Lay Of The Land

Buy the dip? Or patiently sit on ones hands? As usual, I only offer what I am personally doing.

Not everyone likes it, not everyone wants to see it, but that matters not; economic fundamentals are clearly deteriorating. If one still actually has faith invested in the religion of government data points, then this was a bad week for optimists:

7.7 million job openings vs 8.1 million expected

142k US employment vs 161k expected

August is officially the 7th consecutive month that full time jobs in the United States have declined year over year

On that last point, such declines in full time workers have happened during the depths of - or as a result of - recessions eight times going back to the late 1960’s. Care to guess what the percentage is of instances to recessions? I’ll save you the trouble… it’s 100%…

Sahm rule triggered. 10’s minus 2’s officially un-inverted. Some would say this time is different. Meh. Like I said a couple weeks ago, it’s all confirmation bias at this point. We’ve been talking about these things for a few weeks but I do think the stress we’re now seeing in the market is very real and indicative of larger problems:

The question each individual investor must ask him/herself is simple; when do I need this money? Short of a complete collapse in the passive movement (not impossible), if you’re 30, there is probably very little to worry about longer term. Still, I think being selective makes sense if one simply can’t help but buy something perceived to be “on sale.” Needs over wants, perhaps being more forgivable.

But the adage below will likely continue to serve capital allocators well:

Time in the market beats timing the market.

Of course, if you’re 65 and your income is derived from some combination of social security, pension, and/or retirement account - one probably should be far more defensive. I’d even go as far as saying exposure to the Nasdaq at all is probably unnecessary risk when T-bills are still paying 5%. But none of this is new. I know it. You know it. I know you know it.

I repeat it because market speculators, myself included, must remain mindful of the terrain to avoid making mistakes. And right now, the terrain continues to indicate risk off, in my opinion.

