"Then They Fight You"

Is that helicopter in the sky about to drop cash all over town or are they just here to spy on everyone? Yes.

There are no solutions, only trade offs. - Thomas Sowell

If you’re an advocate for cryptocurrency in America, it’s been a rough couple weeks. Right now it looks like the beef is with mixing services but the breadth of recent actions indicate it’s actually quite a bit deeper than just on-chain privacy. It’s becoming increasingly clear that the powers that be in America don’t want self-custody. Who could blame them? After all, let’s recap what has happened in the last couple weeks regarding cryptocurrency enforcement actions in the US:

The developer of crypto’s largest DEX by far was served a Wells Notice - implying impending legal action

Privacy-focused Samourai Wallet’s website was seized and its developers arrested

The FBI released a PSA nudging users away from non-KYC/AML compliant exchanges the following day

Roger Ver, one of the earliest public Bitcoin advocates and author of the recently released book Hijacking Bitcoin, was just arrested for allegations of tax evasion that is apparently nearly a decade old

It's clear where this is going and why it’s happening now. This has nothing to do with tax evasion or money laundering. If any of that stuff actually mattered, Jamie Dimon would have to atone for all of the crap JP Morgan JPM 0.00%↑ has pulled through the years. Banksters pay fines. Crypto bros get locked up. The only real difference in the crime is the technological system being used.

Here’s what I think is really happening

The days of the central bankers pretending they have things like “inflation” under control are over. Now it’s about keeping as many frogs in the water as possible by putting heads on lances publicly. But there’s a problem for the grifter class. Gaslighting only works up to a certain point. Math is still math. You can’t taper a Ponzi scheme and the elite are running out of greater fools to keep their fiat scam going. What are you prepared to do, anon?

You could become cops or criminals. When you’re facing a loaded gun, what’s the difference? - Frank Costello

In 2020, the Federal Reserve told you they weren’t even “thinking about thinking about raising interest rates” until 2023 when Fed Funds was at the floor. By the end of 2022, Fed Funds was at 4% and the banks that allocated treasury strategies based on prior guidance started breaking down less than three months later. They still are by the way!

Then last year we were told to expect as many as 6 rate cuts in 2024. Well, it’s May and not only have we not had a single one yet, but it’s looking increasingly likely that there won’t be one until September the earliest. We were told inflation was transitory even though it clearly wasn’t going to be.

Here’s the problem, we’ve allowed these people to turn themselves into guru influencers even though they, at best, don’t know what they’re talking. Which is a fine role if they’re just mouthing off on Twitter, Instagram, or even Substack like the rest of us. But they’re not. They’re in charge of setting the cost of capital for essentially the entire planet. No, they’re not incompetent. They just think you are.

They blamed inflation on supply chain bottlenecks rather than all the currency creation that they’ve been instrumental in facilitating. Stable prices and full employment? Nah. Their job is to monetize the deficit and keep the punch bowl full for the octogenarians in Washington.

This was all supposed to temporary according to Bernanke. The asset roll off would be like watching paint dry according to Yellen. Well, here we are in 2024 and the Fed has turned temporary intervention into standard operating procedure. The debt-based, fiat-Ponzi system collapses if the central bank doesn’t keep intervening. That’s the game. Recognizing what is happening is half the battle. The old adage is don’t fight the Fed. But the alternative is holding ice cubes on a sunny day.

The problem is it’s getting warm outside.

Anti-State Money

David Bailey is the CEO of Bitcoin Magazine. He’s foreshadowing even more trouble ahead and I have little reason to doubt his claim. The reason the DOJ is turning up the pressure on crypto now is because the filthy masses have escape options and Team Fiat doesn’t want people to head for the exits. Captive user base? Maybe today. Not necessarily tomorrow.

Sure, there is a case to be made for holding Bitcoin ($BTC-USD) through the ETFs and I’ve made that case recently. That said, buying through the ETF wrapper is my admission that self-custody can be pricey and additionally poses asset paralysis risk if transaction fees get too high and it becomes too expensive for an even larger cohort of holders to move assets.

Absolutely everything has tradeoffs. This is why I’ve never been a Maxi. Coins and metal both have utility. Both are attractive as anti-state assets, but there are flaws. Frankly, numerous coins have considerable tradeoffs. On-chain privacy is sorely lacking in this ecosystem and the protocols that help alleviate that lack of privacy are clearly under attack. Last week I highlighted Railgun ($RAIL-USD).

Unlike Tornado Cash or Samourai Wallet, Railgun utilizes zero-knowledge proof technology to show funds within the protocol haven’t come from criminal activity while maintaining the privacy of the fund wallets and asset totals. It’s a really terrific innovation. I’ve written about zero-knowledge (zk) tech in crypto before. Numerous times actually. Zcash ($ZEC-USD) uses zk technology as well.

And yesterday we received a fairly large announcement from the primary developer of Zcash, Electric Coin Company (ECC). The admittedly controversial Dev Fund is expiring in November according to ECC CEO Josh Swihart:

Zcash must be fully decentralized. It must be open. It must be liberated from political pressure and coercion. At its very core, in its source code, Zcash must embody autonomy, and it must welcome broad participation both in its use and stewardship.

The Zcash development fund will expire in November of this year, at this point, its recipients will stop receiving a portion of mining rewards and 100 percent will go to the miners. ECC, ZF, and the Zcash Grants Committee (and their grantees) will be forced to either find other funding sources — donations, grants, revenue-generating activities — or begin to ramp down.

Bold my emphasis. Basically the developers of Zcash will no longer be getting a portion of the block reward subsidy. Which means there is no longer an incentive to develop the network unless funding starts coming from individual donors at scale. When this happens, we will officially be in make or break mode for Zcash.

