As this week grinds to a close, it’s somewhat wild to believe we’re almost through the first month of 2024. I suppose it’s true that days are long but years are short. I’m happy to report my seed had 3 full days of school this week which allowed me far more time to be productive than I possessed last week. It was exhilarating! Yet not as exhilarating as discovering all of the ways school administrators can find justification for cancelling school due to the weather, but still quite amazing nonetheless.

Here are a few of the things I touched on this week:

ICYMI: A Bank Failure, Analog Rails, And The Next Narrative

I went long on stablecoins and tokenization for Heretic Speculator. Of course, my route to the overall point first took us through some twists and turns. We explored the insanity of writing a check in 2024 and the demise of the Bank of New England in 1991. I hope you guys enjoyed it.

Through my efforts over at Seeking Alpha, I covered not one but three single asset crypto funds. With the spot Bitcoin ($BTC-USD) ETFs now getting their footing, I supplied readers with some thoughts on Fidelity’s offering FBTC 0.00%↑, the Van Eck Bitcoin fund HODL 0.00%↑, and pointed out what might prove to be significant issues coming up for Ethereum Classic ($ETC-USD). On the Bitcoin ETFs, my views shouldn’t be all that surprising to readers here.

Friday marked the 4th session of the last 6 that produced a new all time high in the S&P 500 SPY 0.00%↑. The market yearns for 5,000. Will it get it? We also saw everyone’s favorite chip maker NVDA 0.00%↑ make yet another new all time high on Wednesday after briefly trading above $628 per share.

To the inquisitive mind, NVIDIA now trades at a forward P/E of 50 and a price to sales ratio of 34. The good news is insiders have only sold $52 million worth of shares this month, so the inevitable rug pull could be worse, I suppose.

Being the “heretic” that I am, this pig stonk has been a focus of my attention this week on Notes. Simply pointing out overvaluation through the comments section of a website like Yahoo Finance will result in downvotes and a vote off the Island of Euphoric Sensation for heresy:

I do think the top is in for NVDA. I wouldn’t totally rule out another sugar high next week, but we’re way passed ridiculous in my view. Here’s the deal, I keep it really simple with my charts:

NVDA just had a closing RSI-14 above 80 for two consecutive days and just narrowly missed doing it again today. RSI has been above 70 since January 10th. The price appears to be stalling out at my “this is getting stupid” red resistance line that goes back to July. Finally, NVDA hasn’t sniffed its 200 day moving average in over a year. No lie. Look it up for yourself. This pig is begging to be slaughtered and daddy wants that bacon.

Meanwhile, the weekly chart is also massively overbought yet has made an RSI divergence and volume has gone down over these last two weeks. Everyone keeps saying it’s un-shortable. I suppose we’ll find out, won’t we…

Scared money don’t make money.

Disclosure: I’m short NVDA through AXS 1.25 Bear NVDA ETF NVDS 0.00%↑ and I continue to add to my position on every additional rip.

Top. Men.

