BlackRock Three Different Ways

Value isn't value. Bitcoin's 21 million supply cap is, like, I guess, not something IBIT shareholders can count on. And a shill-fest of my stonk market opinions.

On a day when the Dow Jones was down 2.6%, the S&P 500 was down 3%, and the Nasdaq was down 3.6%, ‘S&P Value’ only fell by 2.4%. A rare win for value, perhaps, despite being down a mind-bending 13 straight sessions after today:

That’s right, the iShares S&P 500 Value ETF IVE 0.00%↑ has been down for 13 consecutive days. Unprecedented. I mean, look at that friggin’ chart! Three months of gains wiped out in about three weeks. What a shame. Before going too far into this piece, I’m going to let you all in on a secret; I bought the low in IVE today.

However, I didn’t buy IVE because I particularly like the way the fund is constructed. After all, how great is a “value fund” when 9 of the top 10 holdings get a “D-” or worse Valuation Grade from Seeking Alpha? I’m not making this up:

Two of the top ten value holdings get an “F” value grade. Only Berkshire gets anything resembling ‘good’ with a B+. Best in show.

Grade inputs? The standard multiples one would expect:

40% of the forward P/E multiples among IVE’s top 10 holdings are above 23. Of course, when the average P/E multiple in the market is 30, 23 may look like comparative value. Historical averages would say otherwise:

From a fundamental standpoint, I’m not buying the notion that IVE is great ‘value’ given the multiples I’ve just shared. Technically though, buying this utter carnage may offer a juicy dead cat. I generally share RSI-14 when I talk about relative strength. However, I also look at RSI-3 as well. For me, RSI-3 readings under 1 have often been great dead cat buys:

IVE’s RSI-3? How about a 0.13. My goodness! Not only that, but today was the third consecutive day with an RSI-3 under 1. I don’t know that I can recall ever seeing that before and I’ve been trading for a decade. Also, the 200 day MA still hasn’t been breached. So the long term uptrend is actually still intact.

That’s it. That’s the trade in a nutshell.

“BlackRock explains #Bitcoin”

iShares funds like IVE are actually managed by BlackRock BLK 0.00%↑. BlackRock sort of became a topic of conversation on crypto-twitter over the last 24 hours after Michael Saylor shared this video yesterday:

Catch that little disclaimer nugget at the 1:28 mark?

There is no guarantee that Bitcoin’s 21 million supply cap will not be changed.

Uhm…

Actually, the 21 million supply cap is one of the only legitimate selling points remaining for Bitcoin here in 2024. I’m floored that there are true, hardcore Bitcoiners who are hand-waving this disclaimer away as corporate legal-jargon. After all, BlackRock is essentially advertising a financial product with this video - namely the iShares Bitcoin Trust ETF IBIT 0.00%↑.

