Thorchain: The Bucking Bull

RUNE's performance since March has been abysmal. Is it time to bail?

Thorchain ($RUNE-USD) is one of my favorite protocols in all of DeFi. I’ve written about Thorchain a few times on Heretic Speculator with the most recent example being back in November.

At that time, I noted how overbought RUNE, the native asset of the protocol, had become. But even then I made the argument that the rapid rise in the price of RUNE was fundamentally driven. What feeds RUNE’s value is the utility of the protocol itself. For a look at how it all works, I’d invite you to read my July 2023 note that breaks down the utility of Thorchain that I find to be so interesting.

In my November post, I theorized that the party in RUNE could actually continue precisely because the rally was fundamentally driven. At the time, RUNE was trading at over $6 per coin. The coin is admittedly very volatile. But my call for a continuation of the rally came to fruition in March when RUNE took out $11 per coin. It’s been a gnarly bleed out since then and we are beyond due for an updated look at this crypto high flier.

Thorchain Total Value Locked has been in a painful multi-month pullback. Since the non-native asset values are what drive both the utility of the protocol and the value of the RUNE token itself, TVL flight is problematic:

After eclipsing $439 million in TVL during the month of March, Thorchain Total Value Locked has fallen by over 40% in less than four months. Not ideal. Not to be outdone, RUNE has fallen by a mind-numbing 66% from its March high of $11.47. Believe it or not, from a technical standpoint the coin is still in an uptrend. Though that trend is very much being tested right now:

Technical charts are useful for tactical trading, but again the real value-driver for RUNE is protocol utility. Thus, we have to ask why the TVL flight is occurring to determine if this freefall is likely to continue.

Swaps and Yield

Simply put, Thorchain is interesting because of the protocol’s utility as a cross-chain DEX. Unlike Uniswap ($UNI-USD) which enables straight forward token swaps on the same blockchain network, Thorchain allows users to swap across networks. Uniswap can’t move BTC from the Bitcoin network to ETH on Ethereum. Thorchain can.

This seems simple, but the action of swapping chain-native BTC to chain-native ETH has historically required a centralized exchange like Coinbase COIN 0.00%↑ or Kraken to settle such a trade before the trader can redeem the asset directly. For providing the liquidity that enables these types off swaps on-chain, Thorchain LPs are paid a portion of the fees from those swaps.

Very much in line with the performance of TVL and RUNE since March, monthly swap count is down dramatically since the spring. March swap count was 1.7 million. June just closed at 414k swaps. That’s more than a 75% haircut in monthly swaps since the peak. The lack of swaps means fees are down. Without fees, savers aren’t getting as much yield on their lending. This is less of a problem with proof-of-work coins like Bitcoin ($BTC-USD), Litecoin ($LTC-USD), or Dogecoin ($DOGE-USD) because those assets can’t be natively staked.

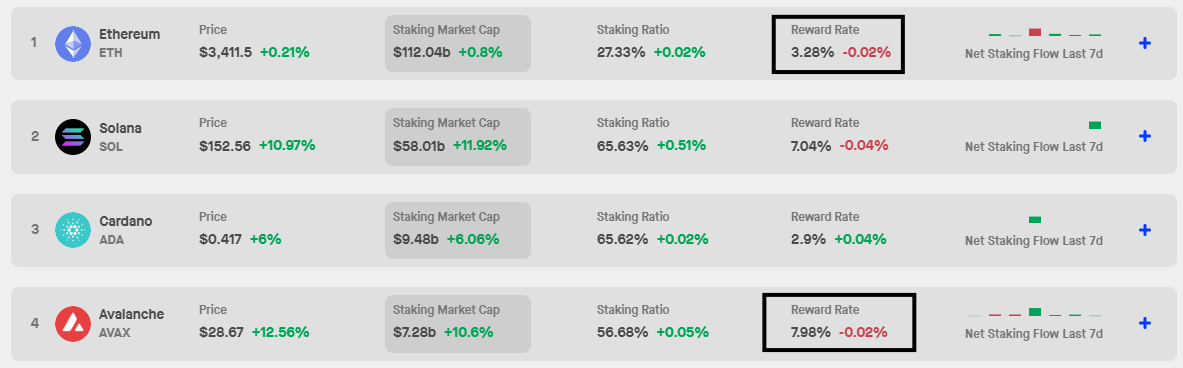

It’s a much bigger problem when there is in-kind yield competition from the proof-of-stake networks:

Consider the yields one Ethereum ($ETH-USD) and Avalanche ($AVAX-USD). At times, ThorFi Savers have been able to earn more on their ETH and AVAX than what could be earned by staking those assets directly on chain. This is no longer the case.

Direct AVAX staking offers a 3% premium over ThorFi. Direct ETH staking offers a 2% premium over ThorFi. Then there’s the stablecoin yields through ThorFi - it’s a similar story. There’s close to a 200 basis point premium keeping USDC with Coinbase or from just buying the t-bills directly. Three of the top five ThorFi savers pools are now uncompetitive. This is why TVL is down, in my view.

