We Are So Back?

Ethereum rallied 20% on Monday amid positive sentiment around spot ETF approval in the US. Let's dive in.

Well I didn’t see that coming.

On May 19th, Polymarket speculators had spot Ethereum ETF approval odds for the US market at 10%. Yesterday that jumped to 69%.

There are quite a bit of takeaways from yesterday so I’ll do my best to briefly cover a few of the very important catalysts that are driving the renewed interest in Ethereum ($ETH-USD) this week while also balancing shorter term expectations. Let’s start with the politics of all this. Turns out, the crypto lobby has some power. That and backing the broom-riding “Anti-Crypto Army” builder might be a losing strategy with voters after all.

It seems as though Democrats in Washington have seen something that has scared them. Maybe it’s Donald Trump’s open embrace of the industry in Mar-a-Lago last week. Perhaps it’s the utter ratio of the BlockWorks op-ed piece suggesting crypto advocates are fools for being single-issue voters earlier this month. Or maybe it’s Democrat incumbents in formerly swing-turned-red states that aren’t feeling so secure any longer...

It’s likely a variety of things. But something changed and we can see a pivot happening in very distinct ways:

Can you feel the vibe shift, anon? In the last two weeks:

>Trump embraces digital assets, putting Biden on the defensive

>SEC reverses course on ETH ETF as approval looks imminent

>SAB 121 repeal passes Congress with dozens of Dems defecting from Warren's anti-crypto army

>Choke Point Marty forced to resign as FDIC Chair

>FIT 21 gains steam in the House, with passage looking more likely by the day.

Multiple policy victories of monumental proportions—and all of them happening in just one month. This is what winning looks like.

That’s quite the take from Director of Public Policy over at Riot Platforms RIOT 0.00%↑ Sam Lyman. This is all very exciting stuff if you’ve been dismayed by the gangster-like treatment that domestic crypto industry builders have endured over the last few years from Operation Chokepoint 2.0 and certain wannabe tyrants in federal bureaucracies.

The question today is; if this does indeed change things, what is the price I am willing to pay for these assets? I would posit that this is not actually the time to be chasing momentum or indiscriminately buying any coin with a ticker and a story. Consider, the circulating price to fees ratio of ETH at this point in time:

Or the MVRV that is quickly approaching a two-year high near 1.6x:

Even when considering all of the apparent “bad news” that has already been priced in, I don’t know that we can argue ETH is a cheap coin at $3,800. Frankly, I would actually argue this rip could be a nice opportunity to rebalance crypto portfolios if one believes Ethereum’s spot ETF applications will actually gain approval in the United States this week. Especially considering the deteriorating economics of the primary chain that I highlighted last week.

First, if we take the view that Ethereum’s spot ETF approval is a sure thing (which I don’t FWIW), than the Grayscale Ethereum Trust $ETHE is arguably a better buy on NAV discount than ETH is outright:

There is 0.00946043 of ETH in each ETHE share. At a $3,800 ETH price, the market value of the ETH in each ETHE share is $35.95. Thus, at $33.74, the fund is still trading at 6% discount to net asset value. If that isn’t a good enough arb any longer then perhaps the applications built on top of Ethereum (and its L2 chains) are the better strategic buys?

How about Uniswap ($UNI-USD)? Which itself just rallied 22% yesterday, has a massive footprint in the broader EVM landscape, and still trades at just 10x circulating fees.

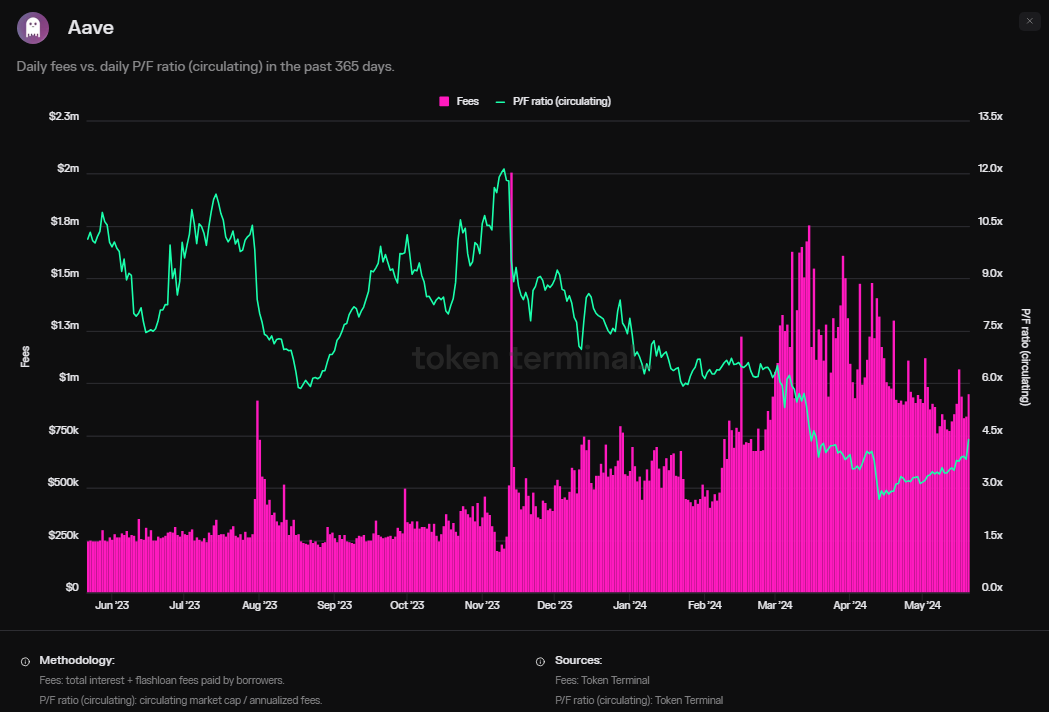

Or Aave ($AAVE-USD) which trades at just 4x circulating fees:

Admittedly, these are just ideas. Valuation in this market is entirely subjective and if there is actually a spot Ethereum ETF approved in the United States, I would imagine it could trigger an explosive rally in the price of ETH. But as speculators, we must remain mindful of economic incentives.

