Why Wouldn't It Be Dramatic?

The Bitcoin miner consolidation many expected following April's halving has unofficially begun. Is a hostile takeover in the cards?

The company is planning what I'd call an aggressive expansion during a period of uncertainty for both Bitfarms and the unit economics of the underlying business. It's certainly possible the worst is priced in already here. But I see a company that is looking for yet another CEO, just reported another net loss, and is battling a very difficult post-halving mining fundamental environment that has yet to be reflected in a quarterly report.

This is what I said about Bitfarms BITF 0.00%↑ in my coverage of the company’s Q1-24 earnings report for Seeking Alpha earlier this month. If you’re not subscribers to that service, have no fear - enjoy this link to the full article on me.

I didn’t think BITF was a buy at $1.79 two weeks ago so I certainly don’t think it’s a buy at today’s close of $2.18. You know who disagrees with my “hold” call? Bitcoin mining peer Riot Platforms RIOT 0.00%↑:

Riot Platforms just disclosed owning 10% of the outstanding common shares in Bitfarms stock. Interestingly, Riot’s disclosure of its beneficial ownership in Bitfarms came a little over a month after making a buyout offer directly to the company at $2.30 per share:

In particular, on April 22, 2024, Riot sent a letter to the Board that set out Riot’s non-binding proposal to acquire all of the outstanding Common Shares of the Company (the “Proposal“) for consideration of US$2.30 per Common Share, to be paid with a combination of cash and shares of Riot’s common stock (the “Purchase Price“).

The Board of Directors for Bitfarms rejected Riot’s offer and just today announced a strategic review as the company attempts to figure out a path forward with sharks clearly in the water. The telling part from the Bitfarms’ press release is bolded below:

Having received additional unsolicited expressions of interest, with each additional party executing a customary Non-Disclosure Agreement, the Special Committee is conducting a thorough strategic alternatives review to ensure it achieves maximum shareholder value. These alternatives could include, among others, continuing to execute on the Company’s business plan, a strategic business combination or other strategic transaction, or a sale of the Company.

It bears mentioning again that Bitfarms doesn’t have an acting CEO and is being sued by its last CEO for alleged wrongful dismissal and breach of contract. The good news is he only wants $27 million in damages. Why on earth would Riot want to get involved in this? Look no further than mining efficiency numbers:

Of the primary Bitcoin mining companies in the public equity markets, Riot’s April efficiency numbers were abysmal. Since we’re entering the summer months and Riot mines in Texas, there’s always a possibility that we’ll get a repeat of last year and it could be more economical for Riot to sell energy credits than mine Bitcoin due to both poor efficiency and less BTC per block this summer compared to last. That said, Bitfarms wasn’t necessarily a shining beacon of efficiency either last month.

So what can we gather from this? If BITF is a legitimate takeover target for peers, then surely there are other names in this space that are as well…

Better Buys Out There?

Let’s get the obvious out of the way: no, I’m not buying BITF shares on this news. And the reason for that is I’m just not sure that BITF is actually a very good takeover target. Let’s start with the good:

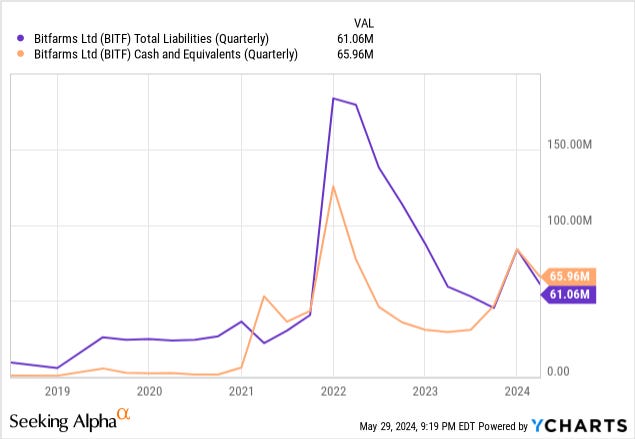

Bitfarms has done a marvelous job paying down debt over the last year or so. Q1-24 was the third consecutive quarter that “net debt” has been negative. While paying down that debt, Bitfarms has even been able to grow mining operations simultaneously (for a diminishing share of block reward):

And yet, I’m still not convinced BITF is the first company I’d try to move on if I was working on a hostile takeover. As a percentage of revenue, Bitfarms’ SG&A expense is 26.5% on a trailing twelve month basis. This makes BITF one of the more lean public miners from an overhead standpoint and it still couldn’t generate a positive net income in the final three months before the halving last quarter.

