You Have the Power: Money

As we continue our exploration of broken systems and institutions, how the money is corrupt and what you can do to protect yourself.

Capitalism. It’s such a dirty word in certain circles. Often, we confuse what the word even means with some abstraction of profiteering and shady business practices that invariably punish the little people. But what is capitalism really? Webster’s, which is quickly becoming an unreliable source for accurate definitions, defines it like this:

an economic system characterized by private or corporate ownership of capital goods, by investments that are determined by private decision, and by prices, production, and the distribution of goods that are determined mainly by competition in a free market

via Websters

I would simplify it by saying capitalism is inherently a system that allows for true price discovery. We don’t really have that. Like, anywhere actually. Why? Because in a free market, the most important price is the cost of capital. Or, more simply, the interest one would pay to borrow and the interest one would receive to lend.

You wanna know what's more important than throwing money away at the strip club? Credit...

Jay-Z, "The Story of O.J."

We don't have a free credit market. We have a central bank that sets the price to borrow via the Federal Funds Rate (FFR). The lower the FFR, the cheaper it is for banks to borrow. The cheaper it is for banks to borrow, the cheaper it is for consumers to borrow. This is a chart of the FFR going back to the mid-1950s.

As you can see, we have had credit cycles that have always seen lower highs in the cost to borrow going back the last 40 years or so. That means during every credit cycle from Alan Greenspan to now, the Fed has continued to incentivize borrowing over saving to a more extreme degree. This has led to credit bubbles absolutely everywhere. A credit bubble in mortgage lending:

A credit bubble in automotive lending:

A credit bubble in education lending:

A bubble in margin lending. Credit of this nature juices equity markets:

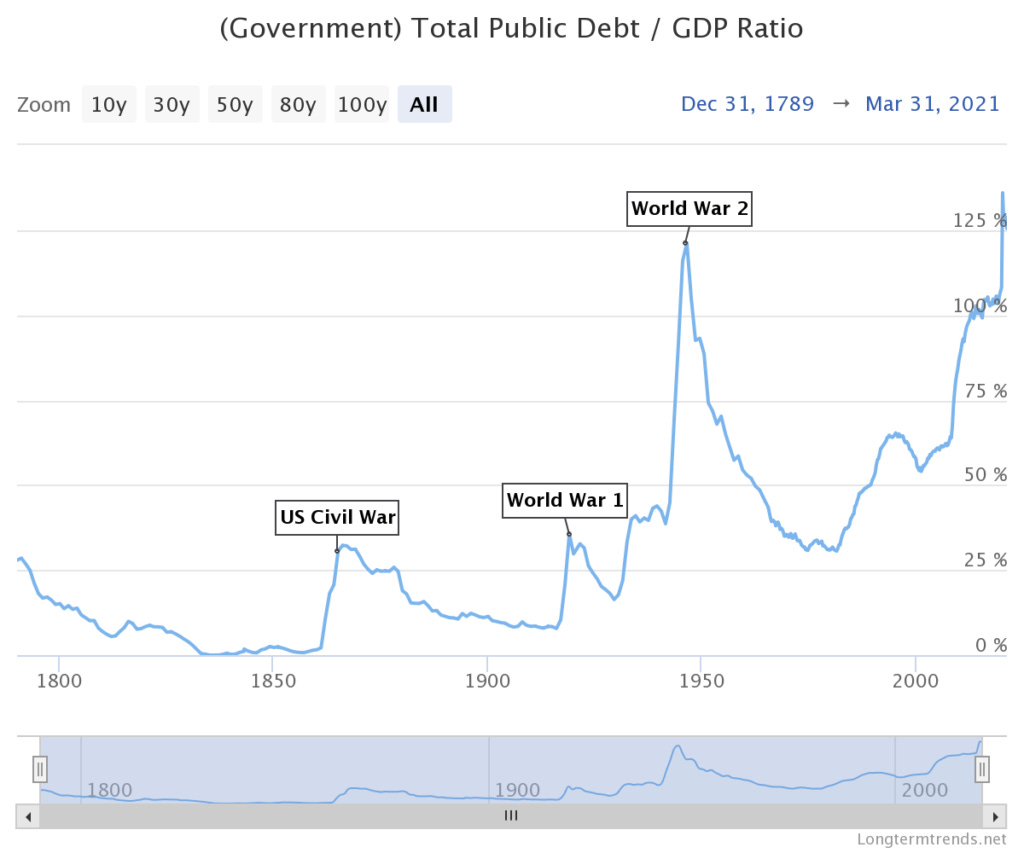

And, of course, a credit bubble in government spending:

Even if we opt to look at the federal debt as a percentage of GDP, the story is terrifying:

This credit binge has had considerable consequences and it likely leads us to a simple question; how has this even been possible? Artificially suppressed interest rates have created an environment where saving in the currency makes little sense when gains can instead be found in the stock market. In my non-finance bro, amateur opinion, this credit binge is primarily because of the fiat currency system. What does "fiat" mean?

an official order given by someone who has power : an order that must be followed

via Websters

The fiat currencies that people all over the world regularly transact in have value simply by decree. There is no intrinsic value to our money. It has value because we are told that it does. My preference isn’t to go down a full history of monetary education in this article. I think history has shown that currency debasement never ends well. It didn’t go well when the Romans tried it. It didn’t go well when the Germans tried it. More recently, it didn’t go well when Venezuela tried it. And though our chickens haven’t totally come home to roost just yet, it’s not going well for the world's reserve currency right now either.

