The Rules Are Clear (As Mud)

The Prometheum saga, making sense of token models, and trying to think like the SEC. My head hurts!

Consuming the news in the crypto-verse over the last several weeks has been a bit like trying to drink water from a firehouse. I gave a brief rundown of some of the recent events a couple weeks ago in The Chips are Pushed In, but there are even more bonkers rabbit holes we could go down now.

One of the craziest stories is the tale of Prometheum. A “crypto exchange” that nobody in the industry has ever heard of and that doesn’t appear to actually have any product at all. Somehow, Prometheum was the first, and as far as we can tell only, crypto firm to successfully acquire a special purpose broker-dealer license from US regulators.

Shortly after attaining this license, Aaron Kaplan, Prometheum’s Founder and Co-CEO, found his way in front of the House Financial Services Committee where he sufficiently regurgitated Gary Gensler’s talking points about the crypto industry’s non-compliance with US securities law. If you want the buttoned up version of this wild AF story, listen to NLW’s masterful explainer on the whole situation in The Breakdown podcast. It’s worth a listen.

Otherwise, the Song A Day version is pretty funny:

In the hearing, we found out that the only crypto exchange with a special purpose broker dealer license can’t actually allow “its customers” to trade Bitcoin or Ethereum. It’s almost like we need new rules or something? The bottom line is the only thing that really is clear is that the rules aren’t clear. And I know it may seem like I’m beating a dead horse on this but I personally view it as critical for anyone even remotely interested in this space to understand what it is they’re getting into if US jurisdiction risk is a concern for coin issuers or developers.

The radical anarcho-capitalist in me doesn’t really care what the regulators say about tokens. But I know that’s a fringe position in 2023 and most in the space do actually want to have a clearer set of rules. With clearly stated goalposts, builders and developers can avoid the types of situations that companies like Coinbase COIN 0.00%↑ are now experiencing; namely, going effing public on the Nasdaq and then getting sued by the SEC two years later for operating the exact business that the company stated in its original prospectus.

Until Congress acts, we’re left to guess

Please bear in mind this is a total guess on my part and I’m absolutely not a legal expert. I have no idea what parameters the SEC is using to determine which digital assets are unregistered securities and which ones aren’t. I think it’s equal parts easy and hilarious dunking on Gary Gensler for his apparent flip-flopping on coin classifications through the years. When at MIT, he stated Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH) were not securities.

Now that he’s running the show at the SEC, apparently everything except BTC is an unregistered security. Okay, cool. Why? I don’t think this is an unfair question. We don’t know. Has anything changed since Gensler’s previous comments regarding ETH? Yes, actually! That network transitioned from a proof of work to a proof of stake consensus mechanism. So that must mean it’s PoS that is the determining factor, right? Wrong. Gensler’s agency also called Dash (DASH) a security and Dash is proof of work.

Gary Gensler notoriously spoke very highly of Algorand (ALGO) when he worked at MIT and then the SEC called ALGO a security in a recent enforcement act against crypto exchange Bittrex. To be fair to Gary (puke), I took a stab at why this perceived flip on Algorand might not actually be a flip at all in an article from April:

Now, in the interest of maintaining my own integrity I think it’s important to mention that the MIT Sloan presentation was from April 2019 and Algorand didn’t do its public token sale until June of that year.

Based off that, we might be able to assume that token sales are a major determining factor regardless of whether those sales were private or through some sort of public ICO/IEO. But that’s not the correct goalpost either because Kromatika (KROM) never had a coin offering and that token was determined to be a security by the SEC last year. Again, we do not actually have clarity.

I’ve tried looking through the SEC’s unregistered securities determinations in recent months and I can’t find a major unique factor that excludes BTC from enforcement other than Gensler simply doesn’t know who to sue. Most of the other coin creators and developers are doxed. But this was also the case when Gensler was at MIT.

Maybe the real question has always been this…

Why are token models even necessary?

The skeptic would say tokens exist so venture capitalists can dump worthless coins on retail investors through a faster time-to-liquidity model. Maybe. There are certainly dozens, if not hundreds, of examples of that in crypto. For me, the less cynical explanation is that there has to be an incentive structure for a decentralized network to operate.

BTC is rewarded to miners for securing and validating transactions on a decentralized ledger. BTC is also used both as the exchange medium and to pay for transactions on this decentralized ledger. BTC is necessary. It was fairly launched and it has no central issuer or controller. It’s not a security and that’s pretty straight forward at this point.

Similarly, ETH is used to pay for transactions on the ledger. How decentralized that network actually is might be up for debate, but ETH is a digital commodity despite its 2014 ICO, in my personal opinion. Then we have things like Solana (SOL) and Polygon (MATIC) which are useful networks that require the native tokens for transaction fees, but could be examples of unregistered securities given the token sale raises and the centralization concerns.

But again, that’s only if decentralization is a factor in determining what is a security and what isn’t. Former SEC Director Bill Hinman would say “sufficiently decentralized” matters. Though the SEC currently doesn’t seem to agree.

But again, the question is why do any of these networks need native coins? Can’t they all just use dollars or some other form of government monopoly money? The short answer is they can, but there are risks associated with doing so as we learned in March when some of the largest “dollar” coins in crypto lost their pegs.

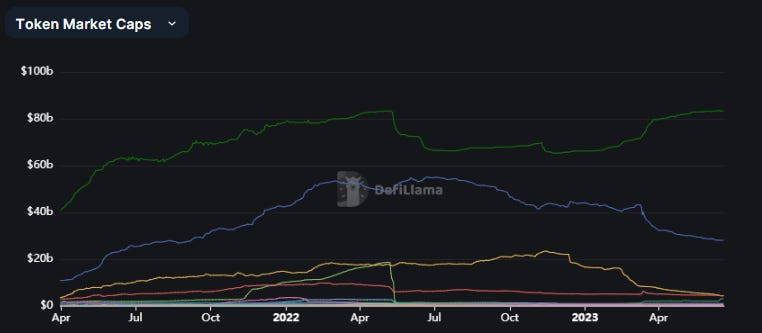

Of course, the peg issues had nothing to do with crypto and everything to do with counter party risk in the traditional financial system. Hilarious. You can’t make this stuff up. Now, the market for dollars on public blockchains is diminishing:

The total stablecoin market cap is down roughly 40% from the peak last year. Essentially everything but Tether is in free fall from a supply standpoint. Capital leaving the ecosystem? To a degree yes. But we’re also starting to see a bid on some of the top native chain assets over the last several days.

Response to the BlackRock BLK 0.00%↑ ETF application? Or is it indicative of a well-chronicled Heretic Speculator theme playing out in real time? I’m not an investment advisor so you have to judge for yourself.

Disclaimer: I’m not an investment advisor. I’m personally long BTC, ETH, LTC, MATIC, DASH, and KROM.