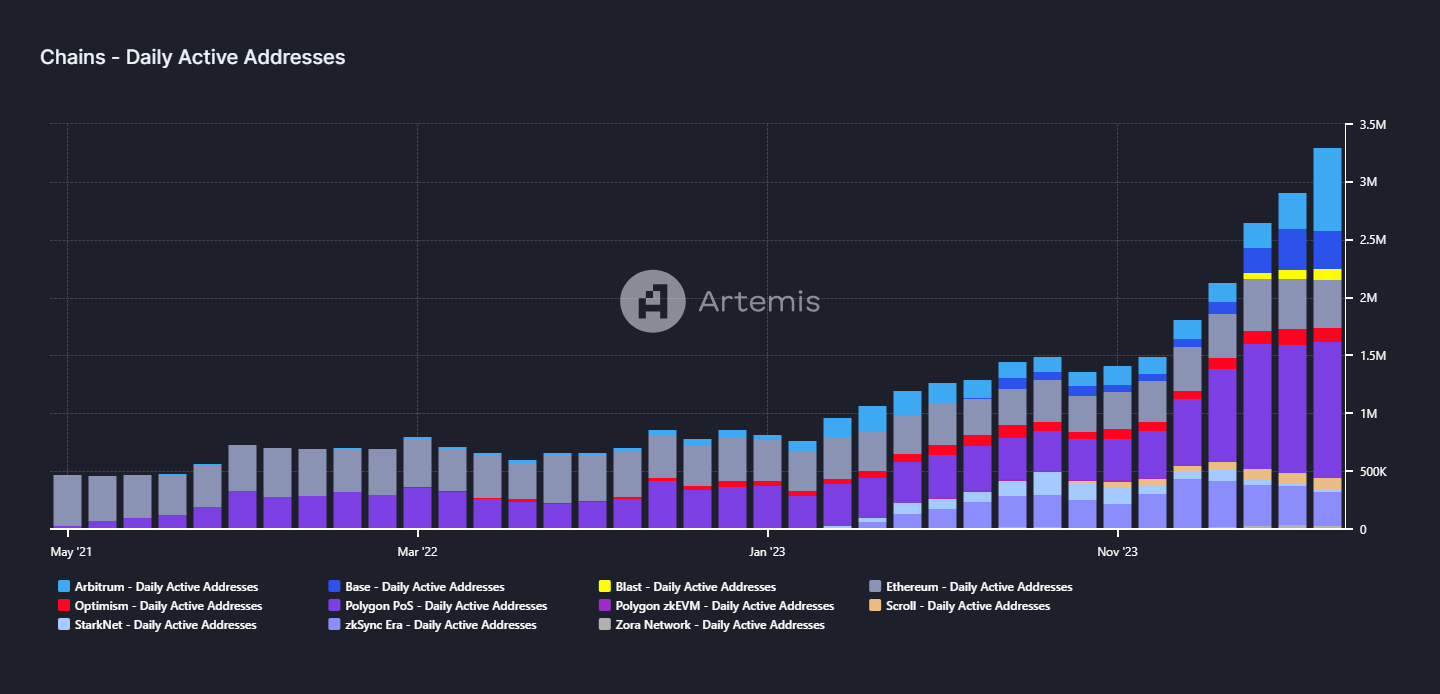

The real growth in the Ethereum/EVM ecosystem is in the L2s and that growth is siphoning fees away from the main layer which are instead being paid to L2 operators. Whether the swap happens on Ethereum, Arbitrum ($ARB-USD), Optimism ($OP-USD), or Base; Uniswap is probably still getting paid. Food for thought.

Disclaimer: I’m not an investment advisor. I trade shitcoins and shitcos. All of this stuff could go to zero. I’m long ETH, ETHE, UNI, and AAVE.

So what’s your best prognostication re: where ETH goes from these levels? Melt up into a crescendo “sell-the-ETF launch” event akin to how things played out for Bitcoin’s price action around the Bitcoin ETFs rolling out?? That’s my best hunch as of right now, but I have no clue how this ETH ETP launch truly goes down…sounds as though none of the products will offer staking. If that’s true, how much will that have any diminishing effects on net inflows for these ETH ETF’s I wonder? My guess is 80-90% of net inflows are unaffected by this detail, but it will have some dampening effect on inflows to be sure. So many questions…

Oh, one final pressing question (very relevant to those of us still holding any shares of Grayscale’s ETHE at this time: is Grayscale still one of the ETH ETF applicants at this time?? I thought that I had heard/read news at some point maybe 4 weeks ago (+/—??) that Grayscale actually had decided to pull their application for conversion of the ETHE fund to an ETF after some closed-door meeting with the SEC??? Has anyone seen confirmation anywhere that the ETHE trust is indeed slated to become one of the Ethereum ETF’s, just as GBTC ultimately became one of the Bitcoin ETF’s blessed by crooked Gary & co at the SEC??? Tia!

thanks Mike, a few questions for 'I trade shitcoins and shitcos' what is a shitco? how is it different than a shitcoin? that is 1/2 serious question, meaning 1/2 is serious. and a full serious question AAVe-usd trades at 4 x circulating fees, can you define circulating fees and where do you see them?