The Big Change

Take out a real paper twenty dollar bill. You will probably pull one out that was printed at some point in the last 10 to 20 years. Anything from the last 50 years will make the same point. Actually look at it. What does it say?

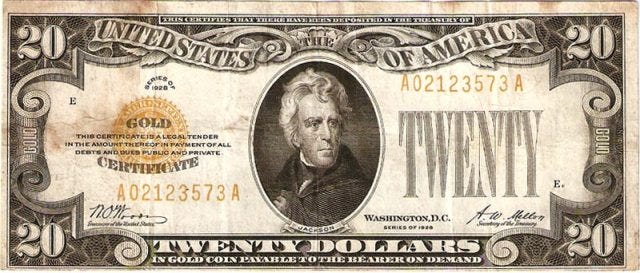

It says "Federal Reserve Note" right across the top. This note, like your auto note if you borrowed to finance a vehicle, is an obligation to provide value at a later time. Our notes haven’t always looked like this. Here’s what a $20 bill said in 1928 before FDR starting fucking shit up.

This iteration of the twenty dollar bill was a gold redemption obligation. Essentially, money as we understand it is a debt instrument and it always has been. Money today is literally just an expression of third party risk. In 1928 when the note above was circulating, the holder could go to a local bank branch and redeem it for physical gold, which was the underlying asset. Because dollars were "as good as gold." The gold that the redeemer would get back from the bank was called a "double eagle" and would look something like this:

This monetary system was called the gold standard. The point of this isn't to debate the viability of a gold standard, it is merely to prove the difference between $20 today and $20 a century ago. To understand this difference is to understand the great scam that is fiat money. If you have a paper $20 from 2000, you can still use it to buy $20 worth of goods today. The paper stays the same, it’s what you can buy with the paper that is changing. Think back to the post about my Costco trip from a couple weeks ago. I can use a $20 bill from the year 2000 to buy exactly 2 cases of Kirkland Signature sparkling water and nothing more. But just 6 months ago, I could have used that same $20 bill to buy those same sparkling water cases and get $2 back in change (before sales tax, obviously). This is an example of that $20 bill losing purchasing power in real time. This a manifestation of inflation through consumer prices. And it is a devastatingly obvious regressive tax.

Let’s say my grandfather loved to save. Let’s say he had a $20 bill back in 1928 and decided to redeem the gold round rather than keep the paper bill or deposit it with his bank. Let’s say he gave me that round before he passed away. That round has a metal weight of 0.9675 troy ounces of pure gold. Unlike the paper that has deteriorated literally and figuratively, the gold weight hasn’t diminished over time. How many cases of Kirkland Signature sparkling water could I buy with the value currently represented by that gold round? Any guesses? The answer is about 173 cases.

In 1928, the paper money was backed by something of intrinsic value. Things that have intrinsic value can’t be printed into existence yet certificates to redeem those things can be printed into existence. This is precisely what has happened to the dollar. Over time, the US printed too many certificates that had a claim on the same gold. In 1971, the US government just stopped pretending it could deliver on our gold obligations all together. Thus, the US defaulted and the fiat money era began. Fiat money is corrupt. It’s not much different from the paper you’ll find in a box with Rich Uncle Pennybags on the cover. The good news is, just as in the previous two parts of this series there are things you can do because you actually have the power.

How to Fight Back

The simplest way to fight back at this corrupt monetary system is take as much of your wealth out of it as possible. In my view, getting out of dollars and putting your wealth in real assets is a prudent thing to do. When I say real assets, I mean things that have value intrinsically. There should be some sort of a use case to these assets. While I am definitely a proponent of traditional inflation hedges like gold and silver, if you're starting from scratch I wouldn't be buying gold or silver first. Securing shelf stable food and water would be the top priority, in my opinion. From there, you probably want to explore home defense. And I don't mean a camera with an alarm. We have a loud dog and an equalizer. I trust that setup more than something designed for evidence collection rather than real protection.

Another real asset is your home. I actually don't have a big problem with renting if your lease has a fixed cost that you can actually afford. The best way to pimp corrupt money though is to borrow at a low cost fixed rate with long maturity. While I'm not generally a proponent of borrowing large sums of money if you don't have to, it's not a bad time do a 30 year fixed rate mortgage. If you can borrow in a currency that is dying and purchase an asset that is productive or that provides shelter, I think you will ultimately find the value of the debt in real terms to be much lower over time as the dollar continues to lose purchasing power. Do NOT borrow to speculate. I don't care what Michael Saylor says. Borrowing to buy Bitcoin is a terrible idea.

