Pomp: Bitcoin is the most exciting asset in the financial markets because of what you just described. It’s this highly complex thing that everyone is trying to figure out. And I think for some people, it is a risk-on asset and for other other people it is a hedge against inflation or a store of value.

Sorkin: Can it be both?

Pomp: Of course. It can be different things to different people.

Anthony Pompliano (Pomp) was on Bubblevision CNBC this morning and it was a delightful ten minutes to say the least. This specimen produced the intro quote to this post. If for no other reason, just watch it for the last 90 seconds when Becky Quick steps in after Joe Kernen compares Bitcoin’s bubble to a bubble in Netflix $NFLX stonk.

Quick: If you own a company you own a percentage of that company, you own a percentage of the revenue, you own a percentage of the earnings that come through. I mean, that’s the argument. If it’s a company that pays a dividend you get a percentage of that.

Yes!! Becky is correct. And this is an argument I have made countless times on this blog and via my commentary on SA. Strangely, CNBC cut this exchange out from their version of the same conversation via YouTube. I don’t know why the network chose to do that and won’t try to guess. But perhaps Netflix isn’t actually the greatest example of fundamental stock market investment on the principle that Quick just laid out.

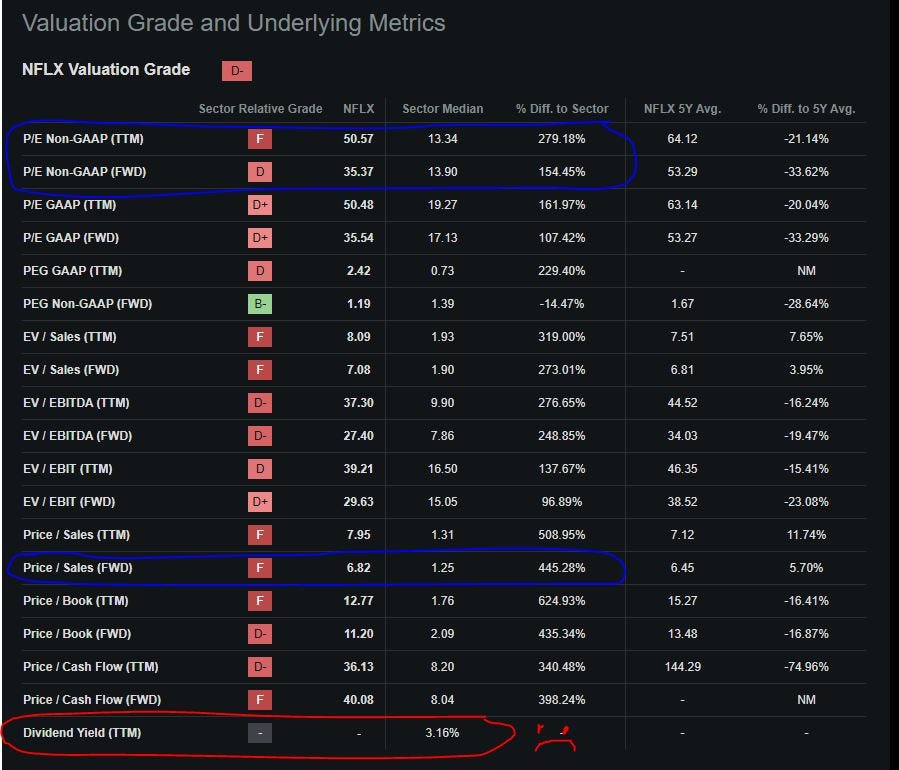

Netflix trades at a 35 forward price to earnings multiple, 7 times forward sales, pays no dividend, and has a tangible book value of a little over $18 per share. You can buy that share for $609 this morning if you like Squid Games enough.

