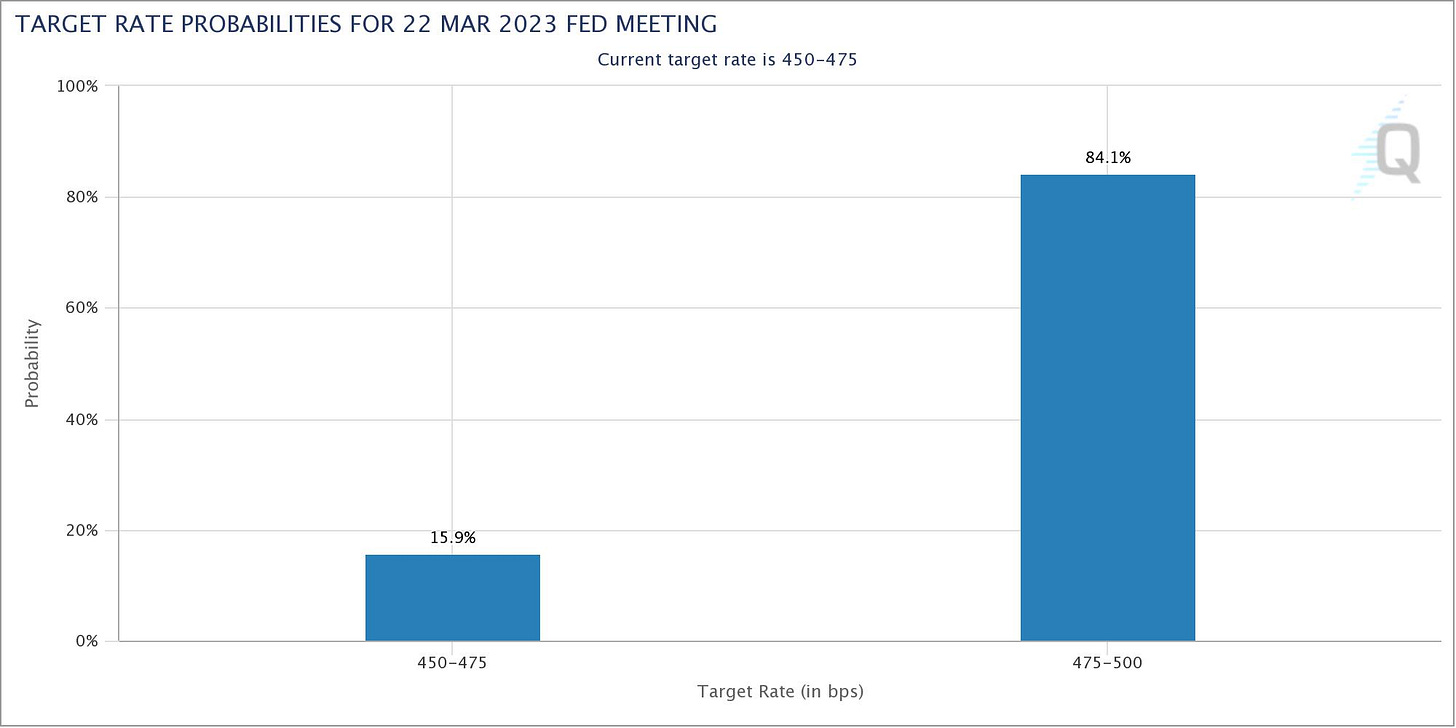

The 2 year went from over 5% on Wednesday down to 4.0% this morning. Incredible. The CME fund rate probability tool is now showing the market is 84% convinced we're getting 25 bps this month:

The 16% long shot bet is for no hike this month. This is an enormous departure from what was expected just a day ago when markets had a 60/40 probability spread between 25 bps and 50 bps:

Incredible. It's really the only word I can use.

The Money Printer Trade

The metal markets and crypto markets have loved this development. Gold is up 2%:

Silver is up 5%:

Bitcoin rallied better than 16% trough to peak since Friday:

This is what I’m comfortable sharing at this point. How I’m personally playing this news is unchanged. I’m already exactly where I want to be. Physical gold and silver. Bitcoin and other crypto assets in self-custody. Cash in FDIC insured accounts. Some stocks will do better than others in this environment.

Have a great week, guys.

Disclaimer: I’m not an investment advisor. I live in my wife’s basement and I have no job.

Every weird inexplicable illegal grotesque thing that’s happening in this country right now can be viewed through this prism: Democrat money laundering from the middle class to their favorite constituencies: their donors and their serfs. This banana republic is run by a parasitic mob that will suck this nation’s grandchildren dry of every nickel they might have earned before they’re even born.