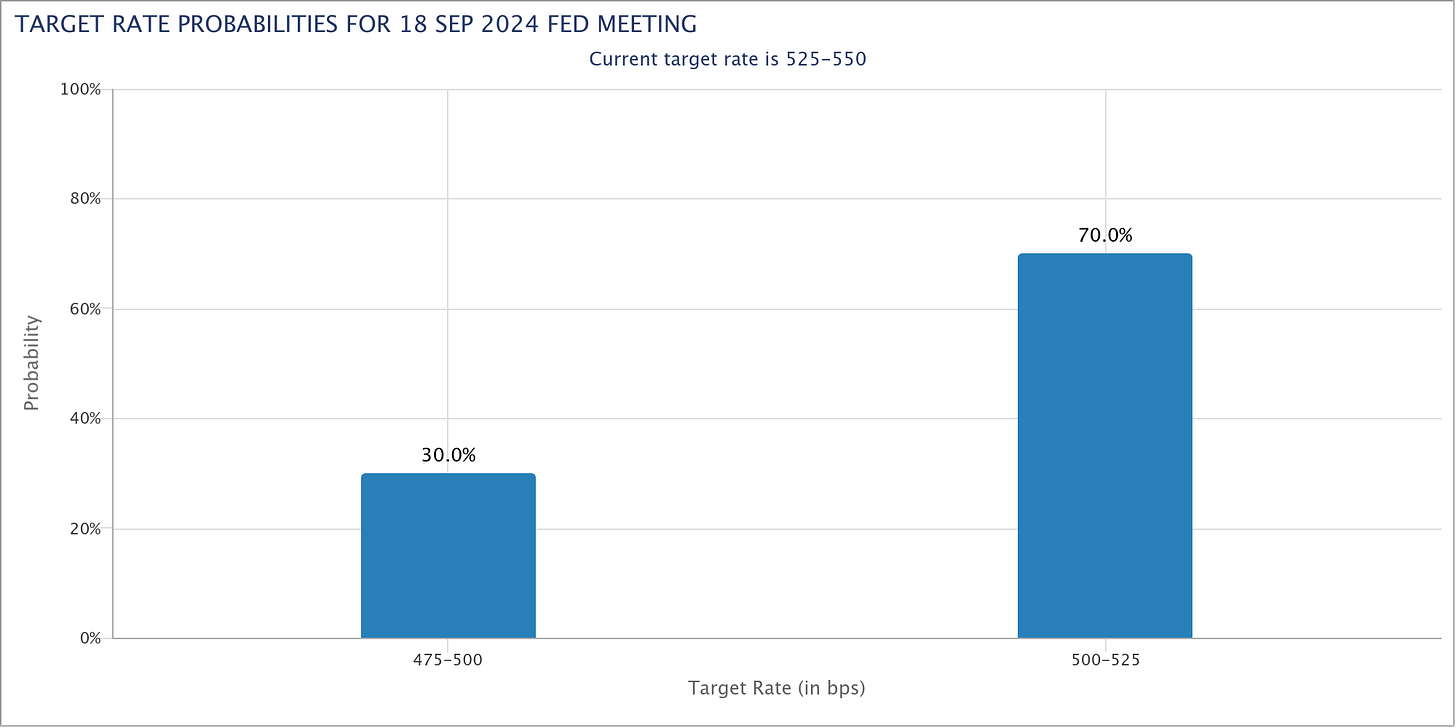

Here’s my thinking; the market wants the Fed to cut by 50 bps in two weeks. I believe this because I suspect that stonk-bulls believe that cash sitting in money market/T-bill products will find its way into things like NVIDIA NVDA 0.00%↑, Apple AAPL 0.00%↑, and Amazon AMZN 0.00%↑ if the Fed cuts by 50 bps. Perhaps the relative unattractiveness of T-bills could indeed pump Jensen’s bags, but I’m not sure Daddy Jerome is going to oblige.

I don’t think the Fed wants to cut 50 bps in two weeks because the quicker the Fed gives back 50 bps, the quicker the Fed gets to a ‘neutral rate.’ And as much as I’ve dunked on the guy over the last couple years, I don’t think Powell wants even a shred of belief that ZIRP is an option. I think these people were embarrassed by ‘transitory’ and I think they want to show how tough they can be on a market that always craves the next sugar high.

Thus, I don’t think we’re getting 50 bps without total calamity in the market. And the market probably knows this. Given that the market probably also knows it’s going to take real pain to move that needle for Credit Master Wizard Jerome.

And I’m sorry to the dip buying bulls out there, but a 3.5% down week with the index SPY 0.00%↑ still within 5% of an all time high less than two months ago simply isn’t enough pain. No. For 50 bps, Powell is probably going to need absolute panic in the streets. He’s going to need Jim Cramer begging people to buy stocks in bankrupt companies. He’s going to need more than a VIX at just 22.

Thus, I suspect this selloff has quite a bit more downside. The Nasdaq QQQ 0.00%↑ isn’t even oversold. It hasn’t been oversold on a daily close since April. I don’t think Bitcoin is a “strong buy” yet either.

I’ll admit, I’ve been having an exceedingly difficult time reading good old orange coin. It’s up, it’s down. It’s up. It’s down. Here’s a fun fact, at $53k, BTC hasn’t really gone anywhere since mid-February. It seems crazy to think that, but it’s true. Now here’s the scary thing, most of the BTC AUM ramp in the spot ETFs happened after mid-February, yet there has been no meaningful outflow to coincide with this price decline:

Which means, the ETF holders haven’t even sold yet and price has already tanked under what I’d imagine is cost basis for most of these holders. And this gets us to the question of just who is holding these assets; is it guys/gals like us who have already been in the game, or is it new money?

Because if its HODLers who have simply changed from buying via Coinbase COIN 0.00%↑ and taking delivery on-chain now switching to purchases through the ETFs instead, then these assets are probably relative safe in HODLer hands.

And there’s certainly evidence to suggest that it is indeed the same people who have always been buying BTC who are still buying it just through the ETF wrapper instead.

But if it’s new money that is in these products, we may have an issue. Because as I’ve pointed out many times, TradFi bros have no pain tolerance. They’ve been riding a 50 year credit wave to the sky made possible by unfettered supply of funny money. When the going gets tough, they’re going to get going because they’ll sell anything that isn’t bolted to the ground to meet margin calls. Speaking of good collateral…

I’ll leave you with one final chart:

The Bitcoin to Gold ratio peaked in November 2021 at 36.8. It hit 33.6 in April 2024 and has been sliding lower ever since. Current reading: 22. Who is to say that ratio can’t fall back below 20. Or 10…

Point of the post today; I’m resisting the urge to buy dips. I think there is more pain coming.

Hope you guys have a great weekend!

which do you prefer at this stage? US bond, gold, or defensive sector stock (like utilities/consumer staple) ?