I don't like short term debt. If you use revolving credit lines like credit cards, make sure you pay off the full balance every single month so you don't get hit with interest. While the cost to borrow has never been lower for things like houses, rates for credit cards are still in the mid teens. One more tip on credit cards; if you truly must use one, go for cash convertible rewards cards. Avoid points systems that incentivize unnecessary spending to be redeemed. And finally, it's not a bad idea to have physical cash in your house. Yes, the dollar is losing purchasing power. But physical cash isn't an inflation hedge. It's a hedge against third party risk.

If you already have a cash safety net with a couple months of emergency spending, some shelf stable food, and the ability to defend yourself, then you can start thinking about certain speculative assets to hedge against inflation. Here I would start with physical gold and silver before branching out to cryptocurrencies. Why? For starters, gold and silver have a history as a medium of exchange. Truth be told, silver might be the better bet at this point because even if gold and silver truly are dead as monetary inflation hedges (which I doubt, but devil's advocate), silver is used to make solar cells. Therefore, there's a strong potential industrial usage tailwind for silver even as the metal loses inflation hedge market share to cryptocurrency.

Physical silver can also be used in transactions without the need for electricity or network service. As awesome as the idea of cryptocurrency is, even crypto under self-custody still needs the miner network to confirm blockchain transactions. This is not required with physical silver. That said, no electricity is an utter calamity scenario. In this sort of a reality, I'd wager nobody cares about monetary inflation hedges. The greater concerns would probably be energy, food, and shelter/security. I am a big believer in crypto and the monetary disruption that the blockchain enables. My two favorite monetary cryptocurrencies at this point are Bitcoin and Zcash. Unlike physical metal which doesn't require electricity to move, the drawback of metal is it keeps transactions in person. If you want the ability to move wealth across borders painlessly and efficiently, cryptocurrency is a gamechanger.

I'm not a money manager or an investment professional. I take a very contrarian view to my investment approach. None of this is investment advice. I share what I'm doing and nothing more. I take a very balanced approach to hedging against inflation from a monetary perspective. I do that with physical gold and silver as well as a handful of cryptocurrencies that I custody myself. Even if you prefer more of an all-in bet when it comes to inflation hedging, an additional risk to consider is that of a third party. Bank runs are killer. Minimize your exposure to something like that if you can. Getting out of dollars and into actual assets will help preserve your real wealth. It will also do something else in our quest to take back power. It will better position you to execute some of the points of emphasis I'll present in our fourth and final installment of You Have the Power. Coming up next week; governance.

Financial freedom my only hope

Fuck living rich and dying broke

I bought some artwork for one million

Two years later, that shit worth two million

Few years later, that shit worth eight million

I can't wait to give this shit to my children

Y'all think it's bougie, I'm like, it's fine

But I'm trying to give you a million dollars worth of game for $9.99Jay-Z, "The Story of O.J."

Speaking of a million dollars worth of game for $9.99, I'm running a paid subscriber special from now through December 24th. 20% off for an annual commitment. The regular monthly fee is $10. The regular annual is $100 - $80 for the year is like getting 4 months free.

The best part is a subscription doesn't have to be for you. My paywalled content generally skews more finance/investment. And even though I'm a proponent of self-sufficiency, I recognize that market commentary isn't for everyone. But, if there's someone who you don't know what to get this holiday season who you think would like it, give the gift of Heretic Speculator! Of course, sharing the free stuff is much appreciated as well.

Pretty good article overall. However, I think crypto is BS but hey, I could be wrong. The rest of this posting is very true. Real assets and the ability to feed and protect your family should be top priority. Period. Gardening or adjacency to farmers is key but you better have something to trade. Silver coins to me are best especially the older 90% silver US variety. Good for transactions like getting eggs or a bag of potatoes. Think I'm kidding? Wait a while. Shit is going to get real here in the USA very soon. Everything going on now and I mean everything is about an economic re-set. Add to this the neocons rattling their sabers with Russia and the bait and switch is in motion. Covid is just the engine driving the bus into the abyss. If you don't really have your shit together it's pretty much too late but at least get some long term food and the ability to heat your home with wood. Pray. Plan. Prepare. Resist.

The way I look at inflation is by looking at how much minimum wage will buy: minimum wage in CA in the early 80s was $2.65; that’d buy you breakfast. Now, it takes $15 to buy that same breakfast. Simplistic, yes, and it doesn’t factor in perverted housing prices or commodities manipulation, but it’s a good general indicator of inflation.

An ounce of silver/gold has the same essential purchasing power as it’s always had, making it (in theory) stable. However, purchase premiums can funkify this formula. (I’m obviously an expert. Not.)

As my kid’s friend said, in reference to an economic crisis, “If you can’t take it, eat it, or fu** it, what good is it?” (Trade, I suppose.)

BTC isn’t going to save us.