This Grayscale Fund is Officially a Bargain

NAV discounts are closing in the crypto closed end funds. However, there is one fund that still trades with an enormous mark down and it makes very little sense in my view.

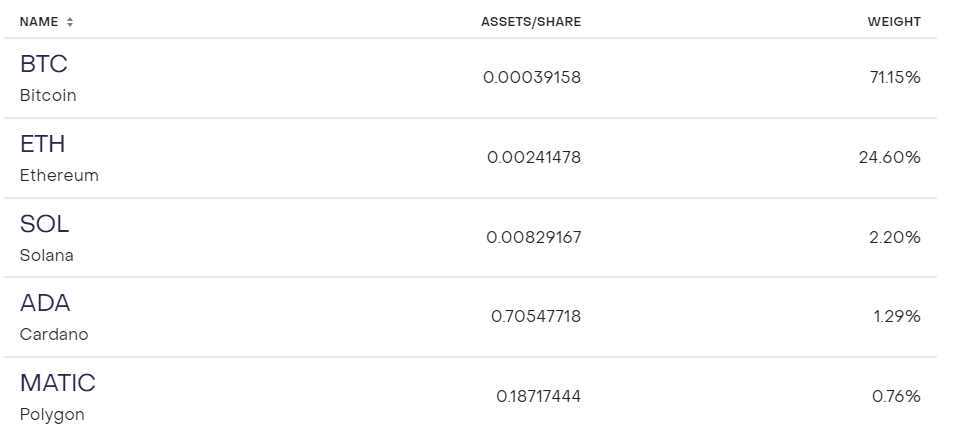

Piggybacking the Grayscale Solana Trust $GSOL NAV premium article I wrote Saturday morning, I wanted to revisit a thesis I’ve had regarding the Grayscale funds for several months. These funds are generally separated into two distinct categories: single-asset blue-chip funds and single-asset shitcoin altcoin funds. The blue-chips are the funds that typically have the most liquidity and the most stable pricing fluctuations:

Consider Grayscale’s Ethereum Trust $ETHE and Bitcoin Trust $GBTC shares versus the much smaller Decentraland Trust $MANA or Stellar Lumens $GXLM that trade at 2-3x the value of the underlying assets in the funds. Notice the Bitcoin and Ethereum trusts are multi-billion AUM funds while the Stellar and Decentraland funds are both under $10 million in AUM. The point is, the shares of those smaller funds are so illiquid that the market hasn’t been able to discover the true price.

But based off the trends we’ve seen in the much larger funds I would say the currently modest discounts compared to where those rates were a year ago are the better reflection of how all of these funds should really be priced. Given that as our baseline, the fact that Grayscale’s Digital Large Cap Fund $GDLC still trades at a 34% discount is absolutely baffling to me. I take that view for two reasons;

At $325 million, it’s a top 5 Grayscale fund by AUM

It has just 5 assets and is 96% backed by ETH and BTC

I’ve made this case through Seeking Alpha before and I stand by it today; the methodology for asset inclusion in Grayscale’s diversified fund is so bad that it’s actually good for arbitrage traders. If we accept that the market wants to price Grayscale’s Bitcoin at a 10% discount and Grayscale’s Ethereum at a 14% discount, than a Grayscale fund that is made almost entirely of Bitcoin and Ethereum trading at a 34% discount is a bargain.

Here’s the math on this currently:

What I’m doing in the table above is applying the NAV discounts from GBTC and ETHE to the underlying BTC and ETH in the GDLC shares and adding those values together. For instance, the Bitcoin in GBTC is trading at a 10% discount to NAV. If I valued the Bitcoin in GDLC at a 10% discount to NAV as well, then the Bitcoin in GDLC shares should be getting a market value of $12.95. Doing the same exercise for ETH gives us a market value of $4.34 and a combined share value of $17.29 versus a closing market price on Friday of $13.62 - 27% upside.

This is a totally logical assessment in my view because both funds are tradable derivatives of the same crypto that is held with the same custodian (Coinbase COIN 0.00%↑ ) and for the same asset manager (Grayscale). I can’t really think of a great reason why GDLC should still be trading at this large a discount. And this model above is assigning no value whatsoever to the Polygon, Solana, or Cardano that is held in GDLC as well.

Things get even more interesting when we factor in how the market is currently valuing Grayscale’s Solana. As I mentioned Saturday morning, GSOL’s closing price on Friday was preposterous. For $202 and 1 share of GSOL, an investor would be buying 0.38 Solana. For that same $202, the investor could have instead bought just under 15 shares of GDLC. Those 15 GDLC shares contain 0.12 Solana. Which is not quite the same amount of SOL from one share of GSOL, but 15 GDLC shares would also contain $291 of combined BTC and ETH.

Obviously nothing is guaranteed. And prevailing sentiment from the market seems to be that spot ETF approval hopes are what is driving Bitcoin higher and closing the NAV discount in GBTC shares. None of this means Ethereum will get a spot ETF in the US or that GDLC will be converted to an ETF. I’d actually wager all of that is some time away if it even happens at all. But see usage of these assets as inevitable and the best discount we have on BTC and ETH at the moment is through GDLC.

Disclaimer: I’m not an investment advisor. I’m long GDLC, GBTC, and ETHE. I hold BTC, ETH, SOL, and MATIC.

Bot GDLC on you recommendation in SA. Great call!

BTW guys, in the two and half weeks since this post, we've seen ETH come down a little bit and it's actually been enough to move the adjusted share value down to $16.06 if we write down the SOL, ADA, and MATIC to zero. GDLC closed at $16 yesterday. Essentially, you could argue we're now at fair value in GDLC! Meaning at this point I'd only hold the shares if you think the assets in the fund will keep going up (possible).