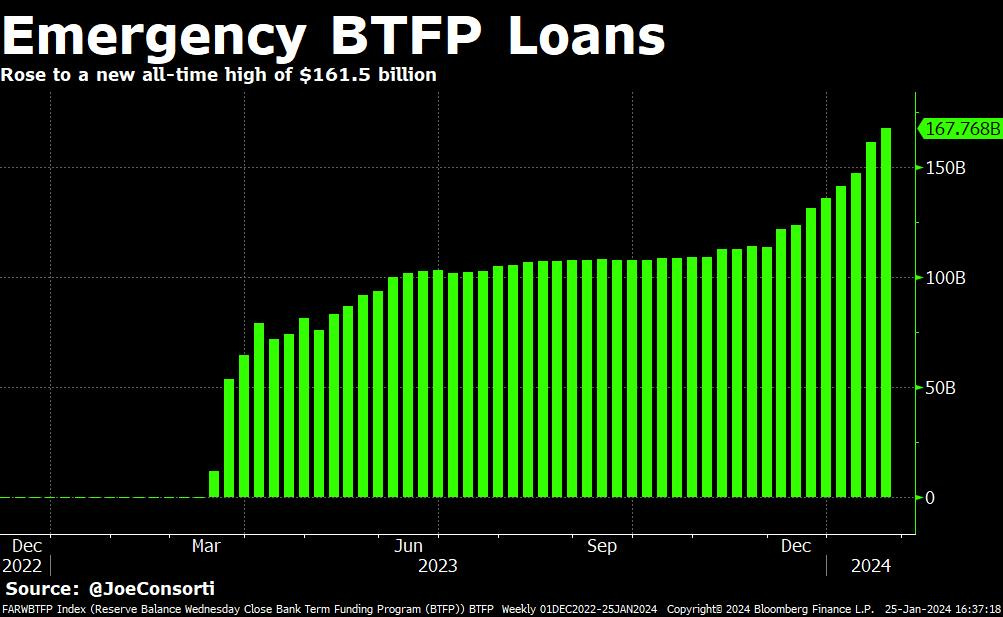

As for the rest of the economy, the big number this week was the 3.3% GDP print for Q4. This eviscerated expectations for 2.0% and I think probably leads to the question of whether or not inflation has indeed been beaten by the Fed. The market is pricing in a lot of rate cuts and there are clearly headwinds coming soon. One such potential problem is the Fed’s announcement this week that it will let the BTFD BTFP expire on March 11th.

This is the program that enabled distressed banks to stay afloat last year when their deposit collateral was underwater and people started asking for their money back. After a modest rise in loans from June through November, the program started seeing a big spike again in December in what has become known as the “BTFP arbitrage” where banks that don’t actually need the program have been taking advantage of rate differentials to essentially print “free money” for themselves. After two months of seemingly allowing this, the central bank has decided enough is enough. They are our top men after all…

Do yourself a huge favor and watch this hour+ macro conversation from DoubleLine Capital from earlier this month. It features Danielle DiMartino Booth, David Rosenberg, Charles Payne, Jim Bianco, and Jeffrey “The Bond King” Gundlach. Yesterday, Gundlach was on Payne’s Fox Business show and dropped this haymaker:

The thing that I’m most concerned about now economically is reports coming from the states. We look at national unemployment data … but the states release unemployment data too. And amazingly, 88% of the states are reporting rising unemployment over the last six months. I’m having a very hard time squaring this circle. If 88% of the states are reporting rising unemployment, how can it be that national unemployment remains stable at a very low level? I guess the only logic would be that the other 12 states are making up for all of that rising unemployment. Which is kind of hard to believe because while those states include Texas and Pennsylvania, it also includes North Dakota and Wyoming.

- Jeff Gundlach, January 25th via Fox Business

This is something that was also pointed out in the DoubleLine Macro discussion for 2024. However, “stable” may be being generous when describing national unemployment:

Forget the headline number, look at the year over year trend. Unemployment is going up. December is the fifth consecutive month that the unemployment print was higher than the same month from 2022. And when we adjust for the horrendous demographic problem facing the US and focus on adults between the ages of 25-54 years, the prime working age, there are some tells:

First, note that it wasn’t until February 2023 that labor force participation for A25-54 finally eclipsed the pre-COVID number of 83.1 in January 2020. That figure was 83.5 in September 2023 and now sits at 83.2. This is not a large decline by any means, but it is going back down. Furthermore, when looking at the larger picture, 83 and change was the top for this metric for both pre-COVID and pre-GFC recessions.

Recall some of the main points that I highlighted last month in Pivot = Signal. Specifically the possibility that something has already broken (in addition the regional banks).

References of “soft landing” are at dot com era levels

The fear and greed index was soundly in greed (it’s now in extreme greed)

Market breadth was bad as seen by underperformance in Russell 2000 IWM 0.00%↑

Tax receipts falling while interest on debt spikes

In the Hedgeye video that I shared in that piece, fund manager Mike Taylor noted that anecdotal evidence that is being shared with him would seem to imply that a recession started in October.

Of course, data lags and is often revised with the benefit of hindsight. By the time they allow us to know a recession started, it will likely be when the worst of it is already over. The best information may come from private parties. Consider that with 24.5k tech layoffs in January (so far), Q1-24 is already ahead of total tech layoffs for Q4-23 and will likely surpass Q3-23 by the end of the month at the current rate.

For as much excitement as there has been about rate cuts, the US 10 year yield is still above its 200 day MA. If this was a stock, I’m not sure you’re selling this ticker given this setup.

I don’t think any of this suggests being overly long risk assets is the play from here. Now, I’ve certainly been wrong in the past and will be wrong again. But my thesis remains; if you’re long stocks because things are bad and that means the money printer is coming back, I think there are better ways to express that trade. Namely, assets that can’t be printed or diluted.

Disclaimer: I’m taking another crack at shorting NVIDIA through the NVDS shares. I’m also long FBTC. I think “T-bill & chill” is as attractive right now as it’s been in months. I’m still staying away from long maturation debt and instead hold things like Gold and Bitcoin.

Fully with you on NVDA, though I believe the entire SMH complex has gotten our of hand, and while I am not as confident as you are on the top for Nvidia (I feel like the whole complex can run/extend as long as S&P continues to extend), I would probably initiate a position in NVDS, for my longer view that the strong will see some severe correction once the euphoria settles down.