Pivot = Signal: Something Broke

The only question is when the "official" data will reflect what many of us are likely already sniffing out.

Dad, you’re right. We are very similar. But what you don’t understand is I’m better and smarter than you in every way.

That quote is a young Ryan Green as told by his father Mike Green on Hedgeye just a few days ago. A hilarious anecdote and a really useful story when considering the context. Mike, who as the Chief Strategist at Simplify has far more investment experience than his son, is merely trying to offer historical perspective relative to conditions in the market.

My takeaway from this story, and if I’m accurately relaying Mike’s overall point in telling it, is that seasoned investors who have been around the block can try to give their viewpoints until they’re blue in the face. Doomed to learn the lessons the market must teach them, the new guys are generally destined to make many of the same mistakes made by the generation before them. And even then, those lessons still may not sink in. If your livelihood depends on not learning something, odds are you’re not going to learn it.

Or maybe it’s different this time! Who knows really?

A few moments before Mike Green shared his family anecdote, he dropped this absolute gem near the 51 minute mark of the video above:

I’m known for highlighting a phrase, “why are you hearing this now,” or “why are you reading this now.” If you Google the headlines “hundred percent equity allocations,” the academic research is now coming out that is saying “you should never own anything other than equities. You should always be one hundred percent allocated to equities because it’s always going to outperform over time.” Right? What that’s telling you is they’re desperately trying to get people in. They want you to be in.

“They” are research firms and asset managers. They want you buying stocks. They want you buying stocks at a 5 P/E. They want you buying stocks at a 25 P/E. They want you buying stocks with positive earnings. They want you buying stocks with negative earnings. They want you buying in the rain, on a train, in a box, with a fox. And now they’re telling you the Federal Reserve has orchestrated a “soft landing.” Joy to the World! 🥁🥁🥁

Halleluiah! Holy shit! Where’s the Tylenol? - Clark Griswold

Of course, this has happened before. The last two “soft landings” weren’t all that soft if my memory is accurate. “Soft landing” leading up to and during dot com. “Soft landing” heading into GFC. Soft landing now. The idea that the Federal Reserve has done the unthinkable and beat inflation with higher rates, all without damaging the real economy, and while breaking the souls of those pesky bears to boot… is probably preposterous.

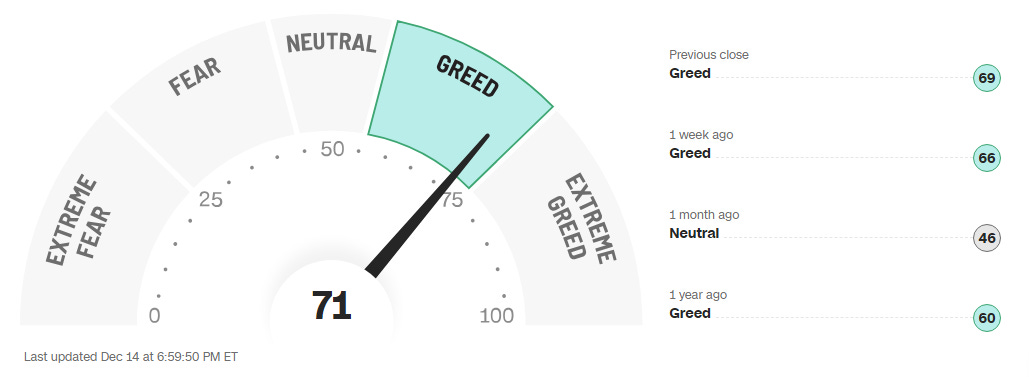

History seems to indicate that now is probably not the time to be piling into stocks. Don’t get me wrong. There are things you can probably buy if you’re suffering from utter FOMO with a fear and greed index at 71:

I personally like gold stocks quite a bit and the Russell 2000 IWM 0.00%↑ has a considerable amount of catching up to do if we are to indeed revisit the highs of November 2021:

Of course, maybe the Russell lagging both the market cap and equal-weighted indexes so badly is a signal in and of itself. Despite what some on bubblevision would posit, I actually don’t think things are all that well economically at the moment. And I’ve provided some of my thinking on that recently here, here, and here. Truth be told, if the bull case on stocks at these levels is simply that a central bank pivot means dollar down so stonks up, I like Gold and Bitcoin much better to express the dollar destruction trade.

Then there’s the nagging question that I think many in finance continue to debate; are we entering a phase of deflation? After all, M2 has been going down. To be sure, I assume the prices of things that people need on a daily basis like food and energy will remain sticky. But other assets - cars for instance - I think it’s a reasonable debate to have.