So fundamentally then, what makes more sense? Chasing a stock like Netflix (or any Mag7 name for that matter), or buying Bitcoin? Holding NFLX pays me no dividend and isn’t even heavily shorted so I can’t get much back from a borrower if I lend it out for shorting. To be sure, one could sell options against a NFLX position, but then we’re probably not making the point we think we’re making as options are about the purest form of straight up gambling in the public equity markets today. Not quite the iNvEStMeNt thesis after all.

Is Bitcoin any different?

Maybe…

Where Becky Quick actually has a valid argument is on her unproductive asset point. I’ve been making the exact same case in my recent commentary on MicroStrategy $MSTR. Despite the assertions from the Cult of Satoshi morons, there is no justifiable reason that MSTR shares should trade at a multiple over the BTC on the company’s balance sheet if the BTC isn’t being put to work. And it’s actually pretty easy to put BTC to work.

THORFi savers yields currently pay 2.3% in-kind on Bitcoin. No such yield exists with MicroStrategy’s BTC which I’m told will be put to work in the future, thus, the premium now...

If one actually believes MSTR should trade at a 6x multiple over the company’s BTC stack, I have some good news; MicroStrategy’s Founder and Executive Chairman Michael Saylor will sell you all you want at just a 2x multiple:

I’m still waiting for the peanut gallery geniuses over in the SA comments section to explain why Saylor would sell his stock at a 2x multiple to buy Bitcoin directly if Bitcoin with MicroStrategy is 6 times more valuable than self-stored BTC.

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” - Mark Twain

Spoiler: it ends badly.

But the ultimate question is, does any of this even matter? I’m not sure it really does to be totally honest. At the end of the day, we’re all just playing the ponies and we all have our own frameworks for determining which ponies are best-equipped to win. Maybe it’s a compelling jockey. Maybe the pony’s muthah was muddah.

Or maybe the animal has a jet pack strapped to its back and a ticket to the moon. When we accept that Bitcoin at $70k probably isn’t all that much different from NFLX at 50 times trailing earnings, the nihilism behind all of the dog money memes might begin to make a lot more sense.

Pick your ponies, Andrew and Becky. Let us pick ours. If, like Joe Kernen, you get it, cool. If you don’t get it. That’s fine too.

