With one day remaining before the Federal Reserve is widely expected to cut interest rates, the only real question many seem to be wondering is will it be 25 basis points or 50?

The market is clearly leaning 50 bps indicated by the 63% probability via CME. Polymarket bettors appear to be slightly less convinced:

That market is currently split 50/50. A toss up. I’ve already made my case for why I believe the Fed will go 25:

Here’s my thinking; the market wants the Fed to cut by 50 bps in two weeks. I believe this because I suspect that stonk-bulls believe that cash sitting in money market/T-bill products will find its way into things like NVIDIA, Apple, and Amazon if the Fed cuts by 50 bps. Perhaps the relative unattractiveness of T-bills could indeed pump Jensen’s bags, but I’m not sure Daddy Jerome is going to oblige. - Ya Boi, 9/6/24

Again, my opinion on this really doesn’t matter. Wizard Master Jerry is going to do what he’s going to do and the market will react. The market reaction tomorrow is completely meaningless, in my opinion. I certainly wouldn’t rule out the sugar high intraday pump to be shared throughout risk assets, but the bigger question is where will we be at the end of the year and beyond?

For best guesses, we look to the past for indications of what the future may hold. History suggests we have problems on the horizon for stocks:

After a few months of chop, the end of the hiking cycle in 2000 was followed by a 50% decline in the SPX two years later.

The 2007 cycle peak was followed by a 57% decline in stonks over the next 19 months.

The end of the hiking cycle in 2019 was followed by a mini-melt up of 12% in 6 months right before COVID lockdowns crashed the market by 35% in two months. Stocks were ultimately 25% lower than they were at the rate cycle peak level

The post-2000 meltdown was even worse for the QQQs.

What about other assets? Here’s Gold 12 months after the last three rate cycle peaks:

Down after dot com, but up significantly the last two times. 34% in 2008 and 48% in 2020. Commodities:

This one is interesting, Invesco Commodities Index DBC 0.00%↑ took a huge nosedive in 2020 because of the exposure to oil, but look at that performance between July 2007 and July 2008 - an 80% moon shot…

Here’s a different basket:

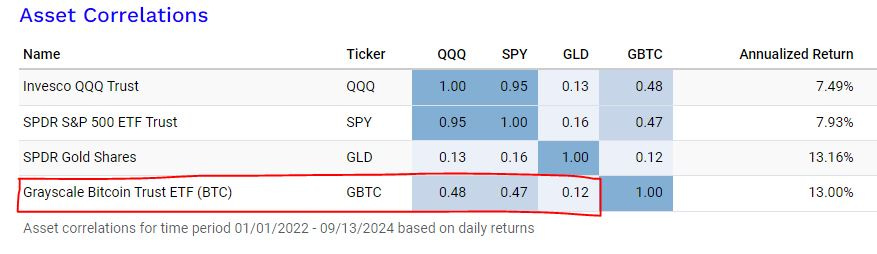

AG commodities DBA 0.00%↑ also did quite well during the GFC recession and fell less than DBC. For Bitcoin, it’s far more difficult to tell because we don’t have price action before 2010. IMO, it ultimately comes down to whether the market thinks BTC is Gold or Tech:

Correlation data would suggest Bitcoin has a stronger relationship with equities than it does with Gold going back to the beginning of 2022. Also interesting is the fact that Gold has beat everything from an annualized return standpoint over the last 2.5 years.

So my position on all of this is probably not surprising. I’m going into FOMC tomorrow with metal, commodities, T-bills, cash, and dividend paying stocks. (EDIT: I’m also long Bitcoin and other cryptos, leaving BTC out was unintentional). Essentially, I’ve changed very little and this is how I expect to be positioned at the end of the year as well. Could the index rip up to 6 stacks? Sure. If that happens, Bitcoin probably outperforms. If everything melts down, we can buy stuff that we want on sale. Each investor should have their own approach and their own plan.

What I don’t think is wise? Being all-in on any one trade or thesis at the top. And that is where we are. That goes for equites, Gold, and BTC. Good luck, everyone.

Holding no Bitcoin into FOMC day tomorrow, Mike? WTF bruh?? Say it ain’t so, bro! I pay you a nominal monthly fee with this unspoken tacit understanding that in return, you’re gonna pump my godd@mn bags, my dear crypto North Czar!!

Pump. My. Godd@mn. Bags. Please 🙏?? Lol…They’ve been nothing but chop/slightly down for 6 full months now. Dear god, Mike, do you understand how long 6 months feels when you’re positioned at around 50% of your entire (ex-real estate) investment portfolio in a single asset that just chops/bleeds out slowly for that entire time??? No, you probably don’t, because I seriously doubt you’ve ever allocated your own hard-earned $$ in such an unbelievably irresponsible way, my dear man. Good for you. I’m happy for you in that way…

Seriously, I am. I hope you are indeed as responsible with your fund allocations as I imagine you to be. Truly.

However, one serious question amongst all my histrionics in this here post: seriously, you have no $BTC long exposure at this point in time?? I’m highly suspicious of such a scenario to be frank [as if I have some great insight into your portfolio make-up at any given time, right?…haha…or do I…?? 🤔🤫].

But back to my point: I’m actually SOOO suspicious of this dubious notion that you truly have ZERO bitcoin exposure at this very moment, that unless I hear directly from you, specifically stating the contrary, I’m gonna go ahead and assume that you simply neglected to mention it amongst your list of active long positions heading into Jerome’s jazzy spectacular (aka the FOMC meeting). It should be so presumed that you are long $BTC at any given point in time, I take it, that you need not even make mention of it in general gentlemen’s discourse, right?? Right Mike??? Pump. Bags. Must. Need. Moon. Rocket ship. Lambos. Something. Anything….

Pump. My. Bags. Jerome!! [Even. Though. It’ll. Most. Likely. Actually. Be. Janet. Doing. The. Majority. Of. The. Stroking. Of. My. Bitcoin. Long. Behind. The. Scenes!!]

P.S. as an aside, something I’ve just been dying to share with someone else for so long now, and I just can’t keep it bottled up in silence any longer: Janet Y is such a TSILF, if I’ve ever seen one, am I right?? Cmon, you know you’re with me on that one fellas…and likely many of the ladies out there too…I need a very cold shower pre-FOMC I think.

Prediction: Gold goes up some more between now and EOY 2024. Bitcoin goes up significantly more than Gold does through the end of 2024 and likely into at least some portion of 2025. I think $BTC is truly gonna start surprising folks to the upside again, just as everyone has discounted it as not as volatile/exciting to the upside as it once was. Relegating it to “just digital gold” and also PRESUMING that it will therefore, at best, only trade as gold does…that’s when Bitcoin (imho) is gonna kick off her pleated dress slacks and she’s gonna get her shiny, shimmering spandex-tighted arse jazzercising again. (Not sure why I went with that metaphor, but just roll with it please.) I’m envisioning numerous $3-5k daily price spikes on the way up…

Yes, I’m very much talking my freaking book with this highly-speculative prediction here. Doesn’t mean it’s improper for me to see that kind of scenario happening in the not-too-distant future! Say it can’t happen, I dare you! I welcome you say it, in fact! Please say it won’t occur…