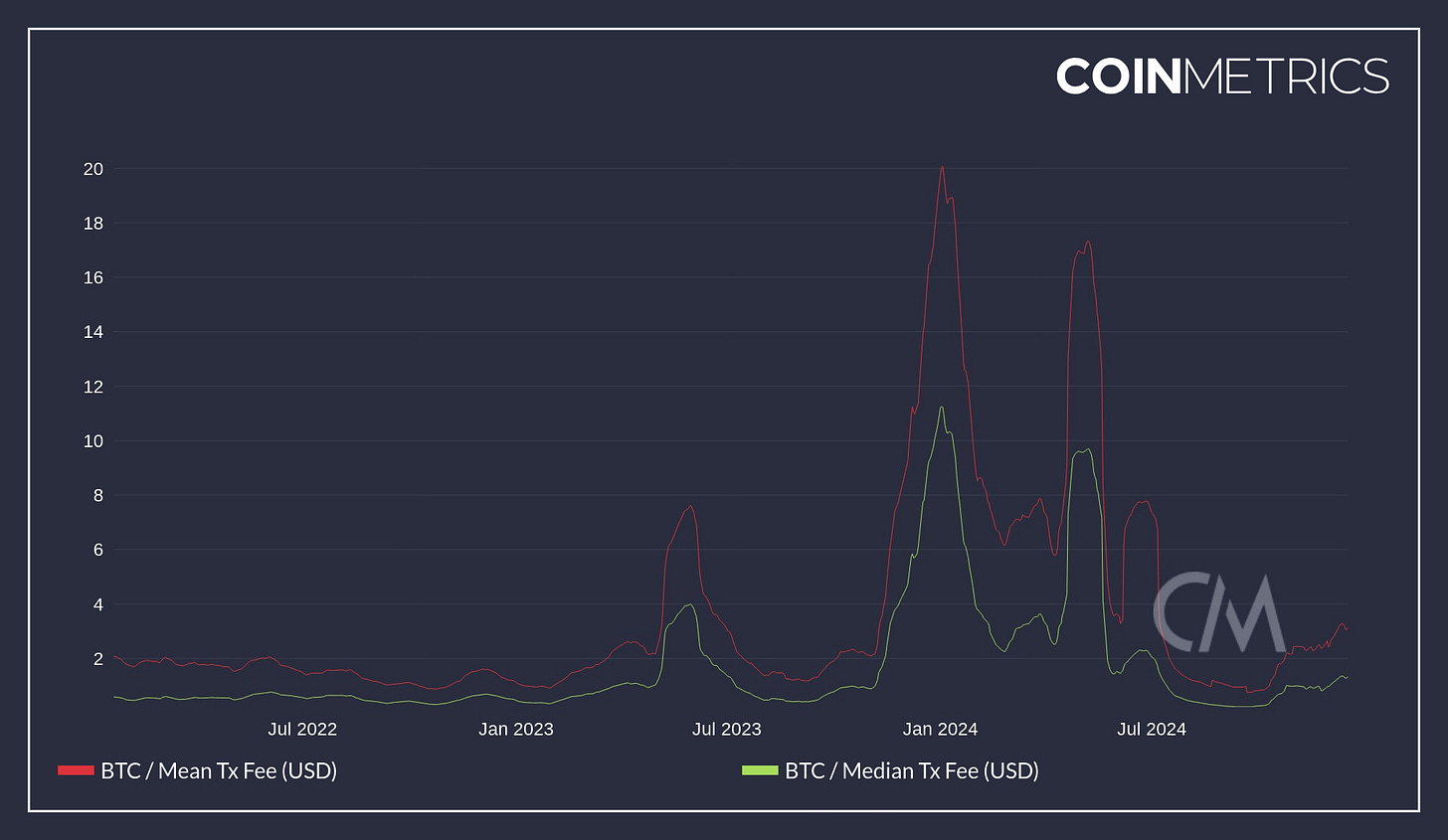

Frankly, I think that ‘corporate legal jargon’ excuse is a reach and I take that view because it’s the only claim in the video that gets a disclaimer. Yet there were numerous claims that are - at best debatable - if not provably false. For instance, the video claims Bitcoin has “near-zero transaction costs?” No way. Just blatantly false.

The 30 day average median transaction fee yesterday was $1.32. The mean was $3.13. These are cheap if you’re sending $20,000 but not if you’re just trying to send $20 to a friend. I would assume users of a peer-to-peer network like the one that BlackRock explained Bitcoin to be in the video are probably more likely to send $20 rather than 20 stacks.

Moving along, BlackRock’s video insinuates there are nearly 300 million people using or investing in Bitcoin and appears to base that figure off Crypto.com’s Crypto Market Sizing Report from January 2024 - which I believe is potentially over-estimating Bitcoin holders based on this formula from the report:

Regardless, we’re to believe that BlackRock decided to give itself legal cover against 21 million coins as a concept but not zero-cost transaction fees or 300 million holders?

That seems like nonsense.

But I digress. I’ve shared all of my issues with Bitcoin before here and elsewhere. I’m beating a dead horse. Why do I still like Bitcoin today and longer term anyway? Two reasons really. First, because it’s basically a religion at this point and I assume the zealots are likely to keep tithing. Second, I actually do believe the concept of a truly decentralized, distributed peer-to-peer ledger/payment system is priceless. And Bitcoin seems to still be the closest thing we have to that as I see it.

Speaking Of The Bitcorns… How About Some Coin Coverage?

I know there are some of you who don’t subscribe to Seeking Alpha. Thus, you don’t have access to most of my work going back to October. For those of you who would like to catch up on some of my ideas from the last quarter, here are several non-paywalled links that I’d enthusiastically invite you to peruse:

MARA Holdings: Mining Kaspa Doesn’t Fix the Fundamental Problem MARA 0.00%↑

BITO: Buying The Bitcoin Breakout BITO 0.00%↑

BITW: The ‘Trump Trade’ At A Discount $BITW

GDX: Dips Are Buys From Here GDX 0.00%↑

Speaking of dips in Gold miners, I’ve been a glutton for punishment with Newmont NEM 0.00%↑:

It’s very degenerate of me, but I can’t wrap my head around this selloff in NEM. I think the market has overreacted to the company’s Q3 earnings and I suspect Q4’s numbers will look quite good when all is said and done. But I’m certainly not a Gold mining stock expert so please don’t take my word for that.

People really didn’t like it when I said the YieldMax COIN Option Income Strategy ETF CONY 0.00%↑ wasn’t suitable for income investors. You guys can decide for yourselves, I suppose. In any case, I don’t plan to write about those high yield freak-shows any time soon!

The Sky Is Falling: Mr. Market Hates MakerDAO’s Re-Brand (Buy, Rating Upgrade)

At $304.3 million, the annualized revenue trend has normalized since the big spike in the DAI Savings Rate (or DSR) earlier this year. But despite the DSR coming back down to January/February levels, the annualized revenue has grown. So if we construct a price to sales multiple that adds both the $92.5 million market cap of SKY tokens with the $990 million market cap of MKR tokens, we get a price to sales multiple of about 3.5. Essentially, MKR is trading at a cheaper P/S valuation than BlackRock - which has issued a far less successful stablecoin in its own right.

Sidebar: I swear I’m not obsessed with BlackRock.

Shortly after that note, MKR did just that. I still have a small position in MKR, FWIW.

In December, I’ve made it a point to update coverage of a few Bitcoin mining stocks and it even led to some rating changes. I actually called one of these companies a ‘buy’ for the first time in two years…

Bit Digital: A Fork In The Road (Hold, Rating Downgrade) BTBT 0.00%↑

The company is still running an annualized HPC revenue rate well below $100 million. In the announced GPU highlights from the company's November update, Bit Digital appears to have added just under $2 million per month based on 3 separate agreements dated November 14th. If we add that $2 million to the $4.3 million from prior clients, we're still a little over $2 million short of the $100 million annual rate with one month to go.

TeraWulf: Sound Strategy But High Valuation (Hold) WULF 0.00%↑

TeraWulf's three-month average between September and November was 147 BTC mined, and it did so on average of about 7 EH/s each month. Let's assume the company gets to a realized average hashrate of 13.2 EH/s in Q1 2025 and can continue to mine 19 BTC per EH/s. That would put TeraWulf at about 250 BTC per month. Shareholders are paying nearly 9 times forward BTC sales for WULF at a $100k BTC price. Even if Bitcoin doubles from here, WULF shareholders are still paying a premium over the 3.3x info tech sector median forward price to sales multiple.

Bitdeer: Sell The $1 Billion Shelf (Sell, Rating Downgrade) BTDR 0.00%↑

Bitdeer's price to book value is running 3 to 4 times other miners in the sector. The only conclusion I can draw from this is that BTDR is wildly overvalued compared to the rest of the large public miners. Frankly, it would be shortsighted for the company to not tap the spigots at these share price levels and capture some of the implied value in the equity by issuing common stock shares. Thus, I suspect they will do so and likely rather soon.

HIVE Digital: I’m Finally A Buyer (Buy, Rating Upgrade) HIVE 0.00%↑

In the past, I've provided readers with a back-of-the-envelope all-in cost to produce a single Bitcoin for most of the mining stocks I've covered. That estimate generally included COGS, SG&A, and Depreciation/Amortization. CoinShares has a really terrific methodology for building a similar all-in cost figure that includes taxes and interest expense. By their estimates, the all-in cost to mine a BTC for HIVE is a little above $80k per coin. Importantly, HIVE claims the fourth lowest all-in cost in the public equity markets and is one of the few miners that could actually be 'all-in' profitable at current BTC price levels.

I still have one more freebie link from SA left for December. I’m keeping it in my back pocket for now. If I could shill one piece that is not my own for a change, I think this

post from a few days ago is must-read material:Hope you all are doing well!

In case I don’t drop another post here before the end of the year, Merry Christmas, Happy Holidays, Happy New Year. All the things…

-Mike

Disclaimer/Disclosure: I’m long Bitcoin, shitcoins, and shitcos. I have no idea when this halving cycle mania will peak. I highly doubt any of us will sell the top, so be careful out there.

NEM is very interesting to me. Thanks Mike.

Thanks so much for linking my posting!