Ponies Moving Without Hype

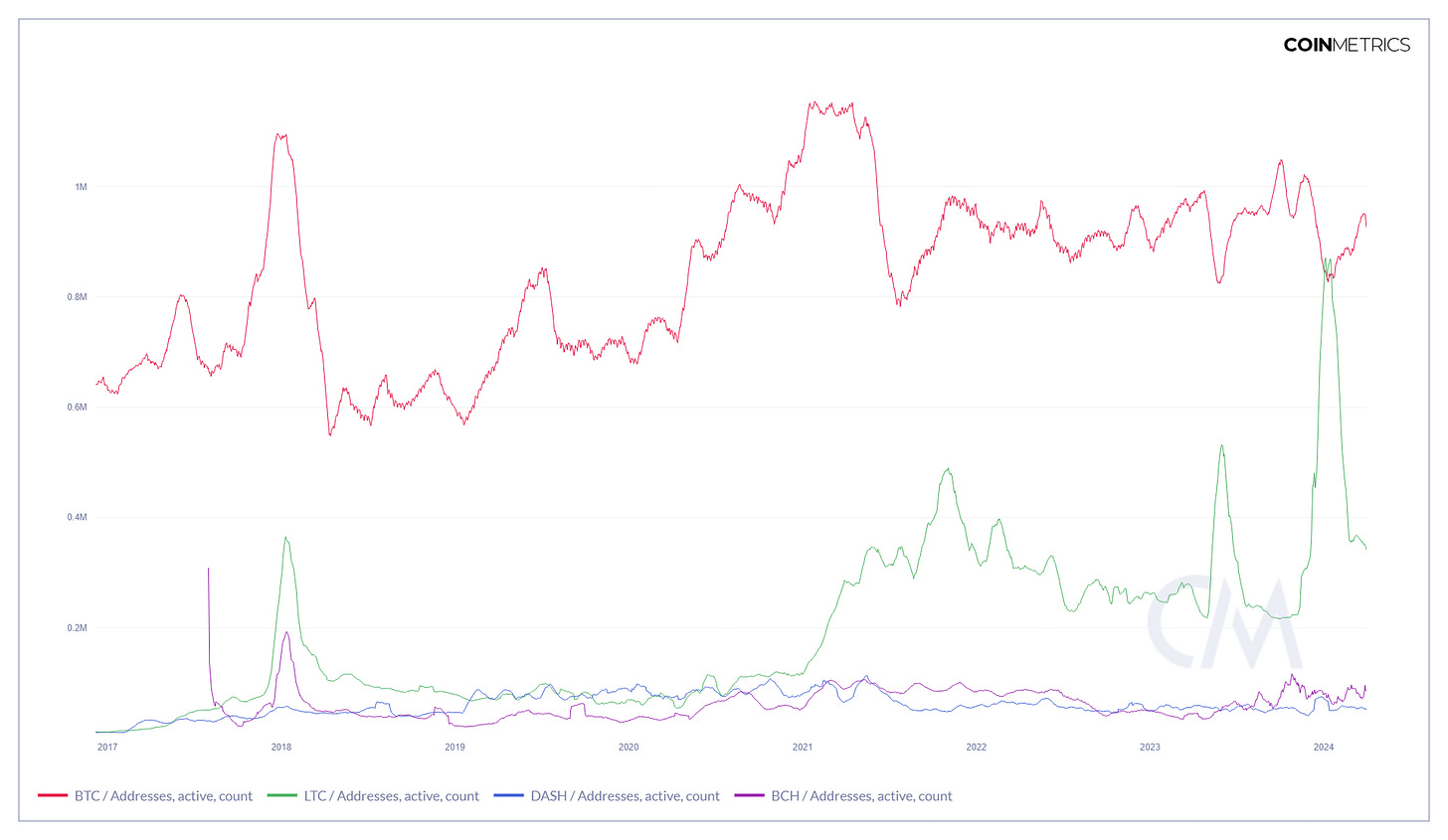

It’s easy to scribble lines on charts and try to predict where supports and resistances might be. For me, this is useful for sentiment purposes. But I think what really drives these markets more is narrative over anything else. And I can’t stop thinking about how BCH reacted to the BlackRock BTC application news. Bitcoin Cash ripped over 200% in a matter of just a few days, spent about 8 months basing, and is again going ballistic as BTC flows into ETF products. BCH is up over 400% in the last 12 months and 145% year to date - each of which are well ahead of BTC.

Bitcoin Cash doesn’t sniff the active addresses of Bitcoin, or even Litecoin for that matter, but it has a very compelling narrative that most other cryptocurrencies will never be able to claim; several early, hardcore Bitcoiners actually supported this network fork at the beginning. To be clear, not all of them did - which is why its referred to as the block size “war.” But some very influential early Bitcoiners were actually big blockers.

So if you buy the notion that the more BTC is held by TradFi the more BTC is potentially compromised, you could probably do a lot worse than taking a flier on BCH under a grand per coin. That’s just a guess though and it’s easy for me to say since I have BCH cost basis that is closer to $250 than today’s $600 price.

Of course, Litecoin is the crypto that can legitimately claim to be “the people’s choice” as a peer to peer payment network. I drew those 284 bar chart patterns on this thing months ago. We’re getting to the point where the coin is now tracking near the top of the large trend channel. At about $100 have the gains from sub-$50 been had here? I’m not sure.

30 day average NVT ratio in Litecoin is still about 50 while everything else is closer to 100. Obviously, I just made the case earlier in this post that valuation multiples don’t matter…

…until they do.

Disclaimer: I’m not an investment advisor. I play the ponies. Nothing is guaranteed. We’re all just guessing. I’m long BTC, BCH, DASH, and LTC.