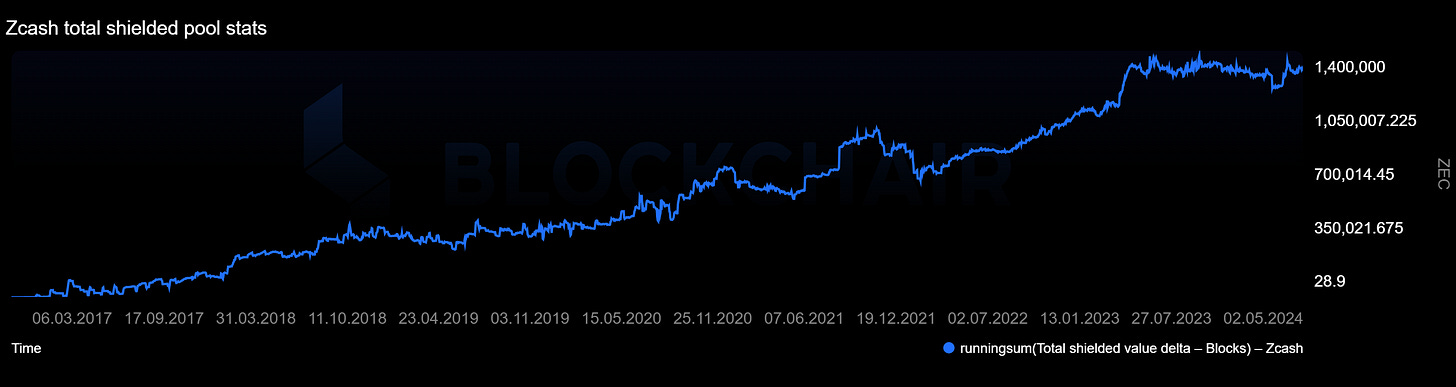

I’m hoping the network survives in a big way but even a loyal supporter must acknowledge the odds are not in the network’s favor. The network does about 3,000 transactions per day. Shielded supply hasn’t gone anywhere in a year. Mining profit remains negative. And without core developers being incentivized to work on the project, a migration to PoS seems a distant dream. It’s certainly not looking good.

Can Railgun pick up the zero-knowledge proof baton? Perhaps. Last week I shared some network metrics and my user review of Railgun, this week we look at the tokenomic model of RAIL.

RAIL Tokenomic Model

RAIL has a similar token-economic model to other coins in the crypto industry. The token’s primary selling point is that RAIL grants governance privileges over the protocol. In addition to that, token stakers are to be paid transaction fees that the Railgun DAO makes when users shield and unshield assets within the Railgun ecosystem:

Perhaps unsurprisingly, the overwhelming majority of RAIL tokens have been put in the staking contract. 73% of RAIL tokens are in the staking contract while just 2.75% are providing Uniswap ($UNI-USD) liquidity. This likely explains why the coin went ballistic last month when protocol usage took a noticeable leg higher:

We know that one of the largest participants in this staking contract is Digital Currency Group - the parent company of Grayscale and numerous other crypto businesses. DCG bought a $10 million stake in the protocol and also donated $7 million in stablecoins to fund protocol development.

From a supply standpoint, just 57% of the maximum 100 million RAIL tokens are considered circulating and there are actually three different Railgun DAOs and governance structures with two additional tokens. Here are the supply numbers by coin:

100,000,000 (RAIL on Ethereum)

44,546,789 (RAILBSC on BNB Smart Chain)

55,000,000 (RAILPOLY on Polygon)

Each token provides governance over a different blockchain network that has Railgun integration. According to CoinMarketCap.com, coin distribution parameters are as follows:

Airdrop: Ethereum addresses that have made donations on the ETH network to privacy charities + nonprofits, such as the TOR Project, the Right to Privacy Foundation, the Free Software Foundation, and others, will be given an airdrop of RAIL tokens.

Foundation: The Right to Privacy Foundation issued the grant to develop this project in the beginning, and has volunteered to custody 25% of RAIL tokens to support the long-term benefit of the Project. The foundation is a registered charity and is not motivated by profit. These tokens will be used only for incentivizing developers and promotion of the Railgun platform and future deployments.

DAO: The tokens given to the DAO (50 Million) are locked and unminted. They can only be minted by a DAO vote by RAIL holders (For example, if the DAO wanted to give a bonus yield to liquidity pool runners of RAIL token.)

The airdrop allocation is also 25%, or 25 million RAIL tokens. And with that, you know everything that I know. It is not easy to find much else on RAIL. Specifically how much RAIL is owned by DCG and when the remaining RAIL tokens vest has alluded me to this point.

For what it’s worth, I don’t own RAIL and I don’t currently have any plan to buy RAIL. I am very interested in the protocol, however, and it’s an ecosystem that I do plan to keep an eye on going forward. As is generally the case with any crypto investment, the odds are staked against the success of this protocol and the Feds seem to see both privacy and self-custody as the low hanging fruit in their fight. RAIL, and ZEC for that matter, could theoretically come under fire as well.

I for one still believe the best way to fight a punitive system is to simply opt out of it entirely. But that is certainly not a recommendation.

Disclaimer: I’m not an investment advisor. I share what I personally do and why I do it. Beyond price volatility, involvement in crypto in any way likely carries a tremendous amount of risk going forward. Particularly in the United States. Also no matter if you self-custody or trade through a centralized exchange, make sure you pay the Don his tribute so you don’t wind up in the clink like Roger Ver. I’m long BTC, ETH, UNI, and ZEC.

nice writing Mike.

We will see to what extent these recent actions (samurai wallet arrests etc) relating to privacy reduce bitcoin anti fragility