The Macro, The Fed, and The Big Trade

While this post is probably going to be redundant for readers who have been here for several months, I think updating metrics and rationale is important given the current setup of things.

I hope you guys enjoyed the podcast recommendations from earlier this week if you chose to listen to them. While I personally had a key takeaway from each program, my biggest takeaway from the collection of pods came out of QTR’s conversation with Andy Schectman. Specifically regarding his question about what is backing the US dollar’s reserve status for years? It isn’t gold. It isn’t even faith really. It’s oil.

The world has needed dollars to buy oil for decades. That’s now changing and it is going to have massive implications all by itself. Couple that catalyst with the dollar weaponization that has happened this year in response to Russia/Ukraine, and it’s no wonder why the BRICS nations are now working on something different. Foreign holdings of US reserves are no longer a prerequisite for global economic participation. That takes a rather massive bid away from dollars and US debt issuance. The problem is we appear to be running out of buyers at the worst possible time.

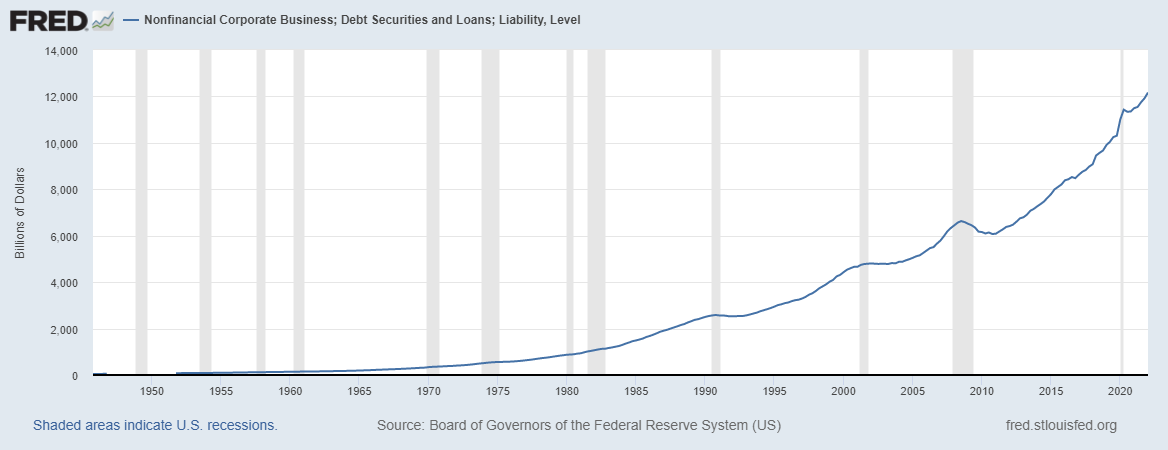

For each of the last two years, federal debt as a percentage of GDP has been higher than the war era peak from the 1940’s. We are already beyond any reasonable level of debt in my opinion. But the problem as I see it is there is almost nothing that can be done about it at this point. It isn’t just public debt. It’s auto loans. It’s student loans. And it’s corporate debt as well - which is now well over $12 trillion.

It is estimated that roughly 1 out of 5 publicly traded companies are zombies. A zombie is a company that doesn’t earn enough to cover the interest expense on its debt. These companies need ever lower interest rates to service their outstanding obligations. And many of these Zombies are S&P 500 companies, not just pump and dump penny stocks. It’s a serious problem.

Now, I want you to pretend you’re a traditional investor - many of you probably are already. What has generally worked well over the last several decades is a portfolio allocation of 60% stocks and 40% bonds. It’s the 60/40 portfolio. As an investor who cares about real returns, can you justify buying US bonds that have a negative real return. Because, remember, the real return is critical.

Buying a bond that yields 3% is great when inflation is 2% or less. But buying a bond that yields 3% when inflation is 8% or more is actually destructive of purchasing power. Now, you could argue that the purchasing power is getting destroyed with or without the bond, and the bond yielding 3% takes an 8% haircut down to a 5% haircut. That’s valid.

But why should there be any haircut at all in real terms? We don’t live to work, we work to live and at some point we are no longer able bodied enough to continue working. The ability to live off savings with some level of comfort for multiple decades is a large part of how I interpret the idea of an American Dream. Monetary policy that destroys wealth in this way is the antithesis of that.

The Setup

We know what will happen if the Fed doesn’t pivot; debts by the public and private sector can’t be refinanced in a way that make them more serviceable. When that happens, everything collapses; stocks, bonds, and more importantly, the entire real economic system. Unless all of those results are intended (entirely possible), the more likely outcome seems to be an imminent Fed pivot. And the current setup sure screams ‘pivot incoming’ to me.