What I don’t believe for a second is the notion that the powers that be have ever actually been worried about price inflation. The BLS has been attempting to gaslight you and I with carefully crafted models that spit out nonsensical consumer price inflation numbers for years. What changed following COVID lockdowns is simply more frogs have started complaining about the temperature over the last two years because the sous-chef turned up the burner too fast.

But I’m convinced, not only are they not scared about inflation, they love it. It’s why the Fed raised just 25 basis points in March 2022 when February inflation was already over 7% for the third consecutive month. Transitory? Child please. That was always just an excuse to not hike. Back in 2021 Powell said inflation was transitory and cited supply chain disruptions as the cause - but he also said the central bank expected supply chain disruptions to persist. So they wanted us to believe the cause of the inflation was going to be sticky but the inflation itself wouldn’t be.

If your livelihood depends on not learning something, odds are you’re not going to learn it.

Or perhaps… they know exactly what the root cause of inflation is, they just can’t say it out loud.

Inflation is always a monetary phenomenon. - Milton Friedman

In my view, what absolutely terrifies the suits, treasury trolls, and Congressional grifters is deflation, not inflation. Thus, we must cut again because things are clearly slowing down to anyone with a set of eyes and ears.

Grounded in empirical data, hands-on observations, and local pulse-checks, it's plausible we're teetering on an inventory precipice—potentially overshadowing national narratives. Absorption and affordability loom large among my concerns. - Joshua DeDecker by way of

Here’s what I know- continuing jobless claims are in an uptrend in virtually every state, which means people will start spending less. And when they do spend, it will likely not be on the same things they used to shell out for such as that trip down to the honky tonks on Broadway. As bookings fall, this squeezes already overpriced STRs, especially if they were purchased recently which means the owner might be forced to sell. Is it apocalyptic? No. But it does represent one of many vulnerable pockets of inventory that could make its way to the market.

Nashville has overbuilt- you can clearly see it in the permitting data. And there’s a lot of multifamily supply on the way. There’s a reason our rent vacancy rate is at 20 year highs right now in the metro area and a lot of properties are offering concessions left and right. Imagine the deflationary forces that creates for both rents and by extension home prices. - Kenny Capital via that same article

Bold above my emphasis. “Deflationary forces.” This is what we’re going to now find out. The central bank essentially shot the regional banks in the head earlier this year when the collateral backing all of their customer deposits was underwater. Strangely, the only casualties of the duration mismatch were the banks that served crypto-adjacent businesses while the rest were saved by the BTFD BTFP program, but that’s a story for another day.

Even though M2 has been pretty much flat since that time, the Fed remarkably kept going with hikes after subsequent meetings. Now housing is showing serious problems. There are other warning signs that are flashing red throughout the economy as well. You can see it an balance sheets and hear it on earnings calls. You can also get a glimpse of it from the full year of negative revisions in labor data. All of that matters.

But ultimately, this is the macro elephant in the room in one chart:

And it’s the reason why if we do indeed see signs of deflation, it may be very short-lived. The United States has a $32,900,000,000,000 mountain of debt. That debt, and the interest on it, are ballooning all while tax receipts actually peaked a year ago.

The problem for the powers that be is paying for everything through clearly defined tax increases is a non-starter politically. Instead, inflation has been the tax that has been hidden in plain site for decades. The only problem is that tax is paid through currency debasement in perpetuity.

It’s as true now as it was in March when I first wrote it.

When it really hits the fan, they will sacrifice the currency in an attempt to save their debt issuance. This hurts lower income workers living paycheck to paycheck. It also hurts the middle income worker who doesn’t own stocks and isn’t on COLA-adjusted welfare programs.

Now we wait.

The scrolls from the past foreshadow discomfort. When panic ensues, we ultimately get QE, rate cuts, and asset price inflation. But all of that generally comes after we’ve seen some sort of black swan. Again, I suppose this time could be different. But if we skip asset price deflation entirely this cycle, that may be a really scary indicator. Because it would probably mean we’re jumping right to the crack up boom phase. And my hunch is nobody actually wants to see Gold at $20,000 per ounce. We buy it just in case it happens.

Disclaimer: I’m an internet rando not an investment advisor.

Good article, Mike. To add some weight to "the macro elephant in the room," if you consider TRUE interest expense to include entitlement spending since those payments are effectively the interest payments on the government's unfunded liabilities, then we've crossed the Rubicon:

((Social Security + Medicare + Medicaid + Interest Expense) > Tax Receipts) = Fiscal Dominance

https://thexproject.substack.com/p/fiscal-dominance

https://thexproject.substack.com/p/everyone-is-missing-the-point-about-5dc

And then one more point... asset prices have become correlated with tax receipts, so the Fed (and Treasury) want higher asset prices. Please take a look at my next note with some additional info to back up that claim.

Great Stack! And thank you so much for the hashtag/reference.