The Beginning of The Global Margin Call?

The Yen carry trade, recessionary signs, and my thoughts on the alarming action in risk markets.

Where do we even start after a day like today?

How about with the infamous “carry trade.” This is not something that I’ve touched on in this space for a variety of different reasons. But let’s give credit where it is due...

of the Lead-Lag Report has been talking about the Japanese Yen carry trade for at least a year. In that time, he’s taken a hell of a lot crap online about being wrong. It turns out, Michael probably isn’t wrong, he was just very early on the call.What is that call, exactly? I’ll let him explain it via his Morning Few podcast - watch this video all the way through:

Basically, the whole world has been borrowing in Yen at virtually no cost and then deploying the borrowed capital into other assets like stocks or competing currencies that offer a higher rate of return. This trade works until Japan is forced to aggressively defend its currency and that’s exactly where we are now.

Dollar/Yen is down to 146 after topping out at 161 just a few weeks ago:

If you borrowed in Yen to ultimately buy dollar-denominated assets, you’re starting to really feel the pain on what is essentially a Yen short; to the point where you’re now selling the assets you acquired through the carry trade so you can settle up your Yen obligation. Since there is so much global capital playing this trade, an unwind would be highly detrimental to risk assets and other currencies. Thus, the DXY and the SPX going down in tandem today.

But the carry trade is just one possible piece of what is driving the bloodbath in equities right now. There’s also that pesky little possibility of a recession:

Economic data was absolutely putrid these last two days. Jobless claims were higher than expected. ISM came in under expectations. And the U.S. employment number - that has been held together by nonsense headline estimates followed immediately by downward revisions for essentially 18 straight months - was such a massive whiff I can only assume its because its now somehow in the interest of the data scrubbers to tell the story negatively:

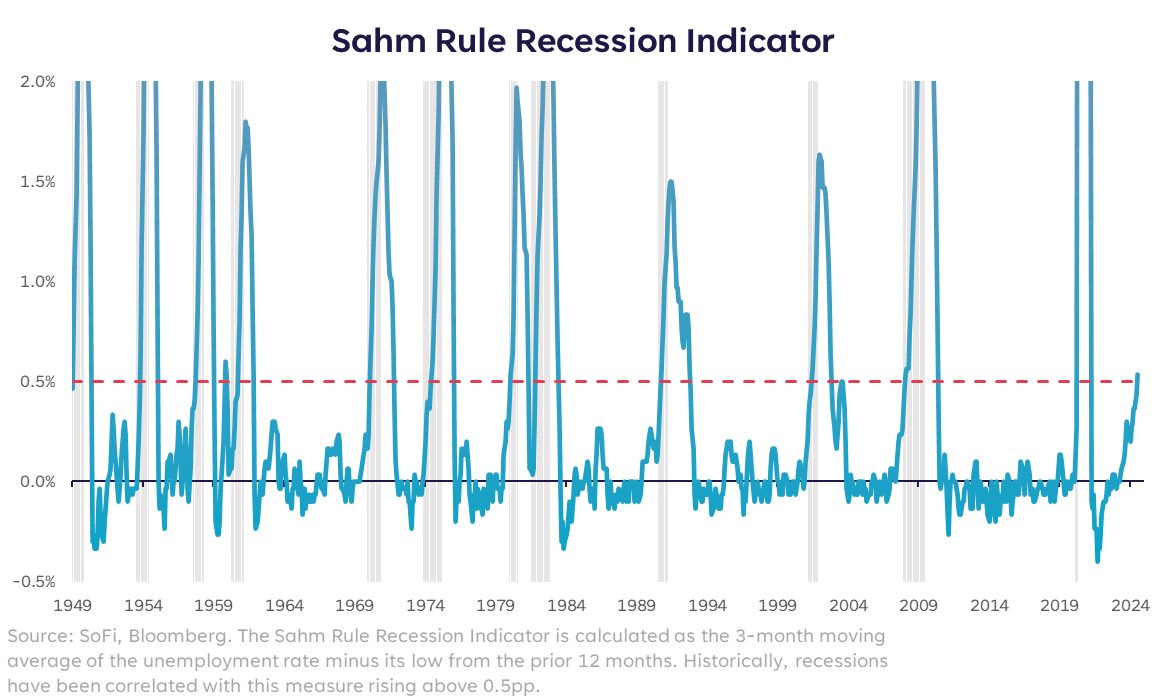

The U.S. Unemployment rate moving up to 4.3% has also triggered the Dudley Rule Sahm Rule - an indication that we are likely in a recession:

And of course, we also now have of the steepening of the yield curve:

The 10 minus 2 inversion is down to just 10 bps. Quick refresher: the inversion of the yield curve is often cited as a major indication of an impending recession. The yield curve has been inverted for two full years:

The trouble doesn’t start until after it has un-inverted… which it is now in the process of quickly doing…

So What Do We Make of All This?

There is going to be A LOT of noise on this platform and on places like X about why you shouldn’t panic (you shouldn’t) and why you should ‘buy the dip’ in stonks or other risk assets - I’m much less sure of the latter advice. There are still serious issues underlying these markets beyond the possible unraveling of the Yen carry trade, the Sahm Rule, bond yields steepening, or the horrendous employment/jobs data we saw this week… and those additional issues are really simple to explain:

Capital flows and valuation.