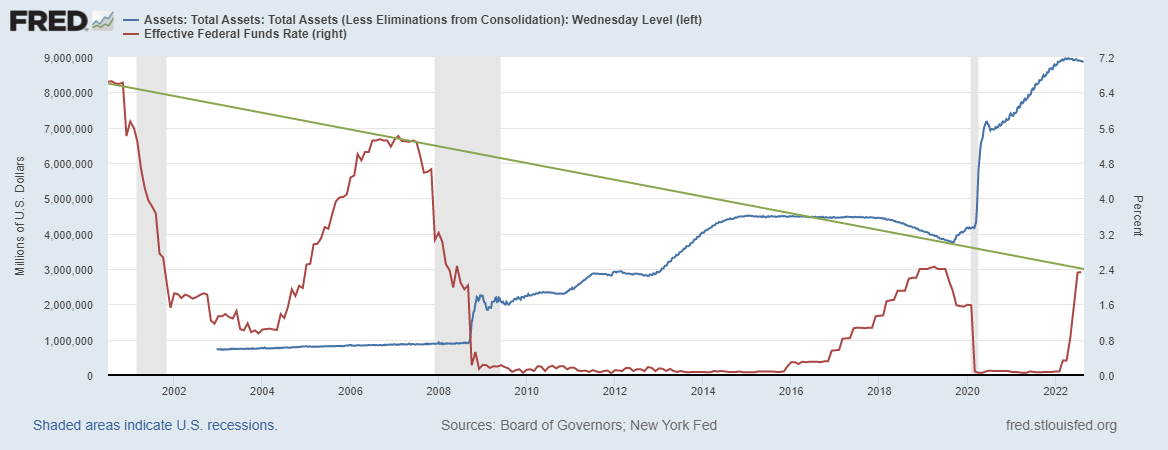

In the FRED graph above, we see the funds rate in red. That rate is now right at what could be considered the trendline (green). Which means in a debt-based, cheaper credit cycle structure like the one we’ve experienced for two decades, rates are right where we can expect them to be before things start breaking. I want to reiterate a point I’ve made in the past again; the Fed has historically cut rates before the recession is recognized rather than after.

It’s the money printer that doesn’t come until later (expressed by the balance sheet, blue line above). But this might explain why the administration is so reluctant to acknowledge what the eyes and ears are telling many of us on the ground; namely, that the recession has already started. Admitting so would mean the Fed probably shouldn’t be hiking any longer. But the Fed desperately wants to maintain some semblance of credibility and can’t pause rate hikes when inflation is still completely out of control. Or is it?

Much of the consumer price inflation that is felt on the ground is sticky. Meaning, once prices have been raised, they generally don’t come back down. That’s why we have to look at different assets to get a read on where things are probably headed.

Home prices decline; first time in 3 years

Used autos declining in August

It’ll likely come down to what oil does. Stay tuned…

The Fed and US Treasuries

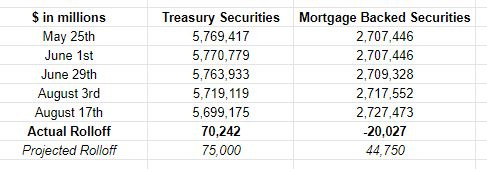

This gets us to the Fed’s balance sheet. The central bank was supposed to start reducing the balance sheet in June by letting mortgage backed securities and treasury securities simply roll off at maturity. From Vanguard:

The Fed plans to reduce its $8.5 trillion balance sheet beginning June 1, when it will no longer reinvest proceeds of up to $30 billion in maturing Treasury securities and up to $17.5 billion in maturing agency mortgage-backed securities per month. Beginning September 1, those caps will rise to $60 billion and $35 billion, respectively, for a maximum potential monthly balance sheet roll-off of $95 billion.

Has that been happening? The simple answer is not really. This is my table below, but the data is all straight from the Fed. You can check it yourself if you want. This is the balance sheet breakdown by line item mentioned in the quote above. The projected figure is 2.5 times the quoted roll-off cap from the Vanguard quote since we’re two and a half months from the beginning of June. Actual roll-off figures compare August 17th to May 25th.

While the Fed is largely staying true on treasuries, the central bank has been buying mortgage backed securities the last several weeks. The MBS held on the balance sheet are actually now higher than the figure from June 1st. Taking the aggregate combination of these two line items, we should have seen the balance sheet come down by close to $120 billion since June 1st. In the real world, the actual reduction has been closer to $50 billion; or less than half of the expectation.

