August 29th, 2023 was preposterous. I’ll start with the news that I’ve been anticipating for months; Grayscale won its lawsuit with the US Securities and Exchange Commission this morning. Last year, the crypto-company claimed the agency was being “arbitrary, capricious and discriminatory” in allowing Bitcoin futures ETFs but not spot Bitcoin ETFs. The judges agreed. I’m not going to spend too much text on this because I’ve made my point again, and again, and again…

From Goldman Gary Must Go in early March:

The actions of the SEC have absolutely nothing to do with protecting investors and everything to do with protecting an incumbent system.

Now that BlackRock BLK 0.00%↑ is ready to lock and load, it seems like the referee that decided to be a player in the game has a viable excuse to exit stage left. That and it turns out the United States does actually still respect rule of law from time to time when ridiculous government actions get to the courts. The Grayscale Bitcoin Trust $GBTC shares went beast-mode following the news:

On the day, GBTC shares jumped 18% higher on massive volume and closed the fund’s discount to net asset value down to just 18.5%. Personally, I’m not fading this rally. I think there’s a lot of room to run yet for GBTC and if stonks continue to rally for the reason they rallied today, things like bitcoin, gold, and their proxies probably do even better. The Bitcoin proxy currently in HSEP rallied more than 20% today and I loved every moment of it!

Jobs, Jobs, Jobs

Not to be outdone by silly bitcorns, the stonk market went absolutely HAM on Tuesday. The US Bureau of Labor Statistics released jobs data for July and it was… ugly… to say the least…

There were 8.8 million job openings in July vs a forecast of 9.5 million - it’s a massive miss. The report also revised down the prior month data by over 400k. Now down 2.55 million openings in the last three months, the JOLTs data just had its biggest three month decline on record. Needless to say, it’s a rough report and it could certainly be an indication that we’re in or entering a recession:

To see a JOLTS report show declines in openings, hires and quits and an increase in layoffs is a 4 SD event. It has happened the grand total of 4% of the time in the past and just 2% when the economy was not in a recessionary state (maybe it is!). - David Rosenberg

Naturally, the stonk market is making an absolute mockery of my short position and ripped higher with the Nasdaq up over 2% and the S&P up over 1.5% on the day.

My short trade, expressed through the Direxion 3x bear ETF SPXS 0.00%↑ was beaten all day like Nicky Santoro at the end of Casino. The reason for the face rip higher in broad equities is because of the market’s expectation that the Fed will now have to stop hiking rates in this cycle. It’s the era of bad news is good news and nothing is as bad good as a possible recession!

The thinking goes like this; with rates down capital theoretically rebalances back to equities as investors get pushed back out on the risk curve - this is especially possible if the Fed goes full 180 and puts the liquidity hose back on (more on this in a moment).

The CME rate probability tables now have an 89% chance of no Fed hike in September. But going even further out, we now have “no hike” through December being the most probable market expectation and there’s even a 4.5% chance of a rate cut before the end of the year.

Is The Fed Really Done Hiking?

I’m not going to pretend I have some grand insight on how this goes. I learned my lesson when I thought the Fed was done last summer - I was very wrong about that. That said, I think that we’re currently dealing with what have been pretty predictable outcomes since the central bank continued on this course.

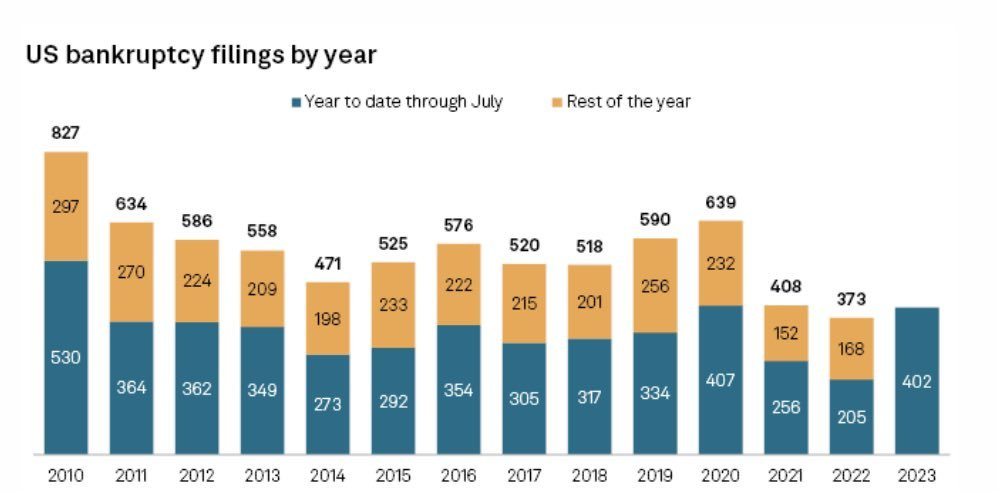

With respect to Real Estate which has been feeling it already for several quarters, we’re starting to see the higher cost of credit start to have an impact in other places as well. While still relatively low at just 2.77%, last quarter we got our highest reading in credit card delinquency rate since 2012. On the business side, there have already been more bankruptcies this year through July than throughout all of 2022 (an admittedly low bankruptcy year).

I could point out a few specific anecdotes since July but I don’t think that will be generally helpful. I’m sure many of you are seeing and hearing things in your own areas. But here’s an important reminder; all of this comes after there was a regional banking crisis earlier this year because the collateral that backs consumer deposits is underwater. The liquidity hose has already been arguably turned back on in a backdoor way because the banks got a bailout through the still ongoing Bank Term Funding Program with very few even batting an eye. The Fed has hiked three times since…

Disclaimer: I’m not an investment advisor. I trade stonks in my pajamas and throw darts at pictures of Gary Gensler in my unfinished basement.

Why ANYONE believes the jobs numbers after they keep being downgraded month after month is beyond me!