Does this mean it’s time to dump out of RUNE and look for cross-chain alternatives?

In my personal view, no.

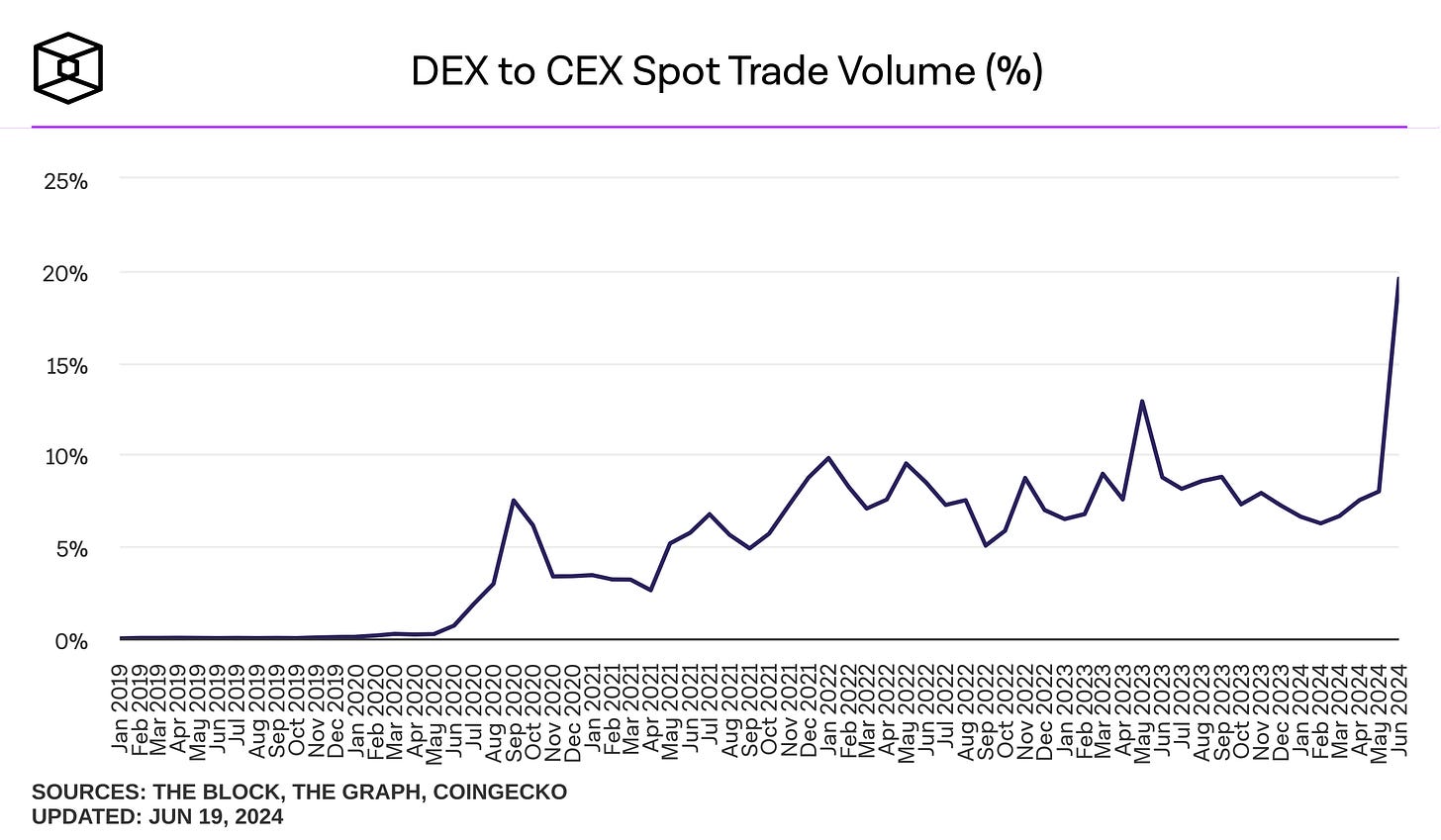

As I noted earlier in this post, RUNE has been one of the true fundamentally driven coins in crypto. If you take the view that DEX volume will ultimately surpass centralized exchange volume long term (as I do), then Thorchain still figures to have a very important purpose in the future. The 19.6% share of total volume that was just exhibited in June is just a teaser of what we may see in the years to come.

The bucking bull that is crypto will try to throw you off. Trading is great. But I’m still very much of the mind that the best way to allocate to this space is to buy good assets when they’re out of favor. I’d argue such is the case with RUNE today.

Disclaimer: I’m not an investment advisor. Crypto is still risky AF. I’m long RUNE, BTC, ETH, UNI and LTC.

Thanks, interesting piece. why do you think CEX will become extinct?