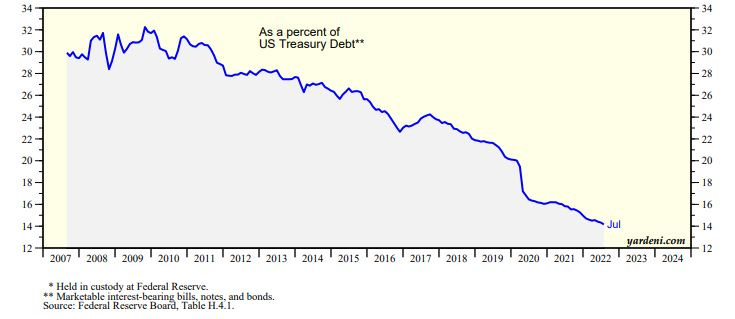

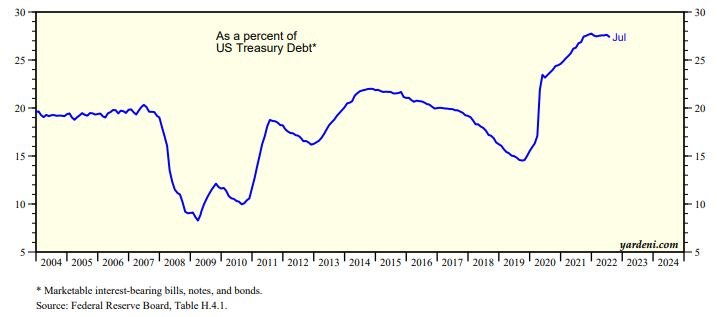

But an essential point on the treasuries is the Fed is supposed to be allowing those to roll off currently. That means there has to be a marginal buyer somewhere else for the federal government to continue refinancing the debt. Since the Fed isn’t buying, that demand has to come from investment demand and from foreign central banks. This chart from Yardeni Research shows foreign central bank holdings as a percentage of total US Treasury debt:

Foreign central banks have not been marginal buyers for a decade. We’ve covered this previously in Crazy Like a Fox. That’s laregely why the US public, the foreign public, and The Fed have had to be buyers of US debt. The Central bank already owns about 28% of the US Treasury’s debt:

That’s higher than at any point in the last two decades. The question is can the central bank unwind it? The answer lies in the rest of the bond market. And so far, we’ve seen a 10 year yields double from 1.5% in late December to over 3% now. Indicating the market doesn’t have a whole lot of interest.

The struggles in the bond market have gotten so bad, that we now have the worst yield curve inversion in the 10’s and 2’s in 22 years. Basically, the bond market is screaming recession.

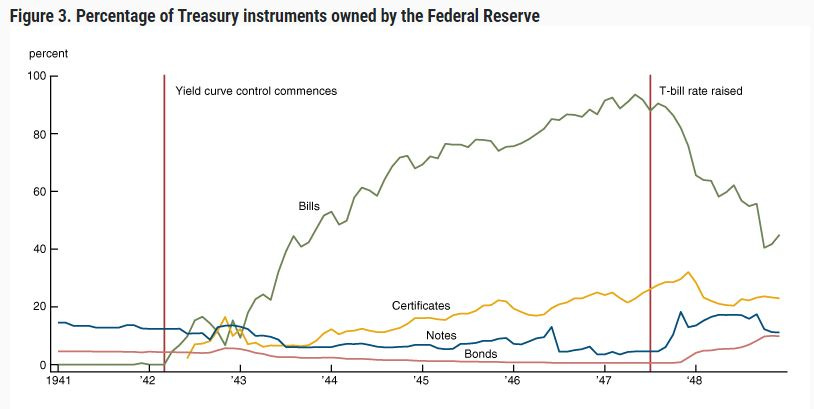

If this continues, it is just a matter of time before “yield curve control” enters the conversation. The last time the US did that? WWII era. The result? The Fed becomes the only buyer and owns almost everything:

To be clear, I’m not saying yield curve control is an inevitability - though I do think it’s highly possible. What I’m saying is if yield curve control enters the public conversation, that’s the tell that the pivot has either already happened or it is imminent.

Where do you put your chips?

The only question in my mind is which scenario plays out if we can assume the Federal Reserve does pivot from tightening and raising rates. I’ve been pretty steadfast in my belief that a Fed pivot back to dovishness is a good thing for risk assets, but the truth of the matter is there is actually another scenario; one in which the Fed pivots and the equity market continues to selloff anyway. After all, none of this is a good thing.

In the scenario where equities actually do go down (as they should theoretically), what is the escape from total destruction? Especially if inflation turns out to be sticky as well. Where does money flow? It’s generally been gold. Though I’m very into the weeds of crypto and I do think Bitcoin and a few other tokens will play in an environment like the one described, the only thing that figures to be a sure thing is metal.

But it’s also important to be cognizant of game theory. Just because gold has worked historically, it doesn’t mean it’s the only option. What if you’re trying to physically escape a brutal regime? Carrying metal around can be heavy and can be confiscated. Bitcoin is weightless. You don’t even need to have a ledger or an app on your phone to travel with it. If you can recite your seed phrase from memory, you are the wallet.

Read the tea leaves. What are they telling you? $300 billion for student debt forgiveness. An “Inflation Reduction” Act that puts $80 billion into the IRS and $369 billion into our corporate masters’ pockets climate change. Apparently it’ll reduce the deficit too! Of course, it won’t actually do that because these bills never do what they’re intended to do and believing government budget projections is akin to believing in Santa Claus.

But, as always, we’re spending. On stuff. And that money has to come from somewhere. We’re either already in a recession or quickly heading for one. Job losses mean a decline in tax receipts. That means the federal budget has to be monetized by the central bank. That means the pivot is coming. I know it. You know it. They know it.

Gold and Bitcoin will account for it.

Disclaimer: I’m not an investment advisor. I share what I do and why I do it. I’m not an expert in energy, economics, credit, or geopolitics. I stack seeds, silver, sats, canned food, and 9 milli ammo. You probably should too.