Consider some of the other “tier two” mining names with similar EH/s capacity and their SG&A figures as a percentage of revenue:

Cipher Mining CIFR 0.00%↑: 56.8%

Iris Energy IREN 0.00%↑: 50.5%

TeraWulf WULF 0.00%↑: 48.1%

If you’re looking to cut redundancy, I’d say each of the three companies above are all far better buyout candidates balance sheets being equal (which they’re not). Though there is still some debt, TeraWulf’s BTC per EH/s number was top of the market in April. And as fate would have it, TeraWulf was one of just two miners with a top ten market capitalization that was actually green on the day:

Perhaps an indication the market is sniffing out a possible acquisition target in WULF as well? We’ll see…

In surveying some thoughts online, very few seem to believe this planned takeover of Bitfarms by Riot Platforms will actually be successful and the prevailing sentiment is that the offer is a slap in the face. I can’t say I totally agree with that. However, if you’re operating under the assumption that things that might not happen will happen (cough BTC at $150k cough) - then sure, I could see why $2.30 per share for a company that hasn’t managed a quarterly operating profit since March 2022 would be a slap in the face.

Surely, shareholders of the hostile buyer and the unwilling seller agree on the inevitability of that assumption and thus… the offer is disrespectful. But I would posit that if you like Bitfarms, a company being sued by its former CEO and that seemingly offers less overhead cost-cutting opportunity, you have to love a company with no debt, a larger BTC stack, and one of the cheapest price to book valuations in the sector:

Oh yes, I’m going there! Bit Digital BTBT 0.00%↑ is a far better buyout target than Bitfarms in my opinion. Shocker, I know.

But getting back to the matter at hand. I suspect a few of you might be long BITF and/or entertaining a purchase on the news of Riot’s position and the possibility of additional suitors. By all means, make your case in the comments if you see it differently than I do. We all do better when we share with each other and I’m certainly not perfect.

But my read on this is Riot management either really miscalculated on what the Bitfarms BOD and shareholders would take and saw opportunity in the absolute mess that is the CEO situation…

-OR-

This is some sort of chess move on Riot’s part. Is Riot distracting the market from the acquisition that it actually wants to make? After all, if any deal is with cash and stock, burning some paper on BITF shares doesn’t necessarily take RIOT out of the mix for other opportunities. And I stand by my claim that there are much better buyout targets in this industry. Perhaps RIOT knows someone else wants Bitfarms and is simply trying to bid them up and make a little bit on the trade?

I really don’t know. But this is a very entertaining space right now. Hypothetically, if this all falls apart and there aren’t actually other serious bidders, that’s quite a bit of BITF that Riot Platforms may have to unwind. Should be fun to watch!

Disclaimer: I’m not an investment advisor. I’m personally long MARA, CLSK, and BTBT.

another interesting Piece Mike! what is your background, were you a financial analyst before getting into the new cool thing called crypto? Specifically concerning these miners, I don't have an opinion because I would need to look into this space. The reason I have not done so (look into the miner space) is because fundamentally I still don't understand the logic behind the business except for the assumption that price appreciation of BTC continues for many years to come. I personally think that is probable, however I would be very hesitant to found a company and take on a lot of debt based purely on that assumption. especially when you consider about 94% of all btc have already been mined and hashing power has already increased exponentially of the last 5 years. you need to believe energy will always be cheap (I agree with that assumption, energy off the grid can be very cheap) and fees will go up a lot (maybe, we will see). So basically if you were to start a mining biz, you need to think you will amortize your debt quickly in the face of declining revenus. Doesn't sound like a good biz plan to me. If ever you wrote an article on why it would make sense to invest in the mining industry in general. I would be interested.

I worked in ad sales as a media analyst. No real financial background whatsoever, I just had to be able to use spreadsheets and/or a calculator to prove ad spend ROI. I think you pretty much nailed it on why mining is a bad investment. I don’t disagree at all and actually have serious doubt about the long term incentive model. Proof of work is a terrific model if anyone can participate but what we have today with ASICs is just a more complex form of proof of stake in my view. Rather that staking coin, validators are staking machines.