Earlier this week, I made the case that cryptocurrencies like Bitcoin and Ethereum are now entirely reliant on investment capital flows for market returns. I think many would argue the same is true for equities. Mike Green’s work on passive flows is seriously must watch material:

Here’s a simple explanation; investment capital that comes from the working population is indiscriminately plowed into the market through products like ETFs, 401ks, and mutual funds. The capital goes into these funds without any thought given to valuation or return. This has led to an environment where we have a handful of super stocks with trillion dollar+ market capitalizations trading at absolutely asinine multiples:

These are assets that have been priced for perfection and perfection simply doesn’t exist. In a recession, we get belt tightening both from companies and the populace, which has the reverse impact of Ben Bernanke’s “wealth effect” that I described just yesterday. With a recession comes layoffs. With layoffs comes less passive capital thrown into equities. And given how much stock trading is done algorithmically, weakness in equities can lead to cascading selloffs that completely incinerates paper wealth. Essentially, exactly what we’ve witnessed over the last several weeks.

The SPX SPY 0.00%↑ was dangerously close to breaking the 100 day EMA today. We’ll see if that was indeed the floor. Even the Russell 2000 IWM 0.00%↑ took a beating today:

To be clear, I still like small caps FAR MORE than anything in the Magnificent 7 MAGS 0.00%↑, but I think it’s wise to be selective if you really feel like you have to buy something on this decline. For instance, look where the outperformance was today:

Staples and Utilities.

Discretionary got whacked. As did energy and tech. Crypto? ROUGH:

This is a bad candle for Bitcoin GBTC 0.00%↑ IBIT 0.00%↑ if the coin does indeed close the week in this way. We’ve again pivoted from trendline resistance, while also taking out the low from the prior week, and we could give back both the 8 and 20 week MAs that I’ve been highlighting for quite some time.

And here lies the problem with something like Bitcoin - it isn’t an income generating asset or business. Many will tell you its digital gold. But I’m much less certain of that. Not to beat a dead horse, but Bitcoin is a similar story to the Mag7 at this juncture:

The Bitcoin network settles about 1/4 the daily volume that Ethereum settles and does so at a 30 day average NVT premium that is 3x what digital asset investors have to pay to buy something like Litecoin - which shares essentially all of the same important properties as BTC and has better privacy functionality at the protocol level as well.

The point is; BTC isn’t perfect and certainly isn’t cheap at $62k per coin. It is unlikely to be immune from a larger liquidity crisis due to the Yen carry trade imploding. Frankly, I don’t think anything will really be immune. So I think it’s good to have some dry powder.

My largest areas of risk exposure at this point are in Gold, Silver, Uranium, Bitcoin, and value stocks. I still like short term US debt quite a bit. But I don’t have anything with longer duration than 2yrs. Most of this positioning shouldn’t be a real surprise. I’ve been making the case for being defensive for quite some time and I took HSEP to 100% cash two weeks ago.

So that’s my two on what we all just witnessed this week. I wish I had a more positive story to tell. But I’m always going to keep it real with you guys even if it means my read on the situation isn’t necessarily rosy. I hope you all have a marvelous weekend. Don’t stare at the screens too much. And don’t be strangers in the chat if you have any questions.

Disclaimer: I’m not an investment advisor.

I do have a very specific crypto-related question for the gallery actually. This one’s probably aimed at Mike, primarily, but if there are any other closet $ZEC investors/degens out there, then by all means, I’d love to hear from you as well!

Ok then, very non-macro question: wtf is going on with $ZEC these past few days? Not sure what platform(s) you may utilize for your crypto degeneracy, but I’m as vanilla (dumb-?) as you could possibly imagine in this regard and I use Coinbase only. (Side note - I’m def open to suggestions if any US-based crypto trading

folks here have recommendations for other platforms I should consider using instead or in addition to CB for my crypto trading needs.)

Anyhoo, I’ve noticed some pretty funky trade patterns going through on the ZEC-BTC pair over the past ~36-48 hrs in particular. I could describe the odd patterns I’m seeing going off in repetitive succession if anyone is curious about the details of that, but I’ll spare folks for now and merely summarize the odd trades as apparently some sort of strangely uniform and repetitive/algorithmic patterned process, but unlike any other trade pattern I’ve seen before….and I’ve logged many thousands of hours staring at L2 screeners over the years, (mostly on OTC stocks but also with a fair amount of cryptos the past 3-4 years. Def not elite day trader status here or anything, but this ain’t my first walk in degeneracy trading park either, alright? that’s all I’m saying.)

Also $ZEC has had quite strong price action over the past few weeks or so. But actually very steady, dare I say it’s been demonstrating a “healthy” uptrend on the daily charts? ‘Healthier’ than any other crypto I’ve come across over this past month, at least, that’s for damn sure. But that’s also a pretty low bar at the same time, now isn’t it. Que lastima…

So my Q: what’s going on with $ZEC lately? Am I missing some VC-driven pump-a-thon? Or is there actually some (dare I say it? 🫣) positive narrative going on with the ZEC ecosystem that I’ve been completely ignorant of lately? It’s not just funky trading patterns lately on Coinbase either…the ZEC-BTC pair has been experiencing some extraordinary volume the past 2-3 days and so something is up. Something in addition to $ZEC’s relative valuation, that is…c’mon, it’s essentially +100% relative to $BTC over the past month! If you go back to the low on the $ZEC-$BTC pair back on July 4th (0.000289 on CB) and it touched as high as 0.000562 a day or two ago, and looks to be *PERHAPS* threatening a breakout above that price here at some point, and perhaps* maybe even very, very soon….🤷🏼♂️🤔

*or maybe never, ever, ever, and instead it’ll be down only from here on out, ‘til the end of time…

Mike, A very fine and worthwhile post today. In my opinion you have it right on. Best to you, John