I'm Officially Concerned About Collectable

Between the horrendous Tiger Putter auction result, the radio silence, and the poor index performance of the assets on the platform - it looks like the fork might be in this one already.

Before I get into this, I want to make it clear this is not sour grapes in any way. Yes, I’m irritated that the company auctioned off the Tiger Woods putter, my largest alternative investment, at a 66% discount to what in-app investors were valuing it at. But that’s done and over with.

I have had an affinity for the Collectable app for over two years now. I even interviewed former Collectable CEO Ezra Levine for my old podcast project The Trend is Your Friend. Some of you might remember that show, but for a few of you it might not be something you’re familiar with.

Okay, I swear I’m done shilling my podcasts for the day.

When I exited the Shattered Backboard Jordan sneakers on Public in December it was my intention to do all of my sports memorabilia buying through Collectable going forward. I actually have several assets on watch that I was considering for the Tiger putter fund distribution. I have since reconsidered that and am even attempting to wind down my remaining investment exposure through that app. I’m not convinced I’m going to get it out any time soon. Here’s why:

We are now over a week since the Tiger auction closed and I wouldn’t even know it if I wasn’t paying attention myself. I haven’t received an email from Collectable stating the asset has a new owner. In fact, the asset is still listed (but not trading) in the app with the pre-auction valuation.

Collectable still hasn’t tweeted anything since April 6th - two full weeks without any communication from the company about that auction. It actually looks like the company has gone entirely silent on all social channels from what I can tell.

The company’s podcast hasn’t been active in a month. Their Discord invite link is now invalid. There is just one active listing on their eBay store.

Oh and the big one… did you notice at the beginning of this post I said “former Collectable CEO Ezra Levine? On April 7th Levine announced his departure from the company via Twitter. On April 12th, he sort of announced a new gig. I learned all this today when I went looking for answers because I wasn’t following him directly.

If this was a crypto project and not a “real company” the community would already be calling this a rug pull. Very discouraging.

In Hindsight, I Should Have Seen This Coming

Altan Insights does a nice job managing a large alternative investment asset database. The team over there has solid data segmentation and has curated indexes that represent asset classes and asset platforms:

Collectable is a clear outlier here and not in a good way. The year to date ROI for Collectable is trailing both Public and Rally - its too largest competitors. And when we take it out longer than just 4 months, we can see the trend has been particularly bad for all of these platforms:

Collectable is a sports-only platform. I think that’s playing a role here at least to some degree because we can see other categories holding up much better than sports:

Wine and spirits are actually up. Autos are down but not nearly as bad as the more speculative stuff like sports and art. And I think that’s probably the difference for something like Rally Rd as Rally offers exposure to both autos and rare booze. Public doesn’t have nearly as large a footprint here because most of the assets from its Otis acquisition didn’t make it to the Public platform and were already liquidated during the merger.

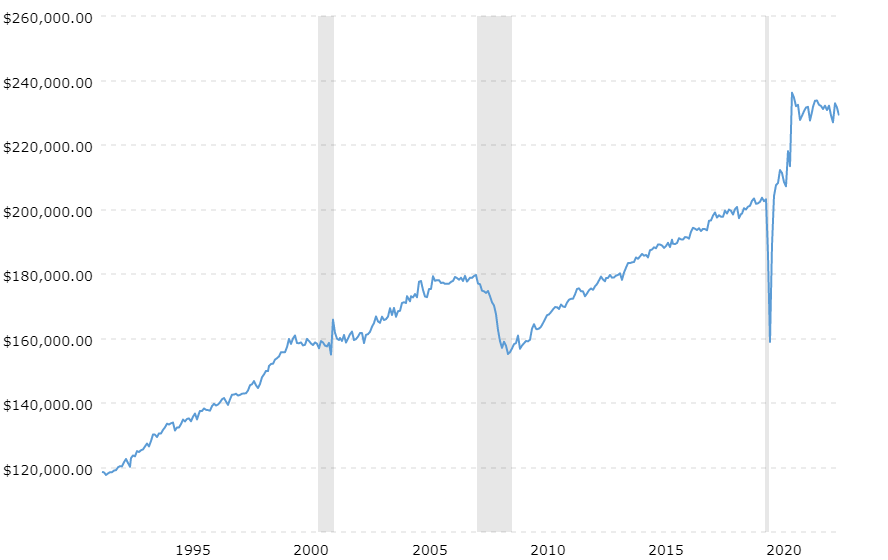

But in hindsight, a lot of this makes sense. Like cryptos and risky Nasdaq junk, the alternative space benefited from the easy money/stimmy era of retail investor bidding and that era has been over for a year:

Credit isn’t cheap anymore. And we’ve already seen how that has been highly detrimental to the financial sector - really anything that requires financing is going to slow as long as credit is allowed to find a free market price without central bank manipulation lower. When we adjust our economic data for inflation, retail sales peaked two years ago:

This credit environment is grinding the economy down and the guys that are now getting carried out back and shot first are the ones offering goods and services that are further out on the risk curve. This is why we’re seeing crypto startups no longer hiring. This is why we’re seeing layoffs start to ramp up, particularly in tech:

I have said from day one and I’ll say it again; all of these investment ideas are risky and we shouldn’t put money into things things that we can’t afford to lose. Period. That goes for shitcoins, basketball cards, beanie babies, stonks, and yes… even US Treasuries if you’re a bank that takes deposits and then doesn’t pay interest on those deposits.

Lessons, Always

I suspect that the remaining leadership at Collectable either knows the company is bankrupt already or is going to soon find out that it is. If, like me, you use these kinds of apps for investing, please be careful. As FTX customers are learning in real time, the lawyers always get paid first. And that money comes from somewhere…

Even though I still firmly believe in a future where assets of cultural significance are investable ideas in a more digital world, there is still a natural world rule that I think is very important to remember:

If you can’t hold it, you don’t own it.

This is why as much as I value something like Bitcoin, I still have far more Gold. I never actually owned that Tiger Woods putter. What I owned was a claim on a small portion of the value of that putter if it were ever sold to an individual buyer. If I’m lucky, I’ll be able to get back a liquidated payment from that claim but I’m becoming much less convinced that it will happen anytime soon.

In closing, I hope this publication helps anyone who has some of the shared interests that I have make sense of what we’re dealing with. Nothing is guaranteed and this has been a very humbling few quarters.

Disclaimer: I’m not an investment advisor. I have no inside knowledge of what is happening at Collectable. I am not personally putting any additional capital into that platform any longer. I very clearly suspect the company is in trouble and am actively planning to get